Modern Insurance Magazine Issue 60

This issue features... Insight: Every Cloud Has A Silver Lining, by Tim Yeates, Co-Founder, Carbon1 Ltd. Interview: Modelling Modern Risk with Dr Kirsten Mitchell-Wallace, Director of Portfolio Risk Management, Lloyd’s of London Interview: Searching for Answers with Iain Willis, Research Director, Gallagher Research Centre Editorial Board: Find out what our editorial board panel of experts have to say in this edition of Modern Insurance Magazine A Final Word with Steve White, Chief Executive, British Insurance Brokers' Association (BIBA) Is it time for Risk Managers to rethink their role in the Climate Crisis? by François Lanavère, Head of Strategic Partnerships, AXA Climate Associations Assemble: Modern Insurance’s panel of resident associations outline the burning issues in insurance Just a Thought with Eddie Longworth - Building Trust through Responsible AI in Claims: Championing a Voluntary Code of Conduct Making Efficiency Gains in Subsidence Claims, by Chris Carlton MRICS, New Business & Key Account Director, Geobear Chemistry for a Sustainable Future: Q&A with Grant Dempsey, Sales Manager - Distribution, BASF Automotive Refinish UK & Ireland Industry Collaboration: Working together to provide the best mobility solution, with James Roberts, Business Development Director, Insurance, Europcar Mobility Group UK Thinking Upside Down: Mind the Protection Gap, by Ashley Preece, Product Owner, Claim Technology In Conversation with… Neil Garrett, UK, South Africa & Nordics Sales Director, Solera | Audatex A New Climate for Claims, from I Love Claims / ARC 360 10 Mins with… Ola Jacob, Independent Insurance Advisor In Celebration: Modern Claims Awards 2023 Insur.Tech.Talk - Interviews with Stephen Weinstein, Former Chair of the Bermuda Business Development Agency; Bill Churney, President, Extreme Event Solutions, Verisk; Jacqui LeGrand, CEO, Maptycs; Heather H. Wilson, Chief Executive Officer, CLARA Analytics Insur.Tech.Talk Editorial Board - Experts from within the insurtech sector and beyond join us once more to share their unique insights!

This issue features...

Insight: Every Cloud Has A Silver Lining, by Tim Yeates, Co-Founder, Carbon1 Ltd.

Interview: Modelling Modern Risk with Dr Kirsten Mitchell-Wallace, Director of Portfolio Risk Management, Lloyd’s of London

Interview: Searching for Answers with Iain Willis, Research Director, Gallagher Research Centre

Editorial Board: Find out what our editorial board panel of experts have to say in this edition of Modern Insurance Magazine

A Final Word with Steve White, Chief Executive, British Insurance Brokers' Association (BIBA)

Is it time for Risk Managers to rethink their role in the Climate Crisis? by François Lanavère, Head of Strategic Partnerships, AXA Climate

Associations Assemble: Modern Insurance’s panel of resident associations outline the burning issues in insurance

Just a Thought with Eddie Longworth - Building Trust through Responsible AI in Claims: Championing a Voluntary Code of Conduct

Making Efficiency Gains in Subsidence Claims, by Chris Carlton MRICS, New Business & Key Account Director, Geobear

Chemistry for a Sustainable Future: Q&A with Grant Dempsey, Sales Manager - Distribution, BASF Automotive Refinish UK & Ireland

Industry Collaboration: Working together to provide the best mobility solution, with James Roberts, Business Development Director, Insurance, Europcar Mobility Group UK

Thinking Upside Down: Mind the Protection Gap, by Ashley Preece, Product Owner, Claim Technology

In Conversation with… Neil Garrett, UK, South Africa & Nordics Sales Director, Solera | Audatex

A New Climate for Claims, from I Love Claims / ARC 360

10 Mins with… Ola Jacob, Independent Insurance Advisor

In Celebration: Modern Claims Awards 2023

Insur.Tech.Talk - Interviews with Stephen Weinstein, Former Chair of the Bermuda Business Development Agency; Bill Churney, President, Extreme Event Solutions, Verisk; Jacqui LeGrand, CEO, Maptycs; Heather H. Wilson, Chief Executive Officer, CLARA Analytics

Insur.Tech.Talk Editorial Board - Experts from within the insurtech sector and beyond join us once more to share their unique insights!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

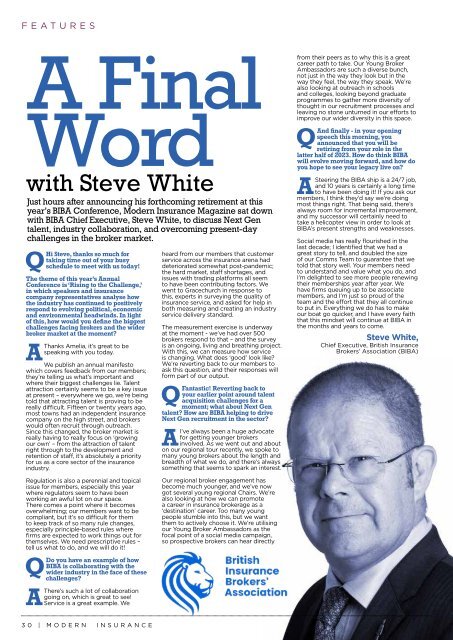

FEATURES<br />

A Final<br />

Word<br />

with Steve White<br />

Just hours after announcing his forthcoming retirement at this<br />

year’s BIBA Conference, <strong>Modern</strong> <strong>Insurance</strong> <strong>Magazine</strong> sat down<br />

with BIBA Chief Executive, Steve White, to discuss Next Gen<br />

talent, industry collaboration, and overcoming present-day<br />

challenges in the broker market.<br />

QHi Steve, thanks so much for<br />

taking time out of your busy<br />

schedule to meet with us today!<br />

The theme of this year’s Annual<br />

Conference is ‘Rising to the Challenge,’<br />

in which speakers and insurance<br />

company representatives analyse how<br />

the industry has continued to positively<br />

respond to evolving political, economic<br />

and environmental headwinds. In light<br />

of this, how would you define the biggest<br />

challenges facing brokers and the wider<br />

broker market at the moment?<br />

AThanks Amelia, it’s great to be<br />

speaking with you today.<br />

We publish an annual manifesto<br />

which covers feedback from our members;<br />

they’re telling us what’s important and<br />

where their biggest challenges lie. Talent<br />

attraction certainly seems to be a key issue<br />

at present – everywhere we go, we’re being<br />

told that attracting talent is proving to be<br />

really difficult. Fifteen or twenty years ago,<br />

most towns had an independent insurance<br />

company on the high street, and brokers<br />

would often recruit through outreach.<br />

Since this changed, the broker market is<br />

really having to really focus on ‘growing<br />

our own’ – from the attraction of talent<br />

right through to the development and<br />

retention of staff, it’s absolutely a priority<br />

for us as a core sector of the insurance<br />

industry.<br />

heard from our members that customer<br />

service across the insurance arena had<br />

deteriorated somewhat post-pandemic;<br />

the hard market, staff shortages, and<br />

issues with trading platforms all seem<br />

to have been contributing factors. We<br />

went to Gracechurch in response to<br />

this, experts in surveying the quality of<br />

insurance service, and asked for help in<br />

both measuring and creating an industry<br />

service delivery standard.<br />

The measurement exercise is underway<br />

at the moment - we’ve had over 500<br />

brokers respond to that – and the survey<br />

is an ongoing, living and breathing project.<br />

With this, we can measure how service<br />

is changing. What does ‘good’ look like?<br />

We’re reverting back to our members to<br />

ask this question, and their responses will<br />

form part of our output.<br />

QFantastic! Reverting back to<br />

your earlier point around talent<br />

acquisition challenges for a<br />

moment; what about Next Gen<br />

talent? How are BIBA helping to drive<br />

Next Gen recruitment in the sector?<br />

AI’ve always been a huge advocate<br />

for getting younger brokers<br />

involved. As we went out and about<br />

on our regional tour recently, we spoke to<br />

many young brokers about the length and<br />

breadth of what we do, and there’s always<br />

something that seems to spark an interest.<br />

from their peers as to why this is a great<br />

career path to take. Our Young Broker<br />

Ambassadors are such a diverse bunch,<br />

not just in the way they look but in the<br />

way they feel, the way they speak. We’re<br />

also looking at outreach in schools<br />

and colleges, looking beyond graduate<br />

programmes to gather more diversity of<br />

thought in our recruitment processes and<br />

leaving no stone unturned in our efforts to<br />

improve our wider diversity in this space.<br />

QAnd finally - in your opening<br />

speech this morning, you<br />

announced that you will be<br />

retiring from your role in the<br />

latter half of 2023. How do think BIBA<br />

will evolve moving forward, and how do<br />

you hope to see your legacy live on?<br />

ASteering the BIBA ship is a 24/7 job,<br />

and 10 years is certainly a long time<br />

to have been doing it! If you ask our<br />

members, I think they’d say we’re doing<br />

most things right. That being said, there’s<br />

always room for incremental improvement,<br />

and my successor will certainly need to<br />

take a helicopter view in order to look at<br />

BIBA’s present strengths and weaknesses.<br />

Social media has really flourished in the<br />

last decade; I identified that we had a<br />

great story to tell, and doubled the size<br />

of our Comms Team to guarantee that we<br />

told that story well. Your members need<br />

to understand and value what you do, and<br />

I’m delighted to see more people renewing<br />

their memberships year after year. We<br />

have firms queuing up to be associate<br />

members, and I’m just so proud of the<br />

team and the effort that they all continue<br />

to put in. Everything we do has to make<br />

our boat go quicker, and I have every faith<br />

that this mindset will continue at BIBA in<br />

the months and years to come.<br />

Steve White,<br />

Chief Executive, British <strong>Insurance</strong><br />

Brokers’ Association (BIBA)<br />

Regulation is also a perennial and topical<br />

issue for members, especially this year<br />

where regulators seem to have been<br />

working an awful lot on our space.<br />

There comes a point where it becomes<br />

overwhelming; our members want to be<br />

compliant, but it’s so difficult for them<br />

to keep track of so many rule changes,<br />

especially principle-based rules where<br />

firms are expected to work things out for<br />

themselves. We need prescriptive rules –<br />

tell us what to do, and we will do it!<br />

QDo you have an example of how<br />

BIBA is collaborating with the<br />

wider industry in the face of these<br />

challenges?<br />

AThere’s such a lot of collaboration<br />

going on, which is great to see!<br />

Service is a great example. We<br />

Our regional broker engagement has<br />

become much younger, and we’ve now<br />

got several young regional Chairs. We’re<br />

also looking at how we can promote<br />

a career in insurance brokerage as a<br />

‘destination’ career. Too many young<br />

people stumble into this, but we want<br />

them to actively choose it. We’re utilising<br />

our Young Broker Ambassadors as the<br />

focal point of a social media campaign,<br />

so prospective brokers can hear directly<br />

30 | MODERN INSURANCE