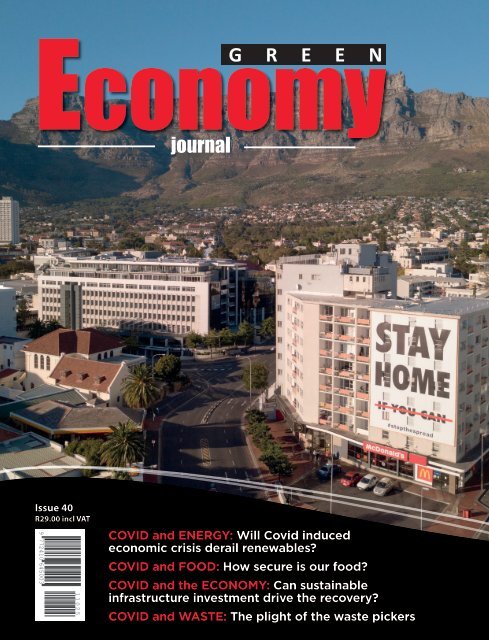

Green Economy Journal Issue 40

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Economy</strong><br />

G r e e n<br />

journal<br />

<strong>Issue</strong> <strong>40</strong><br />

R29.00 incl VAT<br />

9 772410 645003<br />

11025<br />

COVID and ENERGY: Will Covid induced<br />

economic crisis derail renewables?<br />

COVID and FOOD: How secure is our food?<br />

COVID and the ECONOMY: Can sustainable<br />

infrastructure investment drive the recovery?<br />

COVID and WASTE: The plight of the waste pickers

THA 11-2020<br />

Energy efficiency<br />

in practice works<br />

SA Industrial Energy Efficiency Project<br />

Meadow Feeds in the Western Cape, continues to save energy year<br />

on year through the interventions of the South African Industrial Energy<br />

Efficiency (IEE) Project.<br />

This company is a leader in specialised diets and custom feed mixes for the<br />

poultry, dairy, ostrich and pig industries. The Paarl factory produces some<br />

360 000 tons per year. It forms part of the Astral Foods group of companies,<br />

one of the largest integrated poultry producers in South Africa.<br />

Meadow Feeds achieved significant savings by instilling a culture of energy<br />

saving in the company through the following behaviour changes:<br />

• Energy efficiency as a standing agenda item in productivity meetings;<br />

• Operators received regular training on various elements of the<br />

production process;<br />

• The induction programme for new staff includes energy efficiency<br />

content; and,<br />

• It is a procurement requirement to buy only energy efficient equipment.<br />

Energy saving interventions included the replacement of mercury vapour<br />

lights with LEDs, motion detectors for air-conditioning units, solar hot water,<br />

the replacement of blow lines with elevators, installation of a borehole water<br />

filtration system for boilers, heat recovery from air compressors, variable<br />

speed drives on pelletiser cooler fans and the 250kW grinder 3001 system.<br />

A significant lesson was how energy could be saved in the feed pelletising<br />

machines by replacing the dies when energy consumption increased. The<br />

wear of the dies had a significant effect on the energy consumption of these<br />

machines. Meadow Feeds was able to make significant capital savings by<br />

refurbishing the dies, rather than simply replacing them – refurbishing is a<br />

third of the cost of replacing.<br />

ENERGY SAVINGS<br />

3.10%<br />

Overall energy consumption saved<br />

412 342 kWh<br />

Energy saved<br />

ZAR 346 367<br />

Money saved<br />

429.87 tCO2e<br />

GHG mitigated<br />

ZAR 309 800<br />

Investment made<br />

4 Delegates<br />

Trained in EnMS<br />

2 Delegates<br />

Expert level Training<br />

To participate in the IEE Project or access some of the free online tools, contact ncpc@csir.co.za<br />

Download the full case study, and others, at www.ncpc.co.za / www.ieeproject.co.za.<br />

The IEE Project is implemented by a partnership between the United Nations Industrial Development Organization<br />

(UNIDO); the National Cleaner Production Centre South Africa (NCPC-SA) on behalf of the Department of Trade,<br />

Industry and Competition; and the Department of Energy and Mineral Resources and its agency, Sanedi.

Contents<br />

ISSUE <strong>40</strong><br />

08<br />

10<br />

04<br />

07<br />

08<br />

10<br />

13<br />

14<br />

16<br />

News & snippets<br />

Energy<br />

SAWEA explains new generation capacity and<br />

how NERSA determinations will provide hope for<br />

procurement<br />

International insight<br />

Global overview and historical hindsight indicates<br />

a bright outlook for the renewable sector<br />

Finance<br />

NCPC-SA says that they have seen the sharpening<br />

of focus on the implementation of energy<br />

efficiency in the business landscape over the past<br />

ten years<br />

Waste<br />

Thought leader, Chris Whyte, explains how Covid-19<br />

has impacted the waste industry, specifically with<br />

regards to the recycling sector<br />

Thought leadership<br />

Wendy <strong>Green</strong>, agriculture and energy expert,<br />

expounds on how food security in South Africa is<br />

faring in the face of Covid-19<br />

Food security<br />

The Minister of Agriculture, Land Reform and Rural<br />

Development and other sectoral leaders share their<br />

views on how to feed Africa during Covid-19<br />

18 Construction<br />

Increase property investment value by adding<br />

sustainable value. Clay Brick tells you how<br />

22<br />

20<br />

21<br />

22<br />

Infrastructure<br />

Graham Qruickshanks, from GBCSA, explains why<br />

South Africans should get a certified green home<br />

rating<br />

Waste<br />

PETCO’s pilot recycling programme boosts the<br />

informal sector and highlights the plight of the<br />

waste pickers<br />

Profile<br />

Boekenhoutskloof Winery share their story and<br />

philosophy on creating a prodigy of the renaissance<br />

1

RECYCLE.<br />

IT MAKES<br />

OUR WORLD<br />

GO ROUND.<br />

Recycling PET plastic bottles creates over 60 000 income<br />

opportunities every year in South Africa. Many of these are<br />

reclaimers, who helped divert upwards of 90 000 tonnes<br />

of PET plastic bottles from landfill in 2018. The used bottles<br />

they collect are recycled, ensuring that they become<br />

bottles yet again. This creates yet more jobs in the process,<br />

contributing positively to our country’s GDP while eliminating<br />

the chance that they end up harming the environment.<br />

Recycling ensures that a circular economy is established<br />

where the value of plastic bottles continues indefinitely.<br />

Plastic bottles are not trash.<br />

16 BILLION<br />

PET plastic bottles<br />

collected for recycling<br />

R6.6 BILLION<br />

injected into South<br />

Africa’s economy<br />

68 000<br />

income opportunities<br />

created**<br />

** 2018 specifically<br />

1905356_FP_E

Dear Reader,<br />

Once we stop screaming in terror at the immediate question: will<br />

my business survive C19, we might take a moment to ponder<br />

the bigger picture question: Is it possible to emerge from the<br />

greatest global economic crisis in recorded history in a better<br />

position than we entered it? In other words, can the C19 induced<br />

economic shutdown and lessons learned from it somehow<br />

trigger a reset that takes us in a new, more sustainable, more<br />

crisis-resilient developmental direction?<br />

As an extension of this conversation, we start to consider the<br />

impact of the C19 crisis beyond the actual illness and consider<br />

how the economy and the state will be forced to transform how<br />

goods and services are delivered to consumers into the future.<br />

C19 could radically affect policy, and a key to a sustainable<br />

future is the migration to renewable energy in South Africa.<br />

How will the crisis affect this trajectory? See insight from global<br />

management consultancy firm Kearney on page 8.<br />

In Africa, C19 will have a massive impact on food markets.<br />

Even before C19, the world was rapidly moving towards a more<br />

nationalistic sentiment. We asked Wendy <strong>Green</strong>, an independent<br />

expert, to shed some light on how these shifts towards greater<br />

national self-interest, now heightened by the C19 crisis, is<br />

affecting consumers and agribusinesses in South Africa. Read<br />

her illuminating thoughts on page 14 and gain further insight<br />

from Minister of Agriculture, Thokozile Didiza, the UN FAO<br />

Director-General and the AU Commissioner of Rural <strong>Economy</strong><br />

and Agriculture in their joint article Keeping Africa Fed on page 16.<br />

Another primary sector is waste management, now reopening<br />

fully under level 4 lockdown, how has the lockdown affected this<br />

sector, and what does the future hold? We asked waste sector<br />

expert Chris Whyte of Use-It for his views, see page 13.<br />

All sectors have been affected by the Coronavirus media is<br />

no different. Like many others, our response has been to ramp<br />

up our digital strategies with the launch of our new brand<br />

<strong>Green</strong><strong>Economy</strong>.Media and website www.greeneconomy.media.<br />

This website promises to deliver real value to the green economy<br />

sector as it breaks down the problems, shares the science,<br />

exposes the innovation, and highlights the solutions to every<br />

aspect of the green economy. Featuring the stories behind the<br />

news, thought leadership, research, technology, alternative<br />

approaches, and a unique buyers guide – giving you the how,<br />

the why, and the how much! Check it out today!<br />

In another shot-in-the-arm for <strong>Green</strong><strong>Economy</strong>.Media, I take<br />

this opportunity to announce that green economy professional<br />

Songo Didiza of <strong>Green</strong> Building Design Group will take over as<br />

editor of <strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong> from next edition. Welcome,<br />

Songo!<br />

G r e e n<br />

<strong>Economy</strong><br />

journal<br />

Editor-in-Chief: Gordon Brown<br />

PRODUCTION MANAGER: Alexis Knipe<br />

LAYOUT AND DESIGN: CDC Design<br />

GM: MEDIA SALES: Danielle Solomons<br />

danielle@greeneconomy.media<br />

PROJECT MANAGER: Munya Jani<br />

SALES: Vania Reyneke<br />

Gerard Jeffcote<br />

PRINTING: FA Print<br />

WEB: www.greeneconomy.media<br />

GENERAL ENQUIRIES: info@greeneconomy.media<br />

ADVERTISING ENQUIRIES: munya@greeneconomy.media<br />

EDITORIAL PROPOSALS: alexis@greeneconomy.media<br />

PUBLISHER: Gordon Brown<br />

gordon@greeneconomy.media<br />

PHYSICAL ADDRESS: 21 Selous Rd<br />

Claremont<br />

7709<br />

Cape Town<br />

REG NUMBER: 2005/003854/07<br />

VAT Number: 4750243448<br />

ISSN NUMBER: 2410-6453<br />

PUBLICATION DATE: April 2020<br />

G r e e n<br />

<strong>Economy</strong><br />

journal<br />

PUBLISHER<br />

Enjoy your read,<br />

<strong>Issue</strong> <strong>40</strong><br />

R29.00 incl VAT<br />

11025<br />

9 772410 645003<br />

COVID and ENERGY: Will Covid induced<br />

economic crisis derail renewables?<br />

COVID and FOOD: How secure is our food?<br />

COVID and the ECONOMY: Can sustainable<br />

infrastructure investment drive the recovery?<br />

COVID and WASTE: The plight of the waste pickers<br />

<strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong><br />

is audited by ABC<br />

Cover image: Shutterstock<br />

All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or in any form without the prior written permission of the Publisher. The opinions expressed herein are not<br />

necessarily those of the Publisher or the Editor. All editorial and advertising contributions are accepted on the understanding that the contributor either owns or has obtained all necessary copyrights<br />

and permissions. The Publisher does not endorse any claims made in the publication by or on behalf of any organisations or products. Please address any concerns in this regard to the Publisher.<br />

The <strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong> is printed on Hi-Q Titan plus paper, manufactured by Evergreen Hansol, a leading afforestation member acknowledged by FOA. Hi-Q has Chain of Custody certification, is<br />

totally chlorine free, and is PEFC, ISO 1<strong>40</strong>01, ISO 9001 accredited. This paper is FSC certified.<br />

3

News & Snippets<br />

Solar industry calls on president<br />

The Chairperson of SAPVIA, Wido Schnabel,<br />

has written an open letter to President Cyril<br />

Ramaphosa, in which it calls on him to remove<br />

limitations to private power generation. He writes:<br />

“As an industry, we support both the state-run<br />

utility model and the integration of Distributed<br />

Generation methodologies, although the latter<br />

delivers electricity at a faster rate with no cost<br />

to the Government. The Distributed Generation<br />

approach provides additional capacity to the grid,<br />

promotes broad-based participation in the energy<br />

sector, and aligns with the tenets of a just energy<br />

transition. In fact, the Distributed Generation<br />

space plays a strategic role in balancing the<br />

country’s sustainable development needs with<br />

employment security.<br />

To assess the potential of the sector to create<br />

jobs, we partnered with the Council for Scientific<br />

and Industrial Research (CSIR). According to our<br />

study, there are approximately <strong>40</strong>0 SMMEs (and<br />

growing) in the Distributed Generation space with<br />

the potential to create more than 100 000 jobs<br />

over the next 10 years. Unfortunately, the growth<br />

of the Distributed Generation market has been<br />

stymied by three factors linked to Schedule 2 of the<br />

Electricity Regulation Act (ERA). These problematic<br />

amendments came into effect in 2017.<br />

There are three main issues:<br />

• The Integrated Resource Plan (IRP) does<br />

not explicitly spell out the allocation for<br />

Distributed Generation projects over the next<br />

4 years. Without a clear allocation, the energy<br />

regulator does not have a clear mandate to<br />

grant licenses to entities wanting to generate<br />

electricity outside of the proposed state<br />

procurement process.<br />

• Schedule 2 imposes a 1MW threshold for<br />

licensing exemption, which makes the development<br />

of projects up to 10MW impractical<br />

for small and medium sized businesses.<br />

• Projects with a generating capacity of just<br />

over 1MW must endure the same onerous<br />

application process as large-scale projects.<br />

Both require a public participation process<br />

and hearings on a per project basis…<br />

“…The limitations imposed by Schedule 2 of the<br />

ERA are weighing heavily on our industry at a<br />

time when the country is in the midst of a crisis.<br />

Nevertheless, we are confident that by working<br />

together with the Government, we will be able to<br />

power the economy back to life. This is precisely<br />

why we are calling for an urgent meeting with<br />

your administration to plot a way forward.<br />

Mr President, we urge you to consider the<br />

following proposals:<br />

• Lift the licensing exemption threshold from<br />

1MW to 10MW.<br />

• Make it a requirement for projects to<br />

register with the regulator by submitting<br />

an independent certificate of compliance<br />

against which the allocation to embedded<br />

generation can be measured, and ensure that<br />

the database of installed megawatts is public<br />

and updated.<br />

• Ensure there are clear guidelines on how to<br />

obtain a generation license for projects above<br />

10MW in size.<br />

• Ensure that NERSA has the resources and<br />

capacity to process applications timeously and<br />

efficiently.<br />

Mr President, we need urgent interventions from<br />

your government to drive growth in the energy<br />

sector. The Solar PV Industry stands with you to fight<br />

the COVID-19 pandemic and commits to positively<br />

participate in the recovery of the economy. As an<br />

industry we’ll continue to engage with you so that<br />

we can get our economy moving again.”<br />

Construction: An essential service?<br />

Construction industry suppliers are calling for government leaders to add construction to the list of<br />

essential businesses. According to a joint statement from the Clay Brick Association of Southern Africa<br />

(CBASA) and Aggregate and Sand Producers Association of Southern Africa (ASPASA), Government<br />

at all levels should treat the construction industry and the work it performs as vital and essential<br />

to the critical industries that must remain in operation.<br />

In many countries including Canada and most US States, construction<br />

has been designated an essential service.<br />

SAWEA<br />

welcomes<br />

new IPPO<br />

head<br />

The South African Wind Energy Association<br />

(SAWEA) has welcomed the appointment<br />

of Tshifhiwa Bernard Magoro, as the new<br />

head of the Independent Power Producers<br />

Office (IPPO). The Association trusts that the<br />

country’s Renewable Energy Independent<br />

Power Producer Procurement Programme<br />

(REI4P) will be well led and directed by<br />

Magoro.<br />

4

News & Snippets<br />

Lockdown halts water use<br />

licence applications<br />

The clock has essentially been stopped on water<br />

use licence (WUL) application timeframes until<br />

South Africa’s lockdown comes to an end.<br />

According to Jacky Burke, principal scientist<br />

at SRK Consulting, the lockdown has meant that<br />

the Department of Water and Sanitation cannot<br />

work on applications submitted. In water use<br />

license (WUL) applications, there are usually<br />

strict timeframes within which applicants must<br />

complete each stage of the licence application.<br />

The department has stated that applicants<br />

will be credited with the time lost due to the<br />

lockdown, so they will still have the time to<br />

complete the work required, said Burke.<br />

“While this means that applications and<br />

projects will invariably be delayed, the<br />

Department is trying to ensure that the<br />

stipulated time allowed for each phase of the<br />

application still applies to applications,” she said.<br />

Eskom issues curtailment notice<br />

to wind farms<br />

Despite government issuing an official notice in<br />

March 2020, classifying electricity production,<br />

supply and maintenance as essential services,<br />

Eskom is proposing to curtail operational wind<br />

farms citing reduced demand concerning<br />

Covid-19, claiming Force Majeure.<br />

This comes as a surprise to the 22 operational<br />

wind farms, who have a combined installed<br />

capacity of 1980MWs, as the power utility failed<br />

to alert or warn the IPPs of such action, before<br />

issuing the notices.<br />

“It is concerning that wind energy power<br />

producers have not been allowed to engage<br />

on this matter with Eskom, despite both Eskom<br />

and Government confirming that operational<br />

IPPs are an essential service. The industry<br />

Jacky Burke,<br />

principal<br />

scientist at SRK<br />

Consulting<br />

She noted that the Department of Environmental<br />

Affairs had issued similar notification<br />

advising that timeframes were also being<br />

extended for official processes including<br />

environmental licencing, public participation,<br />

appeals and reporting.<br />

The notification stipulates that any authorisations<br />

and exemp-tions expiring during<br />

this timeframe will be regarded as extended.<br />

will be approaching Eskom intending to<br />

find a constructive resolution that does<br />

not prejudice the country nor the power<br />

producers,” explained Ntombifuthi Ntuli, CEO<br />

of SAWEA.<br />

The industry is seeking legal counsel on<br />

whether the reduced electricity demand as<br />

a result of Covid-19 does constitute Force<br />

Majeure as some experts deem reduced<br />

demand as a normal system event, which<br />

would therefore not imply a Force Majeure<br />

event. Additionally, experts raise the point<br />

that South Africa is not currently facing a<br />

structural oversupply and the fact that Eskom<br />

is still struggling to keep the system stable,<br />

despite a shift in demand patterns.<br />

Plastics industry<br />

supports waste<br />

pickers<br />

South Africa waste pickers play a substantial role<br />

in the country’s waste management industry.<br />

With the country in a national lockdown,<br />

these waste reclaimers unexpectedly found<br />

themselves unable to put food on the table since<br />

economic activity has been limited to essential<br />

food and health products or services only.<br />

Plastics|SA, the plastics PROs, the other<br />

packaging PROs and Packaging SA rallied<br />

together to donate funds when the request<br />

was made by Packaging SA. Working in<br />

close partnership with the Department of<br />

Environment, Forestry and Fisheries (DEFF)<br />

and in support of the members of the two<br />

associations representing the waste pickers,<br />

ie the South African Waste Pickers Association<br />

(SAWPA), African Reclaimers Organisation (ARO),<br />

a total amount of R785 000 was collected within<br />

a matter of days.<br />

These funds will now be used to purchase<br />

electronic food vouchers that will be sent to<br />

the collectors who are on the DEFF database<br />

via cellphones and can be redeemed at major<br />

supermarket retailers.<br />

For more information or to donate funds, please<br />

email payments@fibrecircle.co.za<br />

5

OPINION<br />

New generation capacity<br />

NERSA determinations<br />

provide hope for procurement<br />

BY BEN BRIMBLE, SAWEA<br />

Following the approval of the Integrated Resource Plan in 2019,<br />

Section 34 of the Electricity Regulation Act requires that the<br />

Minister of Mineral Resources and Energy determines what<br />

capacity will be procured when and from what technology to give effect<br />

to the IRP. The Energy Regulator (NERSA) is then required to concur<br />

with the Minister on his determination, but not before they go through<br />

a public participation process.<br />

NERSA has officially launched the public-participation process by<br />

releasing the two consultation papers for public comment. The wind<br />

sector sees this as significant progress, as it brings us a step closer to the<br />

procurement of new generation capacity that the country desperately<br />

needs. It is a great opportunity to use this lockdown period to progress<br />

the public participation process so that when the economy gets back on<br />

track (and energy demand rises again), the government will be ready to<br />

commence with procurement.<br />

The first consultation process for 2 000MW suggests that an expedited<br />

process could be concluded within 60 days from the date of submission,<br />

approximately in July. For the second consultation paper (6 800MW), the<br />

process includes public participation for up to 120 days (six months). It is<br />

currently unclear whether the lockdown will impact on these timelines,<br />

however, NERSA has indicated that any public meetings that are required<br />

as part of the public participation process could be held over video<br />

conference. Should the lockdown result in delays, it is hoped that NERSA<br />

will look to make up the time further into the concurrence process.<br />

The wind industry is of the view that the determinations should allow<br />

for sufficient allocation for energy procurement by government and by<br />

the private sector, in line with the Minister’s announcement to allow the<br />

private sector to procure their energy from independent energy producers.<br />

With specific regards to emergency procurement, we believe that<br />

renewable/wind energy should not be excluded from the emergency<br />

procurement process as it is cost-competitive and can be quickly deployed.<br />

The South African electricity supply crisis is critical and procurement<br />

should be expedited wherever possible so that new capacity can be<br />

brought online to alleviate this crisis.<br />

The government should not be fixated on plant size restrictions because<br />

process restrictions will automatically exclude plants that are either too<br />

small or too big. Energy producers should be free in the choice of energy<br />

technology they bid as long as aspects like dispatchability, environmental<br />

as well as health and safety requirements are met.<br />

SAWEA supports the inclusion of battery storage technology in the<br />

Determination. Despite the emergency nature of the procurement, tariffs<br />

should still be market related and competitive. We see this process as<br />

an opportunity to fast-track the commitments to have an independent<br />

system operator that would procure energy from all generators on a fair<br />

and equitable basis, without prejudice.<br />

Once NERSA provides concurrence to the Determinations, it will give<br />

effect to the IRP 2019, thereby setting the wind industry up for 6 800MW<br />

procurement over a three-year period from 2022 to 2024. This will enable<br />

the wind industry to contribute to rebuilding the economy in terms of<br />

quickly bringing electricity onto the grid, attracting investment and<br />

creating jobs.<br />

* Ben Brimble is the Policy & Markets Working Group Chair at the South African Wind<br />

Energy Association (SAWEA)<br />

Background<br />

The South African Wind Energy Association (SAWEA) has co-ordinated<br />

a consolidated wind industry response to the two consultation papers,<br />

published last month by the National Energy Regulator of South Africa<br />

(NERSA), for two separate Ministerial Determinations submitted by<br />

Mineral Resources and Energy Minister, Gwede Mantashe. The first<br />

consultation paper deals with the Minister’s Section 34 Determination<br />

aimed at closing the immediate supply gap of 2 000MW, as identified<br />

in the IRP 2019 for the years 2019 to 2022. The second deals with the<br />

specific generation technologies outlined in the IRP 2019, which is<br />

normal power procurement that will constitute further rounds of the<br />

REI4P (6 800MW).<br />

7

International insight<br />

The outlook for<br />

renewable energy<br />

is still bright<br />

BY PRASHAEN REDDY, SANEA<br />

After the coronavirus mayhem, governments, corporations and associations globally<br />

will have to draw the right conclusions to protect us from any future outbreaks. The<br />

renewables sector will need to get back on track toward a green and sustainable economy.<br />

The magnitude of the impact of Covid-19 on projects, developers, utilities, and equipment<br />

manufacturers is still unclear, but the medium-term fundamentals are optimistic.<br />

In Spain, as in most European countries, the outlook for renewables<br />

before the global pandemic was strong. Sector reform had<br />

alleviated pressure on public budgets despite raising concerns<br />

among investors about the country’s legal security for investment.<br />

The economics of renewable energy technologies, especially wind and<br />

solar, had achieved levelized cost of energy (LCOE) competitiveness<br />

comparable with conventional sources. And money was flowing<br />

back into renewable projects, supported by low Capex, low-interest<br />

rates, and growing future power price curves—creating an appetite<br />

from commercial and corporate off-takers for power purchase<br />

agreements (PPAs).<br />

Although the Covid-19 crisis hasn’t peaked yet, the impact on the<br />

renewables sector is already evident in project delays and other longlasting<br />

impacts:<br />

Lockdowns, transit limitations, and labour issues in Asia, Europe, and<br />

the United States are impacting production from original equipment<br />

manufacturers, including leading European wind players. Delays in<br />

administrative approvals, bottlenecks in port facilities, and issues in<br />

construction and commissioning can also be expected. Developers are<br />

discounting two-to-three-month delays on projects to be commissioned<br />

in the next 18 months.<br />

The pandemic is affecting power consumption patterns, reducing the<br />

share of industrial and commercial segments and flattening domestic<br />

curves. This economic downturn will trim demand, impacting the market’s<br />

renewable capacity needs, reducing the utilisation of the least-economic<br />

power plants, and more importantly, beating down price curves – on top<br />

of the wholesale price erosion created by wind and solar during peak<br />

production hours.<br />

8

International insight<br />

The price of oil has plummeted to an 18-year low (Brent at $26.23 and<br />

WTI at $22.46 on March 18), and the carbon cost lost 33% in mid-March<br />

to €16 per metric ton. Although commitments for the green energy<br />

transition are firm, low prices for oil and carbon will remove incentives and<br />

delay final investment decisions.<br />

The challenges ahead for renewable energy players remain largely the<br />

same, although this crisis will put to the test their skills, their resilience, and<br />

their depth of pockets.<br />

In our long journey to a decarbonised society and meeting 2030<br />

objectives, this crisis could be more than a hiccup. With solid fundamentals<br />

and strong market momentum, the renewables sector can be confident<br />

that targets will eventually be achieved. But some players will struggle<br />

financially and face liquidity issues along the way. Isolating the virus<br />

promptly will not only save human lives but also help reduce economic<br />

distress and put our sector back on track.<br />

Heeding history’s lessons<br />

When you’re in the middle of a crisis, it’s easy to overestimate the shortterm<br />

impact while overlooking the potential long-term outcome. This is<br />

certainly true now amid the Covid-19 pandemic – a once-in-a-lifetime<br />

event but one that is quite similar to four other events that have occurred<br />

over the past century.<br />

Each crisis—the 1918 flu pandemic, the Great Depression, World<br />

War II, and the Great Recession—was marked by a period of economic<br />

contraction, an uptick in mortality (especially during pandemics and<br />

wartime), and swift destruction of value. We already see all three of these<br />

occurring in our current crisis.<br />

The past offers four lessons for how to put our best<br />

foot forward:<br />

1. Take big, bold, fast action.<br />

2. Balance any efforts to reduce costs with ingenuity and<br />

innovation.<br />

3. Prepare to serve tomorrow’s consumer, not yesterday’s.<br />

4. Use emerging technologies to soften the blow of disruption.<br />

3 key factors will determine the profitability of South<br />

Africa’s renewable sector against the impact of the<br />

coronavirus:<br />

1. Building portfolios around privileged assets with solid<br />

renewable resource and straightforward access to the power<br />

grid and prioritise efforts on the projects that have the<br />

greatest chances to progress economically.<br />

2. Adapting organisations to promote agile execution, with<br />

modular plant designs and layouts, strong permitting<br />

capabilities in key markets, and PPA expertise to speed up<br />

agreements with off-taker and project financing.<br />

3. Developing tool kits to flexibly cope with renewable<br />

intermittency and its impact on revenues, both on the<br />

demand side (access to market, ability to profile production<br />

curves, and price segmentation) and on the supply side<br />

(smart storage solutions and asset pooling).<br />

when strong measures were taken early on. The speed element cannot be<br />

overemphasised. Many of these situations saw successful responses within<br />

their first 100 days. Conversely, dithering leads to destruction, as clearly<br />

evidenced by the 10 000 deaths in an ‘open for business’ Philadelphia in the<br />

1918 flu pandemic and Hoover’s tepid responses to the Great Depression.<br />

During a global crisis, forward-thinking companies make shrewd<br />

investments. Rather than cutting costs and shying away from investing,<br />

those that have weathered the storms of the past focused on improving<br />

their operational efficiency, which in turn lowered their costs. They also<br />

put their limited resources to work in creative new ways. Forward-thinking<br />

investments in marketing, R&D, and even new assets can lead to growth.<br />

Looking to the future, keep in mind that tomorrow’s consumer may<br />

well be very different from the one we have become accustomed to as<br />

global crises tend to reshape behaviours and lead to the creation of<br />

new industries. Success will come to those that capitalise on these new<br />

behaviours by shifting their business models and creating consumerfocused<br />

programs to meet them where they are rather than where the<br />

company wants them to be.<br />

The importance of these lessons cannot be overstated as any missteps<br />

will be extremely costly. The 1918 flu spread rapidly because many people<br />

refused to quarantine despite the cries of public health experts. And<br />

during the Great Depression, US President Herbert Hoover’s laissez-faire<br />

approach after Black Tuesday sent the economy into a freefall. Stronger<br />

short-term responses during World War II and the Great Recession suggest<br />

leaders learned from history.<br />

And now, after more than a decade of economic expansion, the Covid-<br />

19 pandemic has swiftly decimated the employment ranks as most of the<br />

United States is under stay-at-home orders that have closed many nonessential<br />

businesses. In a three-week period ending on April 10, more US<br />

jobs were lost than in all of the Great Recession.<br />

While we cannot be certain about the long-term impact, the recovery<br />

could take some time because of the debt that households, businesses,<br />

and government bodies alike are taking on. Many supply chains will need<br />

to be reinvented to create the flexibility needed to respond to future<br />

calamities. One winner seems to be e-commerce, which has seen nearly<br />

a doubling of retail transaction volumes year over year in the first month<br />

of this emergency as people seek the sort of touchless transactions that<br />

brick-and-mortar retailers have yet to master.<br />

Unprecedented times such as these call for big, bold, and immediate<br />

action. In each crisis discussed above, the worst outcomes were avoided<br />

The challenges ahead for renewable energy<br />

players remain largely the same, although<br />

this crisis will put to the test their skills, their<br />

resilience, and their depth of pockets.<br />

Finally, emerging technologies can soften the blow of disruption. During<br />

a global crisis, many supply chains and even the means of production<br />

are upended—as we are now seeing in consumer products and retail.<br />

Ensuring business continuity requires launching new technologies and<br />

digital tools to reinvent supply chains—creating a whole new normal.<br />

*Prashaen Reddy, Principal at Kearney and is on the board of the South Africa National<br />

Energy Association (SANEA). Kearney is a global consulting partnership in more than<br />

<strong>40</strong> countries. www.kearney.com<br />

9

Finance<br />

Sharpen your<br />

financial<br />

focus<br />

BY MILISHA PILAY, NCPC-SA<br />

Fortified by steeply rising electricity prices, stricter environmental regulations and taxes<br />

as well as energy insecurity, the decision of businesses in South Africa to become more<br />

energy efficient has become somewhat of a revolutionary one.<br />

The National Cleaner Production Centre South Africa’s (NCPC-SA)<br />

Industrial Energy Efficiency (IEE) Project has inadvertently seen a<br />

perceptible sharpening of focus amongst companies with regards<br />

to the implementation of energy efficiency (EE), in the last decade.<br />

Unfortunately, the trajectory for the scale-up of EE finance in South<br />

Africa has not moved with quite the same momentum and this remains a<br />

significant area of opportunity for the financial sector.<br />

Despite more and more South African companies (both industrial and<br />

commercial) converting to a sustainable mindset and at a rate faster than<br />

ever before, a lack of project finance still consistently ranks as one of the<br />

key reasons that small-to-medium enterprises do not implement energy<br />

efficiency projects.<br />

While several EE technologies are well-established and have shorter<br />

payback periods where upfront costs can be paid back from energy<br />

cost savings, there are pipelines of bankable EE projects that remain<br />

unimplemented even though they may offer compelling economic<br />

returns. One of the root causes for this gap can be attributed to the lack<br />

of available financial instruments that are tailored to suit the specific<br />

characteristics of EE.<br />

EE projects are unique and the peculiarity of the payback mechanisms<br />

needs to be well understood so that packages can be developed<br />

accordingly by financial institutions (FIs). The focal point is not always<br />

a tangible piece of equipment that is installed and commissioned to<br />

produce determinate or easily recognisable results. Cost savings can be<br />

achieved through a wide range of interventions, not all of which are easily<br />

justifiable as a solar PV project.<br />

For example, companies may look to install power meters that will enable<br />

better measurement and management of future energy consumption but<br />

are challenged to justify this investment without being able to validate<br />

the savings. Similarly, operational control type interventions that might<br />

require some investment for process control changes to machinery may<br />

not fit the banks’ criteria for what is deemed as bankable.<br />

10

Finance<br />

Commercial banks in South Africa mostly offer direct loans (both asset<br />

and non-asset based) as they do not have packages that are structured<br />

to take into account the inherent nature of EE – the savings from EE<br />

projects cannot be directly measured with a simple meter because energy<br />

savings infer the absence of energy use and this introduces a new level of<br />

complexity to FIs.<br />

The lack of available financing for EE was recently revealed in a study<br />

undertaken by the NCPC-SA, where only one of a group of 15 financiers<br />

(commercial, developmental and governmental) interviewed had<br />

amongst their offerings a specialised financial package for EE projects. All<br />

other respondents indicated that if companies borrowed money for any EE<br />

improvement projects, it was usually off their balance sheet.<br />

Enterprises in South Africa are fortunate enough to be able to have<br />

access to other potential sources of finance such as international<br />

development agencies, governmental, energy services companies and<br />

original EE equipment suppliers. The three main costs associated with<br />

energy efficiency projects can be categorised into upfront costs (research<br />

and development costs including activities such as initial assessment and<br />

post-project savings measurement) as well as capital costs and operational<br />

costs (including running and maintenance costs).<br />

Different finance options can apply to each of the above-mentioned<br />

three categories and may sometimes be sector-specific (especially in the<br />

case of government grants) and have important minimum qualifying<br />

criteria such as Broad-Based Black Economic Empowerment (B-BBEE)<br />

rating, company size and project size.<br />

Several guides into the different financing options in South Africa have<br />

been made available in recent years by the National Business Initiative<br />

(NBI) and the NCPC-SA.<br />

Here are some general guidelines and considerations for the implementation<br />

and financing of energy efficiency projects:<br />

• Start with understanding the need for EE in the business. Is it a cost<br />

imperative or is it to build and strengthen the brand? This will help to<br />

direct the initiative in a more focused manner, assign resources and<br />

decide on schedules based on timed targets.<br />

• Build a strong business case for energy efficiency and obtain buy-in<br />

and commitment from senior decision-makers in the company.<br />

• Conduct an investment-grade assessment (IGA) using inhouse<br />

resources or an independent consultant. The IGA forms the<br />

foundation for the successful implementation and financing of an<br />

energy efficiency project. The report will detail all assumptions made,<br />

major calculations of estimated savings and projected costs (with<br />

supplier quotes) and most importantly, the baseline development<br />

and M&V methodology to be followed in calculating the actual<br />

savings. This will include the establishment of an accurate Energy<br />

Performance Indicator to enhance credibility in measurement and<br />

verification of actual savings.<br />

• Consider conducting a cost risk benefit analysis as part of the<br />

assessment. This will allow the capturing of non-energy benefits<br />

and identification of potential risks associated with the respective EE<br />

project/technology so that mitigation measures can be put in place.<br />

• Use a set of metrics for evaluating the financial feasibility of the<br />

project as opposed to just a simple payback period and capital<br />

cost. This can include Net Present Value, Internal Rate of Return and<br />

Life Cycle Costing (which considers the full cost of owning,<br />

operating and maintaining a piece of equipment over its lifetime).<br />

Assess these metrics against what is deemed as acceptable<br />

business criteria such as the company rate of return and acceptable<br />

payback period.<br />

• Assess the available finance options that are appropriate for the EE<br />

project and subject to the company meeting the minimum required<br />

criteria. One must ensure that the most updated information for the<br />

various finance options are obtained as they tend to change from<br />

time to time and outdated handbooks or guides may not provide the<br />

most up to date information.<br />

• In addition to the actual financing component of the project,<br />

evaluate any additional fiscal opportunities to exploit savings<br />

benefits such as carbon credits and tax incentives.<br />

• The application may require the facilitation and assistance of an<br />

independent accredited auditor or specialist especially in the case<br />

of carbon offsets and tax incentives (where measurement and<br />

verification of savings are required).<br />

• It is important to consider the timeline for the grants and incentives,<br />

as some can be quite lengthy. The 12L tax incentive, for example,<br />

requires that a baseline assessment be conducted using energy<br />

consumption data for 12 months before implementation. Similarly, a<br />

performance assessment must be conducted using 12 months’ postimplementation<br />

data.<br />

• Once a project is implemented, the economic returns have been<br />

proven to lose half their economic benefits every six months, if<br />

not maintained. It is therefore important to consider putting in<br />

place a systemic structure for managing the energy performance<br />

improvement derived savings in the long-term. This can include<br />

the implementation of an ISO50001 aligned Energy Management<br />

System which integrates EE into every functional level of the business<br />

and will ensure the long-term effectiveness and sustainability of the<br />

EE projects that savings have been derived from.<br />

South African companies will inevitably be<br />

required to adapt to the new business unusual.<br />

While EE by itself may not be the silver bullet to the growing threat of<br />

climate change, it is indisputably one of the biggest spheres of opportunity<br />

for South Africa to significantly reduce its GHG emissions and achieve the<br />

energy reduction targets committed to in the Paris Agreement. Despite<br />

the opportunity it offers, mainstreaming and mobilising finance for EE in a<br />

developing country such as ours, remains a challenge.<br />

In the wake of the economic destruction left by the global pandemic<br />

of Covid-19, South African companies of all sizes will find themselves<br />

hard-pressed to reduce operational costs to protect the livelihoods of<br />

their stakeholders and employees. EE, being the cleanest and cheapest<br />

form of energy, provides an invaluable opportunity in this regard as it<br />

goes straight to the bottom-line to enhance cash flow and profitability of<br />

a business. While other mechanisms in South Africa offer varied financing<br />

options, these often have their minimum criteria and may fall short in some<br />

areas of providing project-based funding that is commercially attractive to<br />

facilities looking to become more energy efficient.<br />

There has never been a more opportune time for FIs to become more<br />

disposed and invested in grasping the complexities of EE projects and<br />

structure financial packages that are designed to appreciate its nuances.<br />

South African companies will inevitably be required to adapt to the new<br />

business unusual and the economic resilience of the country as a whole<br />

will necessitate a combined strategy of a balance of energy supplydemand<br />

and the security of energy supply, industry competitiveness<br />

and environmental protection – all of which are possible through EE.<br />

Commercial banks, FIs and investors, therefore, have a critical role to play<br />

in stimulating the economy as South Africa continues on its low-carbon<br />

journey in a New World order.<br />

11

Electric Bikes by<br />

www.bhsouthafrica.co.za<br />

BH Easy Motion e-Bikes<br />

• Powered by Bosch electric motors and Panasonic batteries<br />

• Pedal-assisted electric power Maximum speeds of up to 45 km/h<br />

with a range of up to 125 km<br />

• Battery lifespan of 30 000 km or 500 charges (20% max deterioration)<br />

• Choose between dual suspension or hard tail<br />

CONTACT<br />

Email: sales@bhsouthafrica.co.za<br />

Tel: 021 715 7182

Waste<br />

It is estimated that the informal sector saves<br />

municipalities up to R750 million per year in<br />

landfill costs by diverting recyclable materials.<br />

The impact of<br />

Covid-19<br />

on waste<br />

streams<br />

BY CHRIS WHYTE, FOUNDER OF USE-IT<br />

These are uncertain times. Perhaps no more<br />

so than for the recycling sector in South<br />

Africa. While we ponder economic hardships<br />

across all the economic areas, this sector is<br />

one of several that will suffer the effects of<br />

Covid-19 long after the lockdown is over.<br />

Recycling in South Africa has suffered since before the pandemic,<br />

with the last six months being particularly difficult, relating to<br />

supply and demand imbalances, pricing issues, rising logistics<br />

costs and global influences such as the Chinese market’s abrupt<br />

withdrawal from the sector (with their National Sword policy that<br />

closed their doors to imported materials) in January 2018. We started to<br />

see plummeting prices for recycled commodities in the middle of 2019.<br />

The recycling sector is largely made up of the formal sector with some<br />

1800 process agents and manufacturers as well as the informal sector or<br />

‘pickers’ numbering upwards of 90 000 individuals. With the lockdown that<br />

came into effect on 27 March 2020, waste management was deemed an<br />

essential service – recycling was not.<br />

Many municipalities with effective source separation programmes<br />

effectively terminated these services stating the negative impacts of the<br />

virus. Many even stipulated that all recyclables be placed in the same<br />

black bag as residual waste for the formal waste collection to landfill. The<br />

immediate impact on the informal collectors was disastrous. Pretty much<br />

all of these individual pickers live from hand-to-mouth on a daily basis<br />

– how are they to survive weeks, or months? Even if they were able to<br />

collect, they would have nobody to sell to, because the formal sector was<br />

closed as part of the lockdown, and only expected to resume operations<br />

at 50% capacity by the 1 May as we ease lockdown restrictions. So, will<br />

we slowly get back to normal conditions? The effective and inconsolable<br />

answer to this is no.<br />

Covid-19 has had a global effect, and this has been complicated by<br />

politics. The Crude Oil price war initiated between Russia and Saudi Arabia<br />

on 8 March caused the oil price to crash dramatically from $47 per barrel<br />

to below $25 per barrel within 2 weeks. This was due to Saudi Arabia’s<br />

response to Russia’s refusal to reduce oil production to keep prices at a<br />

moderate level since consumption fell dramatically with the pandemic.<br />

This did not work for any of the oil-producing countries in OPEC, and they<br />

collectively agreed to decrease global production by 10% on 9 April. The<br />

impact of this decision has had little effect with the crude oil price now at<br />

under $17 per barrel. Quite simply we are reducing global oil production<br />

by 10% when the global demand has decreased by 25% and so we are<br />

producing way more oil than we are consuming globally. On 21 April<br />

global prices dipped below $12 to the barrel and markets in the USA<br />

dropped to a negative value for the first time in history. These are not<br />

usual times.<br />

The impact of global oil price has a direct impact on plastics pricing as it<br />

is now much cheaper to use virgin plastics than to use recycled polymers.<br />

As we slowly emerge from lockdown globally, we will retain a low value for<br />

oil as production will continue to exceed demand. It is estimated that as<br />

much as 90% of our plastics locally are collected by the pickers who can<br />

barely survive on their earnings of about R100 per day. Estimates are that<br />

the value of daily picking will reduce to around R25 per day – nobody can<br />

survive on that. This will have an immediate and devastating effect on the<br />

informal sector. The impact on the formal sector will experience a slight<br />

lag but expected that most of those industries solely reliant on processing<br />

recycled materials will not survive the next few months if we continue<br />

business as usual. It is also estimated that the informal sector saves<br />

municipalities up to R750 million per year in landfill costs by diverting<br />

recyclable materials (CSIR, 2016) and so this is an additional burden the<br />

state will have to bear.<br />

If we stand any chance of the recycling sector emerging from the<br />

pandemic, then we need to ensure that as a country we collectively pull<br />

together. Without the proper policies, support and infrastructure from<br />

the public sector and without appropriate and immediate Extended<br />

Producer Responsibility (EPR) inputs from the private sector, there is no<br />

future for recycling in South Africa. The recycling sector can’t survive the<br />

12-18 months it may take to stabilise global economies and oil prices. Any<br />

hesitation in how we react to this as a country will see the impacts of waste<br />

become a much bigger issue than we ever expected possible.<br />

13

Thought Leadership<br />

Food security<br />

in a post-Covid-19<br />

South Africa<br />

BY WENDY GREEN<br />

The outbreak of Covid-19, a natural human tragedy, is a prime example of a black<br />

swan phenomenon: entirely unexpected, and completely unpredictable. This has had<br />

immediate impacts on the agriculture value chain, however, the medium- and longterm<br />

impact and implications are still uncertain.<br />

Epidemiologists are predicting the possibility of further waves of<br />

the pandemic across the globe. The disease is spreading quickly<br />

and will continue to affect significant aspects of both food supply<br />

and demand for agricultural products. We risk a looming food crisis<br />

unless measures are taken fast to keep agricultural food supply chains<br />

alive and to mitigate the pandemic’s impacts across the food system.<br />

Currently, we are experiencing lockdowns in at least 33 of Africa’s 54<br />

countries. According to the Food and Agriculture Organisation, about<br />

one in every five people in Africa, nearly 250 million, already didn’t have<br />

enough food before the virus outbreak. The World Food Program was<br />

already feeding millions in Africa, mainly rural people, due to a myriad<br />

of disasters: natural disasters, armed conflict, government failures, even<br />

plagues of locusts. The Covid-19 pandemic has added another layer of<br />

hardship and complexity in terms of pure survival for many.<br />

In South Africa, to add to the complexity of the matter, the cut in South<br />

Africa’s credit rating to junk status has contributed to a rapid depreciation<br />

of the South African Rand. The combined effect of the depreciation, as<br />

well as the current disruptions in the supply of and demand for food, will<br />

certainly be the main drivers affecting food availability and food prices for<br />

the rest of 2020.<br />

Kenmure Farm, Barkly East, Eastern Cape.<br />

14

Thought Leadership<br />

South Africa has a world-class food system, and we are in a reasonably<br />

good position regarding food security as our exports exceed imports<br />

by a significant margin. However, we import a substantial share of the<br />

inputs required to produce this surplus. According to the ITC Trademap,<br />

2020 our main agricultural and food exports in 2019 included citrus fruit,<br />

wine, grain, apples, pears, maize and sugar with main imports being rice,<br />

poultry, wheat, sugar and palm oil. Pre-Covid-19, South Africa imported<br />

good mostly from China, Thailand, Brazil, Eswatini and Argentina.<br />

With the current lockdown, the importance of agriculture has certainly<br />

gained relevance and awareness – food needs to be both available and at<br />

the right price. In the long term, we can expect major disruptions to trade<br />

in global food.<br />

Various elements need to be considered and understood to ensure our<br />

food availability remains secure:<br />

Pricing, markets and marketing<br />

In South Africa, about <strong>40</strong>% of all food sold and distributed is through the<br />

informal markets. This market system is enormous and extremely efficient.<br />

Fortunately, with quick industry intervention, the government realised<br />

the importance of such markets and did not close them in the lockdown.<br />

According to the Bureau for Food and Agricultural Policy, given the<br />

severe depreciation of the exchange rate, certain products, typically<br />

those where South Africa is well integrated with global markets, will<br />

exhibit significant cost-push price increases. This will be exacerbated in<br />

instances where countries such as Vietnam have put export restrictions on<br />

commodities such as rice.<br />

Where there are risks, there are opportunities.<br />

Already changes in local and global market supply and demand are<br />

being seen. For example, there is a shortage of garlic; a decrease in demand<br />

for crops like barley, used for alcohol production; and an increased demand<br />

for eggs. We must use our data to track and forecast these changes as the<br />

pandemic changes. As agri-businesses, it is important to keep on top<br />

of the market changes and be proactive in unlocking new markets and<br />

investigate alternative ways to market and distribute products.<br />

Supply chain<br />

A critical element in maintaining food security is ensuring continuity of<br />

the logistics and supply chains across all levels – local, provincial, national,<br />

as well as imports and exports. Jaco Oosthuizen, CEO of the RSA Group,<br />

the country’s top fresh produce organisation, says that they were most<br />

concerned about logistics at the ports, yet together with the government,<br />

these risks are being managed well. Initially, the capacity was reduced to<br />

about 30%, however, it has now been increased to about 70%.<br />

South Africa is currently in its peak for fruit exports, exports which could<br />

be up to R25bn. The industry is working hard to ensure that barriers are<br />

lifted both at our borders and the destination ports.<br />

In many instances, supply chains are being shortened and businesses<br />

are adapting through various forms of new business models, technology<br />

and innovation. At a more grass-roots level people are more aware of<br />

growing their own vegetables and buying locally, for example, farms<br />

such as Boschendal in the Western Cape are delivering vegetable parcels<br />

directly to customers in surrounding areas.<br />

Kenmure Farm, Barkly East, Eastern Cape.<br />

Social impacts<br />

The health and security of farmers and farmworkers and their ability<br />

to maintain production levels is a critical consideration, especially in<br />

industries where seasonal, and often migrant labour is used for harvesting,<br />

such as the citrus industry.<br />

There is a direct link between food security and social security. Although<br />

South Africa’s national food security is good, household food security is<br />

a risk. Given the impact of the lockdown, many households don’t have<br />

the financial means to buy food and millions are going to bed hungry.<br />

Government and many organisations have stepped up to the plate and are<br />

supporting in terms of food parcels, but there will always be gaps amongst<br />

communities. The risk is that we will see an increase in social unrest and<br />

looting, as is already evidenced in various provinces.<br />

Agricultural investment<br />

There is a concern about ongoing investment across the agricultural value<br />

chain both at a local level as well as national and international level. With<br />

the raised awareness and importance of agriculture as a key element in<br />

the United Nations Sustainable Development Goals, we would hope to see<br />

increased investment into agriculture.<br />

At the farm level, if we see a major reduction in prices, as we have seen<br />

in the red meat market, farmers could go into further debt in trying to<br />

prepare for next season or they may not be able to invest for next year’s<br />

crop, thus exacerbating the food security issue.<br />

Where there are risks, there are opportunities. There are opportunities<br />

across the value chain for new products, new markets and new business<br />

models using innovation and technology, as has been the case in the<br />

development of the ‘HelloChoice’ online trading platform that links buyers<br />

and sellers. In cases such as poultry meat and vegetable oil, imports are<br />

only supplementary to our production, so these industries could have the<br />

opportunity to expand capacity and replace imported products.<br />

Although this can be described as a black-swan event, it certainly won’t<br />

be the last time we are faced with similar situations – whether it is due<br />

to pandemics, wars or natural disasters. We should use this opportunity<br />

to reimagine. Reimagine our agricultural businesses, reimagine new<br />

markets and a new inclusive agricultural system. Farmers are known for<br />

their resilience, hard work and determination, this pandemic is certainly<br />

highlighting the crucial role that farmers and the entire agricultural value<br />

chain play in the country and the economy – no farmers no future!<br />

We have an opportunity to emerge from this crisis with a more<br />

sustainable, resilient, robust food system across the country, continent<br />

and around the globe.<br />

*Wendy <strong>Green</strong> is a business advisor and investor across energy and agriculture<br />

15

FOOD SECURITY<br />

Covid-19:<br />

Keeping Africa<br />

fed as the<br />

disease bites<br />

BY QU DONGYU, JOSEFA SACKO<br />

AND THOKOZILE DIDIZA<br />

It takes a village to raise a child, Africans like<br />

to say. But you could just as easily argue the<br />

opposite: it takes a child to raise a village.<br />

Give a child a school meal. He or she will stay in the classroom and<br />

learn. Economic pressure on the family will lessen. Over time,<br />

the combined effect of education and good nutrition in young<br />

age will ripple through entire communities, fostering healthier, more<br />

productive societies. Research sponsored by the African Union suggests<br />

that if nations on the continent were free from child malnutrition, they<br />

could see their GDP expand by as much as 16%.<br />

Conversely, close the school. Take away that school meal. The family<br />

will struggle. The child may suffer from wasting. In the long run, economic<br />

vitality will dry up. Societies will shrink. The promise of development will<br />

wither, unfulfilled.<br />

Like much of the rest of the world, African countries reacted to the<br />

Covid-19 crisis by shutting down schools, closing businesses and limiting<br />

population movements. Even in rich countries, such measures entail hard<br />

choices: in the African context, these are truly agonising. With high levels<br />

of food insecurity; large informal labour forces; fragile health systems;<br />

scarce welfare provisions; and little budgetary leeway, African nations –<br />

many already battling other crises such as Desert Locusts and drought –<br />

risk mortgaging their future as they seek to protect their people.<br />

16

FOOD SECURITY<br />

Qu Dongyu is Director-General of the Food and Agriculture Organisation<br />

(FAO) of the United Nations<br />

Josefa Sacko is the African Union Commissioner for Rural <strong>Economy</strong><br />

and Agriculture<br />

Thokozile Didiza, Minister of Agriculture, Land Reform and Rural<br />

Development of South Africa and Chair of the African Union Specialised<br />

Technical Committee on Agriculture<br />

To avoid irreparable outcomes, Africa’s coronavirus lockdowns need<br />

rapid and decisive mitigation. Steps to be taken by governments – with<br />

the support of donors, multilateral institutions, NGOs and the private<br />

sector – must involve dialling up social protection programmes where<br />

they exist and rolling them out where they do not. The need is most acute<br />

in the countryside, yet the cities pose the highest risk to social stability:<br />

both need urgent attention. Now is the time to hand food or cash directly<br />

to households.<br />

The preservation of life and health takes precedence, but food<br />

production and livelihoods must come a close second. This is why<br />

agricultural activities must be maintained. Borders should be kept open<br />

to food and agricultural commodities: Covid-19 must not be allowed to<br />

undo the painstaking progress we have witnessed in recent years towards<br />

trade liberalisation.<br />

Moreover, no effort should be spared in increasing quantity and<br />

improving the quality of agricultural products. Producing more and<br />

better entails strengthened capacities. All technical assistance required in<br />

that context needs to be provided. Shorter supply chains and innovative<br />

marketing tools to link producer and consumer through e-commerce are<br />

future-oriented approaches that are needed today.<br />

Taking all necessary precautions, seeds and planting materials must<br />

continue to flow to smallholders; animal feed and veterinary care to<br />

communities reliant on livestock; and aquaculture inputs to fish farmers.<br />

Agricultural supply chains should be kept alive by any means compatible<br />

with health safety concerns. Crop calendars need to be performed on<br />

time, otherwise vital harvests may be lost and planting not feasible,<br />

further challenging food availability. By the same token, pastoralists –<br />

major contributors to food security in parts of Africa – should retain access<br />

to pastures. Emergency strategic food reserves linked to social protection<br />

programmes should be monitored and replenished.<br />

To write off this year’s harvests would be catastrophic. Further: if ever<br />

there was an opportunity to tackle post-harvest losses by stepping up<br />

investment in storage facilities and refrigeration, this is it. Low energy<br />

prices, meanwhile, could offer a historic window for mechanisation.<br />

Economic forecasts for rich countries suggest GDP could plummet by a<br />

third in the second quarter of the year. No nation has the luxury to shrug<br />

off such vertiginous slumps. So tight is the margin separating many of<br />

Africa’s families from hunger, and so tenuous societies’ defences against<br />

disaster, that any failure to act at dawn may result in tragedy by dusk.<br />

In this context, African countries should protect, promote and further<br />

strengthen interregional trade.<br />

Mindful of the urgency, FAO, AU agriculture ministers and international<br />

partners met virtually in mid-April and vowed to minimise disruption<br />

to Africa’s food system even as they work to contain the pandemic. This<br />

includes keeping the food and farm trade moving across national frontiers;<br />

and providing direct support to African citizens – preferably, wherever<br />

possible, in the form of electronic cash or vouchers. The European Union,<br />

the World Bank and the African Development Bank all pledged billions of<br />

US dollars to this effort: this includes both fresh and re-purposed funding<br />

and technical assistance.<br />

Our determination stems from experience. The Ebola epidemic caused a<br />

severe drop in food output across the areas where it raged. With Covid-19,<br />

that distressing precedent may well be outdone. It is not entirely up to us<br />

to guard against such a fate. But what is up to us, we must do.<br />

*Qu Dongyu is Director-General of the Food and Agriculture Organisation (FAO)<br />

of the United Nations; Josefa Sacko is the African Union Commissioner for Rural<br />

<strong>Economy</strong> and Agriculture; Thokozile Didiza is the Minister of Agriculture, Land Reform<br />

and Rural Development of South Africa and Chair of the African Union Specialised<br />

Technical Committee on Agriculture<br />

17

CONSTRUCTION<br />

Sustainability saves:<br />

and not just the planet<br />

BY THE CLAY BRICK ASSOCIATION OF SOUTHERN AFRICA<br />

Ongoing electricity use is a major expense for property owners. By designing energyefficient<br />

commercial and residential buildings, it is possible to achieve a lifetime of lower<br />

operating costs. It also reduces reliance on South Africa’s ageing power grid while increasing<br />

the property’s investment value.<br />

A<br />

recently published thermal performance study gives insight into<br />

the impact of walling materials on operational energy usage.<br />

The research assessed five different walling materials across<br />

South Africa’s seven climate zones.<br />

“This study gives architects the information they need to make informed<br />

decisions about walling material specifications,” reports Mariana Lamont,<br />

Executive Director of the Clay Brick Association of Southern Africa (CBASA).<br />

“Buildings that are designed to be naturally cooler in summer and warmer<br />

in winter reduce the need for additional air-conditioning and heating.”<br />

Annual operational energy is the sum of all heating, cooling and<br />

ventilation electricity costs accumulated over one year. Measurements for<br />

the study were based on the residents living in reasonable thermal comfort<br />

which is between 19˚C and 25˚C.<br />

The research shows that when it comes to energy efficiency, the top<br />

performer is a ceramic clay brick cavity wall (preferably with insulation).<br />

Substantial savings can be realised in almost every energy zone by using<br />

this construction material.<br />

The worst energy use in all climate zones is the hollow concrete block.<br />

The empty spaces built into the block together with the low-density<br />

material allows both heat and cold to penetrate the wall quickly. There is<br />

minimal protection against extreme temperatures.<br />

The CBASA website offers free technical manuals and research on clay<br />

masonry construction for architects and contractors.<br />

Proposed regulation targets energy-efficiency<br />

“As the industry watchdog, CBASA lobbies for energy-efficient building<br />

standards like the new SANS 10<strong>40</strong>0-XA regulations,” informs Nico Mienie,<br />

the Association’s technical director.<br />

The updated walling statistics align with key revisions to the National<br />

Building Regulations to address thermal performance in walls, floors,<br />

windows and roofs. Specifically, masonry walling will require some type of<br />

thermal intervention – either a cavity wall (with or without insulation) or a<br />

composite wall which must have insulation.<br />

Cavity walls offer add-on benefits to residents and tenants including<br />

noise reduction and reduced condensation. “The winter rainfall regions of<br />

South Africa’s southern and western Cape are particularly susceptible to<br />

condensation,” says Nico. “This is due to the differential between heated<br />

indoor air and the icy cold outdoor temperatures. No matter how thick<br />

the wall or what it is made from, condensation will always be a problem if<br />

there is only a single walling layer or ‘leaf’.<br />

“Cavity walls are the answer and have been successfully used since<br />

the 1800s to naturally insulate buildings in cold, wet climates like the UK,<br />

Europe and Russia,” Nico concludes.<br />

Annual electricity use in an average 130m 2 home built with different types of<br />

walling. In cities like Johannesburg and Pretoria, electricity costs can be<br />

substantially reduced by designing sustainable buildings that take advantage<br />

of the insulation benefits of cavity walls.<br />

What is a cavity wall?<br />

A cavity wall is composed of two<br />

masonry walls separated by an<br />

air space or cavity. The result is<br />

a watertight, energy-efficient<br />

masonry structure appropriate<br />

for external load-bearing walls.<br />

Between the two masonry<br />

leaves, the cavity must be a<br />

minimum width of 50mm and<br />

consistent from the bottom<br />

of the wall to the top. The<br />

cavity can be partly filled with<br />

insulation which is attached<br />

to the inner leaf. Insulation<br />

provides additional thermal<br />

performance.<br />

Weep holes provide an exit<br />

point for water condensing in<br />

the cavity, or if rain enters through gaps in the roof, window frames or<br />

masonry.<br />

For further information: www.claybrick.org<br />

18

SECURE<br />

SAVE<br />

SUSTAIN<br />

STYLE<br />

environment-friendly<br />

THE VOICE OF THE CLAY BRICK INDUSTRY<br />

CLAYBRICK.ORG<br />

REAL CLAY BRICK!<br />

Clay brick is your sustainable walling and paving material for the future. Made from<br />

organic materials, clay brick stays naturally warm in winter and cool in summer.<br />

Long-lasting and reusable, ceramic clay brick is impervious to fire and lasts a lifetime.<br />

CBASA represents clay brick & paver manufacturers across Southern Africa - buy local!<br />

Free technical and construction guides for clay bricks & pavers at www.claybrick.org<br />

Promoting Inclusive Sustainable Practices in the South African Clay Brick Sector<br />

Switch Africa <strong>Green</strong><br />

is funded by the<br />

European Union

INFRASTRUCTURE<br />

Why South Africans should get a<br />

certified green rating<br />

for their home<br />

BY GRAHAME QRUICKSHANKS, GBCSA<br />

What uses 27% of the energy produced in South Africa,<br />

generates 44% of municipal waste and buys 60% of water and<br />

sanitation sales? The South African household.<br />

The GBCSA seeks to reduce the environmental footprint of<br />

every local household. This bold ambition is remarkably viable,<br />

especially considering the significant costs of energy, water and<br />