SLO LIFE Winter 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

| real estate<br />

leverage<br />

A powerful tool if you know how to use it.<br />

Despite the recent correction in the housing market, it’s no secret that real estate remains the greatest source of wealth creation nationwide. <strong>SLO</strong> <strong>LIFE</strong><br />

Magazine set out to ask local real estate professionals: “Why is that?”<br />

And, while the answers were varied, every single person we talked to touched on the power of leverage.<br />

Leverage, as it pertains to real estate, means “borrowing money” and derives from the word “lever,” which, of course, can be used to create a<br />

tremendous amount of force. Here is how it works:<br />

Let’s say you buy a $400,000 home with a 20% down payment ($80,000) and the bank loans you the remaining 80% ($320,000). The word “leverage”<br />

is appropriate because, like the strength you gain by using a lever, you have gained more purchasing power by borrowing money. You essentially buy a<br />

$400,000 asset for just $80,000. Of course, now you have to repay the bank, but here is where the power of leverage kicks in.<br />

Let’s assume that real estate continues on the same trajectory it has been on for the past 100 years and it gains in value of 2% over the rate of inflation<br />

(this is the average of all the bubbles and recessions during that time frame). So, just by living in your home and not including any improvements you<br />

may make, your investment creates $8,000 ($400,000 x 2%) of wealth in the first year alone. When measured against the original down payment, that is<br />

a 10% return on your cash investment ($8,000 / $80,000 = 10%) which is pretty hard to find these days.<br />

Now, imagine that you live in this home for 20 years, through the magic of interest compounding at an annual rate of 2% that same $8,000 will turn into<br />

$194,379. After 30 years, the gain would be $324,545 plus, by then, you would have probably paid off the original principle balance.<br />

All of this is made possible by leverage, which is the borrowing of money to make the purchase possible. Of course, we all got carried away with the use<br />

of excessive leverage during the bubble, but now may be a great time to revisit the concept. You can continue to track what the market here in San Luis<br />

Obispo is doing by watching the numbers below, but your best bet is to find a house that you will be happy to live in, make a significant down payment<br />

(20%), be happy, live the “<strong>SLO</strong> Life,” and let power of leverage and compounding interest do their thing. <strong>SLO</strong> <strong>LIFE</strong><br />

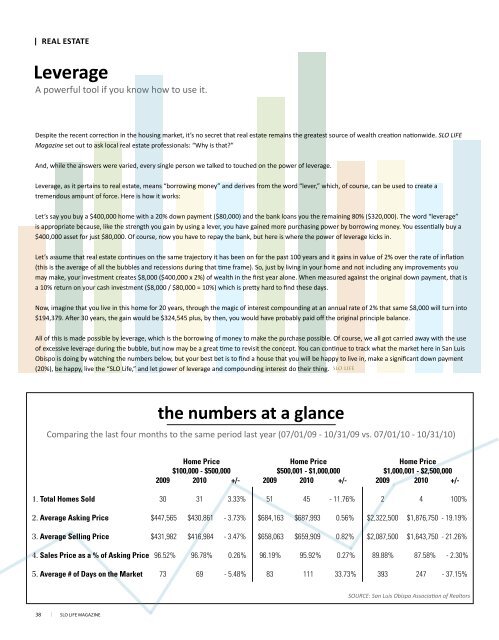

the numbers at a glance<br />

Comparing the last four months to the same period last year (07/01/09 - 10/31/09 vs. 07/01/10 - 10/31/10)<br />

Home Price<br />

$100,000 - $500,000<br />

2009 <strong>2010</strong> +/-<br />

Home Price<br />

$500,001 - $1,000,000<br />

2009 <strong>2010</strong> +/-<br />

Home Price<br />

$1,000,001 - $2,500,000<br />

2009 <strong>2010</strong> +/-<br />

1. Total Homes Sold<br />

30 31 3.33%<br />

51 45 - 11.76%<br />

2 4 100%<br />

2. Average Asking Price<br />

$447,565 $430,861 - 3.73%<br />

$684,163 $687,993 0.56%<br />

$2,322,500 $1,876,750 - 19.19%<br />

3. Average Selling Price<br />

$431,982 $416,984 - 3.47%<br />

$658,063 $659,909 0.82%<br />

$2,087,500 $1,643,750 - 21.26%<br />

4. Sales Price as a % of Asking Price<br />

96.52% 96.78% 0.26%<br />

96.19% 95.92% 0.27%<br />

89.88% 87.58% - 2.30%<br />

5. Average # of Days on the Market<br />

73 69 - 5.48%<br />

83 111 33.73%<br />

393 247 - 37.15%<br />

SOURCE: San Luis Obispo Association of Realtors<br />

38 | slo life magazine