Local Life - Wigan - April 2020

Wigan's FREE local lifestyle magazine.

Wigan's FREE local lifestyle magazine.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

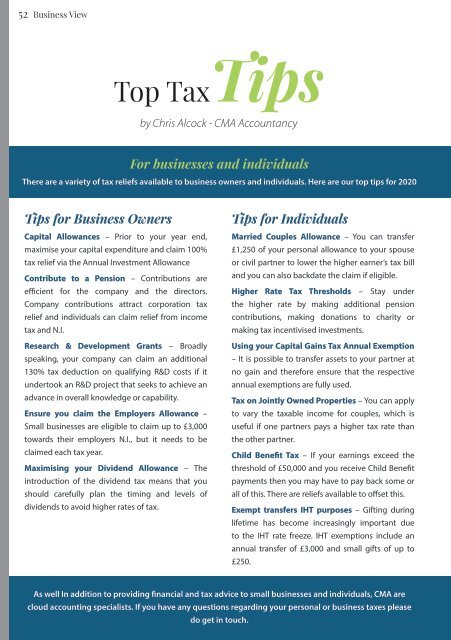

52 Business View<br />

Top TaxTips<br />

by Chris Alcock - CMA Accountancy<br />

For businesses and individuals<br />

There are a variety of tax reliefs available to business owners and individuals. Here are our top tips for <strong>2020</strong><br />

Tips for Business Owners<br />

Capital Allowances – Prior to your year end,<br />

maximise your capital expenditure and claim 100%<br />

tax relief via the Annual Investment Allowance<br />

Contribute to a Pension – Contributions are<br />

efficient for the company and the directors.<br />

Company contributions attract corporation tax<br />

relief and individuals can claim relief from income<br />

tax and N.I.<br />

Research & Development Grants – Broadly<br />

speaking, your company can claim an additional<br />

130% tax deduction on qualifying R&D costs if it<br />

undertook an R&D project that seeks to achieve an<br />

advance in overall knowledge or capability.<br />

Ensure you claim the Employers Allowance –<br />

Small businesses are eligible to claim up to £3,000<br />

towards their employers N.I., but it needs to be<br />

claimed each tax year.<br />

Maximising your Dividend Allowance – The<br />

introduction of the dividend tax means that you<br />

should carefully plan the timing and levels of<br />

dividends to avoid higher rates of tax.<br />

Tips for Individuals<br />

Married Couples Allowance – You can transfer<br />

£1,250 of your personal allowance to your spouse<br />

or civil partner to lower the higher earner’s tax bill<br />

and you can also backdate the claim if eligible.<br />

Higher Rate Tax Thresholds – Stay under<br />

the higher rate by making additional pension<br />

contributions, making donations to charity or<br />

making tax incentivised investments.<br />

Using your Capital Gains Tax Annual Exemption<br />

– It is possible to transfer assets to your partner at<br />

no gain and therefore ensure that the respective<br />

annual exemptions are fully used.<br />

Tax on Jointly Owned Properties – You can apply<br />

to vary the taxable income for couples, which is<br />

useful if one partners pays a higher tax rate than<br />

the other partner.<br />

Child Benefit Tax – If your earnings exceed the<br />

threshold of £50,000 and you receive Child Benefit<br />

payments then you may have to pay back some or<br />

all of this. There are reliefs available to offset this.<br />

Exempt transfers IHT purposes – Gifting during<br />

lifetime has become increasingly important due<br />

to the IHT rate freeze. IHT exemptions include an<br />

annual transfer of £3,000 and small gifts of up to<br />

£250.<br />

As well In addition to providing financial and tax advice to small businesses and individuals, CMA are<br />

cloud accounting specialists. If you have any questions regarding your personal or business taxes please<br />

do get in touch.