OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12 PROPERTY REPORT - <strong>OFFICE</strong> <strong>MARKET</strong> <strong>MADRID</strong> <strong>AND</strong> <strong>BARCELONA</strong> - Q3 2011<br />

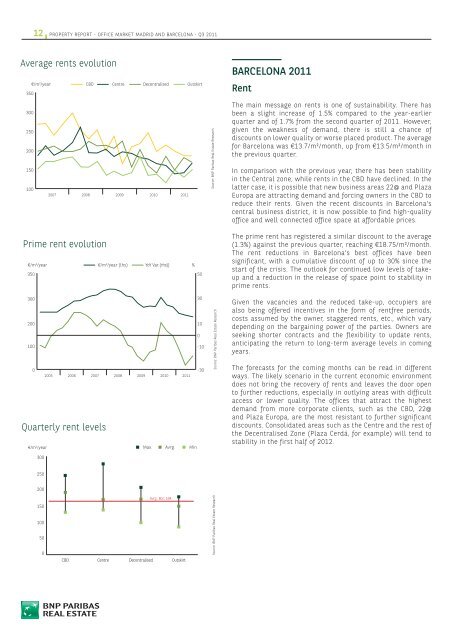

Average rents evolution<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

€/m 2 /year<br />

2007 2008 2009 2010 2011<br />

Prime rent evolution<br />

€/m 2 /year<br />

350<br />

300<br />

Quarterly rent levels<br />

€/m 2 /year<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

CBD Centre Decentralised Outskirt<br />

€/m 2 /year (lhs) YoY Var. (rhs))<br />

200 10<br />

100 -10<br />

0 -30<br />

2005 2006 2007 2008 2009 2010 2011<br />

Max. Avrg. Min.<br />

Avrg. Bcn; 164<br />

CBD Centre Decentralised Outskirt<br />

%<br />

50<br />

30<br />

0<br />

Source: BNP Paribas Real Estate Research<br />

Source: BNP Paribas Real Estate Research<br />

Source: BNP Paribas Real Estate Research<br />

<strong>BARCELONA</strong> 2011<br />

Rent<br />

The main message on rents is one of sustainabil<strong>it</strong>y. There has<br />

been a slight increase of 1.5% compared to the year-earlier<br />

quarter and of 1.7% from the second quarter of 2011. However,<br />

given the weakness of demand, there is still a chance of<br />

discounts on lower qual<strong>it</strong>y or worse placed product. The average<br />

for Barcelona was €13.7/m²/month, up from €13.5/m²/month in<br />

the previous quarter.<br />

In comparison w<strong>it</strong>h the previous year, there has been stabil<strong>it</strong>y<br />

in the Central zone, while rents in the CBD have declined. In the<br />

latter case, <strong>it</strong> is possible that new business areas 22@ and Plaza<br />

Europa are attracting demand and forcing owners in the CBD to<br />

reduce their rents. Given the recent discounts in Barcelona’s<br />

central business district, <strong>it</strong> is now possible to find high-qual<strong>it</strong>y<br />

office and well connected office space at affordable prices.<br />

The prime rent has registered a similar discount to the average<br />

(1.3%) against the previous quarter, reaching €18.75/m²/month.<br />

The rent reductions in Barcelona’s best offices have been<br />

significant, w<strong>it</strong>h a cumulative discount of up to 30% since the<br />

start of the crisis. The outlook for continued low levels of takeup<br />

and a reduction in the release of space point to stabil<strong>it</strong>y in<br />

prime rents.<br />

Given the vacancies and the reduced take-up, occupiers are<br />

also being offered incentives in the form of rentfree periods,<br />

costs assumed by the owner, staggered rents, etc., which vary<br />

depending on the bargaining power of the parties. Owners are<br />

seeking shorter contracts and the flexibil<strong>it</strong>y to update rents,<br />

anticipating the return to long-term average levels in coming<br />

years.<br />

The forecasts for the coming months can be read in different<br />

ways. The likely scenario in the current economic environment<br />

does not bring the recovery of rents and leaves the door open<br />

to further reductions, especially in outlying areas w<strong>it</strong>h difficult<br />

access or lower qual<strong>it</strong>y. The offices that attract the highest<br />

demand from more corporate clients, such as the CBD, 22@<br />

and Plaza Europa, are the most resistant to further significant<br />

discounts. Consolidated areas such as the Centre and the rest of<br />

the Decentralised Zone (Plaza Cerdá, for example) will tend to<br />

stabil<strong>it</strong>y in the first half of 2012.