Trader Dale Volume Profile

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Volume</strong> <strong>Profile</strong><br />

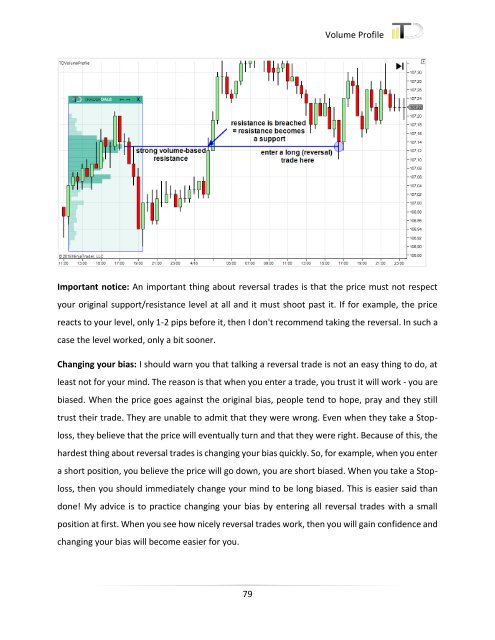

Important notice: An important thing about reversal trades is that the price must not respect<br />

your original support/resistance level at all and it must shoot past it. If for example, the price<br />

reacts to your level, only 1-2 pips before it, then I don't recommend taking the reversal. In such a<br />

case the level worked, only a bit sooner.<br />

Changing your bias: I should warn you that talking a reversal trade is not an easy thing to do, at<br />

least not for your mind. The reason is that when you enter a trade, you trust it will work - you are<br />

biased. When the price goes against the original bias, people tend to hope, pray and they still<br />

trust their trade. They are unable to admit that they were wrong. Even when they take a Stoploss,<br />

they believe that the price will eventually turn and that they were right. Because of this, the<br />

hardest thing about reversal trades is changing your bias quickly. So, for example, when you enter<br />

a short position, you believe the price will go down, you are short biased. When you take a Stoploss,<br />

then you should immediately change your mind to be long biased. This is easier said than<br />

done! My advice is to practice changing your bias by entering all reversal trades with a small<br />

position at first. When you see how nicely reversal trades work, then you will gain confidence and<br />

changing your bias will become easier for you.<br />

79