PropTaxBrochOnlineVersion2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Police Services<br />

What’s In A Mill?<br />

A mill levy is the “tax rate” that is applied to the assessed value of a property. One mill<br />

is one dollar per $1,000 dollars of assessed value. Mill levies are determined by each<br />

individual taxing authority such as the school, county, city, fire, water, sanitation, and<br />

recreation districts. A property owner’s total mill levy will depend upon the districts<br />

in which their property is located. County taxes are levied by the Board of County<br />

Commissioners and city taxes are levied by the City Council. Special district taxes are<br />

levied by their board of directors, and school taxes are levied by school boards. In<br />

addition to each city like Greenwood Village establishing its own mill levy, there are<br />

additional mill levies for given districts outlined on your property tax bill.<br />

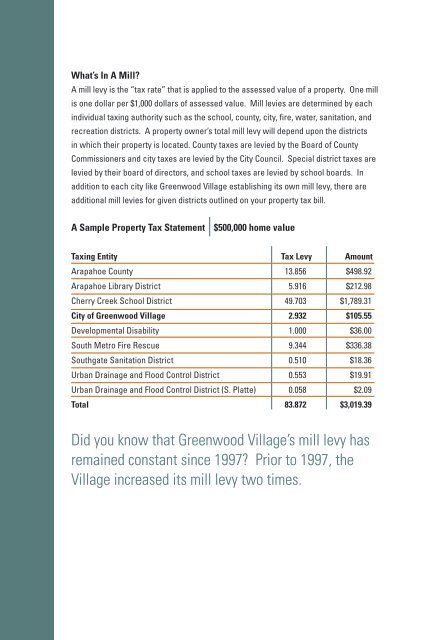

A Sample Property Tax Statement $500,000 home value<br />

Taxing Entity Tax Levy Amount<br />

Arapahoe County 13.856 $498.92<br />

Arapahoe Library District 5.916 $212.98<br />

Cherry Creek School District 49.703 $1,789.31<br />

City of Greenwood Village 2.932 $105.55<br />

Developmental Disability 1.000 $36.00<br />

South Metro Fire Rescue 9.344 $336.38<br />

Southgate Sanitation District 0.510 $18.36<br />

Urban Drainage and Flood Control District 0.553 $19.91<br />

Urban Drainage and Flood Control District (S. Platte) 0.058 $2.09<br />

Total 83.872 $3,019.39<br />

Greenwood Village Portion Of Your Property Tax<br />

The Village’s mill levy of 2.932 accounts for less than 4% of the average resident’s<br />

property tax rate. Therefore, on a home valued at $500,000, the Village receives roughly<br />

$106 of the resident’s total annual property tax payment.<br />

In addition, the property taxes collected are included in the Village’s general fund<br />

revenues to provide essential services to citizens. From total city-wide revenues of<br />

almost $47 million, the Village receives approximately $3 million from property taxes.<br />

Of that, 32%, or just shy of $1 million, is attributable to residential properties.<br />

Arapahoe County 17%<br />

Arapahoe Library<br />

District 7%<br />

Did you know that Greenwood Village’s mill levy has<br />

remained constant since 1997? Prior to 1997, the<br />

Village increased its mill levy two times.<br />

Other 2%<br />

Cherry Creek School District 59%<br />

South Metro<br />

Fire Rescue 11%<br />

City of<br />

Greenwood<br />

Village 4%