Tradewinds August 2020 Web Final

August 2020 Edition of the Albemarle tradewinds

August 2020 Edition of the Albemarle tradewinds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

®<br />

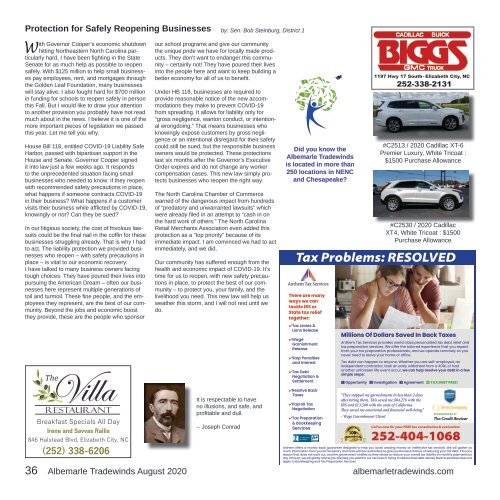

Protection for Safely Reopening Businesses by: Sen. Bob Steinburg, District 1<br />

With Governor Cooper’s economic shutdown<br />

hitting Northeastern North Carolina particularly<br />

hard, I have been fighting in the State<br />

Senate for as much help as possible to reopen<br />

safely. With $125 million to help small businesses<br />

pay employees, rent, and mortgages through<br />

the Golden Leaf Foundation, many businesses<br />

will stay alive. I also fought hard for $700 million<br />

in funding for schools to reopen safely in person<br />

this Fall. But I would like to draw your attention<br />

to another provision you probably have not read<br />

much about in the news. I believe it is one of the<br />

more important pieces of legislation we passed<br />

this year. Let me tell you why.<br />

House Bill 118, entitled COVID-19 Liability Safe<br />

Harbor, passed with bipartisan support in the<br />

House and Senate. Governor Cooper signed<br />

it into law just a few weeks ago. It responds<br />

to the unprecedented situation facing small<br />

businesses who needed to know: if they reopen<br />

with recommended safety precautions in place,<br />

what happens if someone contracts COVID-19<br />

in their business? What happens if a customer<br />

visits their business while afflicted by COVID-19,<br />

knowingly or not? Can they be sued?<br />

In our litigious society, the cost of frivolous lawsuits<br />

could be the final nail in the coffin for these<br />

businesses struggling already. That is why I had<br />

to act. The liability protection we provided businesses<br />

who reopen – with safety precautions in<br />

place – is vital to our economic recovery.<br />

I have talked to many business owners facing<br />

tough choices. They have poured their lives into<br />

pursuing the American Dream – often our businesses<br />

here represent multiple generations of<br />

toil and turmoil. These fine people, and the employees<br />

they represent, are the best of our community.<br />

Beyond the jobs and economic boost<br />

they provide, these are the people who sponsor<br />

Villa<br />

The<br />

Restaurant<br />

Breakfast Specials All Day<br />

Irene and Savvas Rallis<br />

846 Halstead Blvd, Elizabeth City, NC<br />

(252) 338-6206<br />

our school programs and give our community<br />

the unique pride we have for locally made products.<br />

They don’t want to endanger this community<br />

– certainly not! They have poured their lives<br />

into the people here and want to keep building a<br />

better economy for all of us to benefit.<br />

Under HB 118, businesses are required to<br />

provide reasonable notice of the new accommodations<br />

they make to prevent COVID-19<br />

from spreading. It allows for liability only for<br />

“gross negligence, wanton conduct, or intentional<br />

wrongdoing.” That means businesses who<br />

knowingly expose customers by gross negligence<br />

or an intentional disregard for their safety<br />

could still be sued, but the responsible business<br />

owners would be protected. These protections<br />

last six months after the Governor’s Executive<br />

Order expires and do not change any worker<br />

compensation cases. This new law simply protects<br />

businesses who reopen the right way.<br />

The North Carolina Chamber of Commerce<br />

warned of the dangerous impact from hundreds<br />

of “predatory and unwarranted lawsuits” which<br />

were already filed in an attempt to “cash in on<br />

the hard work of others.” The North Carolina<br />

Retail Merchants Association even added this<br />

protection as a “top priority” because of its<br />

immediate impact. I am convinced we had to act<br />

immediately, and we did.<br />

Our community has suffered enough from the<br />

health and economic impact of COVID-19. It’s<br />

time for us to reopen, with new safety precautions<br />

in place, to protect the best of our community<br />

– to protect you, your family, and the<br />

livelihood you need. This new law will help us<br />

weather this storm, and I will not rest until we<br />

do.<br />

It is respectable to have<br />

no illusions, and safe, and<br />

profitable and dull.<br />

-- Joseph Conrad<br />

Did you know the<br />

Albemarle <strong>Tradewinds</strong><br />

is located in more than<br />

250 locations in NENC<br />

and Chesapeake?<br />

1197 Hwy 17 South Elizabeth City, NC<br />

252-338-2131<br />

#C2513 / <strong>2020</strong> Cadillac XT-6<br />

Premier Luxury, White Tricoat :<br />

$1500 Purchase Allowance<br />

#C2530 / <strong>2020</strong> Cadillac<br />

XT4, White Tricoat : $1500<br />

Purchase Allowance<br />

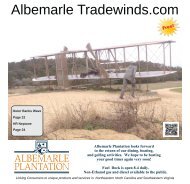

Tax Problems: RESOLVED<br />

Anthem Tax Services<br />

There are many<br />

ways we can<br />

tackle IRS or<br />

State tax relief<br />

together:<br />

✔Tax Levies &<br />

Liens Release<br />

✔Wage<br />

Garnishment<br />

Release<br />

✔Stop Penalties<br />

and Interest<br />

✔Tax Debt<br />

Negotiation &<br />

Settlement<br />

✔Resolve Back<br />

Taxes<br />

✔Payroll Tax<br />

Negotiation<br />

✔Tax Preparation<br />

& Bookkeeping<br />

Services<br />

Millions Of Dollars Saved In Back Taxes<br />

Anthem Tax Services provides world class personalized tax debt relief and<br />

tax preparation services. We offer the tailored experience that you expect<br />

from your tax preparation professionals, and we operate remotely so you<br />

never need to leave your home or office.<br />

Tax debt can happen to anyone. Whether you are self-employed, an<br />

independent contractor, took an early withdrawl from a 401K, or had<br />

another unforseen life event occur, we can help resolve your debt in a few<br />

simple steps:<br />

“They stopped my garnishments in less than 2 days<br />

after hiring them. This saved me $84,276 with the<br />

IRS and $13,500 with the state of California.<br />

They saved my emotional and financial well-being.”<br />

- Wage Garnishment Client<br />

Call us now for your FREE tax consultation & evaluation:<br />

252-404-1068<br />

Anthem offers a money-back guarantee designed to help you avoid wasting money on ineffective tax services. We will gather as<br />

much information from you as necessary and work with tax authorities to give you the best chance of reducing your tax debt. If for any<br />

reason that does not work out, and the government notifies us they refuse to reduce your overall tax liability or monthly payments by<br />

any amount, we will gladly refund you the fees you paid for our services in trying to reduce that debt. Money Back Guarantee does not<br />

apply to Bookkeeping and Tax Preparation Services.<br />

36 Albemarle <strong>Tradewinds</strong> <strong>August</strong> <strong>2020</strong> albemarletradewinds.com<br />

ACCREDITED<br />

A+<br />

BUSINESS<br />

Rating<br />

1 Opportunity 2 Investigation 3 Agreement 4 TAX DEBT FREE!