CONTACT Magazine (Vol.18 No.3 – December 2018)

The third issue of the rebranded CONTACT Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce

The third issue of the rebranded CONTACT Magazine — with a brand new editorial and design direction — produced by MEP Publishers for the Trinidad & Tobago Chamber of Industry & Commerce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vol.18</strong> <strong>No.3</strong> <strong>–</strong> <strong>December</strong> <strong>2018</strong><br />

The Voice of Business in Trinidad & Tobago<br />

Looking<br />

Outwards<br />

The art and science of exporting<br />

Champion exporter: SM Jaleel<br />

Export markets | Trade deals<br />

Non-tariff barriers | Support agencies

Imagine a home that<br />

responds to your<br />

every desire<br />

At Manetsys, we ask you to imagine an<br />

inspired system based on your own desires<br />

for entertainment and comfort, not on any<br />

pre-baked set of offerings. Then we build<br />

your dream. From the first time we meet<br />

with you, to the final day of in-house training,<br />

we’re there to make the entire process as<br />

smooth and enjoyable as possible.<br />

*Showroom by invitation only, please call to schedule a visit.<br />

Manetsys Trinidad, LTD.<br />

Lot 29B-31 Lower Sixth Avenue<br />

Barataria | Trinidad & Tobago<br />

(868) 223-7871 | www.manetsys.com<br />

Manetsys<br />

One-Touch<br />

eliminates<br />

the need<br />

for multiple<br />

remotes and complicated<br />

controls, bringing your<br />

home together with easyto-navigate<br />

systems that<br />

can be accessed from<br />

your smart phone.

<strong>Vol.18</strong> <strong>No.3</strong> <strong>–</strong> <strong>December</strong> <strong>2018</strong><br />

Contents<br />

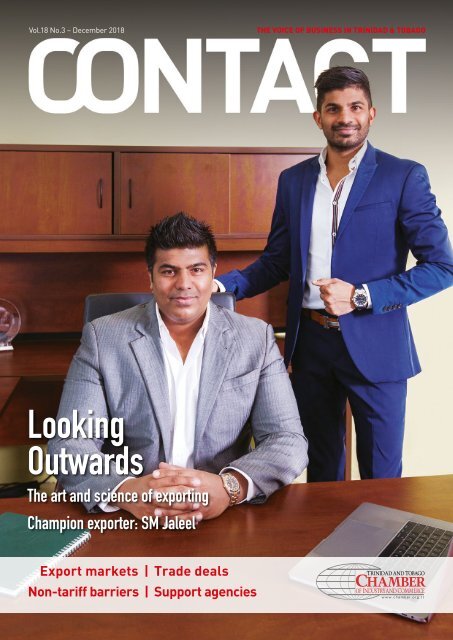

ON THE COVER<br />

Directors of SM Jaleel: Dr Mikaeel<br />

Mohammed (seated) and Eesa<br />

Mohammed, Vice President, Marketing<br />

(Photo courtesy TTCIC)<br />

07<br />

A note from the editor<br />

Natalie Dookie introduces this<br />

issue of <strong>CONTACT</strong><br />

08<br />

SM Jaleel:<br />

global exporter<br />

Kalifa Sarah Clyne profiles the<br />

winner of the T&T Chamber’s<br />

prestigious annual award and its<br />

global brands<br />

14<br />

The will to export<br />

Joel Henry sits down with the CEO of<br />

exporTT to talk about the agency’s<br />

activities and plans, and detects a new<br />

energy in the national export drive<br />

20<br />

Know your<br />

export markets<br />

Every overseas market has its own<br />

characteristics. Lisa Douglas-Paul<br />

looks at our main target areas and<br />

what to expect from each one<br />

SPECIAL <strong>CONTACT</strong> SURVEY: LOOKING OUTWARDS<br />

25<br />

29<br />

32<br />

Breaking into Europe<br />

The European Union is a<br />

particularly complicated<br />

market, with 28 countries (soon<br />

to be 27) involved. The regional<br />

agency Caribbean Export<br />

provides an introduction<br />

Who do we have trade<br />

deals with?<br />

Trinidad and Tobago has<br />

negotiated trade agreements<br />

with many of its trading<br />

partners. The Ministry of Trade<br />

and Industry sets out the<br />

possibilities of each<br />

Non-tariff barriers <strong>–</strong> the<br />

exporter’s nightmare<br />

Usha Samsundar explains<br />

how even the best-prepared<br />

exporter can be ambushed by<br />

unexpected obstacles<br />

04<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

<strong>Vol.18</strong> <strong>No.3</strong> <strong>–</strong> <strong>December</strong> <strong>2018</strong><br />

The Voice of Business in Trinidad & ToBago<br />

Published by<br />

The Trinidad and Tobago Chamber of<br />

Industry and Commerce<br />

Looking<br />

Outwards<br />

The art and science of exporting<br />

Champion exporter: SM Jaleel<br />

Export markets | Trade deals<br />

Non-tariff barriers | Support agencies<br />

44<br />

46<br />

48<br />

The economic outlook<br />

Prospects for Trinidad and<br />

Tobago, the Caribbean, and the<br />

global economy in the year ahead<br />

Energy update<br />

The state of the energy sector<br />

in figures<br />

Welcome to new<br />

members<br />

Columbus Circle, Westmoorings, Port of Spain, Trinidad and Tobago<br />

PO Box 499, Port of Spain • Tel.: (868) 637-6966 • Fax: (868) 622-4475<br />

Email: chamber@chamber.org.tt • Website: www.chamber.org.tt<br />

Tobago Division:<br />

ANSA McAL Building, Milford Road, Scarborough, Tobago<br />

Tel.: (868) 639-2669 • Fax: (868) 639-2669<br />

Email: tobagochamber@chamber.org.tt<br />

Produced for the Chamber by<br />

MEP Publishers (Media & Editorial Projects Ltd)<br />

34<br />

Where to go for help?<br />

A checklist of private sector<br />

and government agencies<br />

which can supply export<br />

guidance, information and<br />

documents<br />

6 Prospect Avenue, Maraval, Port of Spain, Trinidad and Tobago<br />

Tel.: 622-3821 • Fax: 628-0639<br />

Email: info@meppublishers.com • Website: www.meppublishers.com<br />

Editor Natalie Dookie<br />

Consulting editor Jeremy Taylor<br />

Online editor Caroline Taylor<br />

General manager Halcyon Salazar<br />

Page layout & design Bridget van Dongen<br />

Advertising Evelyn Chung, Tracy Farrag, Mark-Jason Ramesar<br />

Production Jacqueline Smith<br />

Editorial assistant Shelly Inniss<br />

38<br />

The voice of experience<br />

Six successful exporters <strong>–</strong><br />

old and new, large and small<br />

<strong>–</strong> tell their stories to Natalie<br />

Dookie<br />

DISCLAIMER<br />

Opinions expressed in Contact are those of the authors, and not<br />

necessarily of the Trinidad and Tobago Chamber of Industry and Commerce<br />

or its partners or associates.<br />

<strong>CONTACT</strong> is published quarterly by the Trinidad and Tobago Chamber of Industry and<br />

Commerce (TTCIC). It is available online at www.chamber.org.tt/contact-magazine.<br />

© <strong>2018</strong> TTCIC. All rights reserved. No part of this magazine may be reproduced in any<br />

form without the written permission of the publisher.<br />

www.chamber.org.tt/contact-magazine 05<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

A note from<br />

the editor<br />

Exports play a crucial role in Trinidad and Tobago’s economy. They influence<br />

economic growth, employment, and our balance of payments. They earn<br />

essential foreign exchange. As we adjust to a low-price energy environment,<br />

there needs to be an even greater focus on growth opportunities for exports.<br />

We are the largest oil and natural gas producer in the Caribbean, and our<br />

hydrocarbon sector has dominated our exports. But in recent years we have become<br />

more diversified, with a greater reliance on services.<br />

There are several factors which determine our level of exports: competitiveness,<br />

quality, value added, the exchange rate, productivity, and the economic prospects<br />

of our export markets. We can work towards raising this level through private sector<br />

innovation, reducing tariff and non-tariff barriers, and by pursuing supply-side<br />

policies to increase our competitiveness. Exporting provides real benefits for firms,<br />

including longer-term security, by spreading risk over a wider customer base <strong>–</strong> and<br />

of course increased sales and profits.<br />

In this issue of <strong>CONTACT</strong>, we<br />

are Looking Outwards<br />

In this issue of <strong>CONTACT</strong>, we are Looking Outwards. Our team of experts from<br />

Trinidad and Tobago and the Caribbean provides guidance on export planning, and<br />

identifies where and how to access support locally. ExporTT’s CEO sets the stage<br />

by charting the size of our exports, what we export, where to, and what are the<br />

most promising opportunities in <strong>2018</strong>. Trade agreements can be complex, but the<br />

Ministry of Trade and Industry helps us to penetrate the legal jargon and translate it<br />

into competitive advantage. Exporters are often presented with unexpected market<br />

challenges, but one of our trade specialists outlines how to overcome non-tariff<br />

barriers.<br />

Which market conditions present key opportunities for local exporters, in which<br />

country and in what sector? The Chamber’s Trade & Research Economist guides<br />

us through their recommendations. Learn from organisations that are exporting<br />

successfully, and be inspired as they share their journey.<br />

Exports have a major impact on our economy. They are one of the biggest<br />

determinants of Trinidad and Tobago’s economic performance. Growth in exports<br />

can also advance our domestic economy by creating a knock-on effect for related<br />

industries. Recognising the importance of this for our future sustainability, we look<br />

forward to your feedback: share your export experience, tell us if you agree with<br />

our experts’ advice and recommendations, and what else you would like to see us<br />

add to the conversation.<br />

Editor<br />

www.chamber.org.tt/contact-magazine 07<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

SM Jaleel:<br />

global<br />

exporter<br />

This year’s prestigious Chamber award<br />

“Internationally Known … T&T Owned”,<br />

sponsored since inception by First<br />

Citizens, was won by a company with<br />

extraordinary international reach<br />

WORDS By: Kalifa Sarah Clyne<br />

photos courtesy: sm jaleel<br />

After almost a century in business, SM Jaleel is a proud locally-owned player<br />

with a strong presence on the global stage. It is the largest manufacturer<br />

of non-alcoholic drinks in the anglophone Caribbean.<br />

Its many brands <strong>–</strong> fruit juices, soft drinks, flavoured water, energy<br />

drinks <strong>–</strong> are distributed around the world by nearly 100 distributors, and can be found<br />

in over 30,000 wholesale and retail stores, including Walmart in the United States.<br />

The company manufactures its own PET containers, a technology it pioneered<br />

in the Caribbean in the 1980s. Its staff has grown from 25 to 1,378 located in ten<br />

different countries in five continents.<br />

Evolution<br />

The family-owned business of SM Jaleel was founded in 1924 by a young visionary<br />

entrepreneur, Sheik Mohammed Jaleel. He used to make the company’s first product,<br />

Jaleel Beverages, under his house in San Fernando, and marketed it to clients from a<br />

traditional horse and cart.<br />

08<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

Jaleel Beverages were followed by<br />

a string of other brands. Wonder in the<br />

late 1930s, Applette, Joe Louis Punch<br />

(after the famous boxer whom Jaleel<br />

brought to Trinidad), Red Spot. Dixi Cola<br />

successfully expanded the portfolio<br />

in 1968. By the time Red Spot hit the<br />

market, SM Jaleel was operating ten<br />

trucks and an automated production<br />

line. The company could produce about<br />

90 cases an hour, and a case of sweet<br />

drink cost 24 cents.<br />

The export journey began in the<br />

1950s, when Jaleel built a factory in<br />

Grenada, run by his son Zaid, to produce<br />

The first product, Jaleel<br />

Beverages, was made under<br />

the founder’s house in San<br />

Fernando, and marketed to<br />

clients from a traditional<br />

horse and cart<br />

www.chamber.org.tt/contact-magazine 09<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

A new generation took over<br />

the business and revived both<br />

the founder’s vision and the<br />

company’s fortunes<br />

Red Spot in glass bottles. The company’s<br />

fortunes dipped somewhat from the<br />

late 1960s, and Sheik Mohammed Jaleel<br />

died in 1977, after selling the business<br />

to Shaffikool Mohammed, the husband<br />

of his daughter Salaha.<br />

So a new generation took over the<br />

business and revived both the founder’s<br />

vision and the company’s fortunes.<br />

Aleem Mohammed, Jaleel’s grandson,<br />

joined the company and rose to<br />

become chairman. The business moved<br />

to Otaheite Industrial Estate, where it is<br />

still headquartered today. New products<br />

were introduced <strong>–</strong> Pear D, Cole Cold,<br />

Fruta, the large bottle, Caribbean Cool.<br />

The company earned franchises from<br />

well-known international companies <strong>–</strong><br />

7-UP, Capri Sun, Cadbury Schweppes.<br />

By 1988, market share had grown to<br />

30%.<br />

The first export shipments had<br />

been made from Trinidad and Tobago in<br />

1983. The main export markets were the<br />

UK, the USA, Canada, Jamaica, Antigua,<br />

Dominica, and Barbados. SM Jaleel<br />

began awarding its own franchises:<br />

third party manufacturers produced<br />

and distributed the Caribbean Cool<br />

brand, for instance, in Canada, the USA,<br />

England, Scotland and Malaysia.<br />

The business grew and grew. It<br />

continued to produce new brands,<br />

notably Chubby (1993) in its specially<br />

designed chubby bottle aimed at<br />

children. The company started winning<br />

awards for exports and innovation.<br />

Busta followed, and Viva flavoured<br />

sparkling water. With the help of<br />

subsidiaries, joint ventures and<br />

franchisees, SM Jaleel was doing good<br />

business everywhere from Barbados,<br />

Jamaica and Guyana to Haiti, Mexico<br />

and Brazil, Guatemala and North<br />

America.<br />

As the brand list continued to<br />

swell, the company added Fruta Kool<br />

Kidz, Oasis bottled water, Caribbean<br />

Cool drinks, 1-litre Fruta, and Turbo<br />

energy drinks. It acquired the franchise<br />

for Tampico. It set up a plant in Saudi<br />

Arabia to export to the Middle East, and<br />

another in Durban to market Chubby in<br />

South Africa. It acquired fruit juice<br />

concentrate manufacturing companies<br />

in Trinidad and Jamaica, adding Trinidad<br />

Reconstituted juices and Juciful juices<br />

to the portfolio. These factories allowed<br />

10<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

vertical integration by buying fruit<br />

from local farmers and converting it<br />

into frozen orange and grapefruit juice<br />

concentrate for use throughout the<br />

year.<br />

The export team<br />

Today, SM Jaleel’s Caribbean sales export<br />

team is led by Clint Villafana, Vice<br />

President of Export Sales (Caribbean and<br />

Third Party). It includes Amir Hosein and<br />

Aaron Logie. At an extra-regional level,<br />

Brian Erdelyi (Chief Revenue Officer,<br />

based in Canada) leads a team supported<br />

by Suneeta Hosein and Michelle Grant.<br />

The team is focused on the company’s<br />

continued growth and market expansion.<br />

In an interview, Clint Villafana<br />

confirmed that working with his team<br />

has been a very rewarding experience.<br />

They were instrumental in the growth<br />

of the department, and in the expansion<br />

of the company’s footprint into more<br />

new markets in recent years, such as<br />

Ghana, Puerto Rico, Holland, Bonaire,<br />

Belize, and Aruba. “They have been key<br />

in the expansion of our existing SMJ<br />

portfolio within existing markets, and<br />

increasing overall market share for the<br />

company’s brands.”<br />

Part of SM Jaleel’s success is<br />

surely due to the judicious selection<br />

of export models and products,<br />

based on careful market research. A<br />

franchise agreement? A new affiliate<br />

or subsidiary? Exclusive agreement<br />

with an experienced distributor?<br />

Outsourced production? The decision,<br />

Villafana explained, depends partly on<br />

the size of the country and its distance<br />

from Trinidad, which will affect<br />

shipping costs. “We perform a value<br />

chain analysis to determine the best<br />

approach.”<br />

Local costs matter too. “Markets<br />

have different duty structures,” Villafana<br />

pointed out, “and as such can make<br />

our products uncompetitive due to<br />

price sensitivity. To address this in the<br />

Organisation of Eastern Caribbean States<br />

(OECS), many years ago we introduced<br />

a production facility in St Lucia, which<br />

allows us to benefit from a lower duty<br />

structure since we are selling from a Less<br />

Developed Country (LDC).”<br />

Villafana continued: “Markets<br />

have different regulatory requirements<br />

in terms of labels and ingredients, so<br />

in entering markets we have had to<br />

work closely with our Research and<br />

Development team to customise some<br />

of our existing brands to meet these<br />

requirements.”<br />

SM Jaleel makes good use of the<br />

Caricom free trade agreement, and is<br />

now expanding into Costa Rica, where<br />

Michelle Grant, Finance and Operations<br />

Manager, SMJ Procurement and<br />

Marketing, Inc<br />

Brian Erdelyi, Chief Revenue Officer, SM<br />

Jaleel<br />

From left to right: Export Managers Aaron Logie and Amir Hosein; Suneeta Hosein, Manager, Centralised Planning Unit;<br />

Clint Villafana, Vice President, Export (Caribbean and Third Party)<br />

www.chamber.org.tt/contact-magazine 11<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

it will benefit from concessions available under the trade<br />

agreement that country has with Trinidad and Tobago.<br />

Flexibility<br />

SM Jaleel has an excellent track record in responding to<br />

changing market conditions and innovating to support<br />

growth.<br />

In 1984, for example, when the economic climate<br />

demanded a container that would bring consumers both<br />

savings and convenience, the company introduced the<br />

revolutionary Jaliter bottle (Jaleel + litre), and became the<br />

pioneer in large-format 2-litre soft-drink packaging. In<br />

conjunction with Reynolds Metals Company, it was the first<br />

company in the world to market fruit juices in two-piece<br />

aluminium cans using nitrogen technology, thus eliminating<br />

the need for artificial preservatives.<br />

Chubby is another example of flexibility. It was born<br />

when SM Jaleel observed that children were being given soft<br />

drinks in large bottles which were cumbersome for them to<br />

hold: so it filled that gap in the market by introducing the<br />

flagship brand in its characteristic chubby bottle.<br />

Chubby changed the market and created a global<br />

transformation for SM Jaleel. Today, it is sold in over 60<br />

countries and is manufactured on four continents around<br />

the world; it has proven to have almost unrivalled global<br />

reach in terms of penetrating new markets and countries.<br />

Responsibility<br />

SM Jaleel is notable for its response to environmental<br />

challenges too. In Trinidad, it recycles all its cardboard, cans,<br />

plastic bottles, shrink wrap, cardboard, pallets, metal drums,<br />

and unused tetra packs. It is in the process of building a waste<br />

water treatment plant. It is working to reduce the materials<br />

in its packaging, and lowered the weight of its plastic water<br />

bottles by half in two years.<br />

It takes corporate social responsibility very seriously<br />

too. One of its recent projects has been to partner with Vitas<br />

House Hospice during Cancer Awareness Month (October), to<br />

raise funds to promote cancer awareness through education,<br />

early detection, and treatment. In another project, the<br />

company was one of the first to respond to hurricaneravaged<br />

Dominica last year, sending over 200 tonnes of<br />

drinks, water, food, toiletries and groceries as part of the<br />

relief effort.<br />

Reaching out<br />

One of SM Jaleel’s current objectives is truly remarkable: it<br />

wants to leverage its export success so as to give a platform<br />

to other Trinidad and Tobago manufacturers and exporters.<br />

SMJ Director Dr Mikaeel Mohammed told a business<br />

audience earlier this year that the company wanted to help<br />

exporters get things done, and was already working with one<br />

of Trinidad and Tobago’s best-known brands, using SM Jaleel’s<br />

existing distribution and marketing network. “We want to<br />

help each and every company here [to] reach destinations you<br />

never dreamed of,” he declared. “Caribbean brands are just as<br />

good [as international ones], if not better.”<br />

It sounds like the same sort of innovative thinking<br />

that has marked out SM Jaleel since its earliest days in<br />

San Fernando. While it pursues its aggressive growth<br />

campaign, takes care of its corporate social responsibility,<br />

and continues to innovate, SM Jaleel has placed its brands <strong>–</strong><br />

and Trinidad and Tobago <strong>–</strong> in the hands of consumers across<br />

the world.<br />

12<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

Residential Lots and Townhouses<br />

for sale in TOBAGO<br />

“Invest in a new Community”<br />

CALL NOW 639-6313, 628-3596<br />

INEZINVESTMENTSTT.COM

looking outwards<br />

The will to<br />

export<br />

For decades, T&T has dreamed about a big jump in nonenergy<br />

exports, enough to break dependence on oil and<br />

gas. Is that about to happen at last? <strong>CONTACT</strong> sat down<br />

with exporTT’s CEO Dietrich Guichard to find out<br />

WORDS By: Joel Henry<br />

photos courtesy: exportt<br />

courtesy exportt<br />

“<br />

The current environment,” says Trade and Industry<br />

Minister Paula Gopee-Scoon, “requires a more<br />

aggressive approach to implementing government<br />

policy aimed at growing exports to lessen the<br />

country’s vulnerability and dependence on oil and gas.”<br />

The Minister was speaking in November 2017 at the<br />

National Export Facilitation Organisation of Trinidad and<br />

Tobago, otherwise known as exporTT. New signage was<br />

being unveiled at its Charlotte Street headquarters, which<br />

was being renamed “Export House.” A symbolic change, but<br />

symbols have meaning. And the change in signage reflects a<br />

new approach and outlook for exporTT.<br />

“Our approach is much more aggressive,” says Dietrich<br />

Guichard, Chief Executive Officer. “There are a lot of things<br />

that we are doing differently internally, and we are trying to<br />

engage our clients more intimately.”<br />

In this era of uncertain prices for Trinidad and Tobago’s<br />

energy exports, a foreign exchange crunch, and the critical<br />

need for diversification of the economy, the nation needs new<br />

sources of export revenue.<br />

The most recent figures out of the Ministry of Trade and<br />

Industry (for October 2016 to September 2017) show that<br />

TT$37 billion of the total TT$41 billion worth of exports were<br />

energy-related. That’s 88%. This needs to change.<br />

So what is exporTT doing to make it happen?<br />

Dietrich Guichard, CEO, exporTT<br />

14<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

“For the first time the macroeconomic<br />

situation is pushing business in a particular<br />

direction”<br />

What is exporTT and what does it do?<br />

Dietrich Guichard: ExporTT officially is the sole national<br />

export facilitation organisation for Trinidad and Tobago<br />

outside of the oil and gas and petrochemical sector. Our<br />

focus is the development and promotion of the export of<br />

goods and services, regionally and internationally.<br />

Trinidad and Tobago’s top<br />

non-energy exports,<br />

October 2016 <strong>–</strong> September 2017<br />

“Facilitation” is a broad word. What does it entail?<br />

DG: Facilitation can be broken down into various areas.<br />

We have an export promotion division, a research<br />

division, a capacity building division (including standards<br />

implementation), and a training division. In general<br />

our activities are dedicated to growing exports and<br />

diversifying the economy in a very real and practical way.<br />

Can you give me an example of exporTT’s activities?<br />

DG: One programme we have in place is taking the top 120<br />

exporters and working with them in their organisations.<br />

This includes diagnosing where they are in their financial,<br />

marketing, and human resource capability, and identifying<br />

their strengths and weaknesses. Really we are diagnosing<br />

all aspects of their business operations, including the will<br />

to export. Many people say they want to export, but is it<br />

really true?<br />

Then we are developing robust export plans with<br />

them. If they wish to get into a market or markets we<br />

will provide the necessary information and contacts <strong>–</strong><br />

importers, market prices, the contacts to get you there.<br />

If you do not have the wherewithal, we will work with<br />

you to build your firm’s capacity, including training,<br />

research, and even funding for machinery.<br />

How far along is this programme?<br />

DG: We will complete 30 companies at the end of this<br />

fiscal (September <strong>2018</strong>).<br />

You mentioned the “will to export”. It seems there is<br />

a new energy and willingness to get things done.<br />

DG: When I took up the post of CEO at exporTT the<br />

Chairman said, somewhat tongue-in-cheek: “ExporTT is<br />

Trinidad and Tobago’s best kept secret”. So we made a<br />

conscious decision to change that. We have been much<br />

more aggressive in our marketing. And we have made<br />

a conscious decision to change the way we do things.<br />

We have moved our officers from being office-based<br />

most of the time to being out there in the market. It is<br />

Toilet tissue<br />

Cigarettes<br />

Cereals, precooked and otherwise<br />

Building cement (grey)<br />

Aromatic bitters<br />

Biscuits, unsweetened<br />

Sweet biscuits<br />

Other chocolate in blocks, slabs or bars<br />

Other sugar confectionery<br />

Prepared foods from cereals<br />

Beer<br />

Bottles for soft drinks, beers, wines, spirits<br />

Other detergents<br />

Aerated beverages<br />

TT$253 million<br />

TT$239 million<br />

TT$219 million<br />

TT$156 million<br />

TT$97 million<br />

TT$89 million<br />

TT$87 million<br />

TT$84 million<br />

TT$79 million<br />

TT$77 million<br />

TT$73 million<br />

TT$72 million<br />

TT$60 million<br />

TT$59 million<br />

www.chamber.org.tt/contact-magazine 15<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

Trinidad and Tobago’s top ten non-energy export markets, 2016<br />

Guyana<br />

US$243 million<br />

Suriname<br />

US$66 million<br />

USA<br />

US$236 million<br />

UK<br />

US$40 million<br />

Jamaica<br />

US$117 million<br />

Saint Lucia<br />

US$40 million<br />

Barbados<br />

US$70 million<br />

Netherlands<br />

US$30 million<br />

Grenada<br />

US$68 million<br />

St Vincent &<br />

the Grenadines<br />

US$28 million<br />

“Our<br />

approach is<br />

much more<br />

aggressive”<br />

a much more aggressive approach in terms of interventions and support for local<br />

manufacturing.<br />

Then there is the state of the economy and the lack of foreign exchange. Money<br />

drives everything. The traditional importers and distributors are starting to feel the<br />

crunch. Getting hard currency to restock and so on, and continue operations in the<br />

traditional way, is becoming harder and harder. For the first time the macroeconomic<br />

environment is pushing business in a particular direction to help with their foreign<br />

exchange requirements.<br />

Who are some of our major exporters?<br />

DG: Carib Brewery and SM Jaleel and Company have major investments in the islands.<br />

SM Jaleel goes even further with a presence in South Africa and Saudi Arabia, with<br />

actual production facilities in these territories. Carib has investments up the islands<br />

and acquired a brewery in Florida a few years ago. The ANSA McAL Group of Companies<br />

(owners of Carib) is setting up business in Cuba, in the Mariel Special Economic Zone.<br />

What are the most promising export markets?<br />

DG: The Latin American market seems to have regions which are growing. Our<br />

manufacturers, through exporTT, are aggressively seeking to maximise those territories<br />

where we have existing trade agreements <strong>–</strong> Colombia, Costa Rica, Panama, Haiti and<br />

Cuba. Cuba has taken a lot of time, but we are now seeing tremendous benefits from<br />

our investments in the island.<br />

16<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

www.chamber.org.tt/contact-magazine 17<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

Major Trinidad and Tobago non-energy<br />

companies exporting to CARICOM<br />

Over US$20 million per year<br />

SM Jaleel<br />

WITCO<br />

Associated Brands Industries<br />

Trinidad Cement<br />

Nestlé Caribbean<br />

Trinidad Distillers<br />

Electrical Industries Group<br />

Caribbean Development Company<br />

Holiday Snacks<br />

Between US$10 million and US$20 million<br />

per year<br />

Angostura<br />

Bermudez Biscuits<br />

Baker Hughes<br />

Grand Bay Paper Products<br />

Trinidad Tissues<br />

Universal Foods<br />

Carib Glassworks<br />

John Dickinson<br />

Between US$5 million and US$10 million*<br />

VEMCO<br />

IAL Engineering<br />

Unilever<br />

Advance Foam<br />

NFM<br />

Century Eslon<br />

Chief Brand Products<br />

* There are about 50 firms in this category in total.<br />

“We are now<br />

the number one<br />

exporter into Cuba<br />

from the Caribbean<br />

and Latin America”<br />

ExporTT (in its prior incarnation as the Business<br />

Development Company) and the Ministry of Trade and<br />

Industry have had a trade facilitation office in Cuba for<br />

over ten years. We are now the number one exporter<br />

into Cuba from the Caribbean and Latin America.<br />

That’s impressive.<br />

DG: In fact Carib Glass has just shipped their first major<br />

shipment of glass bottles for the largest local rum<br />

producer in Cuba. Carib beer has signed a distribution<br />

agreement with the largest liquor company in Cuba to<br />

supply the finished beer product to the market. Angostura<br />

has well over 10,000 points of sale on the island, working<br />

closely with exporTT trade facilitation. Sacha Cosmetics<br />

is a major exporter to Cuba. Trinidad Tissues and Grand<br />

Bay Paper and Care Products (makers of tissue paper and<br />

tissue paper pulp) are major suppliers into Cuba.<br />

It has been a bit of a wait, an over 10-year<br />

investment, but we are seeing tremendous growth in the<br />

Cuban market.<br />

What about exporting to the diaspora?<br />

DG: There is a high demand for local products in our<br />

diaspora <strong>–</strong> New York, London, Toronto and Miami.<br />

Caribbean products are growing in prominence, and while<br />

Jamaica has been able to benefit immensely from this, we<br />

have been a bit lagging.<br />

But we are targeting the diaspora market. In<br />

November we will be in Canada on a trade mission.<br />

Targeting the importers who service the diaspora market<br />

will be a major focus for us. Earlier this year, during the<br />

Trade and Investment Convention (TIC), exporTT was<br />

responsible for bringing international buyers. We brought<br />

in the purchasing manager for the GraceKennedy Group<br />

from Canada.<br />

GraceKennedy is well-established, not only in<br />

the diaspora market in North America, but they have<br />

grown and are in the mainstream distribution sector.<br />

18<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

Export House, head<br />

office of exporTT,<br />

on Charlotte Street,<br />

Port of Spain<br />

courtesy exportt<br />

He met with the major local suppliers to discuss<br />

utilising GraceKennedy’s distribution channel. We had<br />

very fruitful meetings and hopefully we will see some<br />

traction in increasing our exports to the diaspora in<br />

North America.<br />

Sounds like progress is being made. What of the<br />

challenges?<br />

DG: The challenges are well-known <strong>–</strong> crime, the<br />

productivity and availability of labour, the lack of foreign<br />

exchange to invest in new or expand existing business.<br />

Companies are not happy with the pace at which they<br />

receive their VAT (value added tax) refunds. Many of them<br />

use it as the liquidity to run their business.<br />

The government understands the problems and<br />

they are working on them. The Ministry of Trade and<br />

Industry is working very hard to improve the ease of<br />

doing business, getting businesses up and running,<br />

getting all the approvals much more easily.<br />

And on a personal level, how do you deal with the<br />

challenges? What motivates you?<br />

DG: I’ve always liked the export arena. My first job, straight<br />

out of university, was travelling up and down the islands<br />

selling construction material for a local company. I just<br />

reached a point in my life and maturity where I wanted<br />

to use my experience to help in nation-building, and give<br />

back to the manufacturing and export sector that has<br />

been good to me. When the position became available I<br />

felt it was an ideal fit with my practical export experience<br />

to bring that understanding to the public sector.<br />

Is there anything you would like to tell potential<br />

exporters?<br />

DG: Don’t be afraid. Don’t be afraid to go out there.<br />

What holds back a lot of business people is the fear of<br />

the unknown. ExporTT is here to demystify your business<br />

expansion aspirations. We are very open. We are very<br />

responsive. We are here to help.<br />

Special resources for companies<br />

• “The Ministry of Trade and exporTT have a<br />

fund of TT$25 million whereby we assist<br />

small and medium-sized manufacturers<br />

to purchase plant and equipment. This<br />

is a grant. You don’t have to pay it back.<br />

You must satisfy the requirement that you<br />

are able to increase your exports or prove<br />

that you are having an impact on import<br />

substitution. You are eligible for this grant<br />

up to $250,000. It is a matching grant,<br />

meaning it will pay the supplier half of the<br />

cost for the equipment up to that amount.”<br />

• “Companies can also access a research and<br />

development grant of up to a million dollars<br />

per company. The grant includes concept<br />

development for an innovative product or<br />

service, commercialisation of the product,<br />

and assistance in marketing the new<br />

product.”<br />

• “ExporTT doesn’t only deal with exporters.<br />

We even have an entrepreneurship<br />

programme for people who are now starting<br />

up, moving them along the developmental<br />

process to one day becoming exporters.<br />

We have a cohort now in Tobago of about<br />

12 indigenous manufacturers who in some<br />

instances are not even exporting to Trinidad.<br />

We are training them in marketing, labelling,<br />

finance and business planning.”<br />

www.chamber.org.tt/contact-magazine 19<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

Know your<br />

export<br />

markets<br />

Every export market has its own character. Get to know<br />

the possibilities, the hazards and the quirks of each one<br />

WORDS By: Lisa M. Douglas-Paul<br />

Trade and Research Economist, Trinidad and<br />

Tobago Chamber of Industry and Commerce<br />

For many countries, the economic outlook in <strong>2018</strong> has been quite positive,<br />

given the changes in the international trade environment. Some of these<br />

changes have opened the way to new opportunities and improved access in<br />

Trinidad and Tobago’s traditional export markets. But political developments<br />

in other traditional markets may threaten the favourable access which many Trinidad<br />

and Tobago companies enjoy.<br />

Caricom, Latin America, the United States and the European Union collectively<br />

accounted for over 80% of Trinidad and Tobago’s exports in 2017. Given the economic<br />

importance of these trading partners, exporters should watch for new opportunities<br />

there. Similarly, experienced exporters will note the changing dynamics in existing<br />

markets that will affect their trade beyond <strong>2018</strong>.<br />

Let’s take a look closer look at the changing conditions that occurred in some<br />

of Trinidad and Tobago’s traditional markets and examine their possible impact on<br />

our exports.<br />

Caricom<br />

The United Nations Commission for Latin America and the Caribbean (UNECLAC)<br />

stated in its <strong>2018</strong> Economic Outlook that Caribbean economies have exhibited<br />

improved growth and resilience in <strong>2018</strong>. Two economies stood out in this regard:<br />

Jamaica and Guyana.<br />

As a result of improvements made to its investment infrastructure, Jamaica<br />

established itself as the top economy in Caricom for ease of doing business in <strong>2018</strong>.<br />

It was also ranked as the fifth easiest place to start business in <strong>2018</strong> by the World<br />

Bank Group.<br />

As the largest English-speaking territory in the Caribbean, with more than<br />

double the population of T&T, Jamaica holds great potential for local businesses<br />

seeking to expand their product and service outreach.<br />

20<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

Travel mania/shutterstock.com<br />

In the case of Guyana, the<br />

estimated 4 billion barrels of oil found<br />

offshore since 2015 could transform the<br />

economy beyond the projected growth<br />

rate of 3.3%. Guyana is expected to<br />

generate increased demand for business<br />

support services well beyond <strong>2018</strong> in<br />

order to sustain the increase in market<br />

activity, particularly in the areas of ICT<br />

and business consultancy.<br />

Latin America<br />

Latin America is seen as the new<br />

horizon for global trade. Trinidad and<br />

Tobago’s exporters can already benefit<br />

from preferential trading arrangements<br />

with Colombia, Venezuela, Costa Rica,<br />

Cuba, the Dominican Republic and<br />

Panama. This access advantage can<br />

have a positive impact on the Trinidad<br />

and Tobago manufacturing sector.<br />

The Dominican Republic, a<br />

significant trading partner for Trinidad<br />

and Tobago, has the highest projected<br />

growth rate for <strong>2018</strong> in Latin America<br />

and the Caribbean. There is much<br />

untapped potential and existing<br />

demand for manufactured products,<br />

particularly inputs for value-added<br />

production for re-export.<br />

In Central America, the market access advantage provided by the TT-Panama<br />

Partial Scope Trade Agreement, coupled with the improvements made to the Panama<br />

Canal, can give T&T manufacturers increased access to greater volumes of cheaper<br />

inputs from global markets for their value-added manufactured products.<br />

Cuba<br />

It has been perceived as difficult to penetrate, but Cuba continues to pique interest.<br />

It has undergone significant changes since 2014 and continues to open up its<br />

economy. Trinidad and Tobago businesses continue to pursue opportunities in the<br />

Cuban market, with varying levels of success.<br />

Restrictions on financial transactions continue to affect the ease of doing<br />

business in Cuba, but the support provided by Trinidad and Tobago’s Trade Facilitation<br />

Office in Havana has made navigating the business landscape significantly easier.<br />

The US and the EU<br />

The changing political landscape in T&T’s traditional export markets has caused<br />

established exporters to feel concerned about the possible impact on preferential<br />

access to the United States and the European Union.<br />

For the past 18 years, T&T exporters have enjoyed duty-free access to the<br />

US through the Caribbean Basin Trade Partnership Act (CBTPA). However, this<br />

arrangement is due to expire on September 30, 2020. There is healthy caution about<br />

its prospects of renewal, given recent developments in US foreign policy under the<br />

Trump administration. This is particularly important as the US is the largest export<br />

market for T&T products.<br />

On the other side of the Atlantic, the infamous Brexit vote sent shockwaves<br />

through the international community in 2016. The United Kingdom announced that<br />

it would be leaving the European Union in 2019, arousing immediate concern as to<br />

how Trinidad and Tobago <strong>–</strong> and by extension Cariforum <strong>–</strong> will continue to benefit<br />

from preferential access for its exports.<br />

Brexit could affect not only the remaining 27 EU member states but also<br />

www.chamber.org.tt/contact-magazine 21<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

Trinidad and Tobago exports 2012-2017 (US$ million)<br />

18000<br />

16000<br />

14000<br />

12000<br />

10000<br />

8000<br />

6000<br />

4000<br />

2000<br />

0<br />

2012 2013 2014 2015 2016 2017p<br />

Non-energy Energy Total<br />

The Trinidad and<br />

Tobago Chamber<br />

of Industry and<br />

Commerce, as a key<br />

business support<br />

organisation, helps<br />

T&T companies to<br />

take advantage<br />

of export<br />

opportunities, and<br />

continues to be a<br />

key partner in the<br />

national export<br />

thrust.<br />

Source: Government of Trinidad and Tobago, Review of the Economy <strong>2018</strong><br />

Caricom, Latin<br />

America, the<br />

United States and<br />

the European<br />

Union collectively<br />

accounted for over<br />

80% of Trinidad and<br />

Tobago’s exports in<br />

2017<br />

trade with the United Kingdom, which happens to be T&T’s<br />

fourth largest trading partner. This is particularly important<br />

since the current Economic Partnership Agreement with the<br />

EU provides preferential market access for both goods and<br />

services from Trinidad and Tobago.<br />

Non-traditional markets<br />

Although market access to traditional trading partners is of<br />

key importance to Trinidad and Tobago, exporters should also<br />

consider opportunities that are developing in non-traditional<br />

markets.<br />

Distance and logistical challenges normally dissuade<br />

smaller exporters from prospecting for opportunities in such<br />

markets. However, ICT and energy-related developments in<br />

Asia and Africa hold some potential for service exports.<br />

Market intelligence<br />

Having an idea of where the global opportunities are is just<br />

the beginning. Making the best decision depends on a sound<br />

market penetration strategy that involves continuous market<br />

intelligence gathering. It also requires an understanding<br />

of your product’s uniqueness, and how it meets existing or<br />

potential demand in your market of interest.<br />

Trade missions and trade expositions offer perfect<br />

opportunities for learning about developments in new and<br />

existing markets. In addition, companies which are interested<br />

in securing preferential access for their products <strong>–</strong> whether<br />

in a new or an existing market <strong>–</strong> should continuously engage<br />

in stakeholder consultations with the Ministry of Trade and<br />

Industry.<br />

22<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

looking outwards<br />

Breaking<br />

into Europe<br />

Exporting to the European market can be a<br />

formidable challenge, even without the threat<br />

of Brexit in March 2019. The key is thorough<br />

preparation and reconnaisance, understanding the<br />

Economic Partnership Agreement, and making use<br />

of the many available sources of guidance and<br />

advice<br />

WORDS BY: Caribbean Export<br />

The European Union (EU) is one of the world’s largest trading blocs, with over<br />

500 million consumers. It is an ideal market for Caribbean firms wanting<br />

to trade and grow their businesses, because the Economic Partnership<br />

Agreement (EPA) negotiated between the Caribbean Forum (Cariforum) and<br />

the EU is designed to enable increased trade, investment and development between<br />

the two regions.<br />

Preparation is key to breaking into any new market, and there are many factors<br />

to consider as you embark on this journey. Here are our top tips for succeeding in a<br />

competitive business environment.<br />

Be completely knowledgeable about the product you are offering<br />

A lack of detail and poor communication about your product’s ingredients, sources of<br />

inputs, safety, shelf life etc., can put you at a big disadvantage with a serious buyer.<br />

Make sure you have product information factsheets on hand when engaging potential<br />

buyers.<br />

Identify a specific country in the EU with a strong and growing demand for what<br />

you can supply<br />

Stay up to date on industry trends and consumption patterns, and identify any special<br />

market niches. Consider who you want to sell to, what consumers may want, and<br />

how best your product can meet their needs. The Caribbean Export Intelligence Portal<br />

(www.ceintelligence.com) can help in identifying the target markets with the highest<br />

demand for your goods, and allows you to generate market profiles.<br />

24<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

BANKING THAT<br />

HELPS YOUR<br />

BUSINESS REACH<br />

NEW HEIGHTS.<br />

Our Corporate and Investment Banking Division<br />

offers an expansive range of intelligent business<br />

solutions. Staffed by a team with decades of<br />

experience, we will take your business to the<br />

next level.<br />

• Working Capital Financing<br />

• Plant and Equipment Financing<br />

• Construction and Commercial<br />

Mortgage Loans<br />

• Bonds and Guarantees<br />

• Investment Banking<br />

• Project Financing

looking outwards<br />

EU-Caribbean: trade in goods 2015-2017 (billion euros)<br />

Year EU imports EU exports Balance<br />

2015 4.6 7.4 2.9<br />

2016 3.6 7.0 3.4<br />

2017 4.0 7.2 3.2<br />

EU-Trinidad and Tobago: trade 2015-2017 (million euros)<br />

Take steps to<br />

protect your<br />

intellectual<br />

property (IP)<br />

in each target<br />

market<br />

2015 1243 660 -583<br />

2016 684 595 -89<br />

2017 1139 513 -626<br />

Source: ec.europa.eu, retrieved on 3 October <strong>2018</strong><br />

Find out about the rules and requirements for exporting to<br />

the EU<br />

There are several non-tariff measures, such as technical<br />

regulations and standards, which must be adhered to when<br />

exporting to the EU. They may vary according to your export<br />

sector. For instance, if you are a food exporter, you will need to<br />

ensure that your product meets the health and safety standards<br />

of the EU: products can be rejected at EU borders for noncompliance.<br />

You will also need to identify any additional, nonlegal<br />

buyer requirements that can enhance your chances of<br />

successfully exporting. These may include quality management<br />

systems, certification (HACCP, Global GAP), and sustainability<br />

standards (Fairtrade, Rainforest Alliance). Additionally, make<br />

sure that you are familiar with the documentary requirements<br />

for export, such as the Commercial Invoice, Customs Value<br />

Declaration, and the Single Administrative Document (SAD).<br />

Develop a strategic export/market entry strategy<br />

Determine the best buyers for your products, and research the<br />

appropriate market segments to ensure that you can meet<br />

the quality and quantity demands of the EU market. Consider<br />

partnering with like-minded suppliers who can help you to meet<br />

quantity requirements and find the best channels to penetrate<br />

the European market. Caribbean Export’s Distribution Channel<br />

Mapping Tool on the CE Intelligence Portal provides guidance<br />

to SMEs on profiling, approaching, and selecting a suitable<br />

distributor.<br />

Participate in trade shows and undertake missions to your<br />

target market<br />

While this may be a costly undertaking, it is always useful to<br />

get a first-hand view of how business is done in the country<br />

you have selected. Check out your main competitors, review<br />

prices for similar products, and begin to introduce your<br />

product to potential consumers.<br />

Protect your intellectual property<br />

Both goods and services exporters should take steps to<br />

protect their intellectual property (IP) in each target<br />

market. This can be achieved through various tools such as<br />

trademarks, patents, copyrights, industrial design rights, and<br />

geographical indications.<br />

Use available resources<br />

Taking the first steps to exporting to Europe can be a<br />

daunting process. But there is a wealth of information and<br />

support to help you on your journey. Caribbean Export<br />

has developed a short, practical, commercially-led export<br />

guidance manual which begins by assessing your export<br />

readiness and provides information on how best to profile,<br />

approach and select a suitable distributor.<br />

There is further advice and information on breaking<br />

into EU, US and other markets, as well as financing<br />

and investment, on the Caribbean Export website<br />

(www.ceintelligence.com).<br />

26<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

Caribbean Export<br />

The Caribbean Export Development Agency, established by<br />

inter-governmental agreement, promotes trade, exports<br />

and investment in the countries of Cariforum.<br />

Who’s who?<br />

Fairtrade<br />

The International Fairtrade Certification Mark guarantees<br />

that specified products meet the sustainability standards<br />

set by Fairtrade International (FLO).<br />

Cariforum<br />

The Caribbean Forum, comprising the countries of<br />

Caricom plus the Dominican Republic, serves as a conduit<br />

between the Caribbean and the EU.<br />

Economic Partnership Agreement (EPA)<br />

The agreement signed in 2008 between Cariforum and the<br />

EU, designed to develop trade and investment between<br />

the two regions.<br />

European Union<br />

The 28 states of western and central Europe within which<br />

the free movement of goods, services, money and people<br />

is being developed. The combined population is over 510<br />

million. The United Kingdom plans to withdraw from the<br />

Union on 29 March, 2019.<br />

Global GAP<br />

An international agricultural certification scheme setting<br />

standards for “good agricultural practice” (GAP) and<br />

unifying requirements for suppliers and retailers.<br />

HACCP<br />

Hazard Analysis and Critical Control Points, a scheme to<br />

monitor and prevent biological, chemical and physical<br />

hazards throughout the food production chain.<br />

Rainforest Alliance<br />

The New York-based Rainforest Alliance certifies<br />

sustainable agriculture and forestry among other things,<br />

and awards a seal for products meeting its criteria.<br />

Single Administrative Document (SAD)<br />

This is the main customs document used for trade into or out<br />

of the EU customs area. It is known in the UK as Form C88.<br />

www.chamber.org.tt/contact-magazine 27<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce

looking outwards<br />

Who do we<br />

have trade<br />

deals with?<br />

Trinidad and Tobago already has trade<br />

agreements in place with many of its<br />

regional and international partners, all<br />

designed to boost exports and make them<br />

easier and less costly<br />

WORDS BY: The Ministry of Trade and Industry,<br />

Trinidad and Tobago<br />

Trinidad and Tobago has trade agreements with trading partners both as<br />

part of the Caribbean Community (Caricom) and on its own (bilaterally).<br />

These agreements facilitate market access for local exporters to third<br />

countries, and also provide for the opening up of the Trinidad and Tobago<br />

market, except in the case of the USA, Canada and Venezuela, which are one-way<br />

agreements in favour of Caricom.<br />

These arrangements provide dual benefits to local companies, by facilitating<br />

the importation of cost-effective inputs and assisting with price-competitiveness<br />

in foreign markets, while providing opportunities for growth through exports. The<br />

table outlines the ten preferential trading arrangements to which Trinidad and<br />

Tobago is a party.<br />

These agreements recognise the importance of trade in services as well as<br />

goods, and thus in some cases include provisions for future negotiations in this area.<br />

Economic and technical cooperation is a key feature of the trade agreement with<br />

Colombia, as it promotes cooperation in a number of areas such as human resource<br />

development, science and technology, and tourism, through exchanges among local<br />

universities.<br />

In addition, Trinidad and Tobago, as part of Cariforum, receives development<br />

cooperation assistance under the European Development Fund for projects related<br />

to economic development, social and human development, regional cooperation<br />

and integration.<br />

Challenges<br />

The main issues encountered by<br />

exporters when trading include access<br />

to market information, difficulties in<br />

meeting standards for products, access<br />

to foreign exchange, and in some<br />

instances distributor laws which act as<br />

a deterrent.<br />

Among other things, the Ministry<br />

of Trade and Industry is actively seeking<br />

to assist exporters with addressing<br />

these issues through:<br />

• trade missions, which provide<br />

opportunities to gather first-hand<br />

information<br />

• exporter training and workshops,<br />

to build capacity and share<br />

information<br />

• the implementation of lines of<br />

credit for specific markets<br />

• the strengthening of its Single<br />

Electronic Window, TTBizLink, to<br />

facilitate and simplify trade<br />

• and the development and<br />

implementation of policies.<br />

Additionally, the agreements<br />

provide a structure for the establishment<br />

of a joint institution to address any<br />

challenges which may arise between<br />

the parties during implementation of<br />

the respective agreements.<br />

See following pages for details of the current<br />

trade agreements<br />

28<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

30<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce www.chamber.org.tt/contact-magazine<br />

Country/<br />

country<br />

grouping<br />

United States<br />

of America<br />

Market<br />

size<br />

(2017,<br />

millions)<br />

Name of trade agreement/date of<br />

signature<br />

325.7 Caribbean Basin Economic<br />

Recovery Act<br />

Signed: January 1984<br />

United States-Caribbean Basin<br />

Trade Partnership Act<br />

Signed: October 1, 2000<br />

Date of expiry: September 30, 2020<br />

Canada 36.7 Caribcan<br />

Signed: November 28, 1986<br />

Date of expiry: <strong>December</strong> 31, 2023<br />

Caricom 18.2 Revised Treaty of Chaguaramas<br />

establishing the Caribbean<br />

Community (Caricom), including<br />

the Caribbean Single Market and<br />

Economy (CSME)<br />

Signed: July 5, 2001<br />

Costa Rica 4.9 Caricom-Costa Rica Free Trade<br />

Agreement<br />

Signed: March 9, 2004<br />

Dominican<br />

Republic<br />

10.8 Caricom-Dominican Republic Free<br />

Trade Agreement<br />

Signed: August 22, 1998<br />

Type of<br />

agreement<br />

Unilateral<br />

One-way<br />

arrangement<br />

in favour of<br />

Caricom<br />

Unilateral<br />

One-way<br />

arrangement<br />

in favour of<br />

Caricom<br />

Free trade<br />

agreement<br />

Two-way<br />

arrangement<br />

Free trade<br />

agreement<br />

Two-way<br />

arrangement<br />

Main provisions<br />

The agreement contains chapters related to:<br />

establishment of common external tariff, rules of<br />

origin, product specific rules of origin, freedom<br />

of transit, internal taxes and other fiscal charges,<br />

quantitative restrictions, subsidies and dumping<br />

safeguards.<br />

The agreement and its protocols contain articles<br />

related to: market access, temporary admission<br />

of goods, rules of origin, product specific rules of<br />

origin, customs procedures, sanitary and<br />

phytosanitary standards, and technical barriers<br />

to trade<br />

The agreement contains articles related to:<br />

market access, rules of origin, product specific<br />

rules of origin, technical barriers to trade,<br />

sanitary and phytosanitary measures, safeguards,<br />

unfair trade practices, anti-competitive business<br />

practices, and customs cooperation<br />

Opportunities available<br />

• Duty-free access for goods into the United<br />

States<br />

• Duty-free access for most goods into<br />

Canada (does not cover textiles, footwear,<br />

luggage, leather garments, lubricating oils<br />

or methanol)<br />

• Free movement of skills/labour, goods,<br />

services, capital, and the right of<br />

establishment among all Caricom member<br />

states (except The Bahamas and<br />

Montserrat)<br />

• Free trade in all products among Caricom<br />

member states<br />

• Framework for the regional harmonisation<br />

of issues such as government procurement<br />

and e-commerce<br />

• Free trade in a wide range of goods and<br />

elimination of non-tariff barriers<br />

• Duty-free access for a selected list of<br />

agricultural products on a seasonal basis<br />

• Duty-free access for electrical products<br />

produced in free trade zones<br />

• Mechanism for settlement of disputes<br />

• Joint Council framework to facilitate<br />

expansion of the agreement and address<br />

trade issues<br />

• Free trade in a wide range of goods<br />

• Future negotiation of access for service<br />

providers in various sectors such as<br />

tourism, financial and professional services<br />

• Joint Council framework to facilitate<br />

expansion of the agreement and address<br />

trade issues<br />

• Duty-free access for a selected list of<br />

agricultural products on a seasonal basis

www.chamber.org.tt/contact-magazine 31<br />

Country/<br />

country<br />

grouping<br />

Market<br />

size<br />

(2017,<br />

millions)<br />

Name of trade agreement/date of<br />

signature<br />

Cuba 11.5 Caricom-Cuba Agreement on Trade<br />

and Economic Cooperation<br />

Signed: July 5, 2000<br />

European<br />

Union<br />

508 Cariforum-European Union<br />

Economic Partnership Agreement<br />

Signed: October 15, 2008<br />

Type of<br />

agreement<br />

Partial scope<br />

agreement<br />

Two-way<br />

arrangement<br />

Free trade<br />

agreement<br />

Two-way<br />

arrangement<br />

Main provisions<br />

The agreement contains articles related to:<br />

market access, rules of origin, technical<br />

standards, safeguards, unfair trade practices, and<br />

anti-competitive business practices<br />

The agreement contains articles related to: trade<br />

in goods <strong>–</strong> market access, rules of origin, product<br />

specific rules of origin, customs duties, antidumping<br />

and countervailing measures,<br />

safeguards, and technical barriers to trade<br />

Opportunities available<br />

• Duty-free access on a selected list of<br />

products<br />

• Access to market support through the<br />

Trade Facilitation Office in Cuba<br />

• The most comprehensive trade agreement<br />

signed by T&T; offers preferential access to<br />

a list of products<br />

• Affords development assistance to fund<br />

key projects within the region under the<br />

European Development Fund<br />

Trinidad and Tobago Chamber<br />

of Industry and Commerce<br />

Venezuela 31.9 Caricom-Venezuela Agreement on<br />

Trade, Economic and Technical<br />

Cooperation<br />

Signed: October 13, 1992<br />

Colombia 49.1 Agreement on Trade, Economic<br />

and Technical Cooperation<br />

between Caricom and the<br />

Government of the Republic of<br />

Colombia<br />

Signed: July 24, 1994<br />

Panama 4.1 Trinidad and Tobago-Panama<br />

Partial Scope Trade Agreement<br />

Signed: October 3, 2013<br />

Partial scope<br />

agreement<br />

One-way<br />

arrangement<br />

in favour of<br />

Caricom<br />

Partial scope<br />

agreement<br />

Two-way<br />

arrangement<br />

Partial scope<br />

agreement<br />

Two-way<br />

arrangement<br />

The agreement contains articles related to:<br />

market access, rules of origin, safeguards, and<br />

unfair trade practices<br />

The agreement and its protocols contain articles<br />

related to: market access, treatment of used<br />

goods, rules of origin, technical standards,<br />

safeguards, and unfair trade practices<br />

The agreement contains articles related to:<br />

market access, rules of origin, safeguards, antidumping<br />

and countervailing measures, sanitary<br />

and phytosanitary standards, technical barriers<br />

to trade, and trade facilitation<br />

• Elimination of tariffs on a selected list of<br />

Caricom products<br />

• Provides mechanism for settlement of<br />

disputes<br />

• Joint Council framework to facilitate<br />

expansion of the agreement and address<br />

trade issues<br />

• Duty-free access for a selected list of<br />

products; opportunity for future<br />

liberalisation of trade in services<br />

• Future negotiation of a bilateral<br />

investment treaty<br />

• Promotes technical cooperation in a<br />

number of areas such as human resource<br />

development, science and technology, and<br />

tourism, through exchanges among<br />

universities<br />

• Joint Council framework to facilitate<br />

expansion of the agreement and address<br />

trade issues<br />

• Duty-free access for a selected list of<br />

products<br />

• Development of a technical cooperation<br />

work programme to improve trade<br />

facilitation between the two countries<br />

• Future negotiation of a bilateral<br />

investment treaty within one year<br />

• Future liberalisation of trade in services in<br />

sectors such as ICT, financial services,<br />

education and transport services, within<br />

two years

looking outwards<br />

Non-tariff<br />

barriers <strong>–</strong><br />

the exporter’s<br />

nightmare<br />

As if exporting wasn’t enough of a challenge already,<br />

the exporter can easily be ambushed by unexpected<br />

traps and pitfalls in the target market. Here’s how to<br />

deal with them<br />

WORDS BY: Usha Samsundar<br />

Business Development Consultant <strong>–</strong> Exports<br />

Quotas<br />

Ask a group of manufacturers why they haven’t been able<br />

to reach their desired level of export growth despite the preferential<br />

agreements now in place with extra-regional markets, and someone will<br />

mention non-tariff barriers.<br />

Non-tariff barriers have long been considered the villain of the piece. They are<br />

one of the key contributors to the gap between where many Trinidad and Tobago<br />

exporters actually are, and where they want to be <strong>–</strong> expanding significantly, even<br />

aggressively, into extra-regional markets.<br />

But we must be careful not to use “non-tariff barrier” as an umbrella term to<br />

refer to any and all issues which challenge exporters and delay or frustrate their<br />

attempts at new market development.<br />

Sanctions<br />

Demystifying the terms<br />

Non-tariff measures (NTMs) and non-tariff barriers (NTBs) are impediments to trade.<br />

They are the result of actions and policy measures beyond what seems to be<br />

reasonable. They are more complex and confusing than they need be. And<br />

they are non-proportional to the risk involved.<br />

Defining NTBs and NTMs is challenging because of the scope and<br />

complexity of the many items they can cover. For example, an exporter<br />

32<br />

Trinidad<br />

and Tobago Chamber<br />

of Industry and Commerce<br />

www.chamber.org.tt/contact-magazine

attempts to register product under sanitary and<br />

phytosanitary (SPS) regulations in a particular<br />

country, and is faced with a flood of onerous and<br />

ever-expanding requests for more information,<br />

maybe confidential or proprietary information<br />

not part of the listed requirements and apparently<br />

unwarranted, plus inexplicably lengthy delays as the<br />

process drags on. This exporter has stumbled on an NTB.<br />

What they are not<br />

The challenging and time-consuming processes associated with<br />

sanitary registration and labelling requirements in the Latin<br />

American region are not NTBs or NTMs.<br />

Those processes have long been in place there, and the<br />

extensive paperwork, the documentation required and the<br />

related costs incurred should not come as a surprise. They are<br />

just part of the entry requirements for doing business there.<br />

The registration process may be a bit cumbersome, but in most<br />

cases registrations are achieved once the required paperwork<br />

and documentation are supplied.<br />

Other regions or markets that continually<br />

challenge our exporters are the USA,<br />

Forex<br />

restrictions<br />

Canada, Europe, and the UK, with their<br />

stringent requirements for product labelling<br />

and packaging, quality standards and<br />

certification. All this has been cited as a<br />

significant impediment to local exporters<br />

trying to doing business, but it cannot be considered an NTB<br />

or NTM, because the standards and processes are transparent,<br />

well-documented and clearly defined.<br />

Inaccurate information<br />

Sometimes incomplete or incorrect information can create<br />

misunderstandings that lead exporters to conclude that they<br />

are being confronted by an NTB.<br />

In a recent case, an exporter complained to a trade<br />

facilitation organisation about an NTB related to the sanitary<br />

registration process in a Central American market. After<br />

investigating, the said organisation concluded that the<br />

exporter had been misled by inaccurate information<br />

from point persons they had contracted locally to<br />

assist with the registration process.<br />

Getting accurate information from trusted<br />

sources about technical and SPS measures is crucial<br />

to minimising costly delays and avoiding unnecessary<br />

expense.<br />

An exporter’s guide to successful market<br />

entry<br />

Above all, be proactive, do due diligence, and network.<br />

Obtain as much data as you can on technical and sanitary<br />

requirements, and on standards and regulations, through the<br />

Enquiry Point on the Trinidad and Tobago Bureau of Standards<br />

(TTBS) website, or through the Ministry of Agriculture, Land<br />

and Fisheries.<br />

Subscribe to the ‘ePing’ online alert system on the TTBS<br />

website: it alerts you with an email when foreign regulators<br />

Customs<br />

Levies<br />

change their requirements.<br />

Access trade facilitation assistance, information<br />

and guidance from the various organisations that<br />

work closely with exporters, like exporTT, the TTMA,<br />

and the TT Chamber of Industry and Commerce. They<br />

can recommend legal resources, and advise on how to<br />

navigate the market. They can also refer you to other local<br />

companies that may already be in the market.<br />

Note that other companies already in the market may be<br />

in different industries, and the NTBs and levels of competition<br />

may differ by industry, so use the information gained from<br />

them as a guide, and not as a blueprint.<br />

A call to exporters: dealing with NTBs<br />

To ensure that NTBs do not continue to be a significant<br />

barrier to trade expansion, we need to create a comprehensive<br />

mechanism for resolution.<br />

At present, exporters seek assistance in one of several<br />

ways: through the Ministry of Trade and Industry (Trade<br />

Directorate Division) if there is a trade agreement in place,<br />

for example, or by contacting one of the trade facilitation<br />

organisations.<br />

This ad hoc arrangement is not an ideal mechanism, since<br />

it diffuses information among many<br />

different agencies and organisations.<br />

There is no central point where<br />

complaints can be logged to create a<br />

viable database.<br />

We need a more sustainable<br />

solution that can help the various<br />

Regulations<br />

stakeholders to understand which markets and industries are<br />

the key offenders, in order to focus on those areas.<br />

A national committee<br />

One recommendation is to create a national committee to<br />