BankVic Annual Report 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

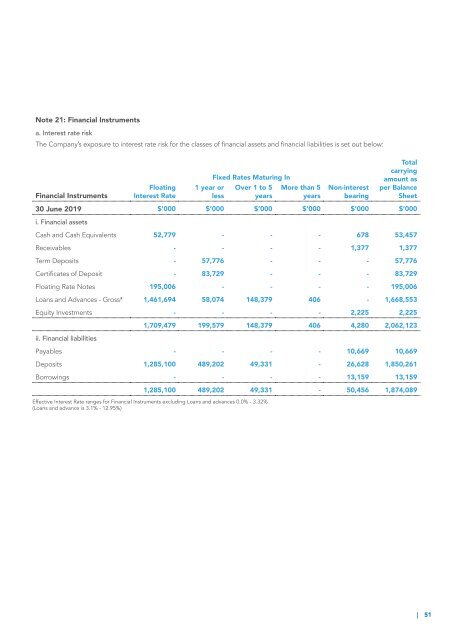

Note 21: Financial Instruments<br />

a. Interest rate risk<br />

The Company’s exposure to interest rate risk for the classes of financial assets and financial liabilities is set out below:<br />

Financial Instruments<br />

Floating<br />

Interest Rate<br />

1 year or<br />

less<br />

Fixed Rates Maturing In<br />

Over 1 to 5<br />

years<br />

More than 5<br />

years<br />

Non-interest<br />

bearing<br />

Total<br />

carrying<br />

amount as<br />

per Balance<br />

Sheet<br />

30 June <strong>2019</strong> $’000 $’000 $’000 $’000 $’000 $’000<br />

i. Financial assets<br />

Cash and Cash Equivalents 52,779 - - - 678 53,457<br />

Receivables - - - - 1,377 1,377<br />

Term Deposits - 57,776 - - - 57,776<br />

Certificates of Deposit - 83,729 - - - 83,729<br />

Floating Rate Notes 195,006 - - - - 195,006<br />

Loans and Advances - Gross* 1,461,694 58,074 148,379 406 - 1,668,553<br />

Equity Investments - - - - 2,225 2,225<br />

ii. Financial liabilities<br />

1,709,479 199,579 148,379 406 4,280 2,062,123<br />

Payables - - - - 10,669 10,669<br />

Deposits 1,285,100 489,202 49,331 - 26,628 1,850,261<br />

Borrowings - - - - 13,159 13,159<br />

1,285,100 489,202 49,331 - 50,456 1,874,089<br />

Effective Interest Rate ranges for Financial Instruments excluding Loans and advances 0.0% - 3.32%<br />

(Loans and advance is 3.1% - 12.95%)<br />

| 51