Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Foresight is 2020:<br />

Coming Reassessment Presents a Call for Action<br />

BY MATT MULLENIX<br />

While next year promises to be a blockbuster for big<br />

decisions in the public sphere, 2020 marks an important<br />

four-year milestone for Louisiana municipalities and<br />

their citizens. The mandatory statewide reassessment<br />

of property values and millage rates occurs next year—<br />

which makes <strong>2019</strong> your municipality’s last opportunity to<br />

levy, collect, and secure the maximum authorized rates.<br />

The Louisiana Constitution mandates that all taxable<br />

property be reappraised at least once every four years,<br />

a process affecting both the aggregate value of homes<br />

and businesses as well as the millage rates levied by<br />

state taxing districts and local governments.<br />

These rates rise and fall according to assessed property<br />

values, so that collected revenues remain neutral. In<br />

theory, this system strikes a balance between individual<br />

taxes and municipal coffers that sustains a level of public<br />

service benefitting all.<br />

But in practice, the process is fraught with the specter<br />

of a perceived tax increase, an often unfounded fear<br />

that nonetheless prevents many local governments from<br />

taking simple steps to maintain the legally approved<br />

maximum rate. As a result, nearly half of all Louisiana<br />

municipalities may leave additional revenue uncollected.<br />

According to property tax consultant Kristyn Childers<br />

of Millage Management LLC, municipal councils may<br />

(and should) vote to preserve millage rates at the legal<br />

maximum. This can be done in any year prior to the next<br />

reassessment by following the legal procedure known<br />

as a “roll forward,” which establishes the authorized<br />

maximum millage rate, typically the same rate as the<br />

previous reassessment.<br />

But this opportunity—crucial to preserving many<br />

public services from year to year—may disappear for<br />

municipalities that fail to roll forward prior to the 2020<br />

reassessment.<br />

According to Childers, this happens because<br />

municipalities that levy less than the maximum rate<br />

stand to lose additional revenue now and in the future.<br />

As the Louisiana Legislative Auditor’s office confirms,<br />

the “prior year’s maximum” millage is lost if the taxing<br />

authority chooses not to roll forward during the<br />

appropriate time frame.<br />

What can elected officials do to preserve revenues and<br />

maintain standards of public service their constituents<br />

expect?<br />

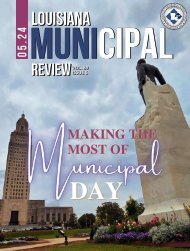

“Take stock of<br />

your current<br />

millage rates<br />

and note<br />

trends in your<br />

municipality’s<br />

tax revenue<br />

over time,”<br />

says Childers.<br />

Local<br />

governments<br />

that fail to<br />

preserve their<br />

maximum<br />

LaMATS recommends municipalities begin<br />

the Roll Forward process no later than March<br />

1, <strong>2019</strong>, to assure all legal requirements are<br />

properly met prior to the 2020 Reassessment.<br />

millage rates in periods of relatively high property value<br />

can find themselves at a loss for options should values<br />

fall in subsequent reassessments.<br />

Childers recommends rolling forward but cautions that<br />

the process takes approximately three months, so the<br />

sooner a municipality begins, the better. “Don’t let your<br />

community’s chance for additional revenue wither on the<br />

vine.”<br />

LaMATS and Millage Management have partnered<br />

to provide free consultations to any Louisiana local<br />

government seeking advice on how to accurately levy ad<br />

valorem taxes from year to year and how best to prepare<br />

for the 2020 statewide reassessment. To schedule an inperson<br />

meeting with Kristyn Childers, contact LaMATS at<br />

(225) 344-5001.<br />

Page 8<br />

<strong>LMR</strong> | <strong>Feb</strong>ruary <strong>2019</strong>