Wealden Times | WT213 | November 2019 | Gift supplement inside

Wealden Times - The lifestyle magazine for the Weald

Wealden Times - The lifestyle magazine for the Weald

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

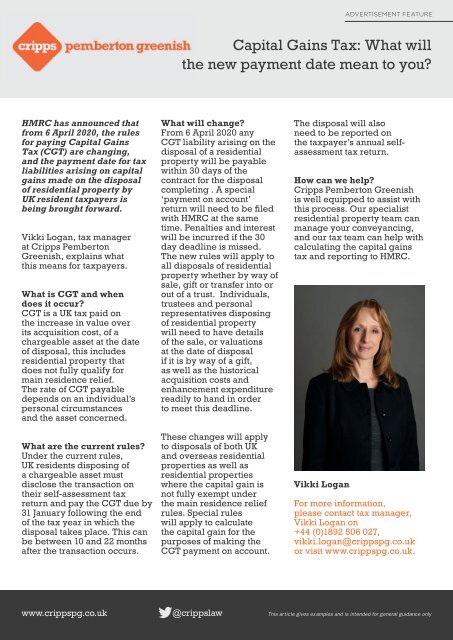

ADVERTISEMENT FEATURE<br />

Capital Gains Tax: What will<br />

the new payment date mean to you?<br />

HMRC has announced that<br />

from 6 April 2020, the rules<br />

for paying Capital Gains<br />

Tax (CGT) are changing,<br />

and the payment date for tax<br />

liabilities arising on capital<br />

gains made on the disposal<br />

of residential property by<br />

UK resident taxpayers is<br />

being brought forward.<br />

Vikki Logan, tax manager<br />

at Cripps Pemberton<br />

Greenish, explains what<br />

this means for taxpayers.<br />

What is CGT and when<br />

does it occur?<br />

CGT is a UK tax paid on<br />

the increase in value over<br />

its acquisition cost, of a<br />

chargeable asset at the date<br />

of disposal, this includes<br />

residential property that<br />

does not fully qualify for<br />

main residence relief.<br />

The rate of CGT payable<br />

depends on an individual’s<br />

personal circumstances<br />

and the asset concerned.<br />

What are the current rules?<br />

Under the current rules,<br />

UK residents disposing of<br />

a chargeable asset must<br />

disclose the transaction on<br />

their self-assessment tax<br />

return and pay the CGT due by<br />

31 January following the end<br />

of the tax year in which the<br />

disposal takes place. This can<br />

be between 10 and 22 months<br />

after the transaction occurs.<br />

What will change?<br />

From 6 April 2020 any<br />

CGT liability arising on the<br />

disposal of a residential<br />

property will be payable<br />

within 30 days of the<br />

contract for the disposal<br />

completing . A special<br />

‘payment on account’<br />

return will need to be filed<br />

with HMRC at the same<br />

time. Penalties and interest<br />

will be incurred if the 30<br />

day deadline is missed.<br />

The new rules will apply to<br />

all disposals of residential<br />

property whether by way of<br />

sale, gift or transfer into or<br />

out of a trust. Individuals,<br />

trustees and personal<br />

representatives disposing<br />

of residential property<br />

will need to have details<br />

of the sale, or valuations<br />

at the date of disposal<br />

if it is by way of a gift,<br />

as well as the historical<br />

acquisition costs and<br />

enhancement expenditure<br />

readily to hand in order<br />

to meet this deadline.<br />

These changes will apply<br />

to disposals of both UK<br />

and overseas residential<br />

properties as well as<br />

residential properties<br />

where the capital gain is<br />

not fully exempt under<br />

the main residence relief<br />

rules. Special rules<br />

will apply to calculate<br />

the capital gain for the<br />

purposes of making the<br />

CGT payment on account.<br />

The disposal will also<br />

need to be reported on<br />

the taxpayer’s annual selfassessment<br />

tax return.<br />

How can we help?<br />

Cripps Pemberton Greenish<br />

is well equipped to assist with<br />

this process. Our specialist<br />

residential property team can<br />

manage your conveyancing,<br />

and our tax team can help with<br />

calculating the capital gains<br />

tax and reporting to HMRC.<br />

Vikki Logan<br />

For more information,<br />

please contact tax manager,<br />

Vikki Logan on<br />

+44 (0)1892 506 027,<br />

vikki.logan@crippspg.co.uk<br />

or visit www.crippspg.co.uk.<br />

www.crippspg.co.uk @crippslaw This article gives examples and is intended for general guidance only