US$75000000 Lupatech Finance Limited - Banco Best

US$75000000 Lupatech Finance Limited - Banco Best

US$75000000 Lupatech Finance Limited - Banco Best

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Flow segment<br />

We are a leader in the Mercosul trading area in the manufacture and sale of industrial valves. Our valves,<br />

marketed under our well-known brands “Valmicro,” “Mipel,” “Valbol” and “Jefferson,” are used in several<br />

industrial segments including the chemical, pharmaceutical, steel, food, ethanol, construction, agriculture, and paper<br />

and pulp industries. Our clients include Rhodia, BASF, Braskem, Companhia Vale do Rio Doce, Votorantim, Sadia<br />

and Companhia de Gás de São Paulo - Comgás (part of the British Gas group).<br />

In addition to our leading position in our sector, we benefit from the experience and close relationships we<br />

have established over the years with customers who have already installed a large number of our products in their<br />

industrial plants. We are also recognized for the quality of our maintenance services and our highly skilled sales<br />

force.<br />

Metal segment<br />

We are a leader in the Brazilian market for investment castings and are widely recognized in the<br />

international market for the development and production of parts, sub-assemblies and components used in the global<br />

automobile industry. In 2006, General Motors, or GM, named us the global “Supplier of the Year” for powertrain<br />

applications, which demonstrates GM’s recognition of the high level of quality of our products in this category. Our<br />

investment casting division, Microinox, has been able to establish long-term partnerships with its customers<br />

because, we believe, of its innovative development skills and the quality of its products. Our PIM subsidiary,<br />

Steelinject, is a pioneer in Latin America in the use and development of this technology for the production of highly<br />

complex metal and ceramic parts for industrial products requiring a higher level of technical specification and<br />

performance. We believe our Itasa division is one of the best sand casting manufacturers in Latin America,<br />

specializing in the production of value-added alloys with a high resistance to corrosion such as duplex and super<br />

duplex, used in valves and pumps used mainly in the oil and gas industry. We supply a wide range of customers,<br />

including General Motors, OPEL, Bosch, Dana, MWM-International and Eaton.<br />

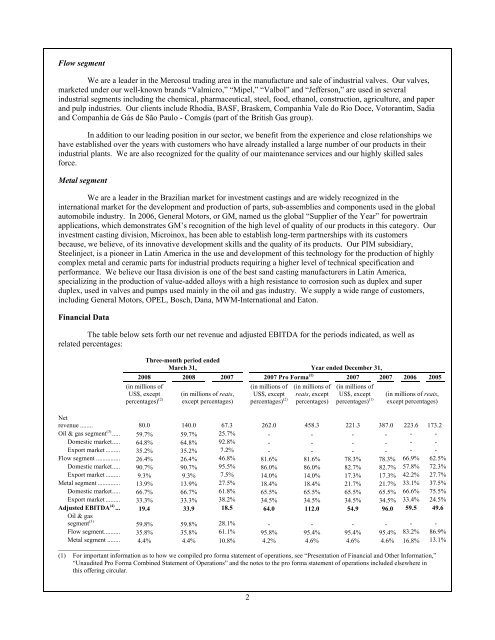

Financial Data<br />

The table below sets forth our net revenue and adjusted EBITDA for the periods indicated, as well as<br />

related percentages:<br />

Three-month period ended<br />

March 31, Year ended December 31,<br />

2008 2008 2007 2007 Pro Forma (1) 2007 2007 2006 2005<br />

(in millions of<br />

US$, except<br />

percentages) (2)<br />

(in millions of reais,<br />

except percentages)<br />

2<br />

(in millions of<br />

US$, except<br />

percentages) (2)<br />

(in millions of<br />

reais, except<br />

percentages)<br />

(in millions of<br />

US$, except<br />

percentages) (1)<br />

(in millions of reais,<br />

except percentages)<br />

Net<br />

revenue ........ 80.0 140.0 67.3 262.0 458.3 221.3 387.0 223.6 173.2<br />

Oil & gas segment (3) ..... 59.7% 59.7% 25.7% - - - - - -<br />

Domestic market..... 64.8% 64.8% 92.8% - - - - - -<br />

Export market ......... 35.2% 35.2% 7.2% - - - - - -<br />

Flow segment ............... 26.4% 26.4% 46.8% 81.6% 81.6% 78.3% 78.3% 66.9% 62.5%<br />

Domestic market..... 90.7% 90.7% 95.5% 86.0% 86.0% 82.7% 82.7% 57.8% 72.3%<br />

Export market ......... 9.3% 9.3% 7.5% 14.0% 14.0% 17.3% 17.3% 42.2% 27.7%<br />

Metal segment .............. 13.9% 13.9% 27.5% 18.4% 18.4% 21.7% 21.7% 33.1% 37.5%<br />

Domestic market..... 66.7% 66.7% 61.8% 65.5% 65.5% 65.5% 65.5% 66.6% 75.5%<br />

Export market ......... 33.3% 33.3% 38.2% 34.5% 34.5% 34.5% 34.5% 33.4% 24.5%<br />

Adjusted EBITDA (4) ... 19.4 33.9 18.5 64.0 112.0 54.9 96.0 59.5 49.6<br />

Oil & gas<br />

segment (3) 59.8% 59.8% 28.1% - - - - - -<br />

Flow segment.......... 35.8% 35.8% 61.1% 95.8% 95.4% 95.4% 95.4% 83.2% 86.9%<br />

Metal segment ........ 4.4% 4.4% 10.8% 4.2% 4.6% 4.6% 4.6% 16.8% 13.1%<br />

___________________<br />

(1) For important information as to how we compiled pro forma statement of operations, see “Presentation of Financial and Other Information,”<br />

“Unaudited Pro Forma Combined Statement of Operations” and the notes to the pro forma statement of operations included elsewhere in<br />

this offering circular.