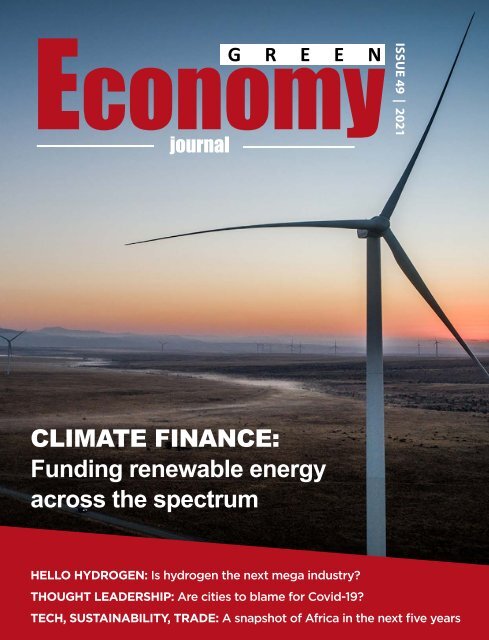

Green Economy Journal Issue 49

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Economy</strong><br />

G R E E N<br />

journal<br />

ISSUE <strong>49</strong> | 2021<br />

CLIMATE FINANCE:<br />

Funding renewable energy<br />

across the spectrum<br />

HELLO HYDROGEN: Is hydrogen the next mega industry?<br />

THOUGHT LEADERSHIP: Are cities to blame for Covid-19?<br />

TECH, SUSTAINABILITY, TRADE: A snapshot of Africa in the next five years

Your partner in building scale<br />

renewable energy generation<br />

and storage projects!<br />

Solar energy is now the cheapest<br />

electricity available, after utility scale wind.<br />

Battery energy storage installations provide access to<br />

solar energy daily when the sun is not shining, enabling<br />

users to bridge their primary energy needs through most<br />

load shedding events.<br />

Altum Energy works with property owners<br />

across the country to model their energy needs and<br />

facilitate projects, and in most cases the economics is<br />

advantageous, with high rates of return and payback<br />

periods as short as 3 years.<br />

Altum Energy is associated with range of preferred<br />

suppliers, offering best-of-breed technologies at<br />

ultra-competitive rates.<br />

We work with reputable and experienced installers<br />

with many satisfied customers.<br />

We also work with lenders ready to finance your project<br />

if you prefer an off-balance sheet structure.<br />

If you are considering installing solar and/or batteries<br />

at your home or business, invite us to quote and allow<br />

us to demonstrate our competitive advantage!<br />

The cost of a hybrid solar + battery storage solution<br />

can beat your current electricity costs, depending on<br />

a number of factors.<br />

Would you like to know if your home or business can<br />

achieve energy security at the same cost or less than<br />

what you are currently paying?<br />

Solar and battery installation by<br />

Did you know that SARS allows for the accelerated<br />

depreciation of your power generation installation?<br />

See Section 12A&B of the Tax Act.<br />

Altum Energy has developed a sophisticated modelling<br />

tool to determine the point of feasibility for each<br />

electricity customer based on your unique set of input<br />

values.<br />

For more information visit us at:<br />

info@altum.energy<br />

www.altum.energy

PUBLISHER’S NOTE<br />

Dear Reader,<br />

I feel like the cork holding back investment in the green economy is<br />

about to be blown out!<br />

The RMIPPPP preferred bidders, popular or not, will likely reach<br />

financial close early next year, and the REIPPPP BW5 preferred<br />

bidders will follow not long afterwards, and with some luck the<br />

winners of all three rounds of phase 1 of the Eskom Battery Energy<br />

Storage Flagship Project will be announced.<br />

These projects will result in billions of US dollars being invested<br />

in South Africa and will trigger a multiplier effect throughout the<br />

whole economy.<br />

At the same time, REIPPPP BW6 is scheduled for release along with<br />

DMRE bids for battery energy storage, gas, and coal being slated for<br />

now-ish. The DMRE plan for coal is now facing opposition through<br />

high court litigation brought by the Centre for Environmental Rights<br />

on behalf of: groundWork, Vukani Environmental Justice Movement<br />

in Action and the African Climate Alliance. Power to them!<br />

Gas has arrived. Literally, with DNG (Karpower litigant in the<br />

RMIPPPP legal matter) receiving their first consignment of LNG from<br />

Holland. Clearly, DNG is set to become the next oligopolist in South<br />

Africa and wants no competition from the likes of the Turks.<br />

Meanwhile, the private sector continues to be suffocated by<br />

energy and water constraints, and one pollution crisis after the<br />

next, a state of affairs that is leading companies to seek ever greater<br />

autonomy from state and local government services, and this is set<br />

to become a mega-trend over the next few years. SMES in the green<br />

economy are waiting in the wings to facilitate this shift, may the<br />

finance community please facilitate this in a less risk averse manner<br />

going forward.<br />

Onwards and upwards as we conclude 2021!<br />

Enjoy!<br />

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

EDITOR:<br />

JOINT PUBLISHER AND PRODUCER:<br />

JOINT PUBLISHER AND PRODUCER:<br />

LAYOUT AND DESIGN:<br />

OFFICE ADMINISTRATOR:<br />

WEB, DIGITAL AND SOCIAL MEDIA:<br />

GEM.TV HEAD OF PRODUCTION:<br />

SALES:<br />

GENERAL ENQUIRIES:<br />

ADVERTISING ENQUIRIES:<br />

Alexis Knipe<br />

alexis@greeneconomy.media<br />

Gordon Brown<br />

gordon@greeneconomy.media<br />

Danielle Solomons<br />

danielle@greeneconomy.media<br />

CDC Design<br />

Melanie Taylor<br />

Steven Mokopane<br />

Byron Mac Donald<br />

Gerard Jeffcote<br />

Glenda Kulp<br />

Tanya Duthie<br />

Vania Reyneke<br />

Zukisani Silwana<br />

info@greeneconomy.media<br />

danielle@greeneconomy.media<br />

REG NUMBER: 2005/003854/07<br />

VAT NUMBER: 4750243448<br />

PUBLICATION DATE: November 2021<br />

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

6<br />

8<br />

12<br />

NEWS & SNIPPETS<br />

SPECIAL REPORT<br />

A snapshot of Africa in the next five years<br />

THOUGHT LEADERSHIP<br />

Are cities to blame for Covid-19?<br />

18 FINANCE<br />

The DBSA: developing development<br />

22 FINANCE<br />

A chance to change history in SA<br />

28 HYDROGEN<br />

Hydrogen in SA gets the green light<br />

08<br />

16<br />

Gordon Brown, Publisher<br />

www.greeneconomy.media<br />

33 WATER<br />

What’s mine is yours. By SAGISA Process<br />

Engineering<br />

EDITOR’S NOTE<br />

As President Rhamaphosa said in his address at the Cop 26 Energy<br />

Session, bold action must start with accelerated decarbonisation<br />

of our energy systems. This involves harnessing new technologies<br />

to reduce our dependence on high-emission fossil fuels, including<br />

unabated coal power. It requires that we move to more sustainable<br />

and cost-effective energy sources.<br />

A feasibility study for South Africa’s first hydrogen valley has just<br />

been completed. The hydrogen valley will serve as an industrial<br />

cluster bringing various hydrogen applications in the country<br />

together to form an integrated ecosystem (page 28). Don’t miss The<br />

race to green hydrogen in Africa on page 30.<br />

While the energy transition is necessary for reducing global<br />

carbon emissions, this transition must also be fair and just. The<br />

financing partnership announced at COP26 between South Africa<br />

and a consortium consisting of France, Germany, the UK, the US<br />

and the EU aims to support our just transition to a low-carbon<br />

economy. On page 22, we discuss climate finance for the transition<br />

away from coal and don’t miss the article on page 18, which looks at<br />

the phenomenal work that the Development Bank of South Africa is<br />

doing in this space.<br />

All this and so much more in <strong>Issue</strong> <strong>49</strong> of The <strong>Green</strong> <strong>Economy</strong><br />

<strong>Journal</strong>.<br />

Alexis Knipe, Editor<br />

All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or<br />

in any form without the prior written permission of the Publisher. The opinions expressed herein<br />

are not necessarily those of the Publisher or the Editor. All editorial and advertising contributions<br />

are accepted on the understanding that the contributor either owns or has obtained all necessary<br />

copyrights and permissions. The Publisher does not endorse any claims made in the publication<br />

by or on behalf of any organisations or products. Please address any concerns in this regard to<br />

the Publisher.<br />

34 WATER<br />

Not all droughts are the same<br />

37 WASTE<br />

The potential of waste in a circular economy.<br />

By Interwaste<br />

39 CIRCULARITY<br />

Making the circular economy a reality.<br />

By NCPC-SA<br />

41 WATER<br />

The worth of water. By SAGISA<br />

42<br />

VALUE CHAINS<br />

Building resilience in manufacturing<br />

and supply chains<br />

42<br />

48<br />

4 5

NEWS & SNIPPETS<br />

NEWS & SNIPPETS<br />

PRESIDENT RAMAPHOSA: COP26 ENERGY SESSION<br />

“There is no longer any doubt that climate<br />

change presents a critical and urgent threat<br />

to humanity. This is so because it will have<br />

devastating consequences for our economies<br />

and societies if we do not take action now.<br />

Bold action must start with accelerated<br />

decarbonisation of our energy systems. This<br />

involves harnessing new technologies to<br />

reduce our dependence on high-emission<br />

fossil fuels, including unabated coal power.<br />

It requires that we move to more sustainable<br />

and cost-effective energy sources.<br />

While the energy transition is necessary<br />

for reducing global carbon emissions, this<br />

transition must also be fair and just. For many<br />

developing economies this requires massive<br />

investment in alternative energy sources and<br />

other infrastructure. It requires substantial<br />

support for workers and communities<br />

throughout the coal value chain who stand to<br />

lose their jobs as well as their livelihoods. A just<br />

transition requires finance and support from<br />

wealthier nations to enable low- and mediumincome<br />

countries to protect employment and<br />

to promote development.<br />

THE WORLD’S LARGEST<br />

FLOATING WIND FARM<br />

The 50MW Kincardine Offshore Wind Farm is<br />

located 15km off the coast of Aberdeenshire,<br />

in water depths ranging from 60m to 80m.<br />

The Kincardine project was started in 2014<br />

by Allan MacAskill and Lord Nicol Stephen,<br />

now both directors of Flotation Energy plc. In<br />

2016, Cobra Group became the main investor<br />

in Kincardine Offshore Wind Farm. Cobra Wind<br />

has been responsible for project delivery,<br />

engineering, construction, installation and<br />

commissioning.<br />

The development uses the highest capacity<br />

wind turbines ever installed on floating<br />

platforms. Kincardine will generate over<br />

200GWh of green electricity a year, powering<br />

over 50 000 Scottish households.<br />

Aaron Smith, chief commercial officer,<br />

Principle Power, says: “Kincardine is further<br />

showing the readiness and commercial<br />

potential of floating technology. With 80% of<br />

the world’s offshore wind resources in deep<br />

water areas, floating technologies like the<br />

WindFloat® open several new geographies to<br />

harness the boundless supply of clean energy<br />

contained therein.”<br />

Courtesy: KOWL<br />

In South Africa, we have committed to<br />

ambitious emission reduction targets. Achieving<br />

these targets will require the transformation of<br />

our energy system at an unprecedented speed<br />

and scale. This will include the decommissioning,<br />

the repowering and the repurposing of coal-<br />

ENERGY COUNCIL LAUNCHED<br />

fired power stations and the roll-out of<br />

renewable energy. But our ability to do so will<br />

be determined by the extent of support that<br />

we receive from developed economies.<br />

The Political Declaration that we announced<br />

this week with the governments of France,<br />

Germany, the UK and the US, as well as the<br />

EU, represents an important breakthrough<br />

in this effort. Through this partnership, an<br />

initial amount of $8.5-billion will be mobilised<br />

over the next three to five years to support<br />

South Africa’s just transition to a low-carbon,<br />

climate resilient future. This will enable us<br />

to implement our ambitious goals and to<br />

develop a model for a just transition that we<br />

hope can be used elsewhere.<br />

We are entering a brave new world bound<br />

together by our common destiny as humanity.<br />

We owe this to ourselves, to one another and<br />

to the future generations.”<br />

The world’s largest floating wind farm.<br />

The Energy Council of South Africa has been launched by founding members from across the<br />

energy value chain, both public and private. The Council will play a leading and collaborative role<br />

in the development and transition of the country’s energy sector.<br />

The initiative is led by CEOs from Anglo American, Central Energy Fund, Eskom, Exxaro, Industrial<br />

Development Corporation of South Africa, Sasol, TotalEnergies South Africa and naamsa, who will<br />

serve on the interim board.<br />

POST-COP26 REFLECTIONS<br />

Various outcome statements from UNFCCC Conference have been published:<br />

• The launch of the Adaptation Research Alliance (ARA), a coalition of<br />

global adaptation actors that will catalyse investment in action-oriented<br />

research and innovation for adaptation that strengthens resilience in<br />

communities most vulnerable to climate change.<br />

• The publication of a Joint Nature Statement by the Multilateral<br />

Development Banks, committing to give nature more prominence in<br />

their policies, analyses, assessments, advice, investments, and operations.<br />

• The development of the COP26 Health Programme, which will enable<br />

transformational change in health systems globally to protect both<br />

people and planet while elevating the trusted voices of health<br />

professionals to present the health argument for higher ambition on<br />

climate change action.<br />

• The formation of the Zero Emission Vehicles Transition Council.<br />

• The commitment to four new “Missions” to catalyse investment to<br />

NEW MARKETS FOR IPPs<br />

After a continent-wide search, with entries from 27 countries across Africa, award-winning<br />

Dr Gideon Idowu from Nigeria is the third recipient of the annual Jennifer Ward Oppenheimer<br />

Research Grant of US$150 000.<br />

Idowu’s research explores how, through poorly enforced environmental laws, Africa<br />

contributes significantly to global marine plastic pollution, as well as the contamination of its<br />

own freshwater bodies, upon which many rural populations depend for drinking water. Idowu’s<br />

study intends to provide scientific evidence of the impacts of microplastics, to inform policy and<br />

attitudinal changes across the African continent.<br />

accelerate technologies to facilitate urban transitions, eliminate emissions<br />

from industry, enable carbon dioxide removal and produce renewable<br />

fuels, chemicals, and materials.<br />

• The launch of the Breakthrough Agenda which commits countries to<br />

work together to make clean technologies and sustainable solutions the<br />

most affordable, accessible, and attractive option in each emitting sector<br />

globally before 2030.<br />

• The commitment to the Global Action Agenda on Transforming<br />

Agricultural Innovation.<br />

• Support for the conditions for a just transition internationally.<br />

• Focus on the Energy Transition Council.<br />

• Support of the product efficiency call to action, in recognition that high<br />

energy consuming products are a key driver of the growth in energy<br />

demand, and the proliferation of energy efficient equipment and appliances<br />

is an important part of sustainable economic growth and development.<br />

The amendment to schedule 2 of South Africa’s Electricity Regulation Act allows privately generated power to be transmitted across the national<br />

grid to company facilities in a willing-buyer willing-seller model, known as “wheeling”.<br />

This will also facilitate power transmission from sites with good wind and solar resource to businesses whose locations are not conducive to<br />

cost competitive renewable energy production. Larger plants could potentially sell energy to several separate customers based on their electricity<br />

needs. Unlike in other markets abroad, where an IPP’s excess capacity can be sold back into the national grid, here the onus to find a power<br />

purchaser will rest with the IPPs.<br />

The threshold increase will stimulate an entirely new market for power trading in which actors will position themselves as brokers, linking<br />

private generators with customers.<br />

The South African connection management interface space, already thriving on a small scale, can now look forward to the prevalence of much<br />

larger deals. While the infrastructure for it is already in place, the regulatory frameworks for wheeling are still being set into law.<br />

RESEARCH GRANT AWARDED<br />

By Paula-Ann Novotny, Webber Wentzel<br />

COVID MASKS<br />

UNMASKED<br />

Since the start of the pandemic, disposable<br />

masks are lying discarded all over the country.<br />

According to Brendon Jewaskiewitz, President<br />

of Institute of Waste Management of Southern<br />

Africa (IWMSA), the problem is snowballing.<br />

“Studies have shown that globally, about<br />

130-billion disposable masks are being used per<br />

month. That equates to an astounding 3-million<br />

per minute,” Jewaskiewitz says. He emphasises<br />

the issue of single-use masks and their disposal<br />

can’t be addressed without acknowledging that<br />

it is part of a bigger plastic pollution problem,<br />

and that human behaviour is at the core of it.<br />

6<br />

7

SPECIAL REPORT<br />

SPECIAL REPORT<br />

A snapshot of<br />

AFRICA IN THE NEXT<br />

FIVE YEARS<br />

Tech, sustainability and trade trends<br />

Source: UN, Fitch Solutions<br />

We believe that this rapid growth in urban populations will also see<br />

increased focus on the use of new technologies and leapfrog innovations<br />

as well as sustainability, particularly through growing the renewable<br />

power sector, emissions reduction efforts and increasing restrictions on<br />

single-use plastics.<br />

Africa: Urban population by sub-region, mn (2000-2035).<br />

The rapid pace of urbanisation in Africa is being driven by three<br />

key factors: rural-to-city migration, in-city population growth and<br />

the modernisation of previously rural population clusters, where rural<br />

areas are transforming themselves into urban spaces because of natural<br />

population growth and accumulated density. The establishment of<br />

new cities in SSA has seen limited success in alleviating pressure on the<br />

more established cities in recent decades, particularly in West Africa.<br />

The fortunes of Yamoussoukro (established in 1983 in Côte d’Ivoire)<br />

and Abuja (declared the capital in 1991 in Nigeria) offer important<br />

lessons for investors in consumer-facing sectors and current planners<br />

of new cities. Abidjan and Lagos are still significantly more populated<br />

than the other major and/or capital cities in these countries. Populations<br />

continue to prefer migrating to or staying in the larger, more established<br />

cities with better infrastructure, more vibrant commercial hubs and<br />

proximity to ports and economic opportunities. We believe that across<br />

the region, countries will seek to increase investment in infrastructure,<br />

particularly through expanding and connecting existing cities and towns,<br />

through strengthening public-private partnerships and increased use of<br />

technology-driven solutions.<br />

KEY SECTOR TRENDS<br />

Infrastructure. Businesses in the construction, energy and transport<br />

space can capitalise on the urgent need for development and expansion<br />

of existing cities. The infrastructure gap can be bridged through a<br />

significant rise in public-private partnerships (PPPs) for infrastructure in<br />

major cities through the development of tolled roads, low-cost housing,<br />

In this special report, Fitch Solutions<br />

unpacks the broader medium- to longterm<br />

trends in technological adoption,<br />

and a stronger push for ESG, as potential<br />

drivers of long-term economic and<br />

social development on the rapidly<br />

expanding continent.<br />

Around 603.5-million people in Africa are urban residents, and<br />

by 2030 we estimate that this will rise to 817-million, and<br />

further to 1.47-billion by 2050. Sub-Saharan Africa (SSA) is<br />

leading the growth, as the share of the urban population is projected<br />

to increase from 41.8% in 2021 to 46.8% and 58% by 2030 and 2050<br />

respectively. With this rapid growth in urban clusters, economies<br />

across the region will see increased demand for goods and services<br />

particularly for consumer facing sectors such as food and drink, retail,<br />

autos, agribusiness, healthcare, ICT as well as industries such as power<br />

and construction.<br />

8<br />

9

SPECIAL REPORT<br />

SPECIAL REPORT<br />

Source: UN, Fitch Solutions<br />

DEMAND ACROSS KEY SECTORS<br />

Africa: Urban population, mn (2025). Note: Circled numbers indicate<br />

urban clusters of over 500 000 for countries with two or more clusters.<br />

sanitation, electricity, health and education. Governments that prioritise<br />

cooperation with the private sector through measures such as PPPs will<br />

see the most investment in sustainable electricity generation sources in<br />

their respective markets.<br />

South Africa, Morocco and Egypt boast the most diverse and largest<br />

industrial bases in Africa and face the most significant pressure to move<br />

towards sustainable energy sources for critical value chains. According<br />

to the latest available data from ClimateWatch, South Africa accounts<br />

for around 1.06% of global greenhouse gas emissions, while Nigeria’s<br />

contribution stands at 0.73% and Egypt accounts for around 0.6%.<br />

PRESSURE TO REDUCE EMISSIONS WILL DRIVE GREEN INVESTMENTS<br />

Regional issues about<br />

sustainability will remain mainly<br />

company-driven to support<br />

brand image.<br />

Power. Liberalised power generation markets and vast solar power<br />

potential will make Egypt and Morocco the renewables generation<br />

growth outperformers in Africa over our forecast period to 2030. By<br />

investing heavily in the expansion and improvement of their transmission<br />

and distribution and generation infrastructure, Angola and Zambia will<br />

see the most significant improvements in power grid efficiency over the<br />

decade, reducing losses from the grid and improving the reliability of their<br />

electricity supplies. Kenya and Morocco will be the most conducive power<br />

markets for sustainable investment in 2021, with the most attractive<br />

balance between renewables generation, grid efficiency and share of<br />

renewables in overall generation.<br />

Telecoms, media and technology. The pandemic has enabled new<br />

digital-centric opportunities for growth, mainly driven by increased<br />

restrictions on movements. In key markets, such as Ethiopia, growth will<br />

be driven by new users coming online. In the region’s outperformers, we<br />

have highlighted cloud, streaming and manufacturing as key areas where<br />

Big Tech will lead. The African telecoms market is poised to provide longterm<br />

demand for data centres as it undergoes significant technological<br />

development. Data centre investments will propel demand and broaden<br />

the range of IT solutions available in the market, supported by global<br />

players Microsoft, Huawei and Amazon Web Services investing heavily to<br />

bolster their presence in the region.<br />

On the downside, power supply challenges in key markets will increase<br />

reliance on costly alternative energy solutions, raising operational costs<br />

for investors. In addition, the dearth of adequate, secure IT infrastructure<br />

means that many countries will be increasingly vulnerable to data theft<br />

and growing cybercrimes, necessitating investment in cybersecurity.<br />

Retail. The Covid-19 pandemic resulted in significant disruptions to the<br />

retail sector as consumers ability was limited to movement restrictions and<br />

restrictions on retail store operations. Consumers adapted to eCommerce<br />

as it offers a safe and convenient way to make purchases. We expect<br />

eCommerce to remain a part of SSA consumer’s purchasing patterns over<br />

the coming years. This will be supported by the region’s high mobile internet<br />

penetration rate and increasing investments in eCommerce services by<br />

consumer facing business such Mass Grocery Retailers (MGR) and clothing,<br />

footwear and accessories retailers. Video on-demand services are in the early<br />

stages of development and adoption in the SSA region as it has historically<br />

been dominated by pay-TV services. However, over the coming years, we<br />

expect streaming to make up a larger share of entertainment consumption,<br />

particularly as players in the industry are making efforts to invest in content<br />

that appeals to audiences across the region.<br />

Healthcare. Digital health will strengthen healthcare operations, while<br />

telemedicine will increase health access in rural areas. Growing mobile<br />

phone ownership and internet access will further facilitate growth<br />

in digital health after the pandemic, although challenges remain.<br />

Environmental sustainability in the medical device industry is still a minor<br />

issue considering the health benefits associated with the sector. Complex<br />

supply chains due to an over reliance of imports in SSA contribute<br />

to greenhouse gas emissions, but a complete ban on plastics in the<br />

medical device industry is still very unlikely and sustainable packaging<br />

will continue to become increasingly important. Regional issues about<br />

sustainability will remain mainly company-driven to support brand image.<br />

Autos. Digital logistics start-ups and rising M&A activity will be key in the<br />

development of tech-enabled freight and logistics solutions across SSA.<br />

This will drive growth in new commercial vehicles sales in the region.<br />

Ecommerce proliferation across the region is helping to drive last-mile<br />

delivery solutions and this in turn will boost light commercial vehicles<br />

and motorcycle sales. The growth of ecommerce and e-logistics will drive<br />

sustainable transportation initiatives as firms embrace environmental, social<br />

and corporate governance (ESG) initiatives by renewing Africa’s ageing CV<br />

fleet that is often more polluting and promote electric vehicles (EVs).<br />

Although the sustainability drive in Africa will lag that of the rest of the<br />

world, there are a few pockets of the continent’s automotive industry that<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

AFRICA BEYOND THE PANDEMIC: Tech, Sustainability & Regional Trade<br />

Transformation | Fitch Solutions [September 2021]<br />

The Covid-19 pandemic has catalysed stronger progress towards digitalisation across key<br />

industries targeting Africa’s rapidly urbanising population. Sustainability will be more of a focus<br />

area, though targets will differ by country, and key initiatives will gain traction in varying degrees<br />

across industries, with the consumer and retail, autos and technology sectors best placed to lead.<br />

Heavy industry will also play a key role, as the region’s population is set to benefit from higher<br />

electrification rates and a recovery in domestic and global demand for products as well as stable<br />

and strong long-term trade growth, which will support road and port infrastructure construction.<br />

The report reveals:<br />

• How Covid-19 has accelerated e-Commerce and digital health uptake in SSA<br />

• The outlook for Africa’s data centre market<br />

• The acceleration of sustainability initiatives in SSA’s food and drink industry post-Covid-19<br />

ORDER REPORT HERE FOR US$995<br />

fitchsolutions.com<br />

offer opportunities to improve sustainability. E-logistics firms will be at<br />

the forefront of purchasing EVs as the income gained from transportation<br />

services rendered will be used to cover some of the purchasing costs. We<br />

note that as businesses in Africa increasingly drive towards a higher degree<br />

of sustainability, they will find it easier to source funding for sustainable<br />

projects amid the ESG investing boom.<br />

Logistics and supply chains. Deeper regional trade integration in the years<br />

ahead will allow countries to specialise and exploit economies of scale,<br />

thereby improving productivity and growth. However, pandemic-induced<br />

logistics bottlenecks have thrown global supply chains out of sync since<br />

2020, causing delays at ports, causing container shortages and recordhigh<br />

shipping rates in 2021. On the other hand, economic disruptions due<br />

to the pandemic have accelerated plans to boost economic diversification<br />

and supply chain resilience all around the world, and Africa is no exception.<br />

Increased digitalisation and streamlined customs procedures are key<br />

measures that will strengthen economic growth and deepen regional<br />

integration over the coming decade. Benefits will be concentrated in a<br />

few countries with strong logistics, security stability and those that are<br />

increasing efforts to ease trading across borders through strengthening<br />

hard and soft infrastructure.<br />

Source: Our World in Data, Fitch Solutions<br />

Africa and key markets: CO2 emissions, per capita (1990-2019).<br />

25 55 61 65<br />

Intra-Africa supply<br />

chains: digitalisation<br />

to unlock<br />

opportunities<br />

Sustainability in Africa’s<br />

autos: EVs, natural gas<br />

and ICE vehicles offer<br />

opportunities<br />

The top power<br />

markets for<br />

sustainable power<br />

investment in Africa<br />

Cooperation between public<br />

and private sector key for SSA<br />

power sector development<br />

post-pandemic<br />

This commentary is published by Fitch Solutions Country Risk & Industry Research and is not a comment on Fitch ratings’ credit ratings. Any comments or data included in the report are solely derived from Fitch<br />

Solutions Country Risk & Industry Research and independent sources. Fitch Ratings analysts do not share data or information with Fitch Solutions Country Risk & Industry Research.<br />

10<br />

11

THOUGHT LEADERSHIP<br />

THOUGHT LEADERSHIP<br />

Are Cities to Blame for<br />

COVID-19?<br />

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the<br />

age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the<br />

season of Light, it was the season of Darkness, it was the spring of hope, it was the winter<br />

of despair, we had everything before us, we had nothing before us, we were all going<br />

direct to Heaven, we were all going direct the other way – in short, the period was so far<br />

like the present period, that some of its noisiest authorities insisted on its being received,<br />

for good or for evil, in the superlative degree of comparison only.”<br />

Charles Dickens, A Tale of Two Cities (1859)<br />

Until recently, many experts prophesied an urban future but now the pandemic has made<br />

that future less clear or, more precisely, the definition of urban more problematic. Covid-19<br />

has upended our fundamental relationship with the city. But even if Covid-19 had not done<br />

so, it is time to re-imagine our fundamental relationship with the city anyway. Covid-19<br />

has just shone the spotlight on to the problem.<br />

BY LLEWELLYN VAN WYK, B.ARCH; MSC. (APPLIED), URBAN ANALYST<br />

A<br />

central theme arising out of the pandemic is whether Covid-19<br />

signals the death of the city. As Tony Matthews puts it: “Many<br />

urban dwellers are redefining their sense of place in response to<br />

Covid-19. We may not view our cities the same way after this pandemic.<br />

Our perceptions and priorities may change, perhaps permanently. As<br />

we start planning for cities after this pandemic, we should recognise<br />

this task is as much philosophical as practical.” 1<br />

Pandemics do challenge existing perceptions, values, and paradigms<br />

about the meaning of progress, modernity, and success. Covid-19 is no<br />

different and is also challenging prevailing perceptions about urban life.<br />

When a major global shock occurs, such as Covid-19 (or 9/11, or potentially<br />

future climate change related events), it fundamentally challenges all<br />

orthodoxy by stressing hitherto covert systemic fault lines, which are<br />

unable to withstand the unleashed forces.<br />

Bruce Schaller perhaps sums it up best when, in the CityLab, he writes,<br />

“The oldest trope in America is back: Cities are bad. Cities mean density<br />

and density means human contact, and human contact, in the crucible<br />

of the pandemic, means illness and death.” The problem, he writes, is not<br />

cities and density. 2<br />

David Madden too observes that cities are once again being cast as<br />

threats to public health and social order and that some commentators<br />

believe there will be a mass exodus from cities, a trend accelerated by<br />

home working, and that large, dense cities are no longer viable.<br />

Samuel Kling, a Global Cities Fellow at the Chicago Council of Global<br />

Affairs, notes the long history of blaming urban areas rather than<br />

economic factors for physical and moral ills. 3 But, he argues, density<br />

can be an asset for fighting coronavirus. He argues that the diagnosis<br />

of Covid-19 as a uniquely urban problem reflects historical tropes about<br />

the dangers of urban space more than current evidence. Citing statistical<br />

analysis, he argues that there is not a consistent connection between<br />

big-city density and coronavirus impacts.<br />

On the contrary, he points out that some of the world’s most heavily<br />

settled spaces – Hong Kong, Seoul, Singapore – have proved to be the<br />

most formidable at containing Covid-19 while in the US, as an example,<br />

small towns in Georgia and Louisiana suffer along with New York City.<br />

He argues that the demonisation of density harkens to the heyday of<br />

urbanisation in the late 19th and early 20th centuries when American civic<br />

leaders and reformers of the time embraced the notion that urban social<br />

problems – disease, poverty, immorality – stemmed from the physical<br />

environments of cities.<br />

This ideology of “moral environmentalism,” as historian Alexander<br />

von Hoffman termed it, formed the foundation of US urban planning<br />

12<br />

13

THOUGHT LEADERSHIP<br />

THOUGHT LEADERSHIP<br />

and reform for decades. Now, he thinks, this legacy is re-emerging with<br />

coronavirus, threatening, as it did in recent urban history, to lead to<br />

distorted, ideological responses that malign city life and obscure the root<br />

of the problem.<br />

He concedes that while crowded tenements and inhumane<br />

conditions did indeed have deleterious effects on residents, the moral<br />

environmentalists tended to blame urban spaces while neglecting the<br />

economic system that created these spaces. He argues that the moralists<br />

believed that if changing the urban environment could solve urban social<br />

problems, the economic system of industrialisation could be left intact.<br />

Cities can generate lifesaving<br />

networks of social ties which combat<br />

isolation and mitigate the effects<br />

of disasters.<br />

Therefore, he argues, a standard method for improving impoverished,<br />

overcrowded urban neighbourhoods was simply to demolish them. He<br />

notes that while some urban voices argued for the building of urban parks<br />

to solve urban problems, the weaknesses of this reform vision – and its<br />

strengths – found clear expression in the era’s public parks movement,<br />

which touched cities across the country in the late 19th century.<br />

Landscape architects, such as Frederick Law Olmsted, Charles Eliot,<br />

and Jens Jensen, sought to solve urban social problems through the<br />

reform of urban space. They imagined parks as a vital source of fresh air<br />

and naturalistic beauty – features that take on special gravity in cities<br />

now under lockdown. But they also treated parkland as a mechanism for<br />

solving cities’ thorniest social problems. Critically, parks, predicated on<br />

the idea that space was the problem, did not address the larger system<br />

that created inhumane urban spaces in the first place.<br />

Urban park advocates embraced careful design because they viewed<br />

aesthetic reform as a tool for social reform. It was Olmsted, the movement’s<br />

leader, who stated that the reasons disease and misery and vice and crime<br />

has been much greater in towns could be attributed to a lack of fresh air<br />

and the constant stimulation of bustling city life. In his view, only “relief<br />

from” city life could return residents to “a temperate, good-natured, and<br />

healthy state of mind.”<br />

Olmsted viewed urban life as a threat to “the mind and the moral<br />

strength” of residents. This aesthetic, rather than ecological approach<br />

to urban parks ironically resulted in park landscapes that were in and of<br />

City leaders should remember<br />

their problem is the virus,<br />

not urban life.<br />

14<br />

15

THOUGHT LEADERSHIP<br />

THOUGHT LEADERSHIP<br />

themselves artificial: hills levelled and built up, ponds dug, and existing<br />

vegetation replaced with thousands of foreign and native plants. The<br />

objective never was ecological: in reformist thinking, creating naturalistic<br />

spaces could improve public health alongside civic health, and cure<br />

physical ailments together with moral ones. They believed they could<br />

quell the threat of social disorder by providing a structured, common<br />

space for cities’ motley populations.<br />

Some contemporaries of the time took their belief in parks’ healing<br />

powers to improbable lengths: As historian Paul Boyer writes, one park<br />

administrator claimed in a popular reform journal that with a bigger parks<br />

budget, he could decrease prostitution in his city by 98%.<br />

But here is the critical issue: convinced that the environment was<br />

both disease and cure, park builders put their faith in spatial reform, not<br />

structural reform. More direct interventions – such as social housing,<br />

robust regulatory protections, and the elements of a welfare state – had to<br />

wait for reformers with different worldviews.<br />

Tracy Loh and Charles Leinberger identify three natural enemies of<br />

urbanism: crime, terrorism, and pandemics. In the 1970s and 1980s, they<br />

note, crime seemed like an existential threat to American cities. In the<br />

2000s, it was terrorism. Today they suggest it is pandemics, especially<br />

as Covid-19 sweeps across the country’s dense urban areas. 4 For many<br />

people, these three cases provoke a fear of cities, especially the dense<br />

clustering of diverse populations. This fear can, they suggest, prevent<br />

decision-makers from understanding and implementing solutions to<br />

those problems. Fear can distort the market, leading public, private, and<br />

philanthropic sectors to fail to invest their money into the right places.<br />

And more critically, given the events in Atlanta in June 2020, they add that<br />

fear of cities feeds racism.<br />

But looking at the real dynamics of crime, terrorism, and pandemics,<br />

one can see that, many times, this fear is misplaced. The actual relationship<br />

between urbanism and threats of crime, terrorism, and pandemics is not a<br />

straight and simple line. Noting the prevalence of Covid-19 cases in places<br />

such as New York City, Los Angeles, and Chicago – urban counties that are<br />

the heart of the US economy – it is easy to conclude that the pandemic is<br />

primarily a big city problem.<br />

They point out that when cases are mapped per capita instead of by<br />

absolute number, a different story emerges. Los Angeles and Chicago are<br />

simply places that have a lot of people, and thus more Covid-19 cases.<br />

More tellingly they note that the spread of the virus is driven by crowding<br />

behaviour, not just density, which is why there have been major outbreaks<br />

in rural areas such as Blaine County, Idaho, and Albany in Georgia.<br />

One park administrator<br />

claimed in a popular reform journal<br />

that with a bigger parks budget,<br />

he could decrease prostitution<br />

in his city by 98%.<br />

They point to rural areas suffering relatively higher death rates from<br />

the virus because their hospital systems are quickly overwhelmed and<br />

their populations are underinsured, older, and have more underlying<br />

health conditions, which is all consistent with how the typical annual<br />

influenza affects the United States. They make the argument that cities,<br />

suburbs, and rural areas can all be affected by Covid-19.<br />

Regardless of size or density, all places need to invest in the qualities<br />

that build resiliency. While fear of cities regarding pandemics may be<br />

misplaced, they suggest that the solutions to such crises can have a place<br />

everywhere. They remind us that Covid-19 is not the only crisis we are<br />

facing – climate change, regional divergence, and our aging population<br />

also call for more transformative placemaking.<br />

So, what lessons will today’s city leaders take away from the pandemic?<br />

As in the past, the answer partly depends on how they diagnose the<br />

problem. If they follow the precedent of moral environmentalism, they will<br />

fault the city itself. But doing so distorts the reality of the pandemic and<br />

obscures the systemic policy failures that have made certain places and<br />

While cities are vulnerable<br />

amid the pandemic, they are<br />

not the problem.<br />

populations – particularly the marginalised – far more vulnerable.<br />

A dense urban environment can be an asset in fighting disasters like<br />

Covid-19. Density means cities can more easily concentrate resources and<br />

social services where needed. Residents, in theory, have quicker access to<br />

hospitals and healthcare. And when nurtured by “social infrastructure” –<br />

community centres, libraries, and yes, public parks – cities can generate<br />

lifesaving networks of social ties which combat isolation and mitigate<br />

the effects of disasters. Building on these strengths can make cities more<br />

humane and resilient in the pandemic’s aftermath.<br />

As Covid-19 enlarges the window of policy possibilities, city leaders<br />

should remember their problem is the virus, not urban life. They can<br />

improve their public health and transportation infrastructure by learning<br />

from the dense places that have managed to avoid the harshest impacts of<br />

the virus. They can strengthen the social infrastructure that serves as a first<br />

line of defence against pandemics, supporting neighbourhood institutions<br />

to promote cohesiveness while allowing for distance. They can tailor their<br />

responses to meet the threat of climate catastrophe, which cities – for all<br />

their flaws – remain best positioned to address. They can relieve the deeprooted<br />

inequality that has contributed to Covid-19’s uneven urban spread.<br />

More critically, while cities are vulnerable amid the pandemic, they<br />

are not the problem. Recognising that fact is the first step, to addressing<br />

coronavirus on its own terms, as it appears not just in cities, but also in<br />

suburb and countryside – and to building a more resilient, humane urban<br />

life afterward.<br />

REFERENCES<br />

1 Ibid.<br />

2 Schaller, B. 2020. “Density isn’t easy. But it’s necessary.” CityLab, May 4, 2020. .<br />

3 Kling, Samuel. 2020. “Is the city itself the problem?” CityLab, April 20, 2020. .<br />

4 Loh, T. and Leinberger, C. 2020. “How fears of cities can blind us from solutions to Covid-19.” .<br />

16<br />

17

FINANCE<br />

FINANCE<br />

Our objective is to see projects<br />

become more bankable, fully-financed<br />

and to reach financial close.<br />

projects. This support extends to local community trusts in the form of<br />

equity funding.<br />

While this is a high-risk category, we have managed the risk and<br />

achieved success with these categories of funding from as early as Bid<br />

Window One (BW1) through to BW4, as well as round five and in the risk<br />

mitigation programme.<br />

DBSA was very pleased that several bidders we supported in the<br />

RMIPPPP were successful in being named preferred bidders.<br />

THE DBSA:<br />

DEVELOPING<br />

DEVELOPMENT<br />

Let’s unpack this word “support”. As a development finance institute<br />

(DFI), I assume your support speaks to a more favourable set of<br />

lending terms than what may be available from commercial banks?<br />

For example, aspiring black energy entrepreneurs who would<br />

not necessarily be able to raise an equity portion off their own<br />

balance sheets can apply to DBSA for funding, and would qualify<br />

for assistance?<br />

Absolutely. From a BEE perspective, the pricing of that debt is very<br />

competitive when compared to what certain other institutions charge.<br />

We provide finance to BEEs on a limited recourse basis. We can offer<br />

these because we are comfortable with the revenues being generated<br />

in the underlying project.<br />

The strength of the underlying project allows us to take a position<br />

and provide debt financing to that BEE entrepreneur, at a competitive<br />

level, compared to other BEE funding instruments, such as preference<br />

shares, which are more costly to the BEE entrepreneur. This is DBSA’s<br />

competitive edge.<br />

Recourse versus limited recourse versus non-recourse funding.<br />

What are the points of relaxation between these different categories<br />

of funding?<br />

In this space, the funding that you find is “limited recourse” financing. We<br />

rely solely on the value of the underlying project and not on the lender’s<br />

balance sheets. These are the key principles of project finance, and BEE is<br />

financed on a project finance basis.<br />

Lungile Tom, senior investment officer, DBSA.<br />

Gordon Brown, <strong>Green</strong><strong>Economy</strong>.Media, caught<br />

up with Lungile Tom, DBSA, to discuss the Bank’s<br />

competitive edge, an edge with compounding<br />

success that is built from building the success<br />

of others.<br />

GB: What role has Development Bank of South Africa (DBSA) played<br />

in support of the DMRE’s procurement programmes?<br />

LT: DBSA was instrumental in supporting the IPP office (the agency<br />

designated with implementing and rolling out procurement programmes<br />

on behalf of the DMRE) at inception. We provided the seed capital for<br />

the establishment of the IPP office. Since then, DBSA has continued to<br />

support the initiatives of the IPP office.<br />

DBSA has supported several projects that bid in the early and<br />

subsequent rounds of the procurement programmes, by providing senior<br />

and mezzanine debt, and most importantly for the Bank, in focussing on<br />

funding the BEE component.<br />

The DMRE programmes seek to address multiple economic<br />

development imperatives through the various bidding rounds, and<br />

these align perfectly with the mandate and objectives of DBSA.<br />

We assist many black equity partners, including black women-owned<br />

entities, with BEE funding, which enables them to take stakes in the IPP<br />

In the context of the REIPPPP and of the renewable energy sector<br />

generally; what role does DBSA play within the broader value chain?<br />

This speaks to the activities of the DBSA and how we are structured as<br />

an organisation. We have divisions, with some units that work solely on<br />

providing planning services and assistance to various state organs, such<br />

as municipalities and other institutions.<br />

In this context, we move on from planning to project preparation,<br />

where we become greatly involved, and indeed instrumental, in<br />

supporting projects to reach bankable feasibility stage. At this stage, we<br />

can open the project to other funders. We carry a project through to the<br />

stage where other funders come in. And we provide this project support<br />

within South Africa as well as to the rest of the continent.<br />

Key criteria within projects are seldom aligned. They are quite specific<br />

to country and sector, requiring specialised project preparation work.<br />

Our space primarily deals with project finance, and these are bankable<br />

projects ready to be financed, but as indicated we do have a division<br />

focused on project preparation.<br />

18<br />

19

FINANCE<br />

We also fund municipalities and state-owned companies, so the<br />

nature of the finance depends on the structuring of that project or<br />

financial need. Once projects are funded, we continue to oversee the<br />

operations, maintenance, and support the monitoring of outcomes of<br />

whatever infrastructure project it would be.<br />

The municipalities form the biggest chunk of our business, as the DFI.<br />

We already provide capacity and bulk infrastructure support. Adding<br />

another layer of EGIP funding shows how involved we have become in<br />

the entire municipal value chain.<br />

Specific to the REIP, and even more specific to wind energy projects,<br />

how would you define DBSA’s role? What percentage of your<br />

portfolio is allocated to renewable energy and/or wind?<br />

Subject to correction, of our energy portfolio, renewable energy is<br />

approximately 42%. I would say wind projects account for 10% of<br />

the 42%. We see growth in the renewable energy sector in South Africa<br />

aligned with the integrated resource plan (IRP). As DBSA’s mandate is<br />

to facilitate the IRP, we see our portfolio of renewable energy projects<br />

projected to grow to approximately 50% of our total portfolio, with wind<br />

projects likely to account for 15 to 20%. This is a projection, and it will<br />

ultimately be driven by the market and availability of projects under<br />

development in South Africa and Africa.<br />

DBSA is accredited by international organisations like the <strong>Green</strong><br />

Climate Fund (GCF) and the Global Environment Facility (GEF). How<br />

does this enable the Bank to fulfil its mandate in the region?<br />

Our accreditation allows us to be more proactive in responding to market<br />

failures or gaps in the market that need to be addressed. This occurs<br />

when the private sector is unable or unwilling to provide funding for a<br />

particular investment type deemed developmentally advantageous.<br />

We worked with GEF in the small IPP programme where we developed<br />

a solution to assist black entrepreneurs to have access to adequate<br />

competitive financing into their project. Likewise, with GCF, in support<br />

of embedded generation because we saw a need for a higher level of<br />

first-class or credit enhancement in those projects. We worked with the<br />

GCF to come up with something concessional to support the bankability<br />

of those projects and to offer more affordable funding.<br />

Let’s talk about DBSA’s support of the small embedded generation<br />

projects under the Embedded Generation Investment Programme<br />

(EGIP). I understand that the initial book is closed. Please outline the<br />

details of the programme.<br />

The EGIP was designed to support projects in the embedded generation<br />

space. These are projects that have private off-takers in the commercial<br />

and industrial space as well as municipalities. We saw a growth in this<br />

sector and identified a need for a first-class credit enhancement in the<br />

capital structure of those projects.<br />

We rely solely on the value of<br />

the underlying project and not on the<br />

lender’s balance sheets.<br />

We provided the credit enhancement in the form of a subordinated<br />

debt, with a higher, more competitive rate than would be offered to<br />

REIPPPP projects, improving the affordability of these projects to endusers.<br />

A facility of this nature is second ranking to senior debt, but also<br />

comes in at a cost that is concessional to the project.<br />

Our objective is to see projects become more bankable, fully-financed<br />

and to reach financial close. We want to see this space grow.<br />

As we saw in BW5, the subscription level was five times the capacity<br />

bid. Nevertheless, there are many projects developed on sites with<br />

available resources and all that’s needed is an off taker. It then becomes<br />

about trying to grow that market, which in turn may allow energy users<br />

to secure their energy supply and trigger further development.<br />

Lungile Tom speaking at Windaba 2021.<br />

CAREER HISTORY<br />

Lungile L Tom is a senior investment officer at DBSA, specifically<br />

focused on project-financed projects across various infrastructure<br />

sectors in South Africa and the rest of the Africa. Tom is a chartered<br />

accountant (CA (SA)) and a 2020/2021 Harvard South Africa Fellow.<br />

Her educational background includes Master of Philosophy (MPhil) in<br />

Development Finance.<br />

9-12 May 2022 | Cape Town, South Africa<br />

Reconnect with<br />

the mining industry<br />

in-person<br />

Mining Indaba will be back in<br />

Cape Town in 2022<br />

Get ready to return to Cape Town as the industry unites to<br />

fuel transformations and collaborations. The must attend inperson<br />

event will bring together visionaries and innovators and<br />

connect you with your next business opportunity.<br />

DBSA WINS 2021 IJ GLOBAL ESG AWARD<br />

The judges identified DBSA as the winner of the Sub-Saharan Africa category, recognising the DFI for its issuance of its first ever €200-million green<br />

bond to target climate mitigation, adaptation or indeed both. The green bond was issued through a private placement with French DFI Agence<br />

Française de Développement (AFD) and structured in alignment with DBSA’s <strong>Green</strong> Bond Framework, which reiterates the lender’s commitment to<br />

playing a role in the transition to a low-carbon economy. The framework is aligned with the International Capital Market Association (ICMA) <strong>Green</strong><br />

Bond Principles.<br />

One judge pointed to “lots of firsts in this transaction”, adding that it was “difficult not to applaud the channelling of such extensive investment<br />

into affordable and clean energy in South Africa”. Another judge added: “It is right and proper that development banks take the lead in ESG and set<br />

an example for others to follow.”<br />

“The bonds have been structured in alignment with the DBSA’s recently released <strong>Green</strong> Bond Framework, which reiterates the DBSA’s commitment<br />

to playing a role in the just transition to a low-carbon economy; this is the first green bond issuance by DBSA and the first time a South African issuer<br />

issues bonds in Euroclear France.”<br />

Limited sponsorship and exhibition places remain<br />

Enquire today www.miningindaba.com<br />

Get ahead of the game by registering your place saving you up to<br />

£689 each with the Early Bird rate<br />

#MI2022<br />

20

FINANCE<br />

FINANCE<br />

A CHANCE TO CHANGE<br />

HISTORY IN SOUTH AFRICA<br />

Climate finance for a transition<br />

away from coal<br />

The announcement made international headlines and is highly<br />

significant for many reasons. The finance offer is large; it has<br />

a strong element of justice; it’s not just about a few individual<br />

projects; and it’s for a country that has long been shaped around its<br />

dependence on coal.<br />

This partnership represents an important opportunity for South Africa<br />

at a critical juncture, if it is approached judiciously and if the domestic<br />

politics can be managed. A failure to engage the partnership strategically<br />

will squander the moment, resulting in an incremental outcome that won’t<br />

unlock the just transition the country so desperately needs. A failure to<br />

tame the politics would put the entire flow of finance at risk.<br />

SPECIFICS OF THE SUPPORT<br />

The financing partnership mobilises an initial R131-billion<br />

(US$8.5-billion) over the next three to five years. Some of this<br />

in the form of grants and some is concessional debt finance<br />

(cheaper than commercial debt). The partnership is intended<br />

to enable a range of outcomes. One is to speed up the process<br />

of moving away from carbon in the electricity system.<br />

South Africa has recently updated its nationally determined<br />

contribution to the international emission-reduction effort.<br />

Importantly, the finance will support the workers and<br />

communities who will be affected as the country moves away<br />

from coal.<br />

Another aim is to support a sustainable solution for the<br />

South African power utility’s debt and ensure its long-term<br />

financial sustainability in the context of power sector reforms.<br />

Lastly, finance will be channeled towards the development of<br />

the electric vehicle and green hydrogen sectors.<br />

In the opening days of COP26, a financing partnership was announced between South<br />

Africa and a consortium consisting of France, Germany, the UK, the US and the EU. The<br />

partnership aims to support South Africa’s just transition to a low-carbon economy.<br />

Essentially a just transition is one where no one is left behind.<br />

BY EMILY TYLER*<br />

22<br />

SIGNIFICANCE OF THE FINANCE<br />

Pitched at an initial US$8.5-billion, the partnership has the potential<br />

to be one of the largest individual climate finance transactions to<br />

date. Large <strong>Green</strong> Climate Fund transactions hover closer to the<br />

US$1-3-billion mark.<br />

Its justice element is important. It has an explicit focus on supporting<br />

those who face immediate transition impacts, such as the approximately<br />

80 000 coal miners and the communities who depend on them. The<br />

partnership envisages that the climate finance will enable an energy<br />

sector transition, which is different to the usual focus of climate finance on<br />

individual green projects.<br />

The deal is significant because it has been announced despite South<br />

Africa’s coal legacy and influential incumbents. The country has spent over<br />

Global capitalism<br />

is now oriented towards a<br />

low-carbon economy.<br />

100 years building an economy whose competitive advantage is based on<br />

coal as its primary energy source. The legacy of coal is evident in physical<br />

infrastructure, the way the energy sector is organised and the form of<br />

energy sector institutions. It influences the way finance flows and power<br />

sector contracts are written. And there are powerful groupings who have<br />

vested interests in keeping it all this way for as long as possible.<br />

Ironically, it is this legacy that enables South Africa to offer the world<br />

significant and globally cost-efficient emission reductions as it changes<br />

course. South African electricity is the most carbon intensive in the world.<br />

Because renewable energy is now the cheapest form of power supply,<br />

decarbonising the country’s electricity supply by accelerating the phase<br />

down of the coal fleet will yield a large volume of emission reductions at<br />

very low cost, especially compared to more expensive emission reduction<br />

options in other sectors and countries.<br />

But the political and institutional challenges to realising this transition<br />

are very real.<br />

PACING PROVOCATION<br />

The global target of achieving an average of net-zero carbon emissions<br />

by 2050 is an enormous challenge. It requires rapid and disruptive<br />

change as economies and societies globally are decarbonised within ►28<br />

23

FINANCE<br />

FINANCE<br />

THOUGHT [ECO]NOMY<br />

CLIMATE FINANCE TO TRANSFORM ENERGY INFRASTRUCTURE AS PART<br />

OF A JUST TRANSITION IN SOUTH AFRICA | Research report for SNAPFI<br />

project | University of Cape Town [July 2020]<br />

READ REPORT<br />

greeneconomy/report recycle<br />

The just transition transaction (JTT) has been developed in technical detail since 2019 by<br />

Meridian Economics (2020) and making the financial deal is work in progress. This case study<br />

reflects on the JTT, seeking to understand its architecture. The purpose of the study is to<br />

understand the potential of a just transition transaction to accelerate the phase out of coalfired<br />

power and to fund development projects.<br />

The spatial scale of the analysis is national, in that Eskom debt threatens South Africa’s<br />

financial sustainability. Physically, the Mpumalanga province is a key focus of this study. This<br />

province of South Africa contains its central coal basin, most of the coal-fired power stations<br />

are surrounded by poor communities with several small rural towns dependent on coal for<br />

livelihoods. Mpumalanga is a micro-cosm of the challenges of sustainable energy development<br />

in South Africa – environmentally, socially and economically.<br />

35 61 82<br />

What is a just<br />

transition?<br />

South African<br />

interpretation<br />

54<br />

Key elements<br />

of the<br />

problem<br />

The just<br />

transition<br />

transaction<br />

Renewables<br />

ownership<br />

in the just<br />

transition<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

SUPPORTING JUST TRANSITIONS IN SOUTH AFRICA | Just Transition Case<br />

Study | Climate Investment Funds [September 2020]<br />

The term “just transitions” is used to acknowledge that there are multiple framings of just<br />

transitions related to a variety of theories of change and world views. This has resulted in a<br />

situation, whereby there is no one clear definition of just transitions, but rather a range of<br />

positions, principles, and practices.<br />

At the heart of the just transitions discourse(s) is the debate on whether addressing humancreated<br />

environmental challenges, including climate change, inevitably requires choosing<br />

between protecting the planet or precarious jobs and the economies that sustain (and<br />

simultaneously exploit) people and nature. The falsity of the dichotomy is best summed up in<br />

the slogan: “There are no jobs on a dead planet.”<br />

The recent economic and social impacts of the pandemic, including massive job losses,<br />

have provided an illuminating example of the devastating effects of a global systemic shock.<br />

It is imperative for people to recognise that climate change has the potential to introduce or<br />

exacerbate similar systemic shocks. Therefore, attention to climate change and fundamental<br />

change at the global and local scales are of the utmost urgency and importance. Just transitions<br />

focus attention on important questions related to change, including:<br />

- Who decides what kind of transitions are needed?<br />

- How are different groups included in the decision-making processes?<br />

- Who benefits and loses in change processes?<br />

- How can benefits be distributed and losses mitigated in both safe and just ways?<br />

By raising these questions, the concept of “just transitions” highlights the significance of<br />

encompassing issues of inclusivity and justice in change initiatives.<br />

Courtesy of The Conversation<br />

South Africa will need all the<br />

support it can get to keep up<br />

with the pace of change.<br />

three decades. But technology and finance are already driving the<br />

transition. This can be seen in the massive decline in the cost of<br />

renewable energies and the accelerating shift of financial portfolios to<br />

green investments. Global capitalism is now oriented towards a lowcarbon<br />

economy.<br />

As a small open economy, South Africa can neither resist nor control<br />

these forces. And the country is in a vulnerable starting position as one<br />

of the world’s most carbon-intensive economies. There is not much time<br />

to avoid being economically marginalised as wealthier and nimbler<br />

economies mobilise around net-zero goals. South Africa will need all the<br />

support it can get to keep up with the pace of change.<br />

Fortunately, as studies by the National Business Initiative and Meridian<br />

Economics-CSIR show, accelerated electricity decarbonisation has two<br />

big plusses. It is the cheapest way of providing a reliable electricity<br />

supply to the economy. And renewables have the shortest lead time to<br />

build. So they are the quickest and cheapest way to lift the country out<br />

of its current power cut woes.<br />

DAUNTING DETAILS<br />

The just transition partnership announcement has achieved both a<br />

political space and an implementation platform (the taskforce) to<br />

start working out the support details. These details include the type<br />

of financing instruments, what the finance will be used for, the mix of<br />

grant and debt, and financing terms and conditions. An initial scope of<br />

supported actions, financing sources and terms will be identified within<br />

six months, with a full partnership work programme and investment<br />

plan outlined within a calendar year.<br />

Currently, there are many views on what the details could look like.<br />

These include Eskom’s Just Energy Transaction, Meridian Economics’ Just<br />

Transition Transaction and the Presidential Climate Commission.<br />

The taskforce will have to work out how to:<br />

• Ensure that alternative, attractive and sustainable economic<br />

livelihoods are created in the regions that have depended on coal<br />

• Prioritise spending on activities that will help to fundamentally<br />

re-orientate South Africa’s energy sector as opposed to only achieving<br />

incremental change<br />

• Ensure that the grant and concessional finance components of the<br />

partnership leverage rather than crowd-out commercial investment<br />

• Achieve a transition pace aligned with South Africa’s international<br />

climate commitments.<br />

POLITICAL POWER<br />

But if the technical details are formidable, a recent address by the Minister<br />

of Minerals and Energy, Gwede Mantashe, demonstrates that the domestic<br />

politics are even more so. In direct opposition to Ramaphosa’s vocal support<br />

of the partnership and decarbonisation trajectory, Mantashe argued that<br />

South Africa should continue to exploit its coal resources, suggesting that<br />

the partnership is an attempt to pressurise the country to conform to an<br />

international agenda that is not in the country’s best interest.<br />

Despite the economic realities of a global energy transition well under<br />

way, and the increasingly obvious technical, economic and social failings<br />

of South Africa’s coal-based energy system, the political challenges to<br />

leaving the coal legacy path are clear.<br />

09 18 30 32<br />

Objective and<br />

intention of<br />

case study<br />

11<br />

Importance and<br />

principles of just<br />

transitions<br />

Just transition<br />

framework in<br />

the context of<br />

South Africa<br />

Project Case 1:<br />

The Sere Wind<br />

Farm Project<br />

Project Case 2:<br />

Xina Solar One<br />

CSP Project<br />

* Emily Tyler, honorary research associate, African Climate and Development Institute, University of Cape Town<br />

24<br />

25

ENERGY<br />

IT’S A<br />

GO FOR GREEN<br />

The South African Wind Energy Association has put its voice of support behind the<br />

first-of-its-kind green financing deal, announced at Cop26 climate talks.<br />

BY SAWEA<br />

Noupoort Wind Farm.<br />

USE WOOD, AND SAVE TREES.<br />

The more wood we use, the more forests we will save. It might seem responsibly managed forests, where harvesting is strictly controlled.<br />

contradictory, but it’s simple economics. Greater demand for wood Managed this way, forests become a renewable resource, and you<br />

makes it more valuable to local communities, and less likely that<br />

can choose our wooden windows, doors, garage doors and COL<br />

whole forests will be cleared to make way for other crops,<br />

products secure in the knowledge that the next generation<br />

or other, potentially damaging activities, such as mining.<br />

would be able to do the same. And if you take into account<br />

As a leading building materials manufacturer, we have<br />

the energy-saving benefits of wood, it’s simply the natural<br />

a responsibility to monitor our environmental impact.<br />

choice if you care about the environment. For more<br />

That’s why we prefer to source our wood from<br />

info call 086 110 2425 or visit www.swartland.co.za<br />

Mark Tanton, SAWEA<br />

board member.<br />

Speaking on behalf of the wind power<br />

industry and the country’s broader<br />

renewable energy sector, this deal,<br />

which comprises multi and bi-lateral<br />

grants, concessional loads, guarantees<br />

and private investment, will provide<br />

impetus for South Africa’s accelerated<br />

uptake of green energy.<br />

“We view our sector as a key implementer<br />

for the country to decarbonise its power<br />

sector and increase its energy availability.<br />

Hence, we look to the various policymakers within the Department of<br />

Forestry, Fisheries and the Environment, the Department of Mineral<br />

Resources and Energy; and the Department of Public Enterprises to<br />

facilitate and lead this transition, which will no doubt be abetted by this<br />

financing deal,” says Mark Tanton, SAWEA board member.<br />

The US$8.5-billion package, committed by the UK, France, Germany<br />

and the USA, is intended to speed South Africa’s transition away from coal<br />

and represents a new model of green financing for emerging economies.<br />

This forms part of the global Accelerating Coal Transition Investment<br />

Programme, formulated by the Climate Investment Funds (CIF). The<br />

programme is the first to target developing countries that lack adequate<br />

resources to finance the shift away from coal, which is crucial to limit the<br />

global temperature rise to 1.5 degrees Celsius by 2030.<br />

“This makes sense as sustainable, cost-effective financing, is necessary<br />

to enable developing countries to be able to implement their climate<br />

change mitigation targets and accelerate the required energy transition<br />

away from carbon-intensive power production to renewable energy,”<br />

adds Tanton, who also reiterated that this announcement coincides<br />

with the expected parliamentary tabling of SA’s Climate Change Bill<br />

this month.<br />

While many details as to the structuring of the funds and exactly how<br />

it will be utilised are still to be ironed out, SAWEA notes there are several<br />

considerations. This includes the just energy transition as well as Eskom’s<br />

need to upgrade and add new transmission lines and renew its distribution<br />

network to accommodate additional green electrons.<br />

“In a nutshell, we need to remove CO 2<br />

from the atmosphere as fast as<br />

possible, and at the same time we need to drastically increase our Energy<br />

Availability Factor, so that we can bring a halt to the ongoing and crippling<br />

load shedding. The answer to all of this is a renewables-dominated power<br />

system, which is also the most cost-competitive system for South Africa,”<br />

concludes Tanton.<br />