Blue Chip Issue 81

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry. Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary. Congratulations!

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry.

Blue Chip takes this opportunity to wish the FPI a happy 40th anniversary.

Congratulations!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RISK TOLERANCE<br />

The perils of risk<br />

tolerance questionnaires<br />

Where you (the financial planner) can bridge the gap<br />

Understanding your client’s capacity for risk is key to<br />

advising them on a sound investment strategy. Failure<br />

to do this correctly may result in an excessively risky<br />

portfolio requiring more frequent rebalancing, or<br />

too conservative a portfolio which doesn’t achieve the client’s<br />

investment objectives.<br />

There are a variety of methods to assess risk tolerance, but<br />

questionnaires remain the simplest and most common. Because<br />

of that, they need to be psychometrically sound. They need to<br />

assess cognitive (thinking) and affective (emotional) elements, and<br />

they also need to be valid, reliable and consistent.<br />

This last point is something that piqued my interest a while<br />

back. Risk tolerance differs from one individual to another and is a<br />

function of socio-economic and other personal factors. Thus, surely<br />

a risk tolerance outcome should be unique to the individual, not<br />

dependent on the type of assessment tool?<br />

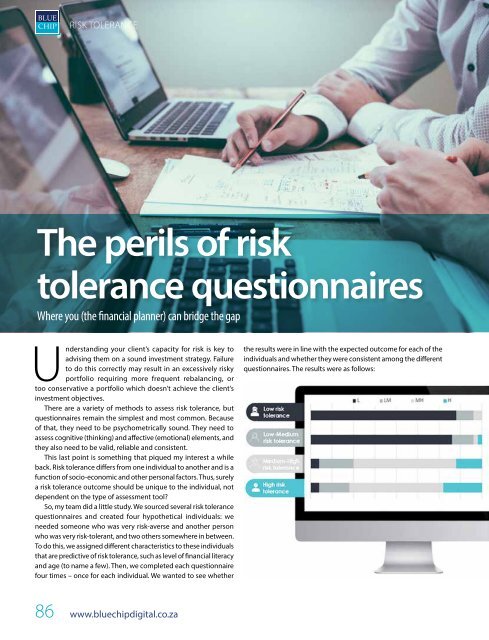

So, my team did a little study. We sourced several risk tolerance<br />

questionnaires and created four hypothetical individuals: we<br />

needed someone who was very risk-averse and another person<br />

who was very risk-tolerant, and two others somewhere in between.<br />

To do this, we assigned different characteristics to these individuals<br />

that are predictive of risk tolerance, such as level of financial literacy<br />

and age (to name a few). Then, we completed each questionnaire<br />

four times – once for each individual. We wanted to see whether<br />

the results were in line with the expected outcome for each of the<br />

individuals and whether they were consistent among the different<br />

questionnaires. The results were as follows:<br />

86 www.bluechipdigital.co.za