DCN May Edition 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

First published in 1891<br />

<strong>May</strong> <strong>2019</strong><br />

thedcn.com.au<br />

The voice of Australian shipping & maritime logistics<br />

Charting<br />

a steady<br />

course<br />

Global drivers support<br />

breakbulk and project<br />

cargo recovery<br />

8 Election <strong>2019</strong>: both<br />

sides have their say<br />

26 QLD ports investing<br />

in greater capacity<br />

56 Australia’s trade<br />

agenda post-election

XXXXXX<br />

Contents<br />

26<br />

34<br />

FEATURES<br />

26 Queensland<br />

A look at how QLD ports are investing in a future with bigger ships<br />

34<br />

42<br />

48<br />

Breakbulk & project cargo<br />

The global recovery in breakbulk and project cargo set to continue<br />

Container shipping & logistics<br />

Intermodal facilities becoming increasingly vital to supply chains<br />

Tugs & towage<br />

Exploring the “new order” of the tug boat industry in Australia<br />

COLUMNS<br />

42<br />

48<br />

8 Election <strong>2019</strong><br />

Michael McCormack and<br />

Anthony Albanese have their say<br />

16 Freight & Trade Alliance<br />

Measures to control the BMSB<br />

18 Maritime Industry Aust.<br />

Angela Gillham examines the<br />

trend towards cleaner fuels<br />

20 Women in maritime<br />

A profile of Natalie Godward<br />

22 Election <strong>2019</strong><br />

Industry group leaders outline<br />

priorities for next government<br />

54 Maritime law<br />

Update on autonomous shipping<br />

56 Trade law<br />

Our trade agenda post-election<br />

58 The forwarder<br />

AFIF explains the finer details of<br />

new air cargo security regime<br />

60 Industry profile<br />

Allied Seafreight hits milestone<br />

62 Out & about<br />

MSC marks 30 years of operation<br />

64 Port sustainability<br />

Lessons from the port<br />

sustainability forum in Geneva<br />

66 The grill<br />

Jackie Spiteri’s journey from<br />

Wales to the Port of Newcastlei<br />

4 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

EXPORTING TO<br />

SOUTHEAST ASIA?<br />

Choose ANL - your business is our<br />

focus. Move your shipments with<br />

one of our five services into<br />

Southeast Asia.<br />

BOOK ON AAX, AAX2, NEMO,<br />

KIX OR PAX TODAY

First published in 1891<br />

<strong>May</strong> <strong>2019</strong><br />

thedcn.com.au<br />

EDITORIAL<br />

ISSUE NUMBER 1246 <strong>May</strong> <strong>2019</strong><br />

From the editor<br />

By the time many of you read this, Australia will be less than two<br />

weeks from the end of a bruising federal election campaign. A week<br />

is a long time in politics but it still seems the likely outcome will be<br />

a change of government.<br />

Logistics and trade have featured in the campaign without being<br />

a central theme, Labor’s Inland Rail inquiry pledge being the most<br />

newsworthy development.<br />

The Coalition has emphasised investment in regional freight<br />

infrastructure (perhaps a nod to the National Party).<br />

Labor, meanwhile, has made the case for revitalising Australian<br />

shipping and the Australian shipping sector. Recent history suggests<br />

the ALP will have its work cut out. But given the 2012 shipping laws<br />

brought in by then federal Minister for Infrastructure Anthony<br />

Albanese remain in place, a Labor federal government would have<br />

reason for believing it could progress its agenda.<br />

On the macro level, the logistics sector needs economic growth,<br />

something no longer to be taken for granted in a volatile world. The<br />

next federal government will need to be nimble on its feet on the<br />

world stage, with Trump and Brexit having turned the free trade<br />

narrative on its head.<br />

Australians want stability. We used to chortle about short-term<br />

and volatile administrations - but no longer. Both governments and<br />

oppositions at federal level have been riven with infighting for the<br />

past decade and coherent policy development has been problematic.<br />

This country and the logistics sector require better of their leaders.<br />

David Sexton<br />

Editor, Daily Cargo News<br />

Stay up to date with the latest industry news and insights<br />

by subscribing to one of our subscription packages!<br />

thedcn.com.au<br />

Publisher<br />

Lloyd O’Harte lloyd.oharte@thedcn.com.au<br />

Editor<br />

David Sexton david.sexton@thedcn.com.au<br />

Deputy Editor<br />

Paula Wallace paula.wallace@thedcn.com.au<br />

Intern<br />

Caroline Drummond caroline@thedcn.com.au<br />

Creative Director Lee McLachlan<br />

Production Manager<br />

Grant Lopez grant.lopez@thedcn.com.au<br />

Electronic Services<br />

Linda Saleh<br />

Advertising Sales Director<br />

Lindsay Reed lindsay.reed@thedcn.com.au<br />

Tel: 0431 956 645<br />

Subscription Manager<br />

James Hayman james.hayman@thedcn.com.au<br />

Tel: 02 9126 9713<br />

The voice of Australian shipping & maritime logistics<br />

Charting<br />

a steady<br />

course<br />

Global drivers support<br />

breakbulk and project<br />

cargo recovery<br />

8 Election <strong>2019</strong>: both<br />

sides have their say<br />

26 QLD ports investing<br />

in greater capacity<br />

56 Australia’s trade<br />

agenda post-election<br />

<strong>DCN</strong>0519_Cover.in d 1 26-Apr-19 10:34:34 AM<br />

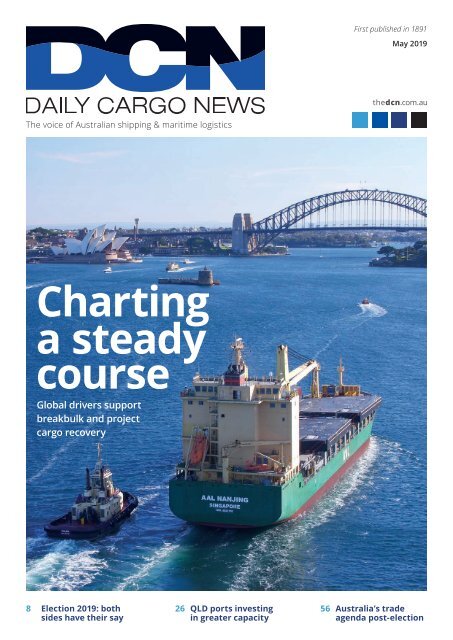

COVER IMAGE<br />

AAL Nanjing on<br />

Sydney Harbour.<br />

Image: AAL<br />

Published by<br />

PARAGON <strong>DCN</strong> PTY LIMITED<br />

ABN: 73 627 186 350<br />

PO Box 81, St Leonards, NSW 1590<br />

Tel: +61 2 9126 9709<br />

CEO<br />

Ian Brooks ianb@paragonmedia.com.au<br />

www.thedcn.com.au<br />

The Daily Cargo News is available to interested<br />

parties throughout Australia and overseas via<br />

subscription.<br />

For enquires please call 02 9126 9713.<br />

The publisher welcomes editorial contributions<br />

from interested parties, however, the publisher<br />

and Paragon <strong>DCN</strong> accept no responsibility for<br />

the content of these contributions and the views<br />

contained therein are not necessarily those of<br />

the publisher or of Paragon <strong>DCN</strong>. The publisher<br />

and Paragon <strong>DCN</strong> do not accept responsibility<br />

for any claims made by advertisers.<br />

Unless explicitly stated otherwise in writing, by<br />

providing editorial material to Paragon <strong>DCN</strong>,<br />

including text and images, you are providing<br />

permission for that material to be subsequently<br />

used by Paragon <strong>DCN</strong>, whole or in part, edited<br />

or unchanged, alone or in combination with<br />

other material in any publication or format<br />

in print or online or howsoever distributed,<br />

whether produced by Paragon <strong>DCN</strong> and its<br />

agents and associates or another party to<br />

whom Paragon <strong>DCN</strong> has provided permission.<br />

Nils Versemann; Ian Ackerman<br />

6 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Hamburg Süd – what we say, we do.<br />

We take care of your cargo – no matter what, where, how much<br />

or how often you ship with us. We’re bringing the personal touch<br />

to container shipping, with first-class customer service and the<br />

unmatched cargo expertise we’ve built our reputation on. Any<br />

questions? Just ask our sales experts, who are near you at<br />

more than 250 locations in over 100 countries.<br />

No matter what.<br />

www.hamburgsud-line.com

ELECTION <strong>2019</strong><br />

Australia votes<br />

With the federal election weeks away, Deputy Prime<br />

Minister and infrastructure minister Michael McCormack<br />

(Nationals) and Labor infrastructure spokesman<br />

Anthony Albanese pitch for the logistics vote<br />

AN AGE OF INFRASTRUCTURE<br />

MICHAEL MCCORMACK<br />

The <strong>2019</strong> budget showed that the Liberals<br />

and Nationals in government are the team<br />

of strong economic management. We are<br />

bringing the budget back into surplus, there<br />

are further tax cuts and we have increased<br />

our already significant infrastructure<br />

investment to $100bn over the next decade.<br />

This is what I call the age of infrastructure.<br />

This investment includes additional funding<br />

for important programs to better connect<br />

the regions and improve regional road safety.<br />

It is yet another sign of our commitment<br />

to regional Australia being stronger than<br />

ever. As the leader of The Nationals, I know<br />

that when the regions are strong so too is our<br />

nation. So much of the wealth and economic<br />

opportunity of Australia is in the regions.<br />

So that’s why our budget is unashamedly a<br />

budget for the bush. Our strong economic<br />

management allows us to invest in projects<br />

with a regional focus, such as regional<br />

freight. By backing country and coastal<br />

communities, we have a focus on helping<br />

build even more liveable, economically<br />

competitive and sustainable regions, and<br />

we’re willing to back this focus with dollars.<br />

STRATEGIC ROADS<br />

For example, we are expanding successful<br />

programs such as our Roads of Strategic<br />

Importance initiative, taking our<br />

investment from $3.5bn to $4.5bn.<br />

Funds will be spent on improving access<br />

to regional and interstate highways and<br />

in doing so connect regions and their<br />

businesses to cities, ports, and new<br />

market opportunities both locally and<br />

internationally. This includes investing<br />

$510m toward road upgrades along the<br />

Toowoomba to Seymour Corridor.<br />

Safe and reliable infrastructure is a<br />

critical foundation to any region’s success,<br />

and forms the building blocks from which<br />

a region can grow its local economy and<br />

form connections with other parts of<br />

Australia. That’s why every council in<br />

the country is getting an additional 25%<br />

for its local roads under the Roads to<br />

Recovery Program. Infrastructure upgrades<br />

such as those made through the Roads of<br />

Strategic Importance initiative deliver not<br />

only faster transportation for regional<br />

business, but also support for industries<br />

and communities critical for freight and<br />

tourism and local councils will get the<br />

support they need to maintain local roads.<br />

GETTING HOME SAFELY<br />

The Liberal and Nationals’ government is<br />

determined to improve the safety of people<br />

on our roads. We want to help you get<br />

home sooner and safer no matter where<br />

Michael McCormack, Deputy Prime Minister<br />

and minister for infrastructure and transport<br />

you live. So we are investing $2.2bn in our<br />

new Local and State Government Road<br />

Safety Package. This includes the boost to<br />

councils I mentioned and a further $550m<br />

for the Black Spot Program to target and<br />

upgrade dangerous sections of road. This<br />

new investment has also seen a further<br />

$275m for both the Bridges Renewal<br />

Program and the Heavy Vehicle Safety and<br />

Productivity Program, which will upgrade<br />

or replace our bridges, rest areas, increase<br />

road capacity, and fund technology trials,<br />

all of which improve heavy vehicle safety<br />

and productivity.<br />

The Liberals and Nationals are also<br />

providing $8m of grant funding to the<br />

National Heavy Vehicle Regulator to<br />

streamline the approval process for road<br />

access by heavy vehicles such as farming<br />

and construction machinery.<br />

Nils Versemann; Image supplied<br />

8 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Ian Ackerman<br />

FIXING ROADS<br />

High-risk areas on our roads – such as<br />

narrow stretches, low-capacity bridges,<br />

and areas with deteriorating bitumen –<br />

damage the efficiency and capacity of our<br />

freight network to extend as far as it has<br />

the potential to do. Unless governments<br />

invest in maintaining and upgrading<br />

regional roads, connectivity between the<br />

regions will be compromised and everyday<br />

individuals and families living in the<br />

regions will have that much more trouble<br />

getting from A to B. That’s an issue that<br />

has long needed addressing – and under our<br />

government, it’s being addressed right now,<br />

all over Australia.<br />

With Australia’s freight task expected to<br />

nearly double, we need forward-thinking<br />

governments to focus on improving<br />

efficiency, particularly throughout regional<br />

Australia, to better connect our cities and<br />

their populations with the regions and each<br />

other. All of this is and will be achieved<br />

without increasing taxes.<br />

A PLAN IN PLACE<br />

We have a plan in place to deliver for<br />

Australia’s future, the Liberals and<br />

Nationals are doing just that. Through our<br />

strong economic management and getting<br />

the budget back in the black, we have<br />

ensured that Australia can afford to do so.<br />

VISION KEY TO EFFICIENT TRANSPORT<br />

SYSTEM<br />

ANTHONY ALBANESE<br />

If you look at the most successful leaders<br />

in Australian and world history, there’s a<br />

common factor in their success – vision.<br />

Vision is about imagining a better future<br />

and taking the steps now that are required<br />

to achieve it. It’s about taking decisions<br />

which establish building blocks for future<br />

prosperity, even if they don’t provide an<br />

immediate political benefit. This approach<br />

will be at the heart of the infrastructure<br />

policies the Labor Party will take to the<br />

election.<br />

Like Bob Hawke and Paul Keating with<br />

their economic reforms of the 1980s and<br />

1990s, a Labor Government would focus<br />

on the long game. Governments need to<br />

stop making short-term decisions and<br />

ensure that decisions lay the foundations<br />

for future growth, beginning with basing<br />

those decisions upon evidence. In 2008,<br />

the former Labor Government established<br />

Infrastructure Australia to provide<br />

independent, evidence-based advice to<br />

the government about infrastructure<br />

policy and projects. The organisation<br />

was designed to produce a pipeline of<br />

properly assessed projects capable of being<br />

embraced by both sides of politics on the<br />

basis of demonstrated merit. We wanted<br />

to break the nexus between the shortterm<br />

political cycle and the long-term<br />

investment cycle.<br />

But upon coming to government, the<br />

Coalition immediately cancelled a series<br />

of Infrastructure Australia-backed projects<br />

aimed at reducing traffic congestion and<br />

improving the movement of freight within<br />

and between our big cities. The next Labor<br />

Government would return to an approach<br />

where we fund projects on the basis of<br />

their potential to drive economic growth,<br />

rather than their political utility. The<br />

former Labor Government also worked<br />

with Infrastructure Australia to improve<br />

transport planning, which led to IA<br />

producing Australia’s first-ever National<br />

Ports Strategy and the National Land<br />

Freight Strategy. This meant that when the<br />

current government took office, it had at<br />

its disposal a blueprint for a more efficient<br />

transport and logistics system. But instead<br />

of grabbing the ball and running with it,<br />

the Coalition did nothing until 2016, when<br />

it began preparing its National Freight and<br />

Supply Chain Strategy, due for completion<br />

later this year.<br />

TIME FOR ACTION<br />

The logistics sector does not need more<br />

plans. It needs more investment in our<br />

roads and rail lines, as well as public<br />

transport in cities to reduce traffic<br />

congestion and allow for faster movement<br />

of road freight. For nearly six years, the<br />

Coalition government has overseen a<br />

reduction in infrastructure investment.<br />

Prior to delivery of the <strong>2019</strong>-20 budget,<br />

annual Federal infrastructure funding was<br />

on a downward trajectory. While this year’s<br />

budget finally did include the promise of<br />

“new’’ spending, the bulk of the spending<br />

is not scheduled to appear until years into<br />

the future. Indeed, the Coalition would<br />

need to be re-elected twice more before<br />

the promised extra investment appeared.<br />

For example, of new investment promised<br />

for New South Wales, just 4% will flow<br />

over the next four years. The budget was<br />

a political document designed to get the<br />

Coalition re-elected, not a blueprint for a<br />

more productive economy.<br />

Anthony Albanese, shadow minister for<br />

infrastructure, transport, cities and regional<br />

development<br />

INFRASTRUCTURE INVESTMENT<br />

Australia needs to increase infrastructure<br />

investment now, not four years from now.<br />

And that would be a priority of an incoming<br />

Shorten Labor Government, particularly<br />

when it comes to rail. We must work to<br />

capitalise on rail’s existing advantages by<br />

ensuring our rail infrastructure is up to<br />

the task. In this area, the former Labor<br />

Government got the ball rolling. We<br />

invested heavily in separating passenger and<br />

freight lines to Sydney’s north and south.<br />

We rebuilt one third of the interstate rail<br />

network. We kicked off work on Moorebank<br />

Intermodal Terminal. We also allocated<br />

funding to duplicate the Port Botany Line<br />

– another investment cancelled by the<br />

incoming Coalition Government, but later<br />

revived when they realised their mistake.<br />

INLAND RAIL<br />

When it comes to Inland Rail, Labor<br />

supports this project. However, I remain<br />

sceptical about the current government’s<br />

financing model. The use of an equity<br />

investment in the Australian Rail Track<br />

Corporation to fund Inland Rail is<br />

based on the Government’s assertion<br />

that the project will somehow stack up<br />

on a purely commercial basis. This fact<br />

was recognised by former Deputy Prime<br />

Minister John Anderson’s 2015 Inland Rail<br />

Implementation Study, which found that<br />

the project’s revenues would not cover its<br />

capital cost in its first 50 years. Inland Rail<br />

is a visionary project. It is critical that we<br />

get the planning right.<br />

thedcn.com.au <strong>May</strong> <strong>2019</strong> 9

News in brief<br />

Full details at thedcn.com.au<br />

BIGGER SHIPS<br />

ABLE TO CALL AT<br />

LYTTELTON<br />

A project to expand the Lyttelton<br />

shipping channel is finished, ensuring<br />

the harbour is prepared for a future<br />

with larger vessels.<br />

But the amount of dredging<br />

required was said to have been<br />

reduced due to the use of dynamic<br />

under keel clearance technology,<br />

maximising the accuracy of shipping<br />

draft calculations.<br />

Lyttelton Port Corporation chief<br />

executive Peter Davie said the new<br />

system would improve the safety of<br />

all commercial shipping movements.<br />

“Container ships have doubled in<br />

size over the last 10 years and the<br />

trend toward bigger ships continues,”<br />

Mr Davie said.<br />

“We have enlarged the existing<br />

shipping channel to provide access to<br />

larger ships and support Lyttelton’s<br />

future as the South Island’s major<br />

international trade gateway.”<br />

The container terminal’s maximum<br />

draught is now 13.3 metres at Cashin<br />

Quay 2 and 3 East.<br />

Mr Davie said one of the biggest<br />

improvements was in terms of<br />

visibility.<br />

The old main channel leading light<br />

was in the hills above Governors<br />

Bay, but the new sector light is 6km<br />

closer to the end of the channel and<br />

is expected to be more visible during<br />

misty and drizzly conditions.<br />

The DUKC program links to<br />

portable pilot units, to calculate and<br />

continuously monitor the under keel<br />

clearance of large draught vessels as<br />

they move through the channel.<br />

There is a weather buoy and<br />

further sensors in the harbour to<br />

analyse swell and wind information<br />

to provide a “tidal window” for each<br />

vessel.<br />

One of the new autostraddles to be used by Patrick<br />

Patrick invests in new straddle carriers<br />

Waterfront technology provider Kalmar<br />

is set to supply 12 diesel-electric straddle<br />

carriers to Patrick Terminals over the year<br />

to come.<br />

The order, which comprises eight<br />

automated Kalmar AutoStrad units and four<br />

manually operated Kalmar straddle carriers,<br />

was booked in the <strong>2019</strong> first quarter intake<br />

with parent company Cargotec.<br />

Delivery of the machines is set for the<br />

Michael Jovicic indicated the deal cemented<br />

an ongoing relationship.<br />

“We’ve been relying on Kalmar’s<br />

innovative, reliable straddle carrier<br />

solutions to keep our automated and<br />

manual operations running safely and<br />

efficiently for many years,” Mr Jovicic said.<br />

“When it came to considering our<br />

options for renewing our straddle carrier<br />

fleet, it was a straightforward decision to<br />

second quarter of 2020.<br />

continue our long-standing collaboration.”<br />

Patrick operates terminals at Fisherman<br />

Kalmar senior vice president automation<br />

Island in Brisbane, Port Botany in Sydney,<br />

and projects Tero Kokko said the company<br />

East Swanson in Melbourne and at<br />

had “developed a highly successful<br />

Fremantle in Western Australia.<br />

partnership with Patrick Terminals over the<br />

Four of the AutoStrads are to operate<br />

years, with our straddle carrier solutions<br />

at Brisbane and four at Sydney, while the<br />

forming the backbone of the fleet at their<br />

manual straddle carriers are set to ply their<br />

terminals”.<br />

trade at Melbourne.<br />

“We have come a long way since the<br />

The new machines are part of Patrick<br />

first ever commercial operation of the<br />

Terminals’ fleet renewal program and are<br />

Kalmar AutoStrad at the company’s<br />

to join the company’s current fleet of more<br />

Brisbane terminal, and we are delighted to<br />

than 120 Kalmar straddles.<br />

continue the story with this new order,”<br />

Patrick Terminals chief executive<br />

Mr Kokko said.<br />

Kalmar<br />

10 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

NEWS IN BRIEF<br />

K Line’s new ro-ro<br />

arrives down under<br />

Japanese carrier K-Line’s new ro-ro ship,<br />

Niagara Highway V1 (IMO 9832638), recently<br />

made its maiden voyage around Australia.<br />

This followed its recent delivery from<br />

Imabari Shipbuilding Co in Japan.<br />

The vessel first docked at Townsville<br />

where it received a warm welcome before<br />

leaving for Brisbane.<br />

From Brisbane it sailed south to Port<br />

Kembla, Melbourne and Adelaide before<br />

returning to Japan.<br />

Port of Townsville acting general<br />

manager business development, David<br />

Sibley said the arrival of the new vessel<br />

demonstrated the global demand on port<br />

infrastructure.<br />

The Niagara Highway<br />

“Globally ships are being built bigger and<br />

better,” Mr Sibley said.<br />

“This resonates with the prediction<br />

of trade volume to treble over the next<br />

30 years.”<br />

Mr Sibley said the channel upgrade<br />

project ensured Townsville remained<br />

northern Australia’s transport link to<br />

the world.<br />

According to K Line, Niagara Highway is<br />

among the company’s new generation large<br />

size pure car carrier vessel to operate on the<br />

Japan–Australia trade.<br />

Flagged in Panama, the vessel has a<br />

beam of 37.2 metres and an overall length<br />

of 200 metres.<br />

Maria James from Port of Townsville presents a plaque<br />

to master of the Niagara Highway, Vincent MM Raj.<br />

GOVERNMENT MAKES<br />

COMMON CAUSE<br />

WITH WHARFIES<br />

OVER WIND PROJECT<br />

A decision by the federal<br />

government to explore the possibility<br />

of a wind farm off the coast of<br />

Gippsland in Victoria received praise<br />

from the Maritime Union.<br />

Energy minister Angus Taylor<br />

recently announced Offshore<br />

Energy Pty Ltd would be allowed to<br />

determine if Australia could be part<br />

of the offshore wind farm sector in<br />

the long term.<br />

“Offshore wind farms could<br />

provide Australia with significant<br />

new investment and employment<br />

possibilities while also contributing to<br />

the stability of the grid and lowering<br />

power prices,” Mr Taylor said.<br />

“Offshore wind is more plentiful and<br />

consistent than onshore wind and<br />

aligns better with energy demand.”<br />

With this licence, OEPL is allowed<br />

to assess wind resources and sea<br />

bed conditions. It has not been given<br />

any rights to develop or operate an<br />

offshore wind farm.<br />

The licence requires OEPL to do<br />

“extensive consultation” with the<br />

community and industry before<br />

undertaking any activities.<br />

MUA deputy national secretary<br />

Will Tracey said the granting of this<br />

exploration license was a “welcome<br />

step towards the construction of<br />

Australia’s first offshore wind farm”.<br />

“This outcome is the result of<br />

months of lobbying by unions<br />

and community groups who have<br />

been highlighting the potential for<br />

an offshore wind sector to create<br />

thousands of quality jobs,” Mr<br />

Tracey said.<br />

“Even the anti-renewable energy<br />

forces within the federal government<br />

have realised the potential of this<br />

project, finally allowing the essential<br />

investigation of sea bed conditions<br />

and wind and wave conditions that<br />

are needed before it can proceed to a<br />

detailed planning stage.”<br />

K-Line; Port of Townsville; Pauljrobinson<br />

12 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Helping economies grow<br />

and customers prosper.<br />

We enable smarter trade to<br />

create a better future for all.

NEWS IN BRIEF<br />

Stevedores set to axe “likely unfair contract terms”<br />

Stevedores DP World Australia,<br />

Hutchison Ports Australia and Victoria<br />

International Container Terminal agreed<br />

to change contracts with land transport<br />

businesses after the competition regulator<br />

raised concerns they could be unfair.<br />

DPWA and Hutchison had contract<br />

terms allowing a stevedore to vary terms<br />

in agreements without notice, including<br />

fees paid by land transport operators.<br />

DPWA and Hutchison also had terms<br />

limiting their liability for loss or damage<br />

suffered by transport businesses, while<br />

not offering the transport businesses<br />

the same protections.<br />

VICT’s contract had a term requiring<br />

transport businesses to indemnify VICT<br />

for loss or damage, without a reciprocal<br />

obligation.<br />

The DPWA standard agreement also<br />

required the transport businesses<br />

to pay the stevedore’s legal costs<br />

and expenses, in situations where<br />

such payments normally would be<br />

determined in court.<br />

The ACCC says the three stevedores<br />

cooperated with the ACCC investigation.<br />

Hutchison made its commitments in a<br />

court enforceable undertaking and is to<br />

place a corrective notice on its website<br />

as well as run a compliance program.<br />

“Thousands of transport businesses,<br />

which have standard form agreements<br />

with DP World, Hutchison and VICT,<br />

stand to benefit from these changes,”<br />

ACCC commissioner Sarah Court said.<br />

“The handling of containers has a<br />

direct bearing on the cost of goods<br />

in Australia and the competitiveness<br />

of Australian exports, so it is crucial<br />

for businesses and consumers that<br />

the supply chain operates fairly and<br />

efficiently.”<br />

The ACCC began its investigation early<br />

last year following concerns raised about<br />

alleged unfair terms.<br />

The ACCC’s 2018 Container Stevedore<br />

Monitoring Report noted the ACCC<br />

was assessing unfair contract terms<br />

within the industry. The ACCC has now<br />

concluded that assessment.<br />

Shipping registration changes take effect<br />

FOR<br />

SALE<br />

The Australian Maritime Safety Authority has reminded industry<br />

that changes have been made to shipping registration laws,<br />

effective 1 April.<br />

According to AMSA, there are no changes to the way that ships<br />

are registered on the Australian registers unless you do not know<br />

the vessel’s full ownership history.<br />

But if you buy or acquire a vessel and do not know its full<br />

ownership history you must lodge a notice of intention to register a<br />

ship to be published on the AMSA website.<br />

This is a change to the old requirement for a gazette notice to<br />

be submitted to the Federal Register of Legislation. If you have a<br />

claim to a ship for which a notice of intention to register has been<br />

received you can submit objections to an intention to register<br />

to AMSA.<br />

Meanwhile the way you close a registration—for ships not<br />

required to be registered— also has changed. It is now possible<br />

for the owner to apply to close a registration if the Australian<br />

registration is no longer required.<br />

“Previously this application could only be made by the registered<br />

owner,” AMSA stated.<br />

More information can be found by visiting the AMSA website.<br />

INDUSTRY EVENTS<br />

<strong>2019</strong> EVENT<br />

23-24 <strong>May</strong> AFIF <strong>2019</strong> National Conference and Gala Dinner, Melbourne afif.asn.au<br />

26-27 June Ports Business & Operational Conference, Townsville portsaustralia.com.au/news/conference/<br />

business-operations<br />

10-13 September Australasian Coasts & Ports <strong>2019</strong>, Hobart coastsandports<strong>2019</strong>.com.au<br />

8-10 October Pacific <strong>2019</strong> International Maritime Conference, Sydney pacificexpo.com.au<br />

28 October – 1 November AMPI Pilotage & Ports Logistics Conference, Sydney ampi.org.au/AMPI<strong>2019</strong><br />

14 November <strong>2019</strong> Australian Shipping & Maritime Industry Awards, Melbourne dcnawards.com.au<br />

To notify <strong>DCN</strong> of events please email us at editorial@paragonmedia.com.au<br />

DOGMAge<br />

14 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

There’s a fresh<br />

new link in the<br />

trans-Tasman<br />

Supply-Chain<br />

Impex Personnel.<br />

The Supply-Chain placement specialists.<br />

A bold new Impex Personnel dedicated to the personnel recruitment needs of Australia and New Zealand’s vital<br />

Supply-Chain industry, is now on-hand to serve your specialist Supply-Chain placement needs.<br />

Impex Personnel has almost 20 years of experience in the industry, so our Placement Specialists know Supply-Chain<br />

inside out. And now, we are better placed, and more focused than ever to provide the candidates you need, with the<br />

skill-sets and experience you want.<br />

Our thorough understanding of your business requirements ensures we will only<br />

propose candidates who have the right skills and right fit for your needs and culture.<br />

Our commitment to proposing only the best and most suitable candidates and<br />

our desire to build long-term exclusive collaborations with our clients make us the<br />

perfect placement partners to fulfil your recruitment needs.<br />

Sydney • Melbourne • Brisbane • Adelaide • Perth • Auckland • Christchurch<br />

impexpersonnel.com

INDUSTRY OPINION<br />

Measures to control the brown<br />

marmorated stink bug<br />

A series of enhanced anti-stink bug measures are set to provide added challenges<br />

to industry, writes Andrew Crawford<br />

AS MANY READERS KNOW, THE<br />

response to the brown marmorated stink<br />

bug 2018-<strong>2019</strong> season by the Department<br />

of Agriculture and Water Resources<br />

exposed deficiencies in processes. Since the<br />

implementation of the BMSB emergency<br />

measures, FTA members witnessed a<br />

deterioration of service levels across the<br />

department, with key import services such<br />

as bookings and inspections most affected.<br />

A DEFICIENCY SUBMISSION<br />

Based on member feedback, FTA<br />

provided a submission to identify those<br />

deficiencies and provide a clear list of<br />

recommendations and considerations<br />

for the inspector-general of biosecurity.<br />

While many recommendations related<br />

to the department’s staffing levels,<br />

others sought to optimise and expand on<br />

existing initiatives, such as the Approved<br />

Arrangement scheme, the 19.2. Automatic<br />

Entry Processing for Commodities, Cargo<br />

Online Lodgement System and the Highly<br />

Compliant Importer Project. Strong, fair<br />

and consistent compliance is essential to<br />

underpin these systems and arrangements<br />

to allow industry an increased<br />

responsibility to manage biosecurity risks.<br />

STRONG COMPLIANCE RECORD<br />

FTA also advocated that increased<br />

responsibility should be given to those that<br />

have a strong compliance record. We now<br />

know that the upcoming <strong>2019</strong>-2020 season<br />

will be expanded to include more target risk<br />

countries. The list of countries includes the<br />

same as 2018/19, however another 23 have<br />

been added. The entire list is as follows:<br />

United States of America, Czech<br />

Republic, France, Canada, Georgia, Russia,<br />

Albania, Germany, Serbia, Andorra,<br />

Greece, Slovakia, Armenia, Hungary,<br />

Slovenia, Austria, Italy, Switzerland,<br />

Azerbaijan, Kosovo, Luxembourg,<br />

Belgium, Liechtenstein, Romania, Bosnia<br />

Andrew Crawford, head of border and<br />

biosecurity, Freight & Trade Alliance<br />

and Herzegovina, Macedonia, Spain,<br />

Bulgaria, Montenegro, Turkey, Croatia,<br />

The Netherlands, Japan (heightened vessel<br />

surveillance will be the measure applied).<br />

UPDATE ON BIOSECURITY LEVY<br />

It now has been confirmed that the start date of the<br />

contentious biosecurity levy has been delayed. In the recent<br />

Federal budget, it was announced that the implementation<br />

date of the biosecurity levy announced in last year’s budget has been changed<br />

from 1 July <strong>2019</strong> to 1 September <strong>2019</strong>. This delay is to allow the Industry Steering<br />

Committee (of which Paul Zalai, one of FTA’s directors, is a member) the opportunity<br />

to make recommendations to the minister. The quantum and method of collection<br />

of the biosecurity levy could well be impacted by a change of government.<br />

BACKGROUND<br />

The Biosecurity Import Levy was announced in the 2018 Federal Budget with the<br />

aim to collect $325m over three years from a start date of 1 July <strong>2019</strong>. Since that<br />

time there has been significant controversy surrounding the implementation of<br />

the levy, ultimately leading to the Department of Agriculture and Water Resources<br />

commissioning an independent review by Pegasus Economics. Its report was<br />

publicly released on Friday 29 March <strong>2019</strong>.<br />

FTA was privileged to be appointed by the minister to participate with eight other<br />

industry representatives in the committee led by an independent chair (David<br />

Trebeck) and supported by Pegasus Economics.<br />

FTA will continue to be heavily involved in discussions and planning and will<br />

provide readers with further updates as they emerge.<br />

MANDATORY OFFSHORE TREATMENT<br />

The other significant difference for next<br />

season could be the introduction of<br />

mandatory offshore treatment of target<br />

high risk goods shipped in sealed six-sided<br />

containers, as LCL (less than container<br />

load) and FAK (freight of all kinds). This<br />

was the department’s preferred position<br />

for 2018/19 and FTA and others advocated<br />

against this due to several commercial<br />

considerations. FTA will continue to work<br />

with the department on this.<br />

SAFEGUARDING ARRANGEMENTS<br />

The department is developing policies to<br />

allow for certain goods and supply chains<br />

to be recognised under safeguarding<br />

arrangements for the <strong>2019</strong>–20 season. A<br />

trial by invitation will be conducted of the<br />

arrangements. We expect more detailed<br />

information in the next few months.<br />

Ruth Swan; FTA<br />

16 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Discover a partner<br />

you can rely on<br />

Contact us to discuss your container supply chain needs.<br />

www..indersadelaidecontainerterminal.com.au | +61 8 8447 0611

INDUSTRY OPINION<br />

Meeting the low<br />

sulphur fuel challenge<br />

Angela Gillham examines the trend towards cleaner fuels<br />

and what it is likely to mean in practice<br />

WHILE MOST TIGHTENING OF<br />

ship emissions standards has occurred<br />

in the northern hemisphere, as urban<br />

encroachment in Australia continues, so<br />

will community pressure on authorities to<br />

act here.<br />

It is worth comparing Australian fuel<br />

sulphur standards from other emissions<br />

compliance options will have an impact<br />

on demand for low sulphur fuel and will<br />

influence supply and price. It is important<br />

to note the IMO fuel availability study,<br />

commissioned in the lead up to the decision<br />

on the sulphur cap implementation date,<br />

found the global refining industry has<br />

capacity to meet projected global demand.<br />

sources. While there has been a tightening<br />

of global fuel standards and emissions<br />

regulations for international shipping, the<br />

current Australian requirement for sulphur<br />

content in automotive diesel remains<br />

considerably more stringent (Table 1).<br />

This is likely to attract further community<br />

attention in the future.<br />

LOW SULPHUR FUEL<br />

Fuel low enough in sulphur to be<br />

compliant, in reality, can mean different<br />

things. Lower sulphur content can be<br />

achieved by blending low sulphur fuels and<br />

heavy fuel oil or further refining HFO, to<br />

produce gasoil (diesel). Sulphur content is<br />

just one of many specifications and there<br />

IMPACT ON INDUSTRY<br />

Total annual marine fuel demand is around<br />

400m tonnes and climbing. The global<br />

sulphur cap will have a significant impact<br />

and as suppliers attempt to meet this new<br />

mix of marine fuel demand there will be a<br />

price increase, possibly a significant one.<br />

A recent survey of vessel operators by<br />

MIAL found average expectation of the cost<br />

differential between HSFO and compliant<br />

fuel was $250, and estimates ranged from<br />

$75 to $740 per tonne.<br />

There are several compliance options<br />

available to shipowners, including using<br />

low sulphur fuel, alternative fuels such as<br />

liquefied natural gas and ‘drop in’ biofuels<br />

and renewable diesel, and exhaust gas<br />

cleaning systems – each having technical<br />

challenges, limitations and accessibility<br />

issues. The degree of uptake of each of these<br />

are some safety concerns around the use of<br />

blended fuels to achieve the 0.5% limit, the<br />

properties of these fuels and compatibility<br />

with existing marine diesel engines.<br />

Work is underway to update guidelines<br />

relating to the relevant ISO specifications<br />

to address the safety concerns using new<br />

fuel blends.<br />

In Australia, low sulphur diesel options<br />

are limited as is refining capacity. Along<br />

with some high sulphur heavy fuel oil and<br />

petrol, the major Australian fuel suppliers<br />

import one grade of diesel at 0.001%<br />

sulphur – this is automotive diesel – a<br />

costly option. Fuel suppliers have indicated<br />

they are planning to have low sulphur fuel<br />

oil available at selected Australian ports,<br />

but ship operators wanting access to this<br />

product need to communicate this early to<br />

ensure capacity.<br />

TABLE 1: FUEL SULPHUR LIMITS IN AUSTRALIA<br />

REGULATED LIMIT<br />

DIESEL USE % PPM<br />

Automotive diesel 0.001 10<br />

Current international shipping 3.5 35000<br />

2020 international shipping 0.5 5000<br />

2020 international shipping ECA 0.1 1000<br />

Angela Gillham, deputy CEO, Maritime Industry<br />

Australia<br />

LNG<br />

LNG contains virtually no sulphur and, in<br />

recognition of the opportunities that LNG<br />

represents particularly for Australia, the<br />

number of newbuilds planned or operating<br />

within the Australian market is growing.<br />

Perceived limitations are loss of cargo<br />

space due to the larger fuel storage area and<br />

current lack of distribution networks and<br />

bunkering infrastructure.<br />

LNG has the added benefit of burning<br />

with about two thirds of the greenhouse<br />

gas emissions of diesel. LNG is a powerful<br />

greenhouse gas, however, and methane<br />

slippage has been flagged as an issue.<br />

BIOFUELS AND RENEWABLE DIESEL<br />

The use of biofuels and renewable diesel<br />

presents a significant opportunity with<br />

little to no sulphur content. There are a<br />

variety of drop-in biofuels and renewable<br />

diesel products available that can be used<br />

in existing marine diesel engines. The main<br />

challenge for wide-scale adoption of these<br />

fuels is the scalability of production to<br />

meet the large volumes required.<br />

MIAL<br />

18 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

WOMEN IN MARITIME<br />

Natalie Godward with Bruce Krumrine senior vice<br />

president of port operations for Holland America Group<br />

Natalie Godward (third from left) at the 2018 Eden Business & Community award.<br />

Cruise Eden won the Volunteer/Community Service Award<br />

PROFILE: Natalie Godward<br />

This month we are profiling Natalie Godward, cruise development manager<br />

for Port Authority of New South Wales. By Kendall Carter<br />

NATALIE GODWARD WORKS FROM<br />

visits from the expedition and luxury segments.<br />

“It is very humbling to see how a<br />

Eden on the beautiful south coast of New<br />

In Eden, both Federal and State funding<br />

community comes together to welcome<br />

South Wales, a wonderful natural harbour<br />

has enabled a new cruise terminal to be<br />

cruise visitors,” Natalie said.<br />

and a developing cruise destination. She<br />

built, where cruise vessels are now able to<br />

“In Eden for example, local volunteers,<br />

manages cruise visits into all the regional<br />

berth alongside instead of remaining at<br />

including individuals and businesses, get<br />

ports along the NSW coastline and runs<br />

anchor as used to be the case.<br />

up very early to be there and offer the<br />

Cruise Eden for the Sapphire Coast in the<br />

The Port Authority, with Natalie in<br />

best possible experience for visiting cruise<br />

far south.<br />

the lead, is now scoping the maritime<br />

passengers.”<br />

viability of several locations up and down<br />

GARDEN OF EDEN<br />

the state’s coast. On the north coast of<br />

BIGGER PICTURE<br />

Natalie took the role of Cruise Eden<br />

NSW Natalie recently has been examining<br />

Natalie is supportive of the Nautical<br />

coordinator about five years ago when it<br />

the possibilities for visits to Yamba, Coffs<br />

Institute’s Women in Maritime initiative<br />

started to become too much for volunteers<br />

Harbour and South West Rocks, working<br />

and believes it has helped remove<br />

in Eden. Initially this was a part-time<br />

with local stakeholders and communities<br />

perceived and actual barriers to entry in a<br />

position while she was working for Sapphire<br />

along with interested cruise lines to tailor<br />

traditionally male-dominated industry, by<br />

Coast tourism. Soon the role was full-time<br />

appropriate shoreside experiences for the<br />

highlighting the success stories of women.<br />

and she was organising all the shoreside<br />

passengers. All the other NSW regional<br />

She recognises you don’t have to go to sea<br />

aspects of cruise ships visiting Eden as well<br />

ports will also soon be examined to see how<br />

to be part of this industry and there are<br />

as being involved in attracting more cruise<br />

their potential may be harnessed.<br />

many varied roles and the opportunities for<br />

lines to the port.<br />

women to get involved. Natalie believes the<br />

Port Authority of NSW has always been a<br />

AMERICAN INSPIRATION<br />

maritime industry is fascinating and ever<br />

great supporter of Natalie’s work for Cruise<br />

Natalie recently attended the SeaTrade<br />

changing, with long term opportunities for<br />

Eden and last year, as the local development<br />

Cruise Global Conference in Miami Beach<br />

growth. She would definitely recommend it<br />

of the port was ramping up, they employed<br />

Florida, where she was extolling the virtues<br />

as a career for women and has been actively<br />

her directly as their cruise development<br />

of visiting NSW to cruise companies.<br />

introducing the industry to her daughters<br />

manager with the expanded role of not only<br />

The aim was to show off the many<br />

through her role, showing them what she<br />

looking after Eden cruise visits but also<br />

opportunities along the coast and bring<br />

does, and will encourage them to consider<br />

cruise visits to all the NSW regional ports.<br />

more cruise ships to the region.<br />

the maritime industry as a career when the<br />

Natalie especially enjoys working<br />

time comes.<br />

‘WHOLE COASTLINE’ OPPORTUNITIES<br />

with regional communities to create<br />

Natalie would thoroughly recommend<br />

Cruising is an expanding area and in NSW<br />

opportunities for cruise ship visits that<br />

getting involved in the industry to women<br />

cruise ships regularly visit Sydney as well<br />

boost local economies. She explains cruise<br />

starting out on their careers as well as<br />

as Newcastle and now more recently,<br />

vessels come in all shapes and sizes and<br />

those considering a “sea change”. In<br />

Port Kembla.<br />

sometimes it might just be a case of 80<br />

her own words, “Through chance and<br />

Natalie passionately believes that there<br />

is a whole coastline of opportunities and<br />

communities in NSW that would welcome<br />

cruise ships with open arms, especially<br />

people getting off a ship, eating their lunch<br />

in the local pub and visiting a few local<br />

stores, but even so it creates a great vibe<br />

and generally the community loves it.<br />

opportunity I fell into the maritime<br />

industry and feel very grateful for that.<br />

This is the best job I have ever had, and I<br />

love working in the industry”.<br />

NG; Cruise Eden<br />

20 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Delivering world-class<br />

port and marine services<br />

in New South Wales<br />

Sydney Harbour | Port Botany | Newcastle Harbour | Port Kembla | Port of Eden | Port of Yamba<br />

www.portauthoritynsw.com.au<br />

Follow us @portauthoritynsw<br />

Piloting a vessel into Newcastle Harbour,<br />

New South Wales

ELECTION <strong>2019</strong><br />

What our sector leaders think<br />

Industry group leaders have their say on what should<br />

be the priorities for the next government of Australia<br />

Rod Nairn, CEO,<br />

Shipping Australia<br />

The best interests of Australia are served<br />

by focusing on optimising the benefits that<br />

international shipping provides. Shipping<br />

should not be used as a political pawn.<br />

Shipping Australia is disappointed<br />

that both the Coalition and Labor are<br />

committed to imposing a new biosecurity<br />

levy, an inefficient new tax on imports<br />

which will cost every Australian a lot<br />

more than if the same amount of revenue<br />

was raised through an efficient tax such<br />

as GST or income tax. But the public<br />

has no escape from this approach as it<br />

seems one of the only areas of bipartisan<br />

agreement is how to extract money from<br />

ordinary Australians without them<br />

realising it.<br />

Shipping Australia is also concerned<br />

the Australian public is being misled over<br />

the contribution of the international<br />

shipping fleet to Australia’s economic<br />

wellbeing.<br />

Australia’s maritime security is best<br />

served by a strong Navy and Australia’s fuel<br />

security is best served by greater onshore<br />

storage reserves and clever use of ships of<br />

multiple flags to carry our fuel imports. The<br />

more flags we utilise, the more resilient the<br />

fleet and the better Australia is protected.<br />

If some nations become unable or unwilling<br />

to trade with Australia, there still will be<br />

many others who will. The alternative, to<br />

carry all our oil supplies in Australianflagged<br />

and crewed ships would be foolish.<br />

It would leave Australia in a position of<br />

being held to ransom by a militant union,<br />

even when there is no war.<br />

Domestic freight policy should include<br />

promotion of shipping as a mode. As an<br />

island nation, Australia is dependent<br />

on shipping for most of its trade.<br />

Shipping should be acknowledged as the<br />

preferred mode of long-haul domestic<br />

freight movement because it is more<br />

economical, more efficient, safer and more<br />

environmentally sustainable than other<br />

transport modes. It is also able to deliver<br />

oversized, heavy and bulky cargo with<br />

minimum impact.<br />

It is imperative for any elected<br />

government to include coastal shipping,<br />

alongside road and rail, in any business<br />

case related to infrastructure investment<br />

projects. Promoting modal shift to sea<br />

freight must be part of its national freight<br />

priorities. Shipping Australia would be<br />

happy to see Australian flag ships operating<br />

at a profit in domestic and international<br />

markets. But the fact is this will not<br />

happen until the ships are automated to<br />

reduce crew costs. Any talk of subsidising<br />

Australian flag ships to carry cargo is<br />

ludicrous. That would be asking ordinary<br />

tax-paying Australians to subsidise wages<br />

of a chosen few.<br />

Commercial shipping is a service,<br />

it is a means to an end, not an end in<br />

itself. Shipping is needed to move cargo<br />

internationally or domestically. You can<br />

control it through regulation, but you<br />

don’t have to own it to use it.<br />

We would like to see a simple regulatory<br />

environment which encourages a cost<br />

effective and flexible shipping service<br />

to operate for the benefit of Australian<br />

producers and customers. The objectives<br />

of the legislation should be prioritised<br />

based on the provision of public benefit.<br />

Mike Gallacher, CEO,<br />

Ports Australia<br />

As both major parties start to unveil their<br />

platforms for the upcoming election,<br />

we already know one thing. Central to<br />

both their platforms for election are the<br />

promises to reduce congestion and create<br />

jobs. The question is what policies are they<br />

looking at to achieve these promises?<br />

Our sector knows that the freight<br />

and supply chain is an important key to<br />

delivering on both these promises and<br />

more. We know that freight shares the<br />

roads and rails with commuters, and we<br />

know freight makes up a considerable part<br />

of the cost of doing business. Therefore, if<br />

you improve the regulatory framework and<br />

target investments in freight, allowing it to<br />

operate more efficiently, we know that we<br />

can reduce congestion and the cost of<br />

doing business.<br />

22 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Teresa Lloyd, CEO,<br />

Maritime Industry<br />

Australia<br />

In addition MIAL calls on the next<br />

federal government to walk away from<br />

the Biosecurity Levy and fund this<br />

departmental need from consolidated<br />

revenue.<br />

Kirk Coningham,<br />

CEO, Australian<br />

Logistics Council<br />

Travellight; Ian Ackerman x 2; MIAL; ALC<br />

It’s up to us to make sure both parties<br />

have heard our solutions and that we<br />

share them not just with the elected<br />

representatives but also with the voters<br />

around us. For us, at Ports Australia, we<br />

would like to see congestion addressed<br />

through improved transport connectivity,<br />

corridor protection and planning around<br />

urban encroachment. On top of that a<br />

serious consideration on how ports through<br />

coastal shipping can move non-time<br />

sensitive goods around the country along<br />

the blue highway. Through increased use<br />

of the blue highway, we see an opportunity<br />

for more jobs. Jobs on and off the water<br />

and in both metro and regional cities.<br />

And through these jobs, we can address<br />

the challenge of fostering new careers in<br />

the maritime industry so we can begin<br />

accumulating the maritime skills necessary<br />

for operating an island nation.<br />

At the recent Australian Logistics<br />

Council Forum in Melbourne, a statement<br />

on bipartisanship surrounding the<br />

importance of the country’s freight<br />

and supply chain strategy was released<br />

including comments from both Mr<br />

McCormack and Mr Albanese. And while<br />

both indicated their support for the work<br />

of the freight and supply chain strategy,<br />

it is imperative the wheels keep rolling to<br />

ensure this reports delivery and adoption.<br />

We believe it is vital that the opposition<br />

be briefed on the report’s findings to<br />

guarantee, irrespective of who wins the<br />

federal election, both parties funding<br />

priorities are identified and aligned with<br />

the current draft of the National Freight<br />

and Supply Chain Strategy.<br />

MIAL’s vision is for a strong, thriving and<br />

sustainable maritime enterprise in the<br />

region. This activity can occur anywhere,<br />

coastal, offshore and international; and<br />

should encompass everything – freight,<br />

tourism, passenger movement, port and<br />

harbour services, offshore oil and gas,<br />

construction, scientific/research, essential<br />

services, and government services.<br />

MIAL’s 10-point plan to achieving this<br />

is outlined in our priority reforms for the<br />

next federal government, as follows:<br />

• Acknowledge and address the maritime<br />

skills shortages - skilled mariners must<br />

be secured for the nation and policy<br />

and financial support is required to<br />

achieve this.<br />

• Establish a strategic fleet - these vessels<br />

will provide the platforms on which our<br />

skilled seafarers can train and work,<br />

assets for the nation in times of need<br />

and secure certain supply chains.<br />

• Make the AISR competitive and fit for<br />

purpose for Australian circumstances,<br />

including operating in coastal activities.<br />

• Make corporate income tax settings<br />

internationally competitive and<br />

maximise the benefit to Australia by<br />

broadening the base of activity that<br />

qualifies to include all vessels regardless<br />

of what “work” they do.<br />

• Extend seafarer income tax settings to<br />

allow more Australian seafarers to work<br />

overseas.<br />

• Abolish Seacare – this regime is out of<br />

step with community standards and too<br />

small to survive. An orderly exit must<br />

commence to avoid an implosion of<br />

the scheme.<br />

• Rewrite the domestic commercial vessel<br />

laws to make them simple and effective.<br />

• Amend customs requirements to benefit<br />

the country not drive business away.<br />

• Adjust Coastal Trading Policy - remove<br />

the red tape, remove the need to pay<br />

Part B wages, move away from port<br />

pairs, and more.<br />

• Manage port pricing to avoid<br />

monopolistic behaviour.<br />

The next three years will be critical in<br />

determining whether Australia is able to<br />

boost the efficiency and safety of its end-toend<br />

supply chain and meet the challenges<br />

associated with a growing freight task.<br />

Both the Coalition and the Labor Party<br />

have unambiguously committed to finalise<br />

and implement the National Freight and<br />

Supply Chain Strategy as soon as possible.<br />

That means the next parliament must<br />

act to deliver the policy reforms needed<br />

to ensure that strategy delivers the right<br />

outcomes for industry and the community.<br />

This includes the federal government<br />

taking more of a lead in planning issues,<br />

so the operation of freight infrastructure<br />

is unimpeded by urban encroachment and<br />

traffic congestion.<br />

We need to get on with delivering a<br />

consistent national regulatory approach to<br />

road, rail and air freight, and ensure our<br />

coastal shipping arrangements actually<br />

deliver the intended outcomes.<br />

Monitoring and measuring supply<br />

chain performance through enhanced<br />

data collection is crucial – and the next<br />

parliament must swiftly prioritise the<br />

establishment of the National Freight Data<br />

Hub outlined in the recent federal Budget.<br />

This will allow us to make more informed<br />

decisions about infrastructure investment.<br />

Australia must also invest in skills<br />

training to build a sustainable workforce<br />

for the industry, capable of embracing the<br />

safety and productivity advantages offered<br />

by evolving technologies, including electric<br />

and high productivity vehicles. Securing<br />

these priorities will require leadership<br />

from whichever side forms government –<br />

and cooperation from other parties - to<br />

implement reforms that will help the<br />

freight sector deliver for consumers, and<br />

take advantage of Australia’s growing<br />

export opportunities.<br />

thedcn.com.au <strong>May</strong> <strong>2019</strong> 23

INDUSTRY OPINION<br />

A maritime vision<br />

Aspirations to revive Australian-flagged shipping need to be<br />

married with commercial reality, writes Llew Russell<br />

THE LEADER OF THE OPPOSITION,<br />

include obligations to pay wages, for<br />

Bill Shorten has committed Labor to<br />

example, in accordance with employment<br />

“making Australia a seafaring nation<br />

contracts, which normally are those<br />

again”. The statement made in late<br />

recommended by the International<br />

February was short on detail. Reference<br />

Transport Federation. There are about<br />

was made to building a national strategic<br />

1,650,000 seafarers in the world engaged<br />

reserve with many more Australian ships.<br />

in international shipping and the majority<br />

A little more detail was contained in the<br />

of ratings come from the Philippines being<br />

Maritime Union of Australia news release<br />

just over 20%. In terms of all ranks, China<br />

of 11 March. The union welcomed Labor’s<br />

takes the lead, then comes the Philippines,<br />

commitment to creating a government-<br />

Indonesia, Russia, Ukraine and India and<br />

owned national fuel reserve to meet<br />

then many nationalities of much smaller<br />

Australia’s obligation of 90-day fuel stocks<br />

percentages.<br />

in accordance with International Energy<br />

The 2015 BIMCO/ICS manpower report<br />

Agency requirements as well as creating a<br />

found there was a shortage of 16,500<br />

national strategic fleet that will include oil<br />

officers worldwide but an oversupply of<br />

tankers and gas carriers.<br />

117,000 ratings. This trend was expected to<br />

continue into the future.<br />

DEFENCE OUTLOOK<br />

The International Collective<br />

Llew Russell, AM<br />

There is no mention in these statements<br />

Bargaining Agreement between employee<br />

as to how such policies would fit within<br />

(the International Transport Workers<br />

four ro-ro vessels in Adelaide capable of<br />

our current defence strategic outlook.<br />

Federation) and employer representatives<br />

carrying around 1200 TEU. Such vessels<br />

History tells us that in regional conflicts<br />

for <strong>2019</strong>-2020 sets out the recommended<br />

would have flexibility to service countries<br />

there have been no problems with<br />

minimum wages. These include US$1602<br />

in a civil emergency, for example, without<br />

requisitioning foreign-flagged vessels to<br />

per month in total for an able seaman<br />

fully established port infrastructure. There<br />

maintain supply to our forces. During<br />

and US$6536 per month for a master.<br />

could be extra accommodation for cadet<br />

the East Timor conflict, for example, the<br />

While low by Australian standards, to put<br />

sea training and for naval officers to obtain<br />

significant majority of vessels chartered<br />

these wages in perspective, a doctor in the<br />

experience in cargo handling. Decks also<br />

by the Commonwealth to deliver supplies<br />

Philippines would earn a similar wage to an<br />

could be strengthened to accommodate<br />

to Dili harbour were foreign-flagged. The<br />

able seaman under this agreement. Nearly<br />

tanks etc. The vessels could be employed<br />

issue goes deeper, even leaving aside the<br />

all of the seafarers from the Philippines<br />

in a clockwise rotation on the Australian<br />

potential drain on the public purse. If our<br />

send most of their wages to their families.<br />

coast giving a fortnightly frequency and<br />

fuel supplies were put at risk by major<br />

avoiding the difficult west to east leg across<br />

economic or geopolitical disruptions how<br />

FLESH ON THE BONES<br />

the Great Australian Bight with its minimal<br />

would Australian-flagged vessels escape the<br />

I recall meeting with a group of<br />

demand for full containers.<br />

obvious forces impacting foreign-flagged<br />

young naval officers on an industrial<br />

An important aspect would be the<br />

tankers in terms of continued supply?<br />

familiarisation course many years ago when<br />

content of a binding agreement between<br />

we discussed the decline of the Australian<br />

the government and a commercial shipping<br />

LABOUR CONDITIONS<br />

flag and what could be done to remedy<br />

operator, selected by open tender. The<br />

The subject of labour conditions was briefly<br />

the situation. An officer came up with an<br />

shipping company would be expected to<br />

raised during a debate on an episode of<br />

idea that the government build vessels for<br />

insure, maintain and meet all operating<br />

the ABC series The Drum in March, when<br />

the Australian coastal trades that could<br />

expenses while the vessels are under their<br />

a journalist from The Guardian stated that<br />

be operated by a commercial shipping<br />

control. All the crew would be Australians.<br />

foreign seafarers were “paid a pittance” and<br />

company but with built-in design elements<br />

The service should be very competitive,<br />

this justified more Australian seafarers in<br />

to meet defence requirements; and could be<br />

given there would be no need to cover<br />

international trades. This is incorrect in<br />

requisitioned by the Commonwealth, with<br />

capital or leasing costs. This is just one<br />

nearly all cases and especially on vessels<br />

notice, to meet emergencies.<br />

idea but a failure to link Labor’s maritime<br />

visiting Australia as the government<br />

Putting some flesh on those bones, it is<br />

aspirations with commercial viability, trade<br />

takes seriously its obligations under the<br />

recommended the government commission<br />

facilitation and providing real value for the<br />

ILO Maritime Labour Convention. These<br />

a feasibility study into, say, building<br />

taxpayer, will be unsustainable.<br />

SAL<br />

24 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Experience the progress.<br />

Mobile Harbour Crane<br />

• Manoeuvrability and versatility – for all areas of application in the harbour<br />

• 360° mobility – absolute outstanding in the MHC market<br />

• Stepless hydrostatic power transmission for smooth and sensitive operation<br />

• Extensive range with load capacities of 42 tonnes to 308 tonnes<br />

• Proven Liebherr quality and full support for our products and services<br />

mobile.harbour.crane@liebherr.com<br />

facebook.com/LiebherrMaritime<br />

www.liebherr.com

QUEENSLAND<br />

An ambitious growth agenda has been delivered on by the Port<br />

of Brisbane during the past 12 months, management says.<br />

Chief executive Roy Cummins told Daily Cargo News the<br />

port has one eye on the present and another on the future.<br />

“The work we are doing now to increase our channel and<br />

wharf capacity will help position the Port of Brisbane well for the<br />

future – we are determined that Brisbane will never be the limiting<br />

factor for shipping on Australia’s east coast,” Mr Cummins said.<br />

“The implementation of our world-leading vessel traffic<br />

management system, NCOS Online, has already enabled the port<br />

to welcome larger container vessels without the need to undertake<br />

capital dredging in the near-term.”<br />

Globally, there is increasing utilisation of container vessels larger<br />

than 15,000 TEU on east-west routes, resulting in a cascading<br />

effect of less than 15,000 TEU vessels onto other routes including,<br />

in time, the east coast of Australia.<br />

In 2017, Brisbane welcomed the 9500 TEU Susan Maersk and the<br />

port now welcomes regular calls from 8500 TEU vessels.<br />

“We have delivered cutting edge technology to maximise the<br />

capacity of our channel, while completing a $110m upgrade of<br />

our main road artery, Port Drive, and beginning groundworks<br />

on our brand new Brisbane International Cruise Terminal,” Mr<br />

Cummins said.<br />

“I’m also proud of our renewed focus on sustainability issues<br />

as well as a raft of new gender diversity policies, particularly our<br />

24-month female cadetship program.”<br />

At the same time the port has managed to sustain steady growth<br />

across almost all commodities except agricultural exports, which<br />

has slumped due to drought.<br />

The Port of Brisbane has gone from being a net exporter of<br />

agricultural seeds to a net importer. Export volumes of bulk<br />

agricultural grain decreased from 619,866 tonnes in 2017 to<br />

61,314 tonnes in 2018.<br />

“We have, however, seen a significant increase in bulk grain -<br />

wheat and barley - imports as shipments from inter-state, mostly<br />

Western Australia and South Australia, arrive at the port destined<br />

for farmers in south-west Queensland,” Mr Cummins said.<br />

Port of Brisbane is currently an “import port” for bulk grain,<br />

with import volumes exceeding one million tonnes in 2018<br />

compared with zero in 2016.<br />

Coal exports have remained fairly consistent during the last few<br />

years, reaching just over seven million tonnes in 2018.<br />

Container volumes have continued to rise over recent years,<br />

growing from 1.175m TEU in 2016 to 1.377m TEU in 2018.<br />

CAPACITY THROUGH TECHNOLOGY<br />

The hydrodynamic and vessel behaviour modelling from NCOS<br />

Online has enabled a 50cm increase in maximum container vessel<br />

draught in certain weather conditions.<br />

“NCOS is also giving us the ability to reduce vessel transit times<br />

across the Bay,” Mr Cummins said.<br />

For example, the port is now seeing almost 60% more bulk<br />

carriers leaving at 14 metres and transiting the channel in one tide,<br />

where previously it was done in two high tides – a significant time<br />

and cost saving for stakeholders such as exporters.<br />

“We have a comprehensive program of infrastructure<br />

improvement works underway to help us cater for future growth,”<br />

Mr Cummins said. These include the construction of a second<br />

swing basin (almost complete), a bollard replacement project for<br />

INVESTING<br />

IN QUEENSLAND’S<br />

FUTURE<br />

Preparing ports to continue increasing<br />

capacity is a key focus, as significant funds<br />

are sunk into accommodating bigger ships<br />

in Queensland, writes Paula Wallace<br />

26 <strong>May</strong> <strong>2019</strong><br />

thedcn.com.au

Port of Townsville<br />

The Port of Townsville<br />

thedcn.com.au <strong>May</strong> <strong>2019</strong> 27

QUEENSLAND<br />

the port’s container wharves, and further structural capacity<br />

analysis of existing wharf infrastructure.<br />

Port management believe it is only using a fraction of the<br />

capability of NCOS Online and is working with Seaport OPX<br />

(developers of NCOS) to explore new opportunities to use the<br />

platform to benefit customers and the port.<br />

“We’re also working with stakeholders on ways we can use data<br />

to make their operations more efficient,” Mr Cummins said.<br />

LANDSIDE EFFICIENCY<br />