Blue Chip Issue 81

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry. Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary. Congratulations!

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary.

Congratulations!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OFFSHORE<br />

Global equity has been the best asset class for local investors<br />

over the past decade. What has been the main driver?<br />

That’s right. Global equity returned 19% per year in rand terms<br />

over the past decade to end August (as measured by the MSCI<br />

All Country World index). Part of the story is rand weakness.<br />

The currency traded at R7 against the dollar 10 years ago. As it<br />

depreciated, it added about 9% per year to the return from global<br />

equity for local investors.<br />

But the main reason has been that global equities performed<br />

well in dollar terms, despite the March 2020 crash. The return in the<br />

10 years to the end of August was in the top 15th percentile of all<br />

10-year periods since 1988.<br />

But this headline performance hides quite a divergence, doesn’t it?<br />

Indeed. We can slice and dice it in many ways, but let’s just look at<br />

it from a regional and a style basis.<br />

On a regional basis, the US has led the way over the past<br />

decade by some distance, while non-US equity returns were<br />

much more muted. The US is by far the biggest market in the<br />

world, accounting for more than half of the major global equity<br />

benchmarks, whether you use MSCI, FTSE or Datastream.<br />

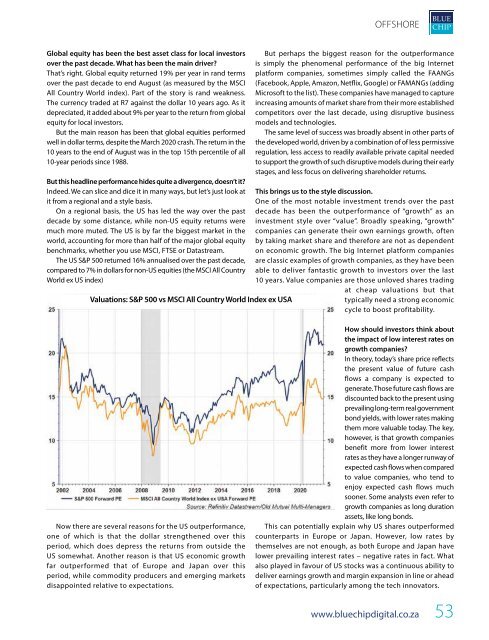

The US S&P 500 returned 16% annualised over the past decade,<br />

compared to 7% in dollars for non-US equities (the MSCI All Country<br />

World ex US index)<br />

Valuations: S&P 500 vs MSCI All Country World Index ex USA<br />

But perhaps the biggest reason for the outperformance<br />

is simply the phenomenal performance of the big Internet<br />

platform companies, sometimes simply called the FAANGs<br />

(Facebook, Apple, Amazon, Netflix, Google) or FAMANGs (adding<br />

Microsoft to the list). These companies have managed to capture<br />

increasing amounts of market share from their more established<br />

competitors over the last decade, using disruptive business<br />

models and technologies.<br />

The same level of success was broadly absent in other parts of<br />

the developed world, driven by a combination of of less permissive<br />

regulation, less access to readily available private capital needed<br />

to support the growth of such disruptive models during their early<br />

stages, and less focus on delivering shareholder returns.<br />

This brings us to the style discussion.<br />

One of the most notable investment trends over the past<br />

decade has been the outperformance of “growth” as an<br />

investment style over “value”. Broadly speaking, “growth”<br />

companies can generate their own earnings growth, often<br />

by taking market share and therefore are not as dependent<br />

on economic growth. The big Internet platform companies<br />

are classic examples of growth companies, as they have been<br />

able to deliver fantastic growth to investors over the last<br />

10 years. Value companies are those unloved shares trading<br />

at cheap valuations but that<br />

typically need a strong economic<br />

cycle to boost profitability.<br />

Now there are several reasons for the US outperformance,<br />

one of which is that the dollar strengthened over this<br />

period, which does depress the returns from outside the<br />

US somewhat. Another reason is that US economic growth<br />

far outperformed that of Europe and Japan over this<br />

period, while commodity producers and emerging markets<br />

disappointed relative to expectations.<br />

How should investors think about<br />

the impact of low interest rates on<br />

growth companies?<br />

In theory, today’s share price reflects<br />

the present value of future cash<br />

flows a company is expected to<br />

generate. Those future cash flows are<br />

discounted back to the present using<br />

prevailing long-term real government<br />

bond yields, with lower rates making<br />

them more valuable today. The key,<br />

however, is that growth companies<br />

benefit more from lower interest<br />

rates as they have a longer runway of<br />

expected cash flows when compared<br />

to value companies, who tend to<br />

enjoy expected cash flows much<br />

sooner. Some analysts even refer to<br />

growth companies as long duration<br />

assets, like long bonds.<br />

This can potentially explain why US shares outperformed<br />

counterparts in Europe or Japan. However, low rates by<br />

themselves are not enough, as both Europe and Japan have<br />

lower prevailing interest rates – negative rates in fact. What<br />

also played in favour of US stocks was a continuous ability to<br />

deliver earnings growth and margin expansion in line or ahead<br />

of expectations, particularly among the tech innovators.<br />

www.bluechipdigital.co.za<br />

53