Insolvency Made Clear: A Guide for Debtors

Plain English, practical guidance for anyone facing demands over a debt they are struggling to pay.

Plain English, practical guidance for anyone facing demands over a debt they are struggling to pay.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 1<br />

Alternatives to<br />

bankruptcy<br />

Some debtors may wish to go bankrupt <strong>for</strong> the advantages it brings. Others have<br />

an alternative to bankruptcy, <strong>for</strong> example if the creditors prefer to settle the<br />

claim out of court or if they qualify <strong>for</strong> a niche alternative. Creditors may prefer<br />

to settle the bankruptcy claim out of court, frequently because they prefer a<br />

smaller sum now to an uncertain sum in the future. Nothing stops a debtor<br />

in<strong>for</strong>mally agreeing with a creditor to pay less debt, or to have more time to<br />

pay. However, the <strong>Insolvency</strong> Act creates certain structures which can be helpful<br />

to give a debtor an alternative to bankruptcy. This chapter discusses these<br />

alternatives.<br />

1.1 Individual Voluntary Arrangements<br />

An important alternative to bankruptcy is an ‘Individual Voluntary Arrangement’<br />

(IVA). An IVA is a type of contract between the debtor and their creditors. If<br />

an IVA is passed it binds all known creditors who were entitled to vote in the<br />

arrangement, or would have been if they had notice of it. This includes creditors<br />

who voted against the arrangement.<br />

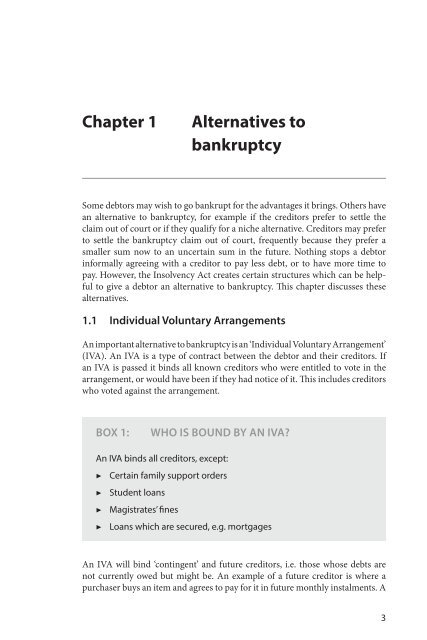

Box 1:<br />

WHO IS BOUND BY AN IVA?<br />

An IVA binds all creditors, except:<br />

▶ Certain family support orders<br />

▶ Student loans<br />

▶ Magistrates’ fines<br />

▶ Loans which are secured, e.g. mortgages<br />

An IVA will bind ‘contingent’ and future creditors, i.e. those whose debts are<br />

not currently owed but might be. An example of a future creditor is where a<br />

purchaser buys an item and agrees to pay <strong>for</strong> it in future monthly instalments. A<br />

3