GV Property Tax Final

In depth information regarding how much property tax is collected and where it is distrubuted.

In depth information regarding how much property tax is collected and where it is distrubuted.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

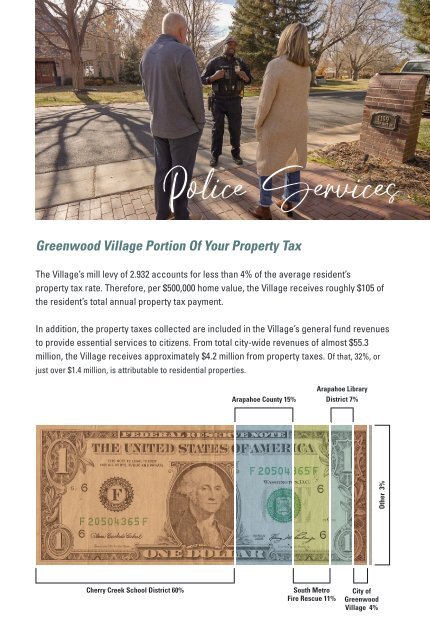

Police Services<br />

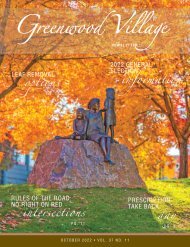

Greenwood Village Portion Of Your <strong>Property</strong> <strong>Tax</strong><br />

The Village’s mill levy of 2.932 accounts for less than 4% of the average resident’s<br />

property tax rate. Therefore, per $500,000 home value, the Village receives roughly $105 of<br />

the resident’s total annual property tax payment.<br />

In addition, the property taxes collected are included in the Village’s general fund revenues<br />

to provide essential services to citizens. From total city-wide revenues of almost $55.3<br />

million, the Village receives approximately $4.2 million from property taxes. Of that, 32%, or<br />

just over $1.4 million, is attributable to residential properties.<br />

Arapahoe County 15%<br />

Arapahoe Library<br />

District 7%<br />

Other 3%<br />

Cherry Creek School District 60%<br />

South Metro<br />

Fire Rescue 11%<br />

City of<br />

Greenwood<br />

Village 4%