JPSCU AR 2018 finan web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

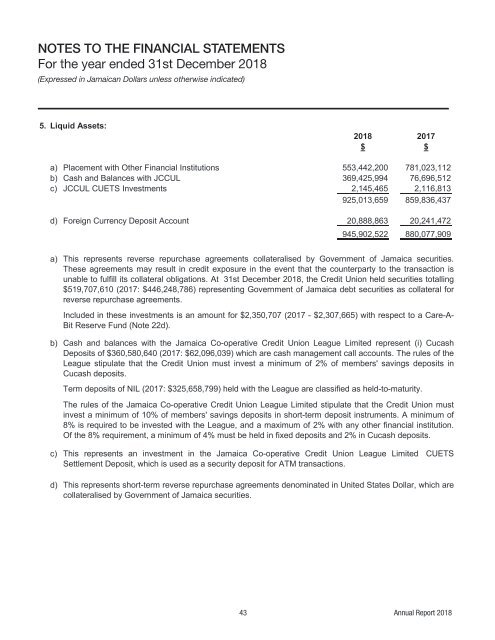

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended 31st December <strong>2018</strong><br />

(Expressed in Jamaican Dollars unless otherwise indicated)<br />

5. Liquid Assets:<br />

<strong>2018</strong> 2017<br />

$ $<br />

a) Placement with Other Financial Institutions 553,442,200 781,023,112<br />

b) Cash and Balances with JCCUL 369,425,994 76,696,512<br />

c) JCCUL CUETS Investments 2,145,465 2,116,813<br />

925,013,659 859,836,437<br />

d) Foreign Currency Deposit Account 20,888,863 20,241,472<br />

945,902,522 880,077,909<br />

a)<br />

b)<br />

This represents reverse repurchase agreements collateralised by Government of Jamaica securities.<br />

These agreements may result in credit exposure in the event that the counterparty to the transaction is<br />

unable to fulfill its collateral obligations. At 31st December <strong>2018</strong>, the Credit Union held securities totalling<br />

$519,707,610 (2017: $446,248,786) representing Government of Jamaica debt securities as collateral for<br />

reverse repurchase agreements.<br />

Included in these investments is an amount for $2,350,707 (2017 - $2,307,665) with respect to a Care-A-<br />

Bit Reserve Fund (Note 22d).<br />

Cash and balances with the Jamaica Co-operative Credit Union League Limited represent (i) Cucash<br />

Deposits of $360,580,640 (2017: $62,096,039) which are cash management call accounts. The rules of the<br />

League stipulate that the Credit Union must invest a minimum of 2% of members' savings deposits in<br />

Cucash deposits.<br />

Term deposits of NIL (2017: $325,658,799) held with the League are classified as held-to-maturity.<br />

The rules of the Jamaica Co-operative Credit Union League Limited stipulate that the Credit Union must<br />

invest a minimum of 10% of members' savings deposits in short-term deposit instruments. A minimum of<br />

8% is required to be invested with the League, and a maximum of 2% with any other <strong>finan</strong>cial institution.<br />

Of the 8% requirement, a minimum of 4% must be held in fixed deposits and 2% in Cucash deposits.<br />

c)<br />

This represents an investment in the Jamaica Co-operative Credit Union League Limited<br />

Settlement Deposit, which is used as a security deposit for ATM transactions.<br />

CUETS<br />

d) This represents short-term reverse repurchase agreements denominated in United States Dollar, which are<br />

collateralised by Government of Jamaica securities.<br />

43 Annual Report <strong>2018</strong>