OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

OFFICE MARKET MADRID AND BARCELONA - monitorimmobiliare.it

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 PROPERTY REPORT - <strong>OFFICE</strong> <strong>MARKET</strong> <strong>MADRID</strong> <strong>AND</strong> <strong>BARCELONA</strong> - Q3 2011<br />

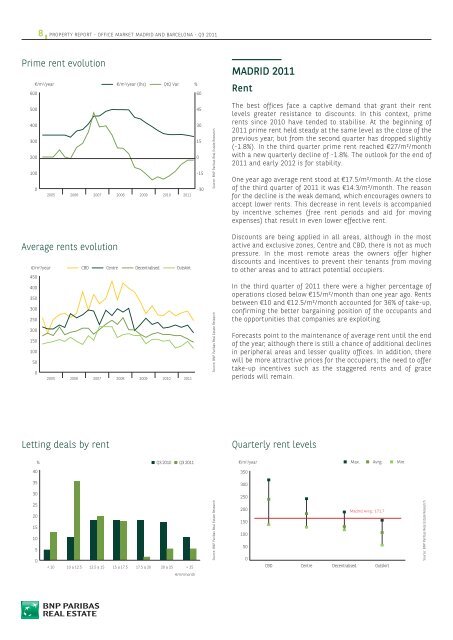

Prime rent evolution<br />

€/m 2 /year<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

€/m 2 /year<br />

600 60<br />

500 45<br />

400 30<br />

300 15<br />

200 0<br />

100 -15<br />

0 -30<br />

2005 2006 2007 2008 2009 2010 2011<br />

Average rents evolution<br />

0<br />

2005 2006 2007 2008 2009 2010 2011<br />

Letting deals by rent<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

%<br />

€/m 2 /year (lhs) QtQ Var.<br />

CBD Centre Decentralised Outskirt<br />

Q3 2010 Q3 2011<br />

< 10 10 a 12.5 12.5 a 15 15 a 17.5 17.5 a 20 20 a 25 > 25<br />

%<br />

€/m 2 /month<br />

Source: BNP Paribas Real Estate Research<br />

Source: BNP Paribas Real Estate Research<br />

Source: BNP Paribas Real Estate Research<br />

<strong>MADRID</strong> 2011<br />

Rent<br />

The best offices face a captive demand that grant their rent<br />

levels greater resistance to discounts. In this context, prime<br />

rents since 2010 have tended to stabilise. At the beginning of<br />

2011 prime rent held steady at the same level as the close of the<br />

previous year, but from the second quarter has dropped slightly<br />

(-1.8%). In the third quarter prime rent reached €27/m²/month<br />

w<strong>it</strong>h a new quarterly decline of -1.8%. The outlook for the end of<br />

2011 and early 2012 is for stabil<strong>it</strong>y.<br />

One year ago average rent stood at €17.5/m²/month. At the close<br />

of the third quarter of 2011 <strong>it</strong> was €14.3/m²/month. The reason<br />

for the decline is the weak demand, which encourages owners to<br />

accept lower rents. This decrease in rent levels is accompanied<br />

by incentive schemes (free rent periods and aid for moving<br />

expenses) that result in even lower effective rent.<br />

Discounts are being applied in all areas, although in the most<br />

active and exclusive zones, Centre and CBD, there is not as much<br />

pressure. In the most remote areas the owners offer higher<br />

discounts and incentives to prevent their tenants from moving<br />

to other areas and to attract potential occupiers.<br />

In the third quarter of 2011 there were a higher percentage of<br />

operations closed below €15/m²/month than one year ago. Rents<br />

between €10 and €12.5/m²/month accounted for 36% of take-up,<br />

confirming the better bargaining pos<strong>it</strong>ion of the occupants and<br />

the opportun<strong>it</strong>ies that companies are explo<strong>it</strong>ing.<br />

Forecasts point to the maintenance of average rent until the end<br />

of the year, although there is still a chance of add<strong>it</strong>ional declines<br />

in peripheral areas and lesser qual<strong>it</strong>y offices. In add<strong>it</strong>ion, there<br />

will be more attractive prices for the occupiers; the need to offer<br />

take-up incentives such as the staggered rents and of grace<br />

periods will remain.<br />

Quarterly rent levels<br />

€/m 2 /year<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Max. Avrg. Min.<br />

Madrid Avrg.; 171,7<br />

CBD Centre Decentralised Outskirt<br />

Source: BNP Paribas Real Estate Research