Jeweller – February 2024

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2024</strong> STATE OF THE INDUSTRY REPORT<br />

JAA - WHO REALLY BENEFITS?<br />

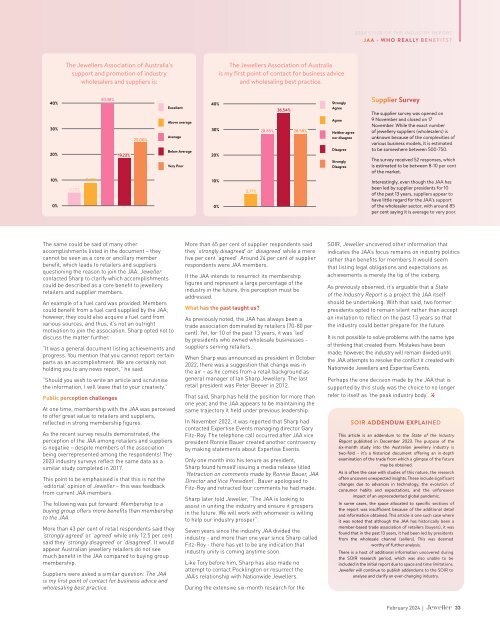

The <strong>Jeweller</strong>s Association of Australia’s<br />

support and promotion of industry<br />

wholesalers and suppliers is:<br />

The <strong>Jeweller</strong>s Association of Australia<br />

is my first point of contact for business advice<br />

and wholesaling best practice.<br />

40%<br />

30%<br />

20%<br />

40.38%<br />

19.23%<br />

25.00%<br />

Excellent<br />

Above average<br />

Average<br />

Below Average<br />

Very Poor<br />

40%<br />

30%<br />

20%<br />

28.85%<br />

36.54%<br />

28.58%<br />

Strongly<br />

Agree<br />

Agree<br />

Neither agree<br />

nor disagree<br />

Disagree<br />

Strongly<br />

Disagree<br />

Supplier Survey<br />

The supplier survey was opened on<br />

9 November and closed on 17<br />

November. While the exact number<br />

of jewellery suppliers (wholesalers) is<br />

unknown because of the complexities of<br />

various business models, it is estimated<br />

to be somewhere between 500-750.<br />

The survey received 52 responses, which<br />

is estimated to be between 8-10 per cent<br />

of the market.<br />

10%<br />

0%<br />

5.77%<br />

9.62%<br />

10%<br />

0%<br />

5.77%<br />

Interestingly, even though the JAA has<br />

been led by supplier presidents for 10<br />

of the past 13 years, suppliers appear to<br />

have little regard for the JAA’s support<br />

of the wholesaler sector, with around 85<br />

per cent saying it is average to very poor.<br />

The same could be said of many other<br />

accomplishments listed in the document <strong>–</strong> they<br />

cannot be seen as a core or ancillary member<br />

benefit, which leads to retailers and suppliers<br />

questioning the reason to join the JAA. <strong>Jeweller</strong><br />

contacted Sharp to clarify which accomplishments<br />

could be described as a core benefit to jewellery<br />

retailers and supplier members.<br />

An example of a fuel card was provided. Members<br />

could benefit from a fuel card supplied by the JAA;<br />

however, they could also acquire a fuel card from<br />

various sources, and thus, it’s not an outright<br />

motivation to join the association. Sharp opted not to<br />

discuss the matter further.<br />

“It was a general document listing achievements and<br />

progress. You mention that you cannot report certain<br />

parts as an accomplishment. We are certainly not<br />

holding you to any news report,” he said.<br />

“Should you wish to write an article and scrutinise<br />

the information, I will leave that to your creativity.”<br />

Public perception challenges<br />

At one time, membership with the JAA was perceived<br />

to offer great value to retailers and suppliers,<br />

reflected in strong membership figures.<br />

As the recent survey results demonstrated, the<br />

perception of the JAA among retailers and suppliers<br />

is negative <strong>–</strong> despite members of the association<br />

being overrepresented among the respondents! The<br />

2023 industry surveys reflect the same data as a<br />

similar study completed in 2017.<br />

This point to be emphasised is that this is not the<br />

‘editorial’ opinion of <strong>Jeweller</strong> <strong>–</strong> this was feedback<br />

from current JAA members.<br />

The following was put forward: Membership to a<br />

buying group offers more benefits than membership<br />

to the JAA.<br />

More than 43 per cent of retail respondents said they<br />

‘strongly agreed’ or ‘agreed’ while only 12.5 per cent<br />

said they ‘strongly disagreed’ or ‘disagreed’. It would<br />

appear Australian jewellery retailers do not see<br />

much benefit in the JAA compared to buying group<br />

membership.<br />

Suppliers were asked a similar question: The JAA<br />

is my first point of contact for business advice and<br />

wholesaling best practice.<br />

More than 65 per cent of supplier respondents said<br />

they ‘strongly disagreed’ or ‘disagreed’ while a mere<br />

five per cent ‘agreed’. Around 24 per cent of supplier<br />

respondents were JAA members.<br />

If the JAA intends to resurrect its membership<br />

figures and represent a large percentage of the<br />

industry in the future, this perception must be<br />

addressed.<br />

What has the past taught us?<br />

As previously noted, the JAA has always been a<br />

trade association dominated by retailers (70-80 per<br />

cent). Yet, for 10 of the past 13 years, it was ‘led’<br />

by presidents who owned wholesale businesses -<br />

suppliers serving retailers.<br />

When Sharp was announced as president in October<br />

2022, there was a suggestion that change was in<br />

the air <strong>–</strong> as he comes from a retail background as<br />

general manager of Ian Sharp <strong>Jeweller</strong>y. The last<br />

retail president was Peter Beever in 2012.<br />

That said, Sharp has held the position for more than<br />

one year, and the JAA appears to be maintaining the<br />

same trajectory it held under previous leadership.<br />

In November 2022, it was reported that Sharp had<br />

contacted Expertise Events managing director Gary<br />

Fitz-Roy. The telephone call occurred after JAA vice<br />

president Ronnie Bauer created another controversy<br />

by making statements about Expertise Events.<br />

Only one month into his tenure as president,<br />

Sharp found himself issuing a media release titled<br />

‘Retraction on comments made by Ronnie Bauer, JAA<br />

Director and Vice President’. Bauer apologised to<br />

Fitz-Roy and retracted four comments he had made.<br />

Sharp later told <strong>Jeweller</strong>, “The JAA is looking to<br />

assist in uniting the industry and ensure it prospers<br />

in the future. We will work with whomever is willing<br />

to help our industry prosper”.<br />

Seven years since the industry JAA divided the<br />

industry - and more than one year since Sharp called<br />

Fitz-Roy - there has yet to be any indication that<br />

industry unity is coming anytime soon.<br />

Like Tory before him, Sharp has also made no<br />

attempt to contact Pocklington or resurrect the<br />

JAA’s relationship with Nationwide <strong>Jeweller</strong>s.<br />

During the extensive six-month research for the<br />

SOIR, <strong>Jeweller</strong> uncovered other information that<br />

indicates the JAA’s focus remains on industry politics<br />

rather than benefits for members.It would seem<br />

that listing legal obligations and expectations as<br />

achievements is merely the tip of the iceberg.<br />

As previously observed, it’s arguable that a State<br />

of the Industry Report is a project the JAA itself<br />

should be undertaking. With that said, two former<br />

presidents opted to remain silent rather than accept<br />

an invitation to reflect on the past 13 years so that<br />

the industry could better prepare for the future.<br />

It is not possible to solve problems with the same type<br />

of thinking that created them. Mistakes have been<br />

made; however, the industry will remain divided until<br />

the JAA attempts to resolve the conflict it created with<br />

Nationwide <strong>Jeweller</strong>s and Expertise Events.<br />

Perhaps the one decision made by the JAA that is<br />

supported by this study was the choice to no longer<br />

refer to itself as ‘the peak industry body’.<br />

SOIR ADDENDUM EXPLAINED<br />

This article is an addendum to the State of the Industry<br />

Report published in December 2023. The purpose of the<br />

six-month study into the Australian jewellery industry is<br />

two-fold <strong>–</strong> it’s a historical document offering an in-depth<br />

examination of the trade from which a glimpse of the future<br />

may be obtained.<br />

As is often the case with studies of this nature, the research<br />

often uncovers unexpected insights. These include significant<br />

changes due to advances in technology, the evolution of<br />

consumer habits and expectations, and the unforeseen<br />

impact of an unprecedented global pandemic.<br />

In some cases, the space allocated to specific sections of<br />

the report was insufficient because of the additional detail<br />

and information obtained. This article is one such case where<br />

it was noted that although the JAA has historically been a<br />

member-based trade association of retailers (buyers), it was<br />

found that in the past 13 years, it had been led by presidents<br />

from the wholesale channel (sellers). This was deemed<br />

worthy of further analysis.<br />

There is a host of additional information uncovered during<br />

the SOIR research period, which was also unable to be<br />

included in the initial report due to space and time limitations.<br />

<strong>Jeweller</strong> will continue to publish addendums to the SOIR to<br />

analyse and clarify an ever-changing industry.<br />

<strong>February</strong> <strong>2024</strong> | 33