full Annual Report 2003(5.9

full Annual Report 2003(5.9

full Annual Report 2003(5.9

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

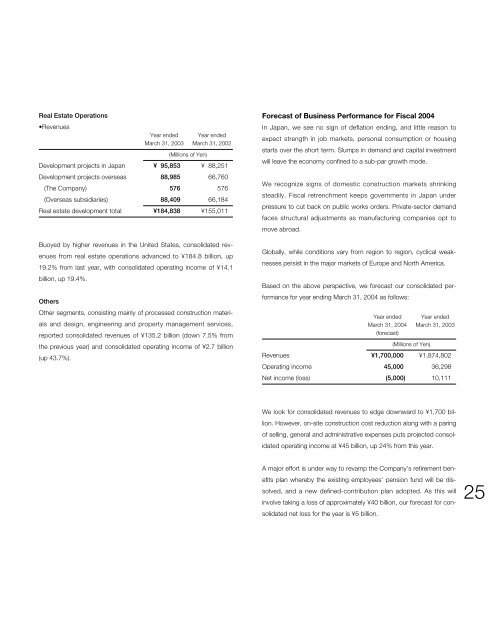

Real Estate Operations<br />

•Revenues<br />

Year ended Year ended<br />

March 31, <strong>2003</strong> March 31, 2002<br />

(Millions of Yen)<br />

Development projects in Japan ¥ 95,853 ¥ 88,251<br />

Development projects overseas 88,985 66,760<br />

(The Company) 576 576<br />

(Overseas subsidiaries) 88,409 66,184<br />

Real estate development total ¥184,838 ¥155,011<br />

Buoyed by higher revenues in the United States, consolidated revenues<br />

from real estate operations advanced to ¥184.8 billion, up<br />

19.2% from last year, with consolidated operating income of ¥14.1<br />

billion, up 19.4%.<br />

Others<br />

Other segments, consisting mainly of processed construction materials<br />

and design, engineering and property management services,<br />

reported consolidated revenues of ¥135.2 billion (down 7.5% from<br />

the previous year) and consolidated operating income of ¥2.7 billion<br />

(up 43.7%).<br />

Forecast of Business Performance for Fiscal 2004<br />

In Japan, we see no sign of deflation ending, and little reason to<br />

expect strength in job markets, personal consumption or housing<br />

starts over the short term. Slumps in demand and capital investment<br />

will leave the economy confined to a sub-par growth mode.<br />

We recognize signs of domestic construction markets shrinking<br />

steadily. Fiscal retrenchment keeps governments in Japan under<br />

pressure to cut back on public works orders. Private-sector demand<br />

faces structural adjustments as manufacturing companies opt to<br />

move abroad.<br />

Globally, while conditions vary from region to region, cyclical weaknesses<br />

persist in the major markets of Europe and North America.<br />

Based on the above perspective, we forecast our consolidated performance<br />

for year ending March 31, 2004 as follows:<br />

Year ended Year ended<br />

March 31, 2004 March 31, <strong>2003</strong><br />

(forecast)<br />

(Millions of Yen)<br />

Revenues ¥1,700,000 ¥1,874,802<br />

Operating income 45,000 36,298<br />

Net income (loss) (5,000) 10,111<br />

We look for consolidated revenues to edge downward to ¥1,700 billion.<br />

However, on-site construction cost reduction along with a paring<br />

of selling, general and administrative expenses puts projected consolidated<br />

operating income at ¥45 billion, up 24% from this year.<br />

A major effort is under way to revamp the Company’s retirement benefits<br />

plan whereby the existing employees’ pension fund will be dissolved,<br />

and a new defined-contribution plan adopted. As this will<br />

involve taking a loss of approximately ¥40 billion, our forecast for consolidated<br />

net loss for the year is ¥5 billion.<br />

25