- Page 2 and 3:

Risk Disclosure Futures and forex t

- Page 4 and 5:

Volume Profile ....................

- Page 6 and 7:

Position management ...............

- Page 8 and 9:

Gap at market open ................

- Page 10 and 11:

Introduction My first tangible succ

- Page 12 and 13:

Price Action Price Action Price Act

- Page 14 and 15:

Price Action Who moves the price? E

- Page 16 and 17:

Price Action If you use for example

- Page 18 and 19:

Price Action Let me now show you a

- Page 20 and 21:

Price Action Strong initiation area

- Page 22 and 23:

Price Action As you can see, there

- Page 24 and 25:

Price Action There are some really

- Page 26 and 27:

Price Action The first one is an EU

- Page 28 and 29:

Price Action aggressive sellers, th

- Page 30 and 31:

Price Action There are some cases w

- Page 32 and 33:

Price Action Step 1: Use the Fibona

- Page 34 and 35:

Price Action Bearish AB = CD (EUR/U

- Page 36 and 37:

Price Action Strategy 5: Daily Open

- Page 38 and 39:

Price Action position. I am basical

- Page 40 and 41:

Price Action Strong high/low Formin

- Page 42 and 43:

Price Action Remember that you are

- Page 44 and 45:

Price Action Weak highs/lows are pl

- Page 46 and 47:

Price Action The reason market tend

- Page 48 and 49:

Price Action The failed auction is

- Page 50 and 51:

Price Action If you are a swing tra

- Page 52 and 53:

Volume Profile Volume Profile Why a

- Page 54 and 55:

Volume Profile I don’t really see

- Page 56 and 57:

Volume Profile If you prefer doing

- Page 58 and 59:

Volume Profile balance and neither

- Page 60 and 61:

Volume Profile “b-profile“ Its

- Page 62 and 63:

Volume Profile Not all the Volume P

- Page 64 and 65:

Volume Profile Currently, I am usin

- Page 66 and 67:

Volume Profile Now you know in whic

- Page 68 and 69:

Volume Profile Let me now explain t

- Page 70 and 71:

Volume Profile When somebody who is

- Page 72 and 73:

Volume Profile The volume cluster c

- Page 74 and 75:

Volume Profile Below you can see a

- Page 76 and 77: Volume Profile Volume Setup #3: Rej

- Page 78 and 79: Volume Profile If there is a reject

- Page 80 and 81: Volume Profile Important notice: An

- Page 82 and 83: Finding your style Stop-loss and Pr

- Page 84 and 85: Finding your style Stop-loss and Pr

- Page 86 and 87: Finding your style Forex brokers us

- Page 88 and 89: What instruments to trade? What ins

- Page 90 and 91: What instruments to trade? So, my a

- Page 92 and 93: What instruments to trade? Steps to

- Page 94 and 95: What instruments to trade? USD/JPY

- Page 96 and 97: What instruments to trade? The cryp

- Page 98 and 99: Macroeconomic news The end of the s

- Page 100 and 101: Macroeconomic news There are ways t

- Page 102 and 103: Macroeconomic news Examples of "Wea

- Page 104 and 105: Macroeconomic news advantage of usi

- Page 106 and 107: Macroeconomic news will often have

- Page 108 and 109: Macroeconomic news Tip #8: When to

- Page 110 and 111: Macroeconomic news Tip #10: Adjust

- Page 112 and 113: Market analysis from A to Z This wa

- Page 114 and 115: Market analysis from A to Z In the

- Page 116 and 117: Position management In the picture,

- Page 118 and 119: Position management Volume-based St

- Page 120 and 121: Position management Volume-based St

- Page 122 and 123: Position management Let me give you

- Page 124 and 125: Position management With 10 pip Pro

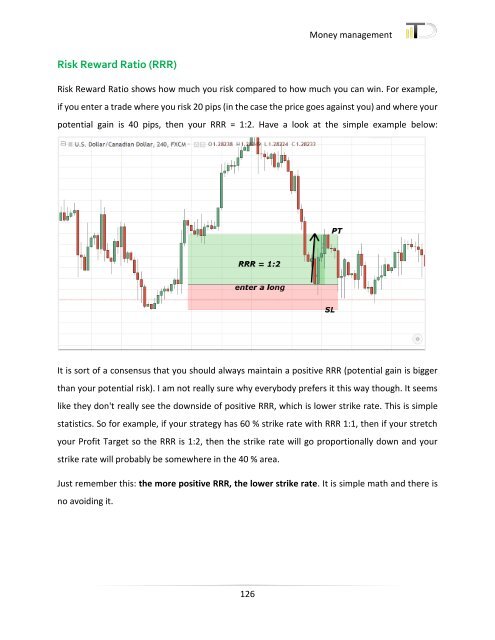

- Page 128 and 129: Money management There is one more

- Page 130 and 131: Money management Let’s say that y

- Page 132 and 133: Trading psychology Trading psycholo

- Page 134 and 135: Trading psychology Good losing trad

- Page 136 and 137: Trading psychology What I call the

- Page 138 and 139: Trading psychology statistics from

- Page 140 and 141: Trading psychology your lost capita

- Page 142 and 143: Backtesting & getting started to lo

- Page 144 and 145: Backtesting & getting started In th

- Page 146 and 147: The 10 most common trading mistakes

- Page 148 and 149: The 10 most common trading mistakes

- Page 150 and 151: The 10 most common trading mistakes

- Page 152 and 153: BONUS: How I manage my intraday tra

- Page 154 and 155: BONUS: How I manage my intraday tra

- Page 156 and 157: BONUS: How I manage my intraday tra

- Page 158 and 159: BONUS: How I manage my intraday tra

- Page 160 and 161: BONUS: How I manage my intraday tra

- Page 162 and 163: BONUS: How I manage my intraday tra

- Page 164 and 165: Real trades Real trades Now you sho

- Page 166 and 167: Real trades Volume accumulation tra

- Page 168 and 169: Real trades Volume accumulation tra

- Page 170 and 171: Real trades Trend setup trade #3: T

- Page 172 and 173: Real trades Trend setup trade #5: T

- Page 174 and 175: Real trades Trend setup trade #8: T

- Page 176 and 177:

Real trades Trades based on Setup #

- Page 178 and 179:

Real trades Rejection Setup trade #

- Page 180 and 181:

Real trades Reversal trades Reversa

- Page 182 and 183:

Real trades This time I didn’t se

- Page 184 and 185:

Real trades Reversal trade #6: Reve

- Page 186 and 187:

Real trades Swing trades based on S

- Page 188 and 189:

Real trades Swing trades based on S

- Page 190 and 191:

Accelerate Your Learning Accelerate

- Page 192 and 193:

Accelerate Your Learning community

- Page 194 and 195:

Just a few testimonials on the cour

- Page 196:

Just a few testimonials on the cour