mqt annual report--updated

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mr. and Ms. George Blake<br />

Mr. and Mrs. Timothy D. Bredahl<br />

Mrs. Jean E. Carlson<br />

Ms. Vivian Carlson<br />

Ms. Catherine Carole<br />

Mr. Peter J. Christopherson<br />

Mr. and Mrs. Charles Coffey<br />

Mr. and Mrs. W.L. Cohodas<br />

Mr. and Mrs. James B. DeVold<br />

Ms. Darla Dompierre<br />

Mr. David A. Dziadula and Ms. Margaret J.<br />

Cavallo-Dziadula<br />

Mr. Gary Ebrecht and Ms. Luanne Peterson<br />

Isabel Edgell<br />

Ms Joyce H. Emmons<br />

Mr. and Mrs. George S. Esber Jr.<br />

Ms. Cheryl Field<br />

Mr. and Mrs. Robert S. Foster<br />

Dr. and Mrs. Mark T. Frank D.D.S.<br />

Mr. and Mrs. Anthony D. “Gigs” Gagliardi<br />

Mr. and Mrs. Albert W. Hardin<br />

Mr. and Mrs. Kenneth Harnett<br />

Mr. and Mrs. Benjamin C. Hassenger<br />

Mr. Philip M. Hill<br />

Ms. Katherine Honkala<br />

Mr. and Mrs. M. Cameron Howes<br />

Ms. Leetha E. Irish<br />

Mr. and Mrs. Daniel R. Jahnke<br />

Mr and Mrs. Clarence D. Johnson<br />

Mr. and Mrs. David A. Karnes<br />

DONORS<br />

Mr. and Mrs. William J. L. King<br />

Mr. Frederick L. Klinger<br />

Ms. Janet Koistenen and Mr. Glen Lerlie<br />

Ms. Courtney A. Kuehl<br />

Mr. and Mrs. Mark S. Kulie<br />

Mrs. Lois F. LaBrecque<br />

Mr. Stuart Laitinen<br />

Mr. William C. Langlois<br />

Mr. and Mrs. Robert Leach<br />

Mr. Jay LeRoy<br />

Mr. and Mrs. Scott A. Lindberg<br />

Ms. Lois B. Lindquist<br />

Mr. Russell Magnaghi<br />

Mr. and Mrs, Matthew G. McCabe<br />

Ms. Renee L. Michaud<br />

Mr. Harold W. Moilanen<br />

Mr. and Mrs. Martin J. Murray<br />

Mr. and Mrs. James E. Nowell<br />

Ms. Barbara J. Nuorala<br />

Ms. Katherine C. Opat<br />

Organic Food Coop of Marquette<br />

David and Lynn Parker<br />

Mr. and Mrs. Steven E. Peffers<br />

Chaplain and Mrs. John A. Piirto<br />

Mr. Stephen Pohlman<br />

Mr. and Mrs. Dan Poirier<br />

Mr. and Mrs. Joseph A. Potvin<br />

Mr. & Mrs. Leino W. Pynnonen<br />

Dr. C.B. Rao<br />

Rehab Services Department - Marquette<br />

General Hospital<br />

Mrs. Elizabeth H. Rumely<br />

Mr. William H. Rutter<br />

Mr. and Mrs. Walter R. Scanlon, Jr.<br />

Mr. and Ms. Ken Schon<br />

Mr. and Mrs. Burns Severson<br />

Mr. Henry Sherry<br />

Ms. Diane A. Skewis and Ms. Cindra K.<br />

Quayle<br />

Mr. and Mrs. Howard C. Smith II<br />

Mr. and Ms. Donald A. Snitgen<br />

Mr. and Mrs. John R. Soderberg<br />

Mr. and Mrs. Ted Soldan<br />

Mr. and Mrs. Kalmer Stordahl<br />

Mr. and Mrs. Bernard J. Suardini<br />

Mr. Louis F. Taccolini<br />

Mr. Dennis R. Tasson<br />

Mr. and Mrs. John Trudeau<br />

University of Wisconsin - Green Bay<br />

Mr. Robert J. Vandyke<br />

Mr. and Mrs. Vincent J. Villa<br />

Dr. and Mrs. H. John Visser<br />

Ms. Helen Waisanen<br />

Mr. and Mrs. Dean L. Warlin<br />

Mr. and Mrs. Charles Weinrick<br />

Mr. and Mrs. Dennis West<br />

Mr. and Mrs. Richard J. Wiesner<br />

Mr. and Mrs. Ken A. Wills<br />

Mr. and Mrs. David J. Winslow<br />

Mr. and Ms. Jonathan Wise<br />

Mr. and Mrs. Roger W. Zappa<br />

Mr. Jack Zatirka<br />

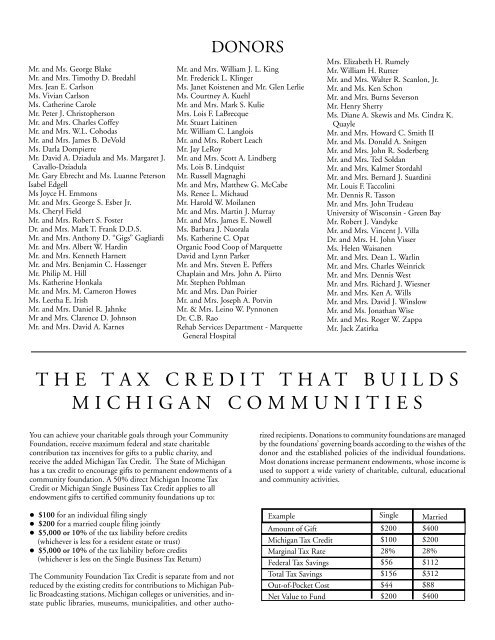

THE TAX CREDIT THAT BUILDS<br />

MICHIGAN COMMUNITIES<br />

You can achieve your charitable goals through your Community<br />

Foundation, receive maximum federal and state charitable<br />

contribution tax incentives for gifts to a public charity, and<br />

receive the added Michigan Tax Credit. The State of Michigan<br />

has a tax credit to encourage gifts to permanent endowments of a<br />

community foundation. A 50% direct Michigan Income Tax<br />

Credit or Michigan Single Business Tax Credit applies to all<br />

endowment gifts to certified community foundations up to:<br />

rized recipients. Donations to community foundations are managed<br />

by the foundations’ governing boards according to the wishes of the<br />

donor and the established policies of the individual foundations.<br />

Most donations increase permanent endowments, whose income is<br />

used to support a wide variety of charitable, cultural, educational<br />

and community activities.<br />

$100 for an individual filing singly<br />

$200 for a married couple filing jointly<br />

$5,000 or 10% of the tax liability before credits<br />

(whichever is less for a resident estate or trust)<br />

$5,000 or 10% of the tax liability before credits<br />

(whichever is less on the Single Business Tax Return)<br />

The Community Foundation Tax Credit is separate from and not<br />

reduced by the existing credits for contributions to Michigan Public<br />

Broadcasting stations, Michigan colleges or universities, and instate<br />

public libraries, museums, municipalities, and other autho-<br />

Example<br />

Amount of Gift<br />

Michigan Tax Credit<br />

Marginal Tax Rate<br />

Federal Tax Savings<br />

Total Tax Savings<br />

Out-of-Pocket Cost<br />

Net Value to Fund<br />

Single<br />

$200<br />

$100<br />

28%<br />

$56<br />

$156<br />

$44<br />

$200<br />

Married<br />

$400<br />

$200<br />

28%<br />

$112<br />

$312<br />

$88<br />

$400