JPSCU AR 2018 finan web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

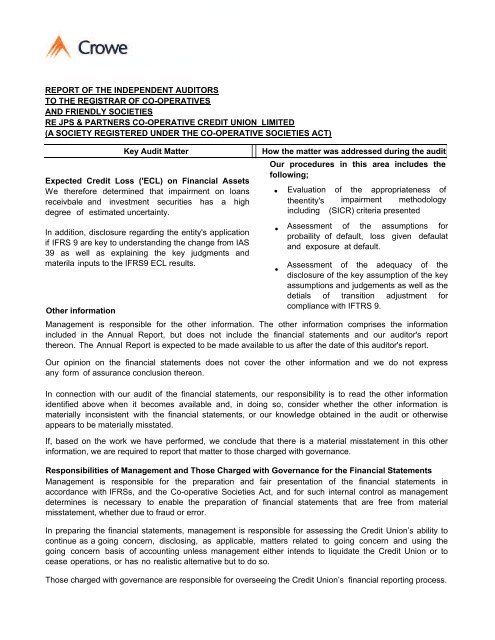

REPORT OF THE INDEPENDENT AUDITORS<br />

TO THE REGISTR<strong>AR</strong> OF CO-OPERATIVES<br />

AND FRIENDLY SOCIETIES<br />

RE JPS & P<strong>AR</strong>TNERS CO-OPERATIVE CREDIT UNION LIMITED<br />

(A SOCIETY REGISTERED UNDER THE CO-OPERATIVE SOCIETIES ACT)<br />

Key Audit Matter<br />

Expected Credit Loss ('ECL) on Financial Assets<br />

We therefore determined that impairment on loans<br />

receivbale and investment securities has a high<br />

degree of estimated uncertainty.<br />

In addition, disclosure regarding the entity's application<br />

if IFRS 9 are key to understanding the change from IAS<br />

39 as well as explaining the key judgments and<br />

materila inputs to the IFRS9 ECL results.<br />

Other information<br />

How the matter was addressed during the audit<br />

Our procedures in this area includes the<br />

following;<br />

If, based on the work we have performed, we conclude that there is a material misstatement in this other<br />

information, we are required to report that matter to those charged with governance.<br />

Responsibilities of Management and Those Charged with Governance for the Financial Statements<br />

Management is responsible for the preparation and fair presentation of the <strong>finan</strong>cial statements in<br />

accordance with IFRSs, and the Co-operative Societies Act, and for such internal control as management<br />

determines is necessary to enable the preparation of <strong>finan</strong>cial statements that are free from material<br />

misstatement, whether due to fraud or error.<br />

In preparing the <strong>finan</strong>cial statements, management is responsible for assessing the Credit Union’s ability to<br />

continue as a going concern, disclosing, as applicable, matters related to going concern and using the<br />

going concern basis of accounting unless management either intends to liquidate the Credit Union or to<br />

cease operations, or has no realistic alternative but to do so.<br />

Those charged with governance are responsible for overseeing the Credit Union’s <strong>finan</strong>cial reporting process.<br />

<br />

<br />

Evaluation of the appropriateness of<br />

theentity's impairment methodology<br />

including (SICR) criteria presented<br />

Assessment of the assumptions for<br />

probaility of default, loss given defaulat<br />

and exposure at default.<br />

Assessment of the adequacy of the<br />

disclosure of the key assumption of the key<br />

assumptions and judgements as well as the<br />

detials of transition adjustment for<br />

compliance with IFTRS 9.<br />

Management is responsible for the other information. The other information comprises the information<br />

included in the Annual Report, but does not include the <strong>finan</strong>cial statements and our auditor's report<br />

thereon. The Annual Report is expected to be made available to us after the date of this auditor's report.<br />

Our opinion on the <strong>finan</strong>cial statements does not cover the other information and we do not express<br />

any form of assurance conclusion thereon.<br />

In connection with our audit of the <strong>finan</strong>cial statements, our responsibility is to read the other information<br />

identified above when it becomes available and, in doing so, consider whether the other information is<br />

materially inconsistent with the <strong>finan</strong>cial statements, or our knowledge obtained in the audit or otherwise<br />

appears to be materially misstated.