Coffee & Consulting: Cross-border commuter - The risk of permanent establishment

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

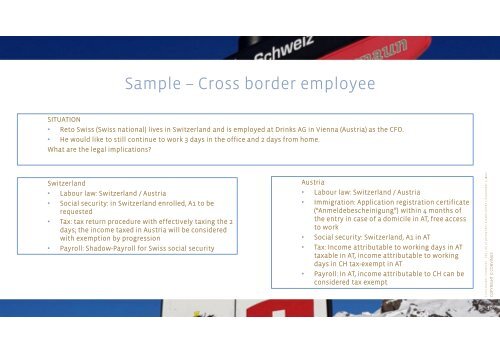

Sample – <strong>Cross</strong> <strong>border</strong> employee<br />

SITUATION<br />

• Reto Swiss (Swiss national) lives in Switzerland and is employed at Drinks AG in Vienna (Austria) as the CFO.<br />

• He would like to still continue to work 3 days in the <strong>of</strong>fice and 2 days from home.<br />

What are the legal implications?<br />

Switzerland<br />

• Labour law: Switzerland / Austria<br />

• Social security: in Switzerland enrolled, A1 to be<br />

requested<br />

• Tax: tax return procedure with effectively taxing the 2<br />

days; the income taxed in Austria will be considered<br />

with exemption by progression<br />

• Payroll: Shadow-Payroll for Swiss social security<br />

Austria<br />

• Labour law: Switzerland / Austria<br />

• Immigration: Application registration certificate<br />

(“Anmeldebescheinigung”) within 4 months <strong>of</strong><br />

the entry in case <strong>of</strong> a domicile in AT, free access<br />

to work<br />

• Social security: Switzerland, A1 in AT<br />

• Tax: Income attributable to working days in AT<br />

taxable in AT, income attributable to working<br />

days in CH tax-exempt in AT<br />

• Payroll: In AT, income attributable to CH can be<br />

considered tax exempt<br />

C r o s s - b o r d e r c o m m u t e r - T h e r i s k o f p e r m a n e n t e s t a b l i s h m e n t , S e p t e m b e r 5 , 2 022<br />

COPYRIGHT © CONVINUS<br />

10