full Annual Report 2003(5.9

full Annual Report 2003(5.9

full Annual Report 2003(5.9

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

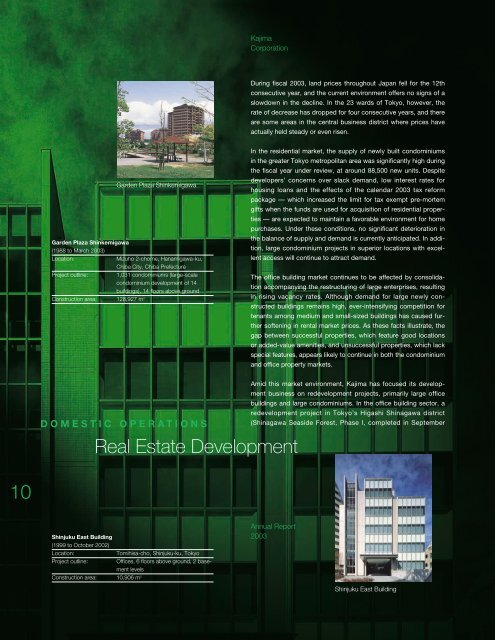

Garden Plaza Shinkemigawa<br />

Garden Plaza Shinkemigawa<br />

(1988 to March <strong>2003</strong>)<br />

Location: Mizuho 2-chome, Hanamigawa-ku,<br />

Chiba City, Chiba Prefecture<br />

Project outline: 1,031 condominiums (large-scale<br />

condominium development of 14<br />

buildings), 14 floors above ground<br />

Construction area: 128,927 m 2<br />

DOMESTIC OPERATIONS<br />

Kajima<br />

Corporation<br />

Real Estate Development<br />

Shinjuku East Building<br />

(1999 to October 2002)<br />

Location: Tomihisa-cho, Shinjuku-ku, Tokyo<br />

Project outline: Offices, 6 floors above ground, 2 basement<br />

levels<br />

Construction area: 10,906 m 2<br />

During fiscal <strong>2003</strong>, land prices throughout Japan fell for the 12th<br />

consecutive year, and the current environment offers no signs of a<br />

slowdown in the decline. In the 23 wards of Tokyo, however, the<br />

rate of decrease has dropped for four consecutive years, and there<br />

are some areas in the central business district where prices have<br />

actually held steady or even risen.<br />

In the residential market, the supply of newly built condominiums<br />

in the greater Tokyo metropolitan area was significantly high during<br />

the fiscal year under review, at around 88,500 new units. Despite<br />

developers’ concerns over slack demand, low interest rates for<br />

housing loans and the effects of the calendar <strong>2003</strong> tax reform<br />

package — which increased the limit for tax exempt pre-mortem<br />

gifts when the funds are used for acquisition of residential properties<br />

— are expected to maintain a favorable environment for home<br />

purchases. Under these conditions, no significant deterioration in<br />

the balance of supply and demand is currently anticipated. In addition,<br />

large condominium projects in superior locations with excellent<br />

access will continue to attract demand.<br />

The office building market continues to be affected by consolidation<br />

accompanying the restructuring of large enterprises, resulting<br />

in rising vacancy rates. Although demand for large newly constructed<br />

buildings remains high, ever-intensifying competition for<br />

tenants among medium and small-sized buildings has caused further<br />

softening in rental market prices. As these facts illustrate, the<br />

gap between successful properties, which feature good locations<br />

or added-value amenities, and unsuccessful properties, which lack<br />

special features, appears likely to continue in both the condominium<br />

and office property markets.<br />

Amid this market environment, Kajima has focused its development<br />

business on redevelopment projects, primarily large office<br />

buildings and large condominiums. In the office building sector, a<br />

redevelopment project in Tokyo’s Higashi Shinagawa district<br />

(Shinagawa Seaside Forest, Phase I, completed in September<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>2003</strong><br />

Shinjuku East Building