OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

%<br />

6 PROPERTY REPORT - <strong>OFFICE</strong> <strong>MARKET</strong> <strong>MADRID</strong> <strong>AND</strong> <strong>BARCELONA</strong> - Q3 2011<br />

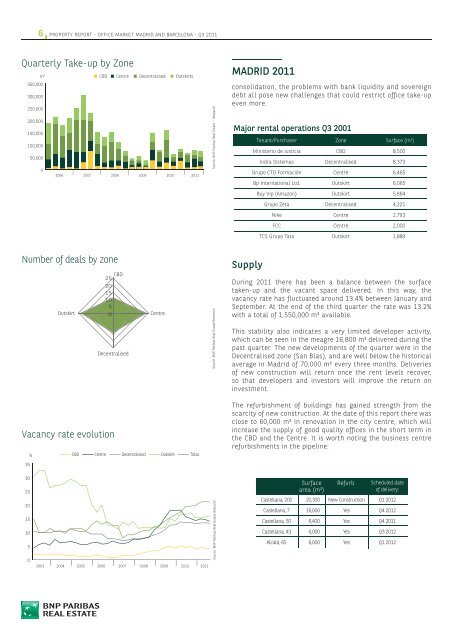

Quarterly Take-up by Zone<br />

m 2<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

2006 2007 2008 2009 2010 2011<br />

Number of deals by zone<br />

Vacancy rate evolution<br />

CBD Centre Decentralised Outskirts<br />

Outskirt<br />

CBD<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Centre<br />

Decentralised<br />

CBD Centre Decentralised Outskirt Total<br />

2003 2004 2005 2006 2007 2008 2009<br />

2010 2011<br />

Source: BNP Paribas Real Estate – Research<br />

Source: BNP Paribas Real Estate Research<br />

Source: BNP Paribas Real Estate Research<br />

<strong>MADRID</strong> 2011<br />

consolidation, the problems w<strong>it</strong>h bank liquid<strong>it</strong>y and sovereign<br />

debt all pose new challenges that could restrict office take-up<br />

even more.<br />

Major rental operations Q3 2001<br />

Supply<br />

Tenant/Purchaser Zone Surface (m 2 )<br />

Ministerio de Justicia<br />

Indra Sistemas<br />

Grupo CTO Formación<br />

Bp International Ltd.<br />

Buy Vip (Amazon)<br />

Grupo Zeta<br />

Nike<br />

FCC<br />

TCS Grupo Tata<br />

CBD<br />

Decentralised<br />

Centre<br />

Outskirt<br />

Outskirt<br />

Decentralised<br />

Centre<br />

Centre<br />

Outskirt<br />

8,500<br />

8,373<br />

6,465<br />

6,065<br />

5,664<br />

4,221<br />

2,793<br />

2,000<br />

1,889<br />

During 2011 there has been a balance between the surface<br />

taken-up and the vacant space delivered. In this way, the<br />

vacancy rate has fluctuated around 13.4% between January and<br />

September. At the end of the third quarter the rate was 13.2%<br />

w<strong>it</strong>h a total of 1,550,000 m² available.<br />

This stabil<strong>it</strong>y also indicates a very lim<strong>it</strong>ed developer activ<strong>it</strong>y,<br />

which can be seen in the meagre 16,800 m² delivered during the<br />

past quarter. The new developments of the quarter were in the<br />

Decentralised zone (San Blas), and are well below the historical<br />

average in Madrid of 70,000 m² every three months. Deliveries<br />

of new construction will return once the rent levels recover,<br />

so that developers and investors will improve the return on<br />

investment.<br />

The refurbishment of buildings has gained strength from the<br />

scarc<strong>it</strong>y of new construction. At the date of this report there was<br />

close to 60,000 m² in renovation in the c<strong>it</strong>y centre, which will<br />

increase the supply of good qual<strong>it</strong>y offices in the short term in<br />

the CBD and the Centre. It is worth noting the business centre<br />

refurbishments in the pipeline:<br />

Castellana, 200<br />

Castellana, 7<br />

Castellana, 50<br />

Castellana, 43<br />

Alcalá, 65<br />

Surface<br />

area (m²)<br />

20,300<br />

16,000<br />

6,400<br />

6,000<br />

6,000<br />

Refurb. Scheduled date<br />

of delivery:<br />

New Construction<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Q1 2012<br />

Q4 2012<br />

Q4 2011<br />

Q3 2012<br />

Q1 2012