Blue Chip Issue 81

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry. Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary. Congratulations!

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary.

Congratulations!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OFFSHORE<br />

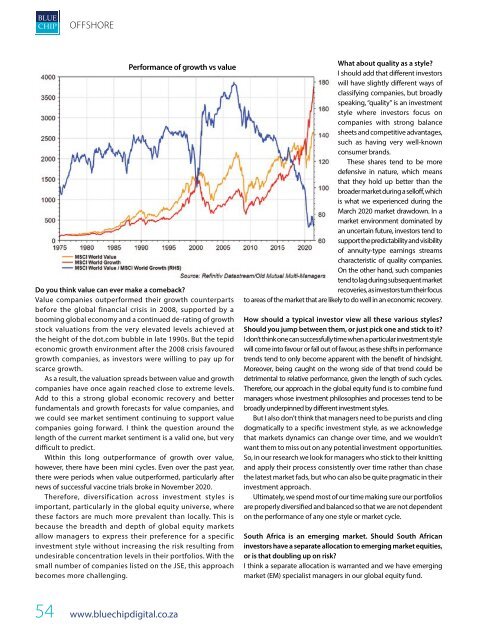

Performance of growth vs value<br />

Do you think value can ever make a comeback?<br />

Value companies outperformed their growth counterparts<br />

before the global financial crisis in 2008, supported by a<br />

booming global economy and a continued de-rating of growth<br />

stock valuations from the very elevated levels achieved at<br />

the height of the dot.com bubble in late 1990s. But the tepid<br />

economic growth environment after the 2008 crisis favoured<br />

growth companies, as investors were willing to pay up for<br />

scarce growth.<br />

As a result, the valuation spreads between value and growth<br />

companies have once again reached close to extreme levels.<br />

Add to this a strong global economic recovery and better<br />

fundamentals and growth forecasts for value companies, and<br />

we could see market sentiment continuing to support value<br />

companies going forward. I think the question around the<br />

length of the current market sentiment is a valid one, but very<br />

difficult to predict.<br />

Within this long outperformance of growth over value,<br />

however, there have been mini cycles. Even over the past year,<br />

there were periods when value outperformed, particularly after<br />

news of successful vaccine trials broke in November 2020.<br />

Therefore, diversification across investment styles is<br />

important, particularly in the global equity universe, where<br />

these factors are much more prevalent than locally. This is<br />

because the breadth and depth of global equity markets<br />

allow managers to express their preference for a specific<br />

investment style without increasing the risk resulting from<br />

undesirable concentration levels in their portfolios. With the<br />

small number of companies listed on the JSE, this approach<br />

becomes more challenging.<br />

What about quality as a style?<br />

I should add that different investors<br />

will have slightly different ways of<br />

classifying companies, but broadly<br />

speaking, “quality” is an investment<br />

style where investors focus on<br />

companies with strong balance<br />

sheets and competitive advantages,<br />

such as having very well-known<br />

consumer brands.<br />

These shares tend to be more<br />

defensive in nature, which means<br />

that they hold up better than the<br />

broader market during a selloff, which<br />

is what we experienced during the<br />

March 2020 market drawdown. In a<br />

market environment dominated by<br />

an uncertain future, investors tend to<br />

support the predictability and visibility<br />

of annuity-type earnings streams<br />

characteristic of quality companies.<br />

On the other hand, such companies<br />

tend to lag during subsequent market<br />

recoveries, as investors turn their focus<br />

to areas of the market that are likely to do well in an economic recovery.<br />

How should a typical investor view all these various styles?<br />

Should you jump between them, or just pick one and stick to it?<br />

I don’t think one can successfully time when a particular investment style<br />

will come into favour or fall out of favour, as these shifts in performance<br />

trends tend to only become apparent with the benefit of hindsight.<br />

Moreover, being caught on the wrong side of that trend could be<br />

detrimental to relative performance, given the length of such cycles.<br />

Therefore, our approach in the global equity fund is to combine fund<br />

managers whose investment philosophies and processes tend to be<br />

broadly underpinned by different investment styles.<br />

But I also don’t think that managers need to be purists and cling<br />

dogmatically to a specific investment style, as we acknowledge<br />

that markets dynamics can change over time, and we wouldn’t<br />

want them to miss out on any potential investment opportunities.<br />

So, in our research we look for managers who stick to their knitting<br />

and apply their process consistently over time rather than chase<br />

the latest market fads, but who can also be quite pragmatic in their<br />

investment approach.<br />

Ultimately, we spend most of our time making sure our portfolios<br />

are properly diversified and balanced so that we are not dependent<br />

on the performance of any one style or market cycle.<br />

South Africa is an emerging market. Should South African<br />

investors have a separate allocation to emerging market equities,<br />

or is that doubling up on risk?<br />

I think a separate allocation is warranted and we have emerging<br />

market (EM) specialist managers in our global equity fund.<br />

54 www.bluechipdigital.co.za