BankVic Annual Report 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

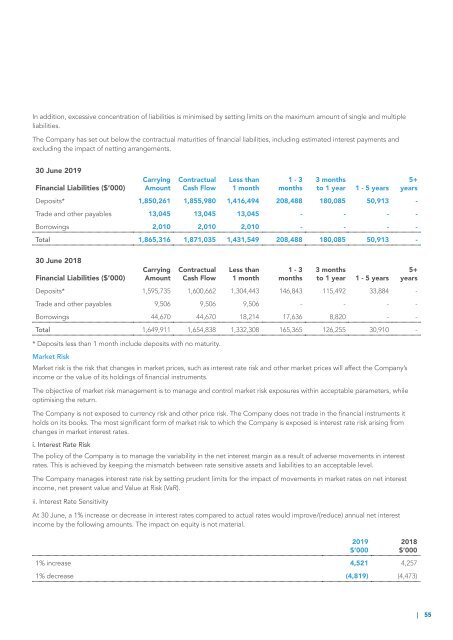

In addition, excessive concentration of liabilities is minimised by setting limits on the maximum amount of single and multiple<br />

liabilities.<br />

The Company has set out below the contractual maturities of financial liabilities, including estimated interest payments and<br />

excluding the impact of netting arrangements.<br />

30 June <strong>2019</strong><br />

Financial Liabilities ($’000)<br />

Carrying<br />

Amount<br />

Contractual<br />

Cash Flow<br />

Less than<br />

1 month<br />

1 - 3<br />

months<br />

3 months<br />

to 1 year<br />

1 - 5 years<br />

Deposits* 1,850,261 1,855,980 1,416,494 208,488 180,085 50,913 -<br />

Trade and other payables 13,045 13,045 13,045 - - - -<br />

Borrowings 2,010 2,010 2,010 - - - -<br />

Total 1,865,316 1,871,035 1,431,549 208,488 180,085 50,913 -<br />

5+<br />

years<br />

30 June 2018<br />

Financial Liabilities ($’000)<br />

Carrying<br />

Amount<br />

Contractual<br />

Cash Flow<br />

Less than<br />

1 month<br />

1 - 3<br />

months<br />

3 months<br />

to 1 year<br />

1 - 5 years<br />

Deposits* 1,595,735 1,600,662 1,304,443 146,843 115,492 33,884 -<br />

Trade and other payables 9,506 9,506 9,506 - - - -<br />

Borrowings 44,670 44,670 18,214 17,636 8,820 - -<br />

Total 1,649,911 1,654,838 1,332,308 165,365 126,255 30,910 -<br />

* Deposits less than 1 month include deposits with no maturity.<br />

Market Risk<br />

Market risk is the risk that changes in market prices, such as interest rate risk and other market prices will affect the Company’s<br />

income or the value of its holdings of financial instruments.<br />

The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while<br />

optimising the return.<br />

The Company is not exposed to currency risk and other price risk. The Company does not trade in the financial instruments it<br />

holds on its books. The most significant form of market risk to which the Company is exposed is interest rate risk arising from<br />

changes in market interest rates.<br />

i. Interest Rate Risk<br />

The policy of the Company is to manage the variability in the net interest margin as a result of adverse movements in interest<br />

rates. This is achieved by keeping the mismatch between rate sensitive assets and liabilities to an acceptable level.<br />

The Company manages interest rate risk by setting prudent limits for the impact of movements in market rates on net interest<br />

income, net present value and Value at Risk (VaR).<br />

ii. Interest Rate Sensitivity<br />

At 30 June, a 1% increase or decrease in interest rates compared to actual rates would improve/(reduce) annual net interest<br />

income by the following amounts. The impact on equity is not material.<br />

<strong>2019</strong><br />

$’000<br />

5+<br />

years<br />

2018<br />

$’000<br />

1% increase 4,521 4,257<br />

1% decrease (4,819) (4,473)<br />

| 55