Green Economy Journal Issue 49

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SPECIAL REPORT<br />

SPECIAL REPORT<br />

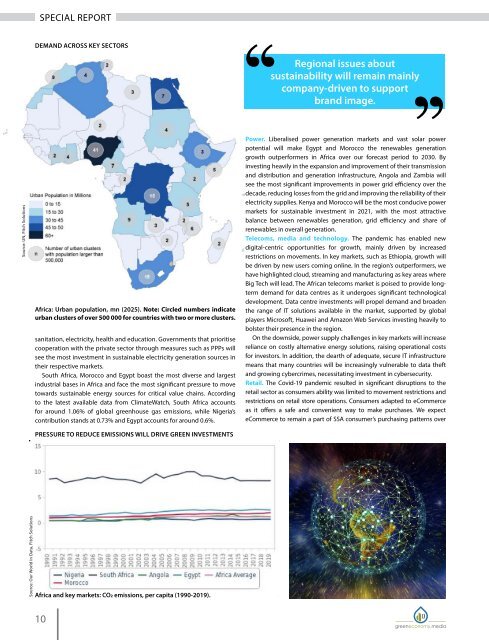

Source: UN, Fitch Solutions<br />

DEMAND ACROSS KEY SECTORS<br />

Africa: Urban population, mn (2025). Note: Circled numbers indicate<br />

urban clusters of over 500 000 for countries with two or more clusters.<br />

sanitation, electricity, health and education. Governments that prioritise<br />

cooperation with the private sector through measures such as PPPs will<br />

see the most investment in sustainable electricity generation sources in<br />

their respective markets.<br />

South Africa, Morocco and Egypt boast the most diverse and largest<br />

industrial bases in Africa and face the most significant pressure to move<br />

towards sustainable energy sources for critical value chains. According<br />

to the latest available data from ClimateWatch, South Africa accounts<br />

for around 1.06% of global greenhouse gas emissions, while Nigeria’s<br />

contribution stands at 0.73% and Egypt accounts for around 0.6%.<br />

PRESSURE TO REDUCE EMISSIONS WILL DRIVE GREEN INVESTMENTS<br />

Regional issues about<br />

sustainability will remain mainly<br />

company-driven to support<br />

brand image.<br />

Power. Liberalised power generation markets and vast solar power<br />

potential will make Egypt and Morocco the renewables generation<br />

growth outperformers in Africa over our forecast period to 2030. By<br />

investing heavily in the expansion and improvement of their transmission<br />

and distribution and generation infrastructure, Angola and Zambia will<br />

see the most significant improvements in power grid efficiency over the<br />

decade, reducing losses from the grid and improving the reliability of their<br />

electricity supplies. Kenya and Morocco will be the most conducive power<br />

markets for sustainable investment in 2021, with the most attractive<br />

balance between renewables generation, grid efficiency and share of<br />

renewables in overall generation.<br />

Telecoms, media and technology. The pandemic has enabled new<br />

digital-centric opportunities for growth, mainly driven by increased<br />

restrictions on movements. In key markets, such as Ethiopia, growth will<br />

be driven by new users coming online. In the region’s outperformers, we<br />

have highlighted cloud, streaming and manufacturing as key areas where<br />

Big Tech will lead. The African telecoms market is poised to provide longterm<br />

demand for data centres as it undergoes significant technological<br />

development. Data centre investments will propel demand and broaden<br />

the range of IT solutions available in the market, supported by global<br />

players Microsoft, Huawei and Amazon Web Services investing heavily to<br />

bolster their presence in the region.<br />

On the downside, power supply challenges in key markets will increase<br />

reliance on costly alternative energy solutions, raising operational costs<br />

for investors. In addition, the dearth of adequate, secure IT infrastructure<br />

means that many countries will be increasingly vulnerable to data theft<br />

and growing cybercrimes, necessitating investment in cybersecurity.<br />

Retail. The Covid-19 pandemic resulted in significant disruptions to the<br />

retail sector as consumers ability was limited to movement restrictions and<br />

restrictions on retail store operations. Consumers adapted to eCommerce<br />

as it offers a safe and convenient way to make purchases. We expect<br />

eCommerce to remain a part of SSA consumer’s purchasing patterns over<br />

the coming years. This will be supported by the region’s high mobile internet<br />

penetration rate and increasing investments in eCommerce services by<br />

consumer facing business such Mass Grocery Retailers (MGR) and clothing,<br />

footwear and accessories retailers. Video on-demand services are in the early<br />

stages of development and adoption in the SSA region as it has historically<br />

been dominated by pay-TV services. However, over the coming years, we<br />

expect streaming to make up a larger share of entertainment consumption,<br />

particularly as players in the industry are making efforts to invest in content<br />

that appeals to audiences across the region.<br />

Healthcare. Digital health will strengthen healthcare operations, while<br />

telemedicine will increase health access in rural areas. Growing mobile<br />

phone ownership and internet access will further facilitate growth<br />

in digital health after the pandemic, although challenges remain.<br />

Environmental sustainability in the medical device industry is still a minor<br />

issue considering the health benefits associated with the sector. Complex<br />

supply chains due to an over reliance of imports in SSA contribute<br />

to greenhouse gas emissions, but a complete ban on plastics in the<br />

medical device industry is still very unlikely and sustainable packaging<br />

will continue to become increasingly important. Regional issues about<br />

sustainability will remain mainly company-driven to support brand image.<br />

Autos. Digital logistics start-ups and rising M&A activity will be key in the<br />

development of tech-enabled freight and logistics solutions across SSA.<br />

This will drive growth in new commercial vehicles sales in the region.<br />

Ecommerce proliferation across the region is helping to drive last-mile<br />

delivery solutions and this in turn will boost light commercial vehicles<br />

and motorcycle sales. The growth of ecommerce and e-logistics will drive<br />

sustainable transportation initiatives as firms embrace environmental, social<br />

and corporate governance (ESG) initiatives by renewing Africa’s ageing CV<br />

fleet that is often more polluting and promote electric vehicles (EVs).<br />

Although the sustainability drive in Africa will lag that of the rest of the<br />

world, there are a few pockets of the continent’s automotive industry that<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

AFRICA BEYOND THE PANDEMIC: Tech, Sustainability & Regional Trade<br />

Transformation | Fitch Solutions [September 2021]<br />

The Covid-19 pandemic has catalysed stronger progress towards digitalisation across key<br />

industries targeting Africa’s rapidly urbanising population. Sustainability will be more of a focus<br />

area, though targets will differ by country, and key initiatives will gain traction in varying degrees<br />

across industries, with the consumer and retail, autos and technology sectors best placed to lead.<br />

Heavy industry will also play a key role, as the region’s population is set to benefit from higher<br />

electrification rates and a recovery in domestic and global demand for products as well as stable<br />

and strong long-term trade growth, which will support road and port infrastructure construction.<br />

The report reveals:<br />

• How Covid-19 has accelerated e-Commerce and digital health uptake in SSA<br />

• The outlook for Africa’s data centre market<br />

• The acceleration of sustainability initiatives in SSA’s food and drink industry post-Covid-19<br />

ORDER REPORT HERE FOR US$995<br />

fitchsolutions.com<br />

offer opportunities to improve sustainability. E-logistics firms will be at<br />

the forefront of purchasing EVs as the income gained from transportation<br />

services rendered will be used to cover some of the purchasing costs. We<br />

note that as businesses in Africa increasingly drive towards a higher degree<br />

of sustainability, they will find it easier to source funding for sustainable<br />

projects amid the ESG investing boom.<br />

Logistics and supply chains. Deeper regional trade integration in the years<br />

ahead will allow countries to specialise and exploit economies of scale,<br />

thereby improving productivity and growth. However, pandemic-induced<br />

logistics bottlenecks have thrown global supply chains out of sync since<br />

2020, causing delays at ports, causing container shortages and recordhigh<br />

shipping rates in 2021. On the other hand, economic disruptions due<br />

to the pandemic have accelerated plans to boost economic diversification<br />

and supply chain resilience all around the world, and Africa is no exception.<br />

Increased digitalisation and streamlined customs procedures are key<br />

measures that will strengthen economic growth and deepen regional<br />

integration over the coming decade. Benefits will be concentrated in a<br />

few countries with strong logistics, security stability and those that are<br />

increasing efforts to ease trading across borders through strengthening<br />

hard and soft infrastructure.<br />

Source: Our World in Data, Fitch Solutions<br />

Africa and key markets: CO2 emissions, per capita (1990-2019).<br />

25 55 61 65<br />

Intra-Africa supply<br />

chains: digitalisation<br />

to unlock<br />

opportunities<br />

Sustainability in Africa’s<br />

autos: EVs, natural gas<br />

and ICE vehicles offer<br />

opportunities<br />

The top power<br />

markets for<br />

sustainable power<br />

investment in Africa<br />

Cooperation between public<br />

and private sector key for SSA<br />

power sector development<br />

post-pandemic<br />

This commentary is published by Fitch Solutions Country Risk & Industry Research and is not a comment on Fitch ratings’ credit ratings. Any comments or data included in the report are solely derived from Fitch<br />

Solutions Country Risk & Industry Research and independent sources. Fitch Ratings analysts do not share data or information with Fitch Solutions Country Risk & Industry Research.<br />

10<br />

11