Coffee & Consulting: Cross-border commuter - The risk of permanent establishment

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

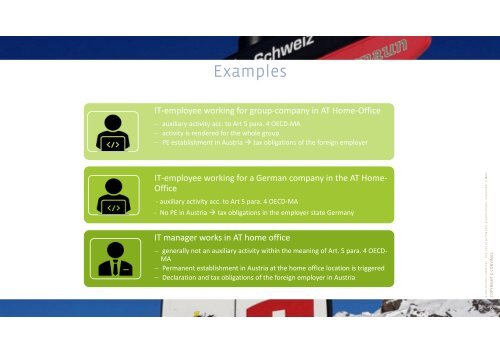

Examples<br />

IT-employee working for group-company in AT Home-Office<br />

auxiliary activity acc. to Art 5 para. 4 OECD-MA<br />

activity is rendered for the whole group<br />

PE <strong>establishment</strong> in Austria tax obligations <strong>of</strong> the foreign employer<br />

IT-employee working for a German company in the AT Home-<br />

Office<br />

- auxiliary activity acc. to Art 5 para. 4 OECD-MA<br />

- No PE in Austria tax obligations in the employer state Germany<br />

IT manager works in AT home <strong>of</strong>fice<br />

generally not an auxiliary activity within the meaning <strong>of</strong> Art. 5 para. 4 OECD-<br />

MA<br />

Permanent <strong>establishment</strong> in Austria at the home <strong>of</strong>fice location is triggered<br />

Declaration and tax obligations <strong>of</strong> the foreign employer in Austria<br />

C r o s s - b o r d e r c o m m u t e r - T h e r i s k o f p e r m a n e n t e s t a b l i s h m e n t , S e p t e m b e r 5 , 2 022<br />

COPYRIGHT © CONVINUS<br />

6