You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

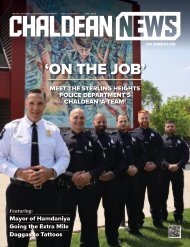

Shimoun, Yaldo, Kashat & Associates, P.C.<br />

A firm with knowledge and expertise<br />

During 2008, the Certified Public<br />

Accounting firm of Shimoun, Yaldo,<br />

Kashat & Associates promoted<br />

Tony Kashat, CPA, to junior partner and<br />

moved to its new offices at the Paramount<br />

Bank Building located at the corner of 13<br />

Mile Road and Northwestern Highway in<br />

Farmington Hills.<br />

The knowledge and expertise at the firm<br />

has been elevated by the makeup of the<br />

three partners and their supporting staff to<br />

a new level that is able to provide outstanding<br />

service to various businesses and individuals.<br />

The firm provides the most current<br />

and up-to-date business and tax advice in<br />

this volatile business environment, which<br />

has not been experienced since the days<br />

of the Great Depression.<br />

The new challenges for this upcoming<br />

tax season started when the new Michigan<br />

Business Tax was enacted to replace the<br />

old Single Business Tax. The new tax was<br />

created by Public Act 36 of 2007 with a<br />

January 1, 2008 date of enactment. It applies<br />

to all business activity after December<br />

31, 2007 for all companies doing business<br />

in Michigan. The new Michigan Business<br />

Tax is a combination of a gross receipts tax<br />

at a rate of .8 percent and a business income<br />

tax at a rate of 4.95 percent. There<br />

is also a surcharge of 21.99 percent that<br />

was added on at a later date to replace the<br />

services tax. This tax was enacted with<br />

credits that reward businesses who hire<br />

employees in Michigan, acquire assets in<br />

Michigan and spend money on research<br />

and development in Michigan.<br />

We have attended several seminars<br />

throughout the year in order to gain an<br />

understanding of the new tax. We have<br />

faced many challenges along the way. The<br />

forms were not available until January <strong>2009</strong><br />

and the law has had several revisions since<br />

the date of enactment. The major challenge<br />

was in calculating 2008 estimated<br />

payments for our clients without having<br />

any forms or instructions available to us.<br />

We were forced to use estimator programs<br />

provided by the State of Michigan on its<br />

website while making several assumptions.<br />

Some tax practitioners were advising their<br />

clients to pay their estimates based on the<br />

old SBT and its rules. Use of this analogy<br />

can be very costly in that the components<br />

of the Michigan Business Tax are different<br />

from the old Single Business Tax.<br />

We have found that some businesses<br />

are paying a great deal more while other<br />

businesses are paying about the same or<br />

less. The industries that were greatly affected<br />

by the new MBT are in the service<br />

industry with gross receipts greater than<br />

$350,000 such as doctors, lawyers, CPAs,<br />

etc. Also affected are high-income rental<br />

real estate entities. Another important aspect<br />

of the new MBT is the Unitary Business<br />

Group (UBG) filing, which requires<br />

businesses with common control to follow<br />

certain guidelines and file one unitary business<br />

group return.<br />

Shimoun, Yaldo, Kashat & Associates<br />

also offers: accounting and compilation<br />

services, real estate and business investment<br />

analysis, payroll check preparation<br />

and services, financial projections and<br />

forecasts, personal financial statements,<br />

assistance with processing business loan<br />

applications, and notary public. The firm<br />

also provides support in Federal, State<br />

and Local Audits for businesses and individuals.<br />

The firm also prepares Anti Money<br />

Partners<br />

Tony Kashat,<br />

Sal Shimoun and<br />

Al Yaldo offer<br />

unparalleled<br />

CPA services.<br />

Laundering Programs and handles Compliance<br />

Audits for businesses that are classified<br />

as Money Services Business (MSB),<br />

which have become very common.<br />

Over the years, the firm has established<br />

relationships with many banks and financial<br />

institutions to aid clients with their business<br />

and individual financing needs and other<br />

banking services. Al Yaldo continues to<br />

serve as a director on the Bank of Michigan<br />

Board of Directors.<br />

In addition to their busy schedules, Sal<br />

and Al are active members of the Chaldean<br />

Chamber of Commerce and have officially<br />

overseen the group’s elections since inception.<br />

Sal continues to serve on the<br />

Associated Food and Petroleum Dealer’s<br />

Finance Committee.<br />

Please call (248) 851-7900 to make an<br />

appointment. The firm of Shimoun, Yaldo,<br />

Kashat & Associates is located at 31000<br />

Northwestern Highway, Suite 110, Farmington<br />

Hills, MI 48331(at the corner of 13<br />

Mile Road and Northwestern Highway).<br />

Tax Tips<br />

• E-file your returns<br />

to eliminate errors<br />

and expedite your<br />

refunds through<br />

direct deposit.<br />

• Make your IRA<br />

contribution by<br />

April 15, <strong>2009</strong> to<br />

be deducted for<br />

2008. The maximum<br />

contribution has<br />

increased to $5,000<br />

for 2008. For those<br />

50 years of age and<br />

over, the additional<br />

catch-up contribution<br />

is $1,000.<br />

• If you need to file<br />

an extension and<br />

you owe money, you<br />

must pay the amount<br />

owed or face penalties.<br />

An extension<br />

of time to file is not<br />

an extension of time<br />

to pay.<br />

• The business mileage<br />

rate for 2008<br />

is $.505 for 1/1/08<br />

to 6/30/08 and<br />

$.585 for 7/1/08 to<br />

12/31/08.<br />

• You may be able<br />

to receive a stimulus<br />

rebate recovery on<br />

your 2008 Federal<br />

Tax Return if you did<br />

not receive the<br />

rebate last year.<br />

• A first-time homebuyer<br />

credit of up to<br />

$7,500 is available<br />

to qualified individuals<br />

who purchased a<br />

principal residence<br />

after April 8, 2008,<br />

and before July 1,<br />

<strong>2009</strong>.<br />

• Standard deduction<br />

filers may be<br />

eligible for a deduction<br />

up to $1,000 for<br />

property taxes paid.<br />

• It is very important<br />

to seek a tax<br />

professional during<br />

these tough economic<br />

times when<br />

household incomes<br />

are lower in order<br />

to maximize your<br />

available credits and<br />

refunds that may not<br />

have been available<br />

to you in past years.<br />

advertisement<br />

<strong>FEBRUARY</strong> <strong>2009</strong> CHALDEAN NEWS 39