Panels & Furniture Asia July/August 2020

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

18 | MARKET REPORT<br />

<strong>July</strong> / <strong>August</strong> <strong>2020</strong>, Issue 4 | <strong>Panels</strong> & <strong>Furniture</strong> <strong>Asia</strong><br />

US HARDWOODS<br />

MARKET OBSERVATIONS AND<br />

POST-PANDEMIC OUTLOOK<br />

By: Judd Johnson Managing Editor, Hardwood Market Report<br />

Business for US hardwoods has<br />

contracted. After experiencing a<br />

downturn that lasted more than<br />

18 months due to the US-China trade<br />

war, demand for US hardwoods suffered<br />

further from the COVID-19 pandemic that<br />

derailed trade worldwide.<br />

Each of these factors, independently,<br />

forced contraction in US hardwood<br />

production and inventories. But,<br />

importantly, the rapid deceleration<br />

in business caused by the trade war<br />

followed immediately by the COVID-19<br />

pandemic has profound and, most likely,<br />

lasting negative effects on US hardwood<br />

production capabilities.<br />

It is well understood that supply follows<br />

demand, therefore decreases in sawmill<br />

and lumber yard output are no surprise.<br />

Yet, the supply decreases are not<br />

necessarily aligned with demand for<br />

specific species or grades of lumber.<br />

Oddly, the estimated volume of lumber<br />

being produced by US hardwood sawmills<br />

is less than the total consumption, but the<br />

availability of certain industrial products<br />

and grade lumber items is more than<br />

ample at present.<br />

The best example of this circumstance<br />

(at the time of this writing) is material<br />

sawn for the domestic US wooden pallet<br />

industry. Sawmills have had difficulty<br />

selling pallet material and many have<br />

accumulated inventory. Yet, the annual<br />

rate of Eastern US hardwood sawmill<br />

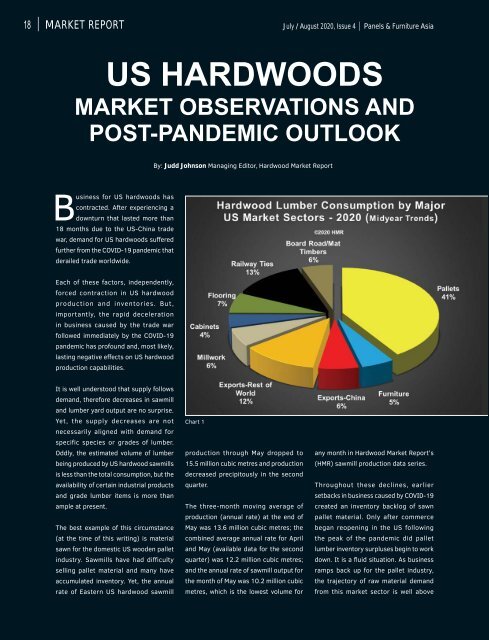

Chart 1<br />

production through May dropped to<br />

15.5 million cubic metres and production<br />

decreased precipitously in the second<br />

quarter.<br />

The three-month moving average of<br />

production (annual rate) at the end of<br />

May was 13.6 million cubic metres; the<br />

combined average annual rate for April<br />

and May (available data for the second<br />

quarter) was 12.2 million cubic metres;<br />

and the annual rate of sawmill output for<br />

the month of May was 10.2 million cubic<br />

metres, which is the lowest volume for<br />

any month in Hardwood Market Report’s<br />

(HMR) sawmill production data series.<br />

Throughout these declines, earlier<br />

setbacks in business caused by COVID-19<br />

created an inventory backlog of sawn<br />

pallet material. Only after commerce<br />

began reopening in the US following<br />

the peak of the pandemic did pallet<br />

lumber inventory surpluses begin to work<br />

down. It is a fluid situation. As business<br />

ramps back up for the pallet industry,<br />

the trajectory of raw material demand<br />

from this market sector is well above