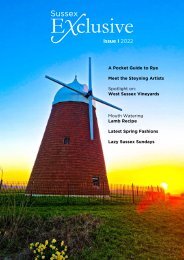

Sussex Exclusive Magazine. Issue 7

A delightful dive into the very best Sussex has to offer. Enjoy 48 hours in Chichester and Rother exploring vineyards, castles and Medieval towns, try fantastic local cuisine and foodie experiences, discover ancient bluebell woods and wild garlic, learn the best places to go bargain hunting or visit one of the county's legendary landmarks. From the weird and the wonderful to the sublime and luxury, enjoy 96 pages about one of the most beautiful and bountiful county's in England.

A delightful dive into the very best Sussex has to offer. Enjoy 48 hours in Chichester and Rother exploring vineyards, castles and Medieval towns, try fantastic local cuisine and foodie experiences, discover ancient bluebell woods and wild garlic, learn the best places to go bargain hunting or visit one of the county's legendary landmarks. From the weird and the wonderful to the sublime and luxury, enjoy 96 pages about one of the most beautiful and bountiful county's in England.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

How taxing is a<br />

side hustle?<br />

Recent alarmist headlines<br />

warned that HMRC were<br />

rolling out a new “side hustle<br />

tax” which would affect<br />

people selling on platforms<br />

like Vinted and Depop. There followed<br />

a flurry of panic that if, for example,<br />

you sell second-hand clothes online you<br />

could end up paying tax on the money<br />

you make. However, the headline is<br />

misleading, so in this post we take a closer<br />

look at the new side hustle rules.<br />

The new rules<br />

Although new HMRC rules came into<br />

force in January 2024, there is no new tax<br />

on side hustles. The rules relate to reporting<br />

requirements between various online<br />

platforms like Vinted or Depop and HMRC.<br />

They do not create new tax obligations.<br />

From 1 January 2024, UK-based<br />

online platforms are required to collect<br />

information about people who make<br />

money through their platforms and send<br />

this information to both HMRC and<br />

to the individual themselves. There is a<br />

specific time period within which the<br />

information collected must be sent.<br />

The information that will be collected will<br />

be in respect of your identity, National<br />

Insurance number and the money you<br />

receive through the platform. All new sellers<br />

now have to share their National Insurance<br />

number with the sale platforms. From<br />

2025, all existing sellers will also have to<br />

share their National Insurance number.<br />

Which platforms are affected?<br />

The rules are quite complex but UK-based<br />

platforms that help facilitate transactions<br />

between sellers of goods and services and<br />

customers are affected. In other words,<br />

platforms like Vinted and Depop. But it’s<br />

important to note, if you’re selling via an<br />

overseas platform, although they may not<br />

be affected by these rules, the platform<br />

may be caught by their own country’s<br />

rules, and any information collected<br />

there, may eventually be shared with<br />

HMRC in the UK.<br />

Which sellers are affected by the<br />

new rules?<br />

If you make money, for example by<br />

selling second hand clothes or other items<br />

via online platforms, you may be affected.<br />

But that does not necessarily mean you<br />

will have to pay additional tax.<br />

The rules do not apply to those who sell<br />

a few personal belongings every now<br />

and again (i.e. you’re just having a clear<br />

out), but you will be caught by the rules<br />

if you’re buying and selling with the<br />

intention of making profit (as you will be<br />

deemed to be “trading”).<br />

What are the tax obligations when<br />

selling via a side hustle?<br />

Regardless of the new rules, you are<br />

always responsible for complying with the<br />

UK’s tax obligations. Therefore, it is your<br />

responsibility to check what, if anything,<br />

you are required to do in order to be<br />

compliant. For this reason, it is important<br />

to keep records of any sales, so you know<br />

how much you have received. Thereafter,<br />

your obligations are as follows:<br />

• If you are in employment, you can<br />

earn up to £1,000 a year extra from<br />

an online side hustle without having<br />

to pay tax on it. This is your tax-free<br />

trading allowance.<br />

• If you are not employed (for example,<br />

you’re self-employed), you can earn<br />

up to (but no more than) £1,000<br />

without having to pay tax or having to<br />

register as self-employed and file a Self-<br />

Assessment tax return at the end of the<br />

financial year.<br />

• If you’re self-employed and your sales<br />

exceed £1,000 in a given tax year,<br />

then you’ll need to do a tax return. If<br />

you’ve never done one before, you’ll<br />

need to register for Self Assessment<br />

first. If you haven’t done this yet,<br />

contact HMRC as soon as possible.<br />

How much tax will I have to pay?<br />

If you do have to pay tax, how much<br />

will depend on your circumstances<br />

and how much you have earned. You<br />

have a tax-free personal allowance. The<br />

basic personal allowance is £12,570 for<br />

2023/24. If that applies to you, you will<br />

pay tax on any profits made over that.<br />

Profit is any money made after you<br />

deduct any allowable expenses. The rate<br />

of tax you’ll need to pay will depend on<br />

your income tax band. The current tax<br />

band for earnings between £12,571 and<br />

£50,270 is 20%.<br />

High-value items may be liable for<br />

Capital Gains Tax which is 10% if<br />

you’re earning up to £50,270 in total<br />

and 20 % if you’re earning above that<br />

threshold.<br />

Other points to bear in mind<br />

If you’re reselling old personal items for<br />

less money than you originally bought<br />

them, you won’t need to pay any tax,<br />

even if you make over £1,000 a year.<br />

Similarly, you can resell gifts and not be<br />

deemed as trading, because you didn’t<br />

buy the original item with a view to<br />

making money.<br />

Get back to your side hustle<br />

The new rules don’t add any further<br />

responsibilities or obligations, to those<br />

which you already had, apart from<br />

having to answer a few extra questions<br />

when you sign up to an online<br />

platform. In fact, they should make<br />

your record keeping easier because<br />

information will be supplied to you.<br />

But you should still always keep your<br />

own records in any event.<br />

If you would like to discuss any of the<br />

issues arising from this post, please get<br />

in touch.<br />

Stuart Ritchie is a<br />

chartered accountant<br />

and chartered tax<br />

adviser with over<br />

30 years’ experience.<br />

He is a tax partner<br />

with Ritchie Phillips<br />

LLP based in<br />

Horsham and can<br />

be contacted on<br />

020 3195 1300 or<br />

stuart.ritchie@<br />

ritchiephillips.<br />

co.uk<br />

78 | sussexexclusive.com 79