JPSCU AR 2018 finan web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

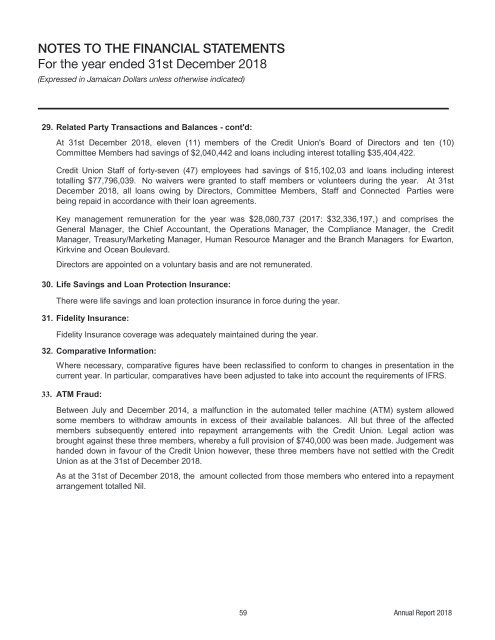

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended 31st December <strong>2018</strong><br />

(Expressed in Jamaican Dollars unless otherwise indicated)<br />

29. Related Party Transactions and Balances - cont'd:<br />

At 31st December <strong>2018</strong>, eleven (11) members of the Credit Union's Board of Directors and ten (10)<br />

Committee Members had savings of $2,040,442 and loans including interest totalling $35,404,422.<br />

Credit Union Staff of forty-seven (47) employees had savings of $15,102,03 and loans including interest<br />

totalling $77,796,039. No waivers were granted to staff members or volunteers during the year. At 31st<br />

December <strong>2018</strong>, all loans owing by Directors, Committee Members, Staff and Connected Parties were<br />

being repaid in accordance with their loan agreements.<br />

Key management remuneration for the year was $28,080,737 (2017: $32,336,197,) and comprises the<br />

General Manager, the Chief Accountant, the Operations Manager, the Compliance Manager, the Credit<br />

Manager, Treasury/Marketing Manager, Human Resource Manager and the Branch Managers for Ewarton,<br />

Kirkvine and Ocean Boulevard.<br />

Directors are appointed on a voluntary basis and are not remunerated.<br />

30. Life Savings and Loan Protection Insurance:<br />

There were life savings and loan protection insurance in force during the year.<br />

31. Fidelity Insurance:<br />

Fidelity Insurance coverage was adequately maintained during the year.<br />

32. Comparative Information:<br />

Where necessary, comparative figures have been reclassified to conform to changes in presentation in the<br />

current year. In particular, comparatives have been adjusted to take into account the requirements of IFRS.<br />

33. ATM Fraud:<br />

Between July and December 2014, a malfunction in the automated teller machine (ATM) system allowed<br />

some members to withdraw amounts in excess of their available balances. All but three of the affected<br />

members subsequently entered into repayment arrangements with the Credit Union. Legal action was<br />

brought against these three members, whereby a full provision of $740,000 was been made. Judgement was<br />

handed down in favour of the Credit Union however, these three members have not settled with the Credit<br />

Union as at the 31st of December <strong>2018</strong>.<br />

As at the 31st of December <strong>2018</strong>, the amount collected from those members who entered into a repayment<br />

arrangement totalled Nil.<br />

59 Annual Report <strong>2018</strong>