Green Economy Journal Issue 52

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

www.greeneconomy.media<br />

ISSUE <strong>52</strong> | 2022<br />

IMPROVING LIVES<br />

THROUGH WATER<br />

The Olifants<br />

Management Model<br />

Big prize for<br />

small enterprise<br />

WIN 3D<br />

PRINTER

Your partner in building scale<br />

renewable energy generation<br />

and storage projects!<br />

Solar energy is now the cheapest<br />

electricity available, after utility scale wind.<br />

Battery energy storage installations provide access to<br />

solar energy daily when the sun is not shining, enabling<br />

users to bridge their primary energy needs through most<br />

load shedding events.<br />

Altum Energy works with property owners<br />

across the country to model their energy needs and<br />

facilitate projects, and in most cases the economics is<br />

advantageous, with high rates of return and payback<br />

periods as short as 3 years.<br />

Altum Energy is associated with range of preferred<br />

suppliers, offering best-of-breed technologies at<br />

ultra-competitive rates.<br />

We work with reputable and experienced installers<br />

with many satisfied customers.<br />

We also work with lenders ready to finance your project<br />

if you prefer an off-balance sheet structure.<br />

If you are considering installing solar and/or batteries<br />

at your home or business, invite us to quote and allow<br />

us to demonstrate our competitive advantage!<br />

The cost of a hybrid solar + battery storage solution<br />

can beat your current electricity costs, depending on<br />

a number of factors.<br />

Would you like to know if your home or business can<br />

achieve energy security at the same cost or less than<br />

what you are currently paying?<br />

Solar and battery installation by<br />

Did you know that SARS allows for the accelerated<br />

depreciation of your power generation installation?<br />

See Section 12A&B of the Tax Act.<br />

Altum Energy has developed a sophisticated modelling<br />

tool to determine the point of feasibility for each<br />

electricity customer based on your unique set of input<br />

values.<br />

For more information visit us at:<br />

info@altum.energy<br />

www.altum.energy

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

CONTENTS<br />

6 NEWS AND SNIPPETS<br />

8 WATER<br />

Improving lives through water<br />

12 MINING<br />

<strong>Green</strong> business for good<br />

14 The economic case for the mining<br />

industry to support carbon taxation<br />

18 STORAGE<br />

Carbon Capture, Utilisation and<br />

Storage<br />

20 MINING<br />

Sunshine is golden for the mining<br />

industry<br />

24 Global standard prioritises better<br />

management of water<br />

26 TSF failure: standards for response<br />

and recovery<br />

29 Opportunity for Africa to fill the<br />

commodity gap<br />

30 Winning with the right procurement<br />

localisation<br />

34 MOBILITY<br />

EV battery supply chain – trends,<br />

risks and opportunities in this<br />

fast-evolving sector<br />

37 State of the motor industry<br />

41 STORAGE<br />

Second-life storage batteries:<br />

a true circular economy solution<br />

42 ENERGY<br />

The race to green hydrogen in Africa<br />

46 Shaping tomorrow’s hydrogen market<br />

48 METROLOGY<br />

The National Metrology Institute of<br />

South Africa supports manufacturing<br />

and trade<br />

50 THOUGHT LEADERSHIP<br />

To densify or not: the pandemic as<br />

a driver of urban transformation<br />

54 WATER<br />

The good, bad and ugly in South<br />

Africa’s watercompliance<br />

56 GREEN TECH<br />

The fully-fledged state-owned<br />

enterprise<br />

59 ENERGY<br />

Industrialisation through local<br />

manufacturing<br />

60 WASTE<br />

Sustainable IT transforms waste<br />

into opportunity<br />

READ REPORT<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

To access the full report in our Thought [ECO]nomy report<br />

boxes: Click on the READ REPORT wording or image in the<br />

box and you will gain access to the original report. Turn to the<br />

page numbers (example below) for key takeouts of the report<br />

key<br />

02<br />

key<br />

key<br />

takeouts<br />

takeouts<br />

takeouts<br />

of the<br />

of the<br />

of the<br />

report<br />

report<br />

report<br />

01 03<br />

3

PUBLISHER’S NOTE<br />

Dear Reader,<br />

The renewable energy market is bursting with megaprojects,<br />

either awarded or about to be awarded, with new<br />

rounds being announced (sic REIPPPP BW6) while at the<br />

same time somehow retentive, hesitant, stymied while the<br />

broader economy is desperate for power and an end to the<br />

incessant load shedding.<br />

RMIPPPP promises so much and yet a combination of<br />

legal challenges, radical technology, cost hikes, delays in<br />

permissions, grid capacity constraints and myriad other<br />

headaches are ratchetting up the pressure, the costs and<br />

ultimately the risk.<br />

And we know how banks feel about risk!<br />

REIPPPP BW5 has been awarded, but also faces the same<br />

input tech cost hikes and grid access challenges. And I<br />

cannot overstate this – IPPs with gigawatts of bid-ready<br />

projects, after doggedly soldiering through the bidding<br />

hiatus, have seen the bulk of their pipelines wiped off the<br />

books by the grid access f__k-up in the Northern Cape. Eish!<br />

The private sector is steaming ahead, but there too, it’s all<br />

too new and it’s taking time for the nay-sayers to leave the<br />

building, and let the doers get on with it, while equipment<br />

gets more expensive and less available in this Putin inspired<br />

global mess previously known as logistics.<br />

I feel like I’m in a straight jacket trying to gesture my<br />

argument, while onlookers note that I’m obviously mad!<br />

Calling all stakeholders to find a way to make these<br />

projects work, shift tariffs if costs have legitimately shifted,<br />

find a way for IPPs to jointly fund investments in grid<br />

capacity, cut red tape, let ideology take a back seat. We all<br />

need this. We all need this now!<br />

Yours,<br />

G R E E N<br />

<strong>Economy</strong><br />

journal<br />

EDITOR:<br />

CO-PUBLISHERS:<br />

LAYOUT AND DESIGN:<br />

OFFICE ADMINISTRATOR:<br />

WEB, DIGITAL AND SOCIAL MEDIA:<br />

SALES:<br />

GENERAL ENQUIRIES:<br />

ADVERTISING ENQUIRIES:<br />

Alexis Knipe<br />

alexis@greeneconomy.media<br />

Gordon Brown<br />

gordon@greeneconomy.media<br />

Alexis Knipe<br />

alexis@greeneconomy.media<br />

Danielle Solomons<br />

danielle@greeneconomy.media<br />

CDC Design<br />

Melanie Taylor<br />

Steven Mokopane<br />

Gerard Jeffcote<br />

Glenda Kulp<br />

Nadia Maritz<br />

Tanya Duthie<br />

Vania Reyneke<br />

info@greeneconomy.media<br />

alexis@greeneconomy.media<br />

REG NUMBER: 2005/003854/07<br />

VAT NUMBER: 4750243448<br />

PUBLICATION DATE: May 2022<br />

www.greeneconomy.media<br />

YOU SEE USED<br />

BOTTLES.<br />

COLLECTORS<br />

SEE VALUE.<br />

Publisher<br />

EDITOR’S NOTE<br />

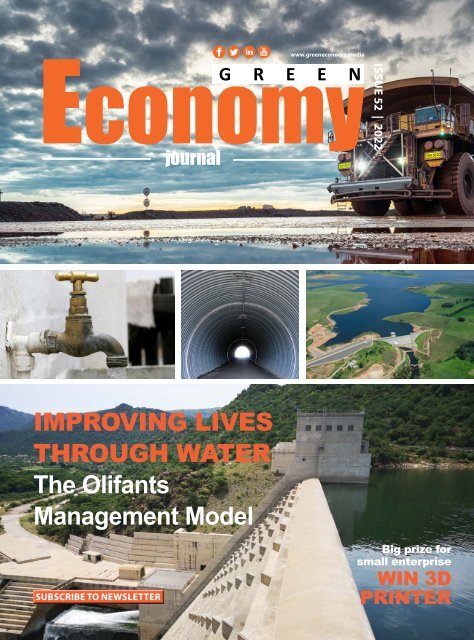

Welcome to the <strong>52</strong> nd issue of <strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong>. On<br />

page 8, we look at an integrated water service model for the<br />

Olifants River raw and potable water management called<br />

the Olifants Management Model Programme. The model<br />

has the potential to be replicated across the country as it<br />

is underpinned by public-private participation which sets<br />

a platform for community inclusivity. We wish the launch of<br />

the Olifants Management Model Programme all the best.<br />

To coincide with the African Mining Indaba 2022, this<br />

issue of <strong>Green</strong> <strong>Economy</strong> <strong>Journal</strong> focuses on all things mining.<br />

Enjoy!<br />

Alexis Knipe<br />

Editor<br />

Cover image: The cover image shows the launch of the Olifants Management<br />

Model Programme. Top picture: Anglo American Platinum. Bottom picture:<br />

De Hoop Dam.<br />

All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or<br />

in any form without the prior written permission of the Publisher. The opinions expressed herein<br />

are not necessarily those of the Publisher or the Editor. All editorial and advertising contributions<br />

are accepted on the understanding that the contributor either owns or has obtained all necessary<br />

copyrights and permissions. The Publisher does not endorse any claims made in the publication<br />

by or on behalf of any organisations or products. Please address any concerns in this regard to<br />

the Publisher.<br />

Recycling PET plastic bottles creates over 60 000 income<br />

opportunities every year in South Africa. Many of these are<br />

reclaimers, who helped divert upwards of 95 000 tonnes<br />

of PET plastic bottles from landfill in 2019. The used bottles<br />

they collect are recycled, ensuring that they become<br />

bottles yet again. This creates yet more jobs in the process,<br />

contributing positively to our country’s GDP while eliminating<br />

the chance that they end up harming the environment.<br />

Recycling ensures that a circular economy is established<br />

where the value of plastic bottles continues indefinitely.<br />

Plastic bottles are not trash.<br />

55% POST-CONSUMER<br />

beverage PET bottles<br />

collected for recycling.<br />

OVER 50 000<br />

active collectors invloved in<br />

PET Collection and recycling.<br />

R278 MILLION<br />

The market value of post-consumer<br />

PET bought by PET recyclers.<br />

* Reported in 2020<br />

2106099_FP_E<br />

4

NEWS & SNIPPETS<br />

NEWS & SNIPPETS<br />

NEW MINING GUIDELINES<br />

In March 2022, the DMRE published the Artisanal and<br />

Small-Scale Mining (ASM) Policy and the Mine Community<br />

Resettlement Guidelines. Both policy documents illustrate<br />

the desired integration of ESG standards in the mining sector.<br />

The regulator provides guidelines on ASM and resettlement of<br />

mine communities to assist them to fulfil their ESG obligations.<br />

THE ASM POLICY<br />

Currently, mining laws in South Africa do not regulate ASM as a<br />

discrete form of mining. Instead, a mining permit which is less<br />

onerous than a mining right can be obtained, but ASM miners still<br />

struggle to meet its requirements. The ASM Policy aims to create<br />

a formal ASM industry that can operate in a sustainable manner<br />

and contribute to the economy. It introduces formal definitions for<br />

artisanal and small-scale mining, setting out monetary thresholds<br />

to differentiate between artisanal (maximum R1-million) and<br />

small-scale (maximum R10-million) miners. It also distinguishes<br />

between illegal mining, which is a criminal activity, and ASM, for<br />

which an ASM permit is required.<br />

IFC TO EXPAND GREEN BUILDING FINANCING IN SA<br />

To support the construction of green buildings in South Africa,<br />

IFC is providing a R600-million ($42-million equivalent) loan<br />

package to Business Partners, a South African non-banking<br />

financing entity specialised in providing finance, mentorship<br />

and support programmes to SMEs.<br />

WIND AND SOLAR<br />

The Global Electricity<br />

Review 2022 reports that<br />

wind and solar generated<br />

over a tenth (10.3%) of<br />

global electricity for the<br />

first time in 2021, rising<br />

from 9.3% in 2020, and<br />

twice the share compared<br />

to 2015 when the Paris<br />

Climate Agreement was<br />

signed (4.6%). Combined,<br />

clean electricity sources<br />

generated 38% of the<br />

world’s electricity in 2021,<br />

more than coal (36%).<br />

Global electricity generation. (Terawatt hours)<br />

DOWNLOAD REPORT HERE<br />

The ASM Policy provides structure to the ASM industry and, as<br />

it becomes formalised and pays taxes, the ASM industry will be<br />

able to contribute to poverty alleviation and economic growth.<br />

The ASM may mostly be limited to surface and opencast mining.<br />

THE RESETTLEMENT GUIDELINES<br />

Resettlement for mining is not a new phenomenon. It is a<br />

global issue which has attracted the attention of international<br />

bodies such as the International Labour Organisation and the<br />

International Council on Mining and Metals, both of which have<br />

published guidance documents.<br />

The Resettlement Guidelines outline the process for applicants<br />

and holders of prospecting and mining rights or mining permits<br />

to follow when their operations require the physical resettlement<br />

of landowners, lawful occupiers, holders of informal land rights<br />

and mine and host communities. It also applies to both new<br />

operations and existing mines that are expanding and is intended<br />

to apply throughout the lifecycle of the operation, whenever<br />

resettlement is necessary.<br />

Business Partners will use IFC’s loan to finance the construction<br />

of certified green commercial buildings in South Africa and/or<br />

to renovate existing commercial buildings to make them more<br />

environmentally friendly, making them at least 20% more energy<br />

efficient. Eligible green building certifications will include EDGE,<br />

LEED, BREEAM and <strong>Green</strong> Star.<br />

IFC will also provide financial incentives to Business Partners<br />

to partially offset the costs involved in greening and certifying<br />

buildings, based on the company meeting certain green building<br />

targets in their portfolio.<br />

Conventional buildings account for almost 40% of energyrelated<br />

greenhouse emissions worldwide due to a growing urban<br />

population and outdated construction practices. An IFC study<br />

estimates that South Africa’s green building demand presents<br />

a $7-billion investment opportunity between 2016 and 2030.<br />

Although the supply of green buildings in the country is growing,<br />

the green building market is still at a nascent stage.<br />

Ember's Global Electricity Review<br />

INVESTEC ISSUES GREEN BONDS<br />

Investec has reaffirmed its commitment to funding a<br />

sustainable future, with the issue of the group’s first green<br />

bond. The bond is backed by several of Investec’s flagship<br />

renewable energy projects. The bonds raised R1-billion under<br />

Investec’s DMTN bond programme. The issue, which was 3.8<br />

times oversubscribed, highlighted a healthy appetite among<br />

institutional investors looking to make a positive impact in<br />

terms of their ESG commitments.<br />

The bonds have been issued in line with the <strong>Green</strong> Bond<br />

Principles of the International Capital Markets Association, a<br />

global association of debt securities issuers as well as the Investec<br />

Sustainable Finance Framework. The principles seek to support the<br />

financing of environmentally sound and sustainable projects that<br />

foster a net-zero emissions economy.<br />

“Investec’s green bond issue references existing, returngenerating<br />

projects, rather than future projects. These are all<br />

accredited renewable projects currently delivering clean power<br />

into the grid,” notes Louis Dirker, head of debt capital markets at<br />

Investec Bank. “In many cases, the projects also have concurrent<br />

programmes helping to create jobs and uplifting communities.”<br />

Investec’s green bonds reference five of South Africa’s leading<br />

wind and solar projects, namely:<br />

• Bokpoort CSP Power Plant (50MW)<br />

• Aurora Wind Power Project (94MW)<br />

• Karoshoek Solar One Project (100MW)<br />

• Kathu Solar Park (100MW)<br />

• Windfall 59 Solar Project (74MW)<br />

According to the World Economic Forum, annual issuance of<br />

green bonds is expected to exceed US$1-trillion in 2023, double the<br />

amount issued last year. Considering that the global bond market<br />

is worth some US$130-trillion, there’s significant room for green<br />

bonds to grow within the fixed income asset class.<br />

According to Dirker, South African institutional investors are<br />

becoming more aware of the risks of climate change to their<br />

portfolios and are having to disclose these. “There’s also greater<br />

pressure being brought to bear from their stakeholders to make<br />

a positive contribution through their ESG policies and related<br />

financing. <strong>Green</strong> bonds thus fulfil an important role within the<br />

fixed-income component of an institution’s portfolio, especially<br />

where there is a reference to bankable, cash-generative projects.”<br />

CLIMATE CHANGE BILL OPEN FOR COMMENTS<br />

The portfolio committee on environment, forestry and<br />

fisheries opened comments for the Climate Change Bill<br />

in April 2022. The bill seeks to enable the development of<br />

an effective climate change response and a long-term just<br />

transition to a low-carbon and climate-resilient economy<br />

and society for South Africa.<br />

The bill details the need for appropriate adaptation<br />

responses and requires the Minister of Environment, Forest<br />

and Fisheries to implement an effective nationally determined<br />

climate change response that encompasses mitigation<br />

and adaptation actions that represent South Africa’s fair<br />

contribution to the global climate change response.<br />

GLOBAL LEADERS TO GUIDE COAL PHASE-OUT<br />

The International Energy Agency (IEA) recently announced<br />

that a high-level advisory group of global energy, climate<br />

and finance leaders will provide strategic input for a<br />

forthcoming IEA special report that will explore how to put<br />

the world’s coal emissions on a path toward net zero amid<br />

the major energy security and affordability challenges that<br />

are affecting countries worldwide with particularly severe<br />

economic impacts in the developing world.<br />

IEA executive director Fatih Birol convened the High-Level<br />

Advisory Group to offer recommendations for the major new<br />

IEA report, Coal in the Global Net Zero Transition: Strategies<br />

for Rapid, Secure and People-Centred Change, which is due to<br />

be published in the fourth quarter of 2022. The report will<br />

provide the first authoritative assessment of how to tackle<br />

one of the world’s biggest energy and climate challenges<br />

in the changed global landscape resulting from Russia’s<br />

invasion of Ukraine.<br />

The emerging global energy crisis driven by Russia’s<br />

invasion of Ukraine has laid bare the challenges that<br />

countries face in ensuring, sustainable and affordable<br />

energy supplies in a complex and uncertain geopolitical<br />

environment. As well as hurting consumers and businesses<br />

around the world, especially in developing economies, the<br />

turmoil in global energy markets threatens to derail efforts<br />

to prevent the worst effects of climate change. Last year,<br />

global energy-related CO2 emissions rebounded to their<br />

highest level in history, largely because of record use of<br />

coal to generate electricity.<br />

The move away from coal will not be straightforward.<br />

Renewable energy options are the most cost-effective new<br />

sources of electricity generation in most markets, but there<br />

are still multiple challenges to reducing emissions from the<br />

existing global fleet of coal power plants while maintaining<br />

secure and affordable electricity supplies. Increased financial<br />

flows and new financing mechanisms will be essential to bring<br />

down coal emissions and innovation in areas such as carbon<br />

capture will be key in many industrial sectors<br />

Tackling the consequences of change for workers,<br />

communities and vulnerable consumers will also require<br />

dedicated and determined policy efforts. This is especially<br />

the case in developing economies where electricity demand<br />

is growing rapidly, coal is often the incumbent fuel for power<br />

generation, and unabated use of coal in the industrial sector<br />

is on the rise.<br />

Many of these challenges have become even more acute<br />

in recent months amid the sharp increases in the prices of<br />

energy and other crucial commodities, such as cereals and<br />

other food staples, which have been driven to all-time highs<br />

by Russia’s invasion of Ukraine. This is putting further strains<br />

on the already fragile financial situation in many developing<br />

economies. It also risks pushing energy sector transformation<br />

down the policy agenda in countries worldwide.<br />

6<br />

7

WATER<br />

WATER<br />

IMPROVING LIVES<br />

THROUGH WATER<br />

Bolstered by a collective call to action by the president for the public and private<br />

sectors to work together to address the infrastructure backlog, the sectors collaborated<br />

and conceptualised the Olifants Management Model Programme.<br />

SYNERGISTIC CO-EXISTENCE<br />

The hive understands the need synergy between nature and<br />

bees and between bees themselves. The bee logo (below) was<br />

chosen as an interim icon to represent the synergistic nature of<br />

the OMM Programme. The programme aims to achieve synergy<br />

or collaboration between the public and private sector.<br />

proposed Olifants Management Model Water User Association<br />

(OMM WUA) with institutional and commercial members based<br />

on a 50/50 collaboration model.<br />

LAUNCHING THE OMM PROGRAMME<br />

Institutional and commercial members joined forces to plan an<br />

integrated water service model for the Olifants River raw and<br />

potable water management called the Olifants Management<br />

Model (OMM) Programme. The model has the potential to be<br />

replicated across the country as it is underpinned by public-private<br />

participation which sets a platform for community inclusivity.<br />

To address the issues relating to the supply of water in the<br />

region, members agreed to accelerate bulk raw water delivery,<br />

potable water service delivery and socio-economic development<br />

(SED). Besides providing much-needed water to surrounding<br />

areas, the model will unlock the strategic mineral and industrial<br />

potential in the region. It will also establish a sustainable platform<br />

for the technical, financial and socio-economic growth of Limpopo.<br />

COLLABORATION IS KEY<br />

The OMM Programme was formalised through the signing of<br />

a Heads of Terms for an OMM Framework Agreement in 2022<br />

between institutional and commercial members.<br />

Structured collaboration<br />

In terms of the proposed governance structure, the OMM<br />

Programme will be housed within the OMM WUA, which will<br />

be the implementation vehicle for the OMM Programme. The<br />

proposed OMM WUA authority structure is underpinned by<br />

a Charter in accordance with the principles of King IV TM good<br />

governance. The OMM Programme Steering Committee shall<br />

consist of seven members: three appointed by DWS, three<br />

appointed by the Commercial Users Consortium, with the CEO as<br />

a co-opted member.<br />

De Hoop Dam outside Steelport in Limpopo.<br />

South Africa is a water-stressed country and is facing several<br />

water concerns. The lack of basic services such as water<br />

supply and sanitation is a key symptom of poverty and<br />

under development. In this context the provision of water supply<br />

and sanitation services cannot be separated from the effective<br />

management of water resources.<br />

Department of Water and Sanitation (DWS), as sector leader,<br />

seeks to manage the critical balance between sustainability of<br />

the resource, equitable allocation and economic growth. The<br />

National Water Act 36 of 1998 mandates DWS to ensure efficient<br />

conservation, management and control of resources to support<br />

the country’s water security needs. Future challenges will depend<br />

on current responses.<br />

Sustainable solutions require a systematic approach of<br />

integrated solutions rather than addressing issues in isolation.<br />

Most of these opportunities will need to take advantage of the<br />

synergies between government, private sector and civil society.<br />

In response to the negative growth impact of water and<br />

sanitation challenges, DWS has over time established a wide<br />

variety of partnerships. Lebalelo Water User Association (LWUA)<br />

was established in 2002, in line with the National Water Act, as a<br />

WATCH VIDEO<br />

collaboration between DWS and the mining industry (ie ordinary<br />

and industrial members) to build bulk raw water infrastructure<br />

that will develop the Eastern Limb of the Bushveld Igneous<br />

complex in Limpopo.<br />

LWUA’s purpose is “improving lives through water” and its<br />

strategy sets out a staged implementation approach that not only<br />

aims to transform the Association into a strategic model for future<br />

water delivery in the country, but to use water as a catalyst for<br />

socio-economic development in the areas it operates in. LWUA<br />

itself is also transforming and rebranding and will become the<br />

Sustainable solutions<br />

require a systematic<br />

approach of integrated<br />

solutions rather than<br />

addressing issues in isolation.<br />

THE NEED FOR THE OMM PROGRAMME<br />

The OMM Programme aims to improve socio-economic growth<br />

in the Limpopo Province through the acceleration of the Olifants<br />

River Water Resources Development Plan (ORWRDP) and the costeffective<br />

provision of potable and raw water infrastructure to<br />

defined areas in the Northern and Eastern Limbs of the Bushveld<br />

Igneous Complex.<br />

In the early 2000s, DWS conceptualised the ORWRDP to address<br />

the bulk water needs of the middle Olifants River catchment<br />

area. Projected water demands had increased significantly due<br />

to the anticipated development of the mining sector. A key<br />

objective of government was to stimulate this mining growth<br />

and associated economic activity in a sustainable way for the<br />

8<br />

9

WATER<br />

WATER<br />

OMM PROGRAMME OVERVIEW<br />

The scope of work entails:<br />

Augment Supply. Move a portion of the scheme’s current<br />

supply from Flag Boshielo Dam, via the abstraction point on<br />

the Olifants River at the Havercroft Weir, to the De Hoop Dam<br />

to enable water supply to the Mogalakwena area from the Flag<br />

Boshielo Dam.<br />

Re-sequence ORWRDP. Re-sequence the construction of the<br />

ORWRDP bulk raw water infrastructure to meet revised water<br />

needs and reduce capital costs.<br />

Establish resource partnership. Set up a partnership to construct,<br />

operate and maintain defined infrastructure.<br />

Implement socio-economic development. Put a SED plan<br />

into effect that is focused on potable water (for approximately<br />

380 000 people), sanitation services, connectivity, education<br />

and enterprise development to develop skills, create jobs and<br />

change behaviour.<br />

benefit of the local and national economy in concert with the<br />

Growth and Development Strategy and the Spatial Development<br />

Framework of the province.<br />

ORWRDP is a designated strategic integrated project in terms<br />

of section 7(1) of the Infrastructure Development Act, 2014 and of<br />

significant importance to South Africa.<br />

Phase 1 of the project, raising Flag Boshielo Dam by five metres,<br />

was closely aligned to the developing mining sector in the area.<br />

Prosperity in the area is closely linked to mining as it creates<br />

employment opportunities and economic growth – and water<br />

is the catalyst for this development. The ORWRDP Phase 2 forms<br />

part of the Presidential Infrastructure Coordinating Commission’s<br />

strategic infrastructure projects, which were aimed at fasttracking<br />

development and growth across South Africa.<br />

The construction of De Hoop Dam was the second phase of the<br />

ORWRDP and was first announced by President Mbeki in 2003 as<br />

one of the flagship programmes of government’s Accelerated and<br />

Shared Growth Initiative for South Africa (AsgiSA). De Hoop is the<br />

13th largest dam in the country with a 347-million cubic metre<br />

reservoir capacity.<br />

The importance of the dam was twofold; it would be a bulk<br />

storage facility to augment the water supply around the Steelpoort<br />

and Olifants rivers as well as to the mines and unlock vast deposits<br />

of platinum group metals (PGM) found in the region – the largest<br />

known unexploited mineral wealth in our country.<br />

While the ORWRDP was partially developed over the last<br />

two decades, recent studies together with rising community<br />

pressure have highlighted the need to adjust and accelerate<br />

the ORWRDP.<br />

In the Eastern Limb of the ORWRDP, social unrest has impacted<br />

on communities’ access to potable water and mines and other<br />

commercial operations’ ability to safely operate. There had also<br />

been increasing levels of vandalism on water infrastructure.<br />

With bulk raw water pipelines passing through communities<br />

that have no access to water, the communities’ frustrations are<br />

understandable. Their difficulties are further compounded by the<br />

lack of employment, economic development and opportunities.<br />

The concerns of the community are valid, and something needed<br />

to be done to improve their quality of life.<br />

The OMM Programme aims to accelerate the delivery of bulk<br />

raw and potable water infrastructure to the Northern and Eastern<br />

Limbs of the Bushveld Igneous Complex.<br />

OBJECTIVES OF THE OMM PROGRAMME<br />

Given the country and the region’s endowment of critical raw<br />

materials, water infrastructure development is a key enabler to<br />

create employment through the infrastructure programmes, mining<br />

expansion and manufacturing of renewable energy technology. This<br />

aligns with the South Africa’s industrialisation objectives.<br />

Besides providing much-needed water to communities, the<br />

OMM Programme will unlock the enormous strategic mineral and<br />

industrialisation potential of the region to capitalise on the global<br />

transition to cleaner energy. Key benefits include:<br />

Water security. Accelerate delivery of the ORWRDP as part of<br />

the OMM Programme and supply potable and bulk raw water to<br />

identified areas.<br />

Economic growth. Develop enabling infrastructure essential to<br />

the industrialisation of the Bushveld Igneous Complex and to take<br />

advantage of mining commodity cycles.<br />

Job creation. Create local jobs through construction and system<br />

operations, as well as mining developments and develop skills in<br />

the water sector.<br />

Cost savings. Re-sequence the build programme to utilise<br />

existing dams and infrastructure to their optimal efficiency levels.<br />

Fiscus support. Private sector contributions to the infrastructure<br />

programme will provide support to the fiscus while tax revenues<br />

will also benefit from the increased economic activity in the region.<br />

Socio-economic development. SED in Limpopo will also be<br />

accelerated through localisation of infrastructure and operational<br />

spend as well as widening the skills base through local and<br />

regional development.<br />

Sustainability. Mandate and equip the OMM WUA to implement,<br />

manage, operate and maintain the OMM Programme.<br />

Replicable model. The public-private collaboration model has<br />

the potential to be replicated across the country and other sectors.<br />

Social harmony. Improve integration through the provisioning of<br />

water, job creation and SED.<br />

Water conservation. The Programme will implement behavioural<br />

change programmes with a focus on conscious water use.<br />

Water reuse. SED activities will prioritise sanitation and water<br />

reuse and address wastewater treatment.<br />

ESG footprint. The OMM seeks to make optimal use of<br />

infrastructure resources (cement, steel, diesel, etc) to minimise<br />

its footprint.<br />

SUSTAINABLE DEVELOPMENT<br />

Sustainable development is one of the key underlying concepts of<br />

the OMM WUA’s mission, vision and strategy. The United Nations<br />

adopted 17 Sustainable Development Goals in 2015 as a universal<br />

call to action to end poverty, protect the planet and ensure that<br />

by 2030 all people enjoy peace and prosperity. The 17 goals are<br />

integrated, and it is recognised that action in one area will affect<br />

outcomes in others, and that development must balance social,<br />

economic and environmental sustainability. The defined OMM<br />

Programme targets will directly or indirectly impact on all these<br />

sustainable development goals.<br />

SOCIO-ECONOMIC BENEFITS<br />

Formal economic activity in Limpopo is highly diverse and is<br />

characterised by commercial and subsistence agriculture, mining<br />

activities, manufacturing, commerce and tourism. Large coal, PGM<br />

as well as copper and phosphate deposits are found in the area. The<br />

Olifants Catchment is home to several large thermal power stations<br />

that are strategically important, and which provide energy to the<br />

country as a whole.<br />

A large proportion of the catchment is not economically active<br />

(45%), with a further quarter (24%) of the population being<br />

unemployed. Only a third of the population (31%) are employed<br />

of which 68% are employed in the formal sector.<br />

The OMM Programme represents a significant opportunity<br />

for SED in the region given the extent of the infrastructure<br />

programme across the province and its associated<br />

capital and operational spend.<br />

Themes to steer development<br />

Five priority themes have been identified to steer socioeconomic<br />

development activities, and all SED projects<br />

within the OMM Programme will align to the themes<br />

represented in the diagram on the left. A central hub<br />

concept is to underpin all collaboration, to ensure inclusivity<br />

and transparency. In terms of quick wins, the OMM<br />

Programme aims to expand on existing SED projects (youth<br />

leadership and entrepreneur development), work with<br />

existing Water Service Authority projects, collaborate with<br />

schools and build on existing technology infrastructure.<br />

WATCH VIDEO<br />

The five priority themes that have been identified to steer socio-economic<br />

development activities.<br />

Watch Bertus Bierman, CEO of Lebalelo Water User Association<br />

in an interview with Gordon Brown, publisher of <strong>Green</strong><strong>Economy</strong>.<br />

Media.<br />

The dam will supply water to thousands of residents as well as mines in the Waterberg, Sekhukhune and Capricorn districts.<br />

GREEN OUTCOMES<br />

The OMM Programme will pursue:<br />

Renewable energy. Considering water resource availability and<br />

regional water needs, additional studies will be conducted in the<br />

pre-feasibility phase of the OMM Programme to further optimise<br />

and reduce water costs through energy use optimisation and the<br />

use of renewable energy.<br />

Future challenges will<br />

depend on current responses.<br />

10<br />

11

OUR IMPACT<br />

PURPOSE<br />

To safeguard global sustainability<br />

through our metals and energy<br />

solutions.<br />

The difference we make in the world through our business.<br />

Core guiding principles - the basis for all our decisions and actions.<br />

VISION<br />

To be a leader in superior shared value<br />

for all stakeholders.<br />

ESG AND SHARED VALUE<br />

STRATEGIC FOUNDATION<br />

C.A.R.E.S VALUES

MINING<br />

MINING<br />

Anglo American Plc<br />

Cox et al. 2022<br />

Projected demand<br />

change for copper and<br />

nickel requirements<br />

for energy transition<br />

technology. The solid<br />

bars show the amount<br />

of metal demand<br />

projected for the<br />

energy transition, while<br />

the transparent bar<br />

shows the actual total<br />

demand for copper<br />

and nickel across all<br />

industries in 2020.<br />

Anglo American Plc, Kumba Iron Ore, Sishen.<br />

industry and government. The idea that the industry supplying the<br />

technology for renewable energy is also opposing the economic<br />

policy needed to curb emissions is counterproductive. Simple<br />

economic modelling proves that resisting a carbon tax is the wrong<br />

strategy for the industry.<br />

METALS OUT, A LITTLE CO2 IN<br />

There are many factors throughout the mining process that<br />

contribute to carbon emissions. The commodity being mined<br />

heavily influences the number of emissions and where the<br />

emissions are generated throughout the mining process.<br />

For iron and steel most emissions are generated in the later<br />

stages during smelting. Mining copper ore, on the other hand,<br />

generates most of its emissions in the earlier stages during the<br />

crushing, grinding and hauling of ore.<br />

One way to look at the impacts of carbon taxation in mining is to<br />

compare the commodity’s carbon footprint to its economic value.<br />

For example, the average carbon footprint of copper is 3.83 tons of<br />

carbon dioxide per ton of copper.<br />

So, for each ton of carbon dioxide emitted, 261 kilograms of<br />

copper worth US$1 700, using 2019 copper prices, are produced.<br />

This is a relatively high value. The same cannot be said for other<br />

The economic case<br />

for the mining industry<br />

to support carbon taxation<br />

Anglo American Plc<br />

As governments try to navigate a path to a safe climate in the 21st century, the public<br />

debate has focused on net zero, carbon taxes, electrification and renewable energy. Mining<br />

is rarely an anchor point of the discussion, even though renewable energy infrastructure<br />

and low-carbon technology require vast amounts of metals and minerals.<br />

BY SALLY INNIS, BENJAMIN COX, JOHN STEEN, NADJA KUNZ*<br />

Nickel, for example, is essential for electric vehicles and<br />

battery storage. The amount of nickel required by 2040<br />

for the energy transition alone will be equal to the total<br />

demand for nickel across all industries in 2020, according to the<br />

International Energy Agency.<br />

There is widespread consensus among economists that carbon<br />

taxation is one of the most effective policies to reduce carbon<br />

emissions. Presently, 27 countries have enacted carbon taxation<br />

policy at the national level, however only seven of these are<br />

leading mining countries, and mining companies and industry<br />

organisations oppose carbon taxes in many of these countries.<br />

Addressing climate change requires a coalition between<br />

Anglo American Plc, Platinum, Mogalawkwena North Concentrator.<br />

14<br />

15

MINING<br />

MINING<br />

One way to look at the impacts<br />

of carbon taxation in mining is to compare<br />

the commodity’s carbon footprint<br />

to its economic value.<br />

industries, like animal agriculture, where a ton of carbon emissions<br />

corresponds to about US$125 of wholesale beef (using equivalent<br />

2019 pricing).<br />

HOW WOULD A CARBON TAX AFFECT MINING?<br />

The basics of a carbon tax are that more carbon-intensive<br />

industries will be taxed more. Our study tested three levels of<br />

carbon taxation: US$30, US$70 and US$150 per ton of carbon<br />

dioxide, and compared them against commodity prices in 2019.<br />

These levels closely follow the Pan-Canadian approach to carbon<br />

pollution pricing, which are currently set to $50 per ton and<br />

increase $15 per year to $170 in 2030.<br />

We modelled the impact of a carbon tax on a range of<br />

commodities. Our model included all Scope 1 and Scope 2<br />

emissions – direct emissions from the source and indirect<br />

emissions associated with heating, cooling or electricity.<br />

The production of some commodities is more carbon-intense<br />

than others, which affects the impact of the carbon price.<br />

In some cases, the carbon tax can be greater than the product’s<br />

value. When the price of carbon is US$150, coal is taxed at 144%<br />

of its value. Copper, on the other hand, is taxed at 10% of its value.<br />

Two metals are outliers to the industry: aluminum and steel. The<br />

mining of the raw materials is not carbon intensive. Bauxite and<br />

iron ore generate 0.005 and 0.02 tons of carbon dioxide per ton<br />

of product respectively but smelting these ores into metals emits<br />

more carbon in production.<br />

MINING FOR CARBON TAXES<br />

Outside of aluminum refining and steel mills, the mining industry<br />

will perform better with a carbon tax than it would without one.<br />

This is because the carbon tax would increase the price of fossil<br />

fuels relative to renewable energy and the materials required for<br />

renewable energy technology.<br />

For example, the costs of coal used for energy production will<br />

more than double, making electricity from coal increasingly<br />

uncompetitive. The rising demand for solar and wind power will<br />

drive further increases in the consumption of base metals for wind<br />

turbines and solar panels.<br />

If implemented on a global scale, a carbon tax would not change<br />

the underlying cost of the base metal business, but it does have<br />

vast financial benefits for the mining sector. These benefits come<br />

from the increased demand for metals from the energy transition,<br />

paired with a relatively lighter percentage of global carbon taxes, in<br />

comparison to other industries.<br />

The impact of<br />

three levels of<br />

carbon taxation<br />

(US$30, $70 and<br />

$150) modelled<br />

as a percentage<br />

of present<br />

product value<br />

for selected<br />

commodities.<br />

This shows<br />

that most<br />

mining industry<br />

and energy<br />

transition<br />

commodities<br />

will not be taxed<br />

to the same<br />

degree as other<br />

commodities.<br />

Rather than opposing carbon taxes, the mining sector should<br />

become a global advocate for aggressive carbon targets, the<br />

harmonisation of international carbon taxes and pursue further<br />

reductions to emissions such as the electrification of fleets or<br />

carbon offsets.<br />

SA CARBON TAX<br />

South Africa introduced a carbon tax in June 2019 as part of<br />

a package of policy measures to help achieve the Nationally<br />

Determined Contribution commitments submitted under the<br />

Paris Agreement. To assist industries to transition to sustainable<br />

and low-carbon practices in a cost-effective manner, a carbon<br />

offset tax-free allowance is provided to companies under the<br />

Carbon Tax Act (No 15 of 2019) to help reduce their carbon tax<br />

liability and encourage additional investments in eligible lowcarbon<br />

offset projects.<br />

The Conversation under Creative Commons License<br />

MINING UNDER PRESSURE TO DECARBONISE OPERATIONS<br />

In 2021, President Ramaphosa recommitted South Africa to a<br />

series of steps aimed at reducing the country’s carbon footprint<br />

because “the world is facing a climate crisis of unprecedented<br />

proportions”. South Africa joins the world in this urgency as it<br />

races to achieve net zero targets over the coming decades.<br />

Sameer Singh, research analyst at Old Mutual Wealth Private<br />

Client Securities, says that to reach the goal of carbon net zero,<br />

industry at large, and diversified miners specifically, can expect<br />

increased stakeholder pressure and must plan for business<br />

process transformation to remain both relevant and profitable.<br />

“Mining, as an extractive activity, leaves a long-lasting mark<br />

on the environment. Additionally, the processes of extraction<br />

and refining emit a substantial amount of greenhouse gases. The<br />

mining industry specifically will see dramatic shifts in both the<br />

demand for their products and the regulatory environment. For<br />

some it will signal the beginning of the end, while for others it will<br />

be the start of a new growth trajectory,” says Singh.<br />

One miner plotting the path of mining for the future is Anglo<br />

American. For much of the company’s existence, it had been about<br />

expansion. The 21st century ushered in a phase of consolidation,<br />

which saw the group shifting from operating eight business units<br />

with multiple commodities to four key business units and six<br />

commodity groups.<br />

Anglo’s strategic shift started in 2015 when the miner<br />

recognised both a change in demand as well as the inevitable<br />

need to define a relevant and more responsible mining industry<br />

of the future.<br />

Singh says increased demand for platinum group metals<br />

(PGMs) is far more than a cyclical commodity trend. “Renewable<br />

energy, electric vehicles and battery storage, electricity networks<br />

and other clean energy technologies require significantly greater<br />

amounts of critical minerals than we are currently consuming.<br />

Transitioning to and meeting this increased demand will be a key<br />

focus for all miners over the next few decades. PGMs are integral<br />

to the energy transition value chain, where hydrogen plays a big<br />

role too,” he says.<br />

Singh says the miner’s vision, which aims to build connected,<br />

intelligent, automated and waterless mines, should see the miner<br />

achieve “less waste, fewer inputs, reduced energy consumption<br />

and lower capital intensity, which are all earnings accretive”.<br />

Anglo is focusing on renewable energy generation, switching<br />

Anglo American Plc, Platinum, water testing at Der Brochen, South Africa.<br />

from diesel for fuel to hydrogen, battery energy storage,<br />

limiting methane emissions, pursuing carbon efficiency and<br />

implementing emission compensation strategies.<br />

“When investors look at the medium and long-term prospects<br />

of mining companies, they should do so with a future-oriented<br />

lens and track where the miner is going relative to where the<br />

world is going, and what stakeholders will demand,” adds Singh.<br />

Anglo has already secured 100% renewable energy for all its<br />

South American operations and is currently testing the mining<br />

industry’s first hydrogen-electric haul truck.<br />

“From an investor’s perspective, Anglo is doing all the right<br />

things and is executing them well,” explains Singh. He adds<br />

that 8% of the company’s long-term incentives are linked to<br />

greenhouse emission reductions and 5% of annual bonuses are<br />

tied to key environmental programmes.<br />

Operationally, the group has realised an 8% improvement in<br />

energy efficiency and a 22% saving in greenhouse gas emissions.<br />

Earlier this year, the group concluded the spin-off of its South<br />

African thermal coal business and announced the sale of South<br />

American thermal coal.<br />

By 2030 Anglo is targeting a 30% improvement in energy<br />

efficiency, a 30% net reduction in greenhouse gas emissions, aims<br />

to have eight carbon neutral sites and by 2040 the group aims to<br />

be carbon neutral across all its operations.<br />

Anglo American has signed a MoU with EDF Renewables, a<br />

global leader in renewable energy to work together towards<br />

developing a regional energy ecosystem in South Africa. While<br />

there is an abundance of solar and wind power in our country,<br />

there is limited renewables infrastructure to harness it.<br />

*Sally Innis, PhD candidate, Benjamin Cox, PhD student, mining engineering, John Steen, ey distinguished scholar, global mining futures, Nadja Kunz, Canada research chair and assistant professor,<br />

mining, all from University of British Columbia.<br />

Anglo American South Africa PGM operations, such as Mogalakwena (featured), are increasingly using treated effluent, or grey water, rather than<br />

drawing on freshwater supplies.<br />

16<br />

17

CoUnCIL FoR GEosCIEnCE<br />

CoUnCIL FoR GEosCIEnCE<br />

CoUnCIL FoR GEosCIEnCE<br />

The Council for Geoscience (CGS) is the national custodian responsible for the collection, compilation and curation of<br />

May<br />

all<br />

2022<br />

onshore and offshore geoscience data and information. The CGS aims to use this information and knowledge to develop<br />

geoscience solutions to real-world challenges in South Africa.<br />

The Council for Geoscience (CGS) is the national custodian responsible for the collection, compilation and curation of all<br />

onshore and offshore geoscience data and information. The CGS aims to use this information and knowledge to May develop 2022<br />

geoscience solutions to real-world challenges in South Africa.<br />

MInERaLs The Council anD for EnERGY Geoscience (CGS) is the national custodian responsible for the collection, compilation EnGInEERInG and curation GEoLoGY of all<br />

The onshore Minerals and and offshore Energy theme geoscience data and information. The CGS aims to use this information anD and knowledge GEoHaZaRDs to develop<br />

includes geoscience integrated solutions geoscience to real-world challenges in South Africa.<br />

As the custodian of the national<br />

MInERaLs mapping, anD which EnERGY is the core<br />

seismological EnGInEERInG network, GEoLoGY the<br />

function of the CGS. This theme<br />

CGS<br />

The Minerals and Energy theme<br />

anD monitors GEoHaZaRDs and maintains<br />

aims to attain a fundamental<br />

a geohazard inventory for<br />

includes understanding integrated geoscience of South<br />

South As the Africa. custodian This of information the national<br />

mapping, Africa’s which is the core<br />

seismological network, the<br />

function<br />

MInERaLs onshore<br />

of the CGS.<br />

anD and EnERGY offshore<br />

is<br />

This theme<br />

EnGInEERInG primarily used in<br />

CGS monitors and<br />

GEoLoGY developing<br />

geology using an innovative<br />

effective maintains<br />

aims The to Minerals attain and a fundamental<br />

Energy theme<br />

anD<br />

a geohazard<br />

GEoHaZaRDs<br />

and novel geohazard<br />

multidisciplinary approach. The<br />

mitigation solutions inventory promote for<br />

understanding includes theme encompasses integrated of fundamental<br />

geoscience South<br />

As safe South the and custodian Africa. judicious This of the land information national use.<br />

Africa’s mapping, geoscience onshore which mapping, and is offshore economic the core<br />

seismological Modern primarily artificial used network, intelligence<br />

developing the<br />

function geology using of and the geochemistry an CGS. innovative This theme and<br />

CGS techniques effective monitors and are novel and applied maintains geohazard<br />

multidisciplinary aims various to geophysical attain approach. a fundamental<br />

techniques. The<br />

a subsidence mitigation geohazard mapping solutions inventory and seismic promote for<br />

theme understanding These encompasses data are fundamental of integrated South<br />

South hazards safe Africa. and characterisation.<br />

judicious This information land use.<br />

geoscience Africa’s towards enabling onshore mapping, South and economic offshore Africa’s<br />

is Modern primarily artificial used in developing intelligence<br />

geology<br />

geology minerals and and using<br />

geochemistry energy an security innovative<br />

and and<br />

effective<br />

techniques<br />

and novel<br />

are<br />

geohazard<br />

applied in<br />

various<br />

multidisciplinary socioeconomic geophysical growth. approach.<br />

techniques.<br />

The<br />

mitigation<br />

subsidence<br />

solutions<br />

mapping<br />

to<br />

and<br />

promote<br />

seismic<br />

theme encompasses fundamental<br />

safe and judicious land use.<br />

These data are integrated<br />

hazards characterisation.<br />

geoscience mapping, economic<br />

Modern artificial intelligence<br />

towards enabling South Africa’s<br />

geology and geochemistry and<br />

techniques are applied in<br />

minerals<br />

various<br />

and<br />

geophysical<br />

energy security<br />

techniques.<br />

and<br />

subsidence aFRICan mapping FootPRInt and seismic anD<br />

socioeconomic<br />

These WoRLD data CLass growth.<br />

are FaCILItIEs integrated<br />

otHER hazards characterisation.<br />

CoLLaBoRatIons<br />

The towards geoscience enabling functions South Africa’s of the<br />

As the Permanent Secretariat<br />

minerals CGS are and supported energy security by a multifacetted<br />

laboratory growth. that performs<br />

Geological aFRICan Surveys FootPRInt (OAGS), anD<br />

and<br />

of the Organisation of African<br />

socioeconomic<br />

WoRLD a wide range CLass of analytical FaCILItIEs services<br />

the otHER CGS leaves CoLLaBoRatIons<br />

an impressive<br />

such as petrography, whole rock<br />

footprint in the African continent<br />

The geoscience functions of the<br />

As the Permanent Secretariat<br />

geochemistry, petrophysics, coal<br />

where<br />

CGS are supported by a multifacetted<br />

WoRLD and<br />

aFRICan it oversees<br />

of the Organisation FootPRInt and carries<br />

of anD African<br />

science<br />

laboratory CLass hydrochemistry.<br />

that FaCILItIEs In<br />

WatER anD EnVIRonMEnt<br />

out<br />

performs<br />

otHER various<br />

Geological CoLLaBoRatIons<br />

geoscience services<br />

addition, the CGS manages a<br />

The CGS carries out hydrogeological studies and<br />

in line with global<br />

Surveys<br />

standards,<br />

(OAGS),<br />

a wide The geoscience range geoscience of analytical museum, functions services library, of the<br />

aquifer modelling. In addition, the organisation carries<br />

As international the the CGS Permanent leaves policy an Secretariat impressive and<br />

such CGS bookshop as petrography, are supported and a national whole by a rock multifacetted<br />

repository, laboratory all petrophysics, of which that are performs coal used<br />

Geological where it oversees Surveys and (OAGS), carries<br />

core<br />

out environmental geoscience research which aims to<br />

of governance. footprint the Organisation in the In African this of capacity, African continent<br />

geochemistry,<br />

science and hydrochemistry. In<br />

WatER<br />

provide sustainable<br />

anD EnVIRonMEnt<br />

solutions to monitor and mitigate the<br />

the CGS also collaborates with<br />

a by wide the range scientific of analytical community services and<br />

impact of geology and mining activities on the health of<br />

the various out CGS various academic leaves geoscience an institutions impressive services and<br />

addition, such the general as the petrography, CGS public. manages whole rock a<br />

The the environment CGS carries and out its inhabitants. hydrogeological studies and<br />

footprint science line councils. in with the African global continent standards,<br />

geoscience geochemistry, museum, petrophysics, library, coal aquifer modelling. In addition, the organisation carries where international it oversees and policy carries and<br />

bookshop science and hydrochemistry. a national core In<br />

WatER anD EnVIRonMEnt<br />

out environmental geoscience research which aims to<br />

out governance. various geoscience In this services capacity,<br />

repository, addition, all the of CGS which manages are used a provide The CGS sustainable carries solutions out hydrogeological to monitor and studies mitigate and the in the line CGS with also global collaborates standards, with<br />

CGs by geoscience the at scientific WoRK museum, community library, and<br />

impact aquifer of modelling. geology and In addition, mining activities the organisation on the health carries of international various academic policy institutions and and<br />

the bookshop general public. and a national core the out environmental and geoscience its inhabitants. research which aims to<br />

governance. science councils. In this capacity,<br />

• repository, The CGS all is of undertaking which are used an integrated provide and sustainable multidisciplinary solutions geoscience to monitor and mapping mitigate the programme the across CGS South also collaborates Africa. with<br />

• by Some the scientific recent community projects under and this programme impact of geology include: and mining activities on the health of<br />

various academic institutions and<br />

the - Multidisciplinary general public. geoenvironmental baseline the environment investigations and its inhabitants.<br />

the southern Karoo into the feasibility science of shale councils. gas development.<br />

CGs at This WoRK work has uncovered previously undefined groundwater aquifers.<br />

• The - Regional CGS is undertaking soil geochemical an integrated sampling and and multidisciplinary detailed follow-up geoscience surveys, particularly mapping programme in the Northern across Cape, South North Africa. West and<br />

CGs at WoRK<br />

• Some Mpumalanga recent projects Provinces. under this programme include:<br />

-• Multidisciplinary The - Geothermal CGS is undertaking energy geoenvironmental and an carbon integrated capture baseline and and multidisciplinary investigations storage research, in geoscience the southern aiming mapping to Karoo expand into programme South the feasibility Africa’s across current of South shale renewable Africa. gas development. energy<br />

• This Some mix<br />

work<br />

while recent has<br />

decreasing projects uncovered under the<br />

previously<br />

country’s this programme carbon<br />

undefined<br />

footprint. include: groundwater aquifers.<br />

- Regional - Ground Multidisciplinary stability and<br />

soil geochemical geoenvironmental geotechnical assessments<br />

sampling baseline and detailed investigations for infrastructure<br />

follow-up the development<br />

surveys, southern particularly Karoo in the into Northern in the feasibility Cape<br />

Northern of and shale Free<br />

Cape, gas State<br />

North development. Provinces.<br />

West and<br />

Mpumalanga This work has Provinces. uncovered previously undefined groundwater aquifers.<br />

- Geothermal - Regional soil energy geochemical and carbon sampling capture and and detailed storage follow-up research, surveys, aiming particularly to expand South in the Africa’s Northern current Cape, renewable North West energy and<br />

mix Mpumalanga while decreasing Provinces. the country’s carbon footprint.<br />

- Ground - Geothermal stability energy and geotechnical and carbon assessments capture and storage for infrastructure research, development aiming to expand in the South Northern Africa’s Cape current and Free renewable State Provinces. energy<br />

mix while decreasing the country’s carbon footprint.<br />

ContaCt<br />

- Ground<br />

Us<br />

stability and geotechnical assessments for infrastructure development in the Northern Cape and Free State Provinces.<br />

Our head office is located at: 280 Pretoria Street, Pretoria, 0184 I @CGS_RSA I I I<br />

Tel: +27 (0)12 841 1911 I Email: info@geoscience.org.za I Web: www.geoscience.org.za<br />

ContaCt Us<br />

Our ContaCt head office Us is located at: 280 Pretoria Street, Pretoria, 0184 I @CGS_RSA I I I<br />

Tel: Our +27 head (0)12 office 841 is 1911 located I Email: at: 280 info@geoscience.org.za Pretoria Street, Pretoria, 0184 I Web: I www.geoscience.org.za<br />

@CGS_RSA I I I<br />

Tel: +27 (0)12 841 1911 I Email: info@geoscience.org.za I Web: www.geoscience.org.za<br />

May 2022<br />

CS2022_ Advert_ CGS Services (Generic)_ Full Page (210x275mm)_ May 2022_ 20220429_ v1.indd 1 2022/04/29 09:22:53<br />

Carbon Capture, Utilisation and Storage<br />

in a South African context<br />

Owing to its reliance on a coal-based energy supply, South Africa ranks globally as one of the<br />

high emitters of greenhouse gases. The Council for Geoscience has been commissioned by<br />

Department of Mineral Resources and Energy to pilot and prove Carbon Capture Utilisation<br />

and Storage in our country.<br />

BY THE COUNCIL FOR GEOSCIENCE<br />

Early research has formulated an Atlas of Geological Storage<br />

focussing on the prospectivity of deep saline aquifers and<br />

depleted oil and gas reservoirs. However, given that the<br />

major CO2 emissions point sources are located inland, primarily<br />

in Mpumalanga and Gauteng, a shift in focus to possible storage<br />

sites proximal to major point-source CO2 emitters was initiated.<br />

As such, the Council for Geoscience has entered into agreements<br />

with the Govan Mbeki Local Municipality in Mpumalanga to<br />

establish a Carbon Capture Utilisation and Storage (CCUS) pilot<br />

injection and storage project near Leandra. It is envisaged that<br />

10 000 to 50 000 tons of CO2 will be injected into Archaean-age<br />

(2 700-million-year-old) mafic and ultramafic formations of the<br />

Ventersdorp Supergroup at depths ranging between 1 000 and<br />

1 700m below the surface.<br />

Mafic volcanic rocks comprise 60% of the earth’s surface and,<br />

owing to their widespread distribution globally, are deemed<br />

viable targets for CO2 sequestration in regions where classical<br />

sedimentary storage options are limited. Mafic (commonly<br />

basalts) and ultramafic units are rich in divalent cations (eg Ca2+,<br />

Mg2+, and Fe2+) which are chemically reactive to CO2.<br />

The addition of water, either injected with the CO2 plume, or<br />

as formational waters, results in the formation of stable, nontoxic,<br />

void-filling carbonate minerals such as calcite, magnesite,<br />

and siderite. In these conditions, geological soluble and mineral<br />

storage conditions are created significantly more rapidly than<br />

can be achieved through conventional storage options, with<br />

mineralisation occurring within a matter of years post-injection.<br />

The current project identified potential target injection zones<br />

within mafic and ultramafic volcanic rocks of the Klipriviersberg<br />

Group which forms the base of the Ventersdorp Supergroup in<br />

the region. The core of sixteen boreholes in the area was scanned<br />

at the National Core Library of the Council for Geoscience<br />

at Donkerhoek using Intellicore hyperspectral core imaging<br />

software. The hyperspectral scanner at the library allows for<br />

high-resolution core imaging in the Red-<strong>Green</strong>-Blue (RGB), Short<br />

Wavelength Infra-Red (SWIR) and Long Wavelength Infra-Red<br />

(LWIR) bands, as well as mineral and spectral classifications.<br />

Of the scanned boreholes, two (BH2068 and BH2188) occur<br />

within a 3km radius of the study area and were therefore<br />

selected for detailed logging and appraisal. The boreholes<br />

achieve adequate depths to intersect deep potential reservoir<br />

zones greater than 800m. For basaltic injection, however, the<br />

800m supercritical CO2 phase barrier is not of vital importance,<br />

as evidenced by the shallow (400-800m depth) injections in the<br />

Carbfix project in Iceland.<br />

The current study focuses primarily on basaltic reservoir/seal<br />

pairs located at depths greater than 800m. This allows for the<br />

potential injection of supercritical, dry (non-water-dissolved) CO2<br />

(as has been achieved by Big Sky Regional Carbon Sequestration<br />

Partnership in Wallula, USA).<br />

STORAGE<br />

Schematic<br />

illustration<br />

of a possible<br />

CCUS site<br />

in Govan<br />

Mbeki<br />

Municipality.<br />

The boreholes were logged at centimetre scale utilising RGB<br />

and mineral composition band ratios to define potential reservoir<br />

zones and associated seals. Cut-off values of 5m thickness, like<br />

those used in the Wallula project, were chosen to delineate the<br />

most prospective reservoir seal pairs. The identified pairs were<br />

subsequently logged and sampled. Reservoir zones comprised<br />

both ultramafic volcanic units, highly porphyritic lava flows,<br />

highly vesicular and amygdaloidal flow-top zones, agglomerates<br />

and flow-top breccias, whilst confining zones (cap rocks) are<br />

defined by individual massive basaltic flows, massive basalt flow<br />

interiors and entablature zones.<br />

In line with international best practice, guidelines for CCUS site<br />

characterisation requires data on porosity, permeability, water<br />

saturation, salinity and pore pressure data to effectively define<br />

and model potential reservoir/seal pairs within specific geological<br />

strata. Analyses of these criteria are currently underway at the CGS<br />

using X-ray fluorescence, X-ray diffraction, helium porosimetry,<br />

conventional optical microscopy, scanning electron microscopy<br />

and X-ray tomography.<br />

Resultant porosities determined for 15 potential seal and 23<br />

reservoir units correlate well with low apparent values defined<br />

for confining zones and reservoir zones, respectively, within the<br />

Columbia River basalts of the Wallula project. Results for average<br />

envelope (bulk) density, true density and porosity are closely<br />

aligned with findings published internationally.<br />

Geological characterisation has defined potential injection<br />

zones within porphyritic basalts, breccia zones and ultramafic<br />

volcanics developed between the depth intervals of 1 000 and<br />

1 700m. The targeted injection reservoirs are capped by massive<br />

basalts, recognised to have low permeability. The identified<br />

sequence of stacked reservoir/seal pairs results in a world-first<br />

scientific opportunity to study the chemical reaction behaviour<br />

of CO2 within Archaean (2 700 Ma) volcanic sequences. The<br />

Council for Geoscience will continue research and development,<br />

including extensive environmental baseline monitoring, with a<br />

view to establishing the first pilot CCUS site in South Africa.<br />

19

MINING<br />

MINING<br />

SUNSHINE IS GOLDEN<br />

FOR THE<br />

MINING INDUSTRY<br />

BASF<br />

This case study details the renewable energy solution modelled for a tailings processing<br />

and exploration diamond mining operation. It uses certain assumptions to demonstrate<br />

the engineering and economic feasibility of various hybrid energy approaches.<br />

BY GLYNIS COETZEE, TOUCHPOINT ENERGY*<br />

CASE STUDY: RENEWABLE ENERGY SOLUTION FOR MINE<br />

Technical and commercial review for a solar photovoltaic and battery energy storage hybrid<br />

project to supply a South African based mine.<br />

Storage projects in Varel, Lower Saxony, Germany using NaS (sodium suphur) batteries. For more information on NaS batteries in South Africa,<br />

please email Lloyd Macfarlane, Altum Energy at lloyd@altum.energy.<br />

PROBLEM STATEMENT<br />

The mine operation, which runs crushing and sorting machines,<br />

water processing and purification as well as general mining<br />

processes has a monthly electricity bill of between R3.5-million and<br />

R5-million, comprising and inclusive of usage charges in cents per<br />

kWh consumed, network demand charge in cents per kWh, as well<br />

as other service and ancillary charges at fixed rates.<br />

The primary objective of this project’s first phase is to lower<br />

the electricity consumption and therefore usage costs of the<br />

mine operation and improve the yield, by the installation of a<br />

photovoltaic (PV) solar energy generation system. This PV solar<br />

system is intended to provide cheaper electricity, generated from a<br />

renewable resource and, if economically viable, provide non-fossil<br />

fuel security of supply, by the additional installation of an energy<br />

storage system (ESS) to mitigate load shedding and other outages<br />

that may occur periodically due to lightning strikes or other<br />

unforeseen events.<br />

BATTERY ENERGY STORAGE SYSTEM<br />

A battery energy storage system (BESS) has been selected to meet<br />

these objectives. Both Lithium Iron (Life) and Sodium Sulphur<br />

(NaS) BESS options were examined to determine the optimum<br />

Levelised Cost of Storage (LCOS) in this application. The ratio split<br />

between off-peak, standard and peak usage costs are calculated<br />

as a percentage of the total consumption to provide a basis<br />

for modelling the application of the BESS. The NaS BESS was<br />

selected as the NaS economics are advantageous when compared<br />

to LiFe under these conditions and is most suitable for the<br />

six-hour option, while the LiFe BESS is more suitable for a twohour<br />

backup.<br />

The addition of a BESS to provide uninterrupted power for the<br />

full 24-hour operational cycle, essentially creating a fully gridindependent<br />

energy usage scenario, would potentially allow for<br />

a lowering of the network maximum demand (NMD) charges by<br />

lowering the peak. Due to the initial CapEx costs, this would likely<br />

have the nett effect of increasing the usage tariff above the current<br />

Eskom tariff, diminishing the cost savings, thus the focus is on<br />

operational expenditure cost saving for now.<br />

CHALLENGES AND ASSUMPTIONS<br />

The primary challenge is to ensure that the solution is financially<br />

beneficial to the operation by being able to offer a reduced<br />

tariff on a power purchase agreement (PPA) for a set period. In<br />

this instance, it is assumed that there will be a 15-year PPA –<br />

reducing the period further will have the effect of increasing the<br />

proposed tariff.<br />

The mine is on a Time of Use (ToU) tariff of Ruraflex Interval<br />

and to determine the competitive levelised tariff which must be<br />

achieved, the breakdown of percentage usage in each of the ToU<br />

periods is applied (see Figure 2). This is a typical usage breakdown,<br />

but further savings are achievable by planning the battery storage<br />

to peak save.<br />

RURAFLEX - NL 22/23<br />

The mine is an open-cast prospecting mineral and tailings<br />

crushing and processing operation, situated in the<br />

Northern Cape region, of South Africa, and operates<br />

24 hours per day, seven days a week. The mine electricity<br />

supply is grid-connected directly to the Eskom grid and could<br />

potentially export energy via the local 10MW substation,<br />

approximately 15km away from the Point of Connection (PoC)<br />

to the mine incoming supply. The mine has several diesel<br />

generators on site that provide electricity supply backup in the<br />

event of outages.<br />

The load profile is essentially flat at a peak demand of 4.8MW<br />

(see Figure 1). There was planned maintenance over the lower<br />

consumption period, which is an anomaly to be ignored for the<br />

purposes of this model.<br />

5000<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

D J F M A M J J A S O N D<br />

Figure 1. Annual peak demand graph.<br />

Extra c/kWh Tariff 22/23 Import<br />

0.3474 1.53 LowPeak 12% R1.88<br />