to 54646 Contact Person: Sagar Karvat - 077383 80033, e-mail

to 54646 Contact Person: Sagar Karvat - 077383 80033, e-mail

to 54646 Contact Person: Sagar Karvat - 077383 80033, e-mail

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

accounted for 49% of the company’s formulations<br />

revenue in 2009-10.<br />

As Orchid Pharma does not have the expertise in frontend<br />

marketing in regulated markets, it is tying up with<br />

large distribution chains for wider coverage. For the<br />

same reason, it has also acquired US-based company,<br />

Karalex Pharma.<br />

����Semi-regulated Market<br />

Orchid Pharma derives 51% of its formulations revenues<br />

from the semi-regulated markets. The pharma company<br />

focuses on branded generics in semi-regulated markets,<br />

including India.<br />

The company has its own distribution network in most<br />

countries, thereby enabling it <strong>to</strong> control the <strong>to</strong>tal network.<br />

This results in quality control as well as better margins<br />

for the company.<br />

����������������������������<br />

To be different from the rest, the company has chosen a<br />

unique business segment <strong>to</strong> position itself. Antiinfectives<br />

is a high-margin, high-entry barrier segment<br />

and hence, keeps a check on competition. And <strong>to</strong><br />

leverage the same benefit, Orchid Chemicals & Pharmaceuticals<br />

Ltd has lined up a healthy product pipeline for<br />

the future <strong>to</strong>o.<br />

It has filed 80 DMFs in the US and 21 COS in Europe in<br />

the API segment. Additionally, the company has filed 36<br />

ANDAs in the US and 18 dossiers in EU, for the formulation<br />

division.<br />

The company plans <strong>to</strong> file 20-22 products every year for<br />

the next three consecutive years, <strong>to</strong> keep its product<br />

portfolio strong.<br />

We believe that the API supply deal with Hospira would<br />

also provide further benefit, once Hospira gets product<br />

approvals for the carbapenems facility, which will also<br />

add <strong>to</strong> the revenues of Orchid Pharma.<br />

�����������������������<br />

By selling its business <strong>to</strong> Hospira, Orchid Pharma paid<br />

off its debts, making the company’s balance sheet less<br />

leveraged and thus increasing the cash flow of the<br />

company <strong>to</strong>o.<br />

The debt <strong>to</strong> equity ratio of the company improved from<br />

4.4 pre-deal <strong>to</strong> around 1.3 after the deal. This provides<br />

further headroom <strong>to</strong> the company <strong>to</strong> leverage it for any<br />

future expansion.<br />

Beyond Market 04th Feb ’11<br />

����<br />

Movement of currency could adversely impact the<br />

pharma company’s profitability.<br />

�������������<br />

We believe Orchid Chemicals & Pharmaceuticals Ltd is<br />

left with enough engines <strong>to</strong> keep its growth momentum<br />

going. It has a rich product portfolio.<br />

The company is also expanding its wings in different<br />

geographies by combining various strategies like acquiring<br />

front-end marketing companies, tying-up with<br />

distribu<strong>to</strong>rs or by having a direct presence in areas it has<br />

the requisite expertise. The company is targeting both<br />

regulated and semi-regulated markets.<br />

Orchid Pharma has a planned strategy <strong>to</strong> build its product<br />

portfolio. For the same reason, it has lined-up 20 <strong>to</strong> 22<br />

product launches every year.<br />

The company management is confident of taking its<br />

formulations contribution of 30% <strong>to</strong> 50% in the near<br />

future <strong>to</strong> balance the API – formulations mix.<br />

����������<br />

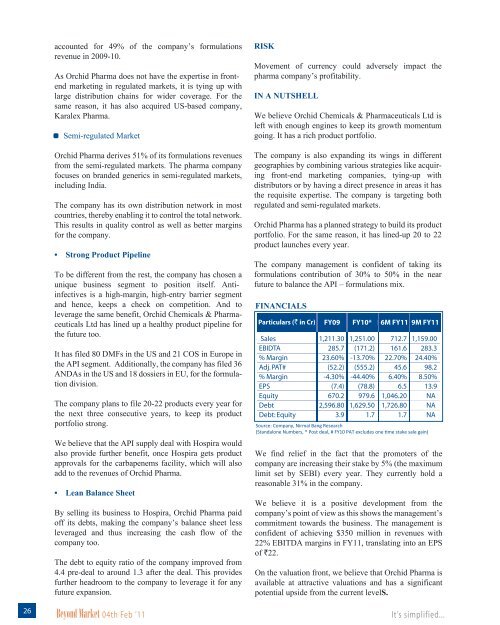

Particulars (` in Cr) FY09 FY10* 6M FY11<br />

9M FY11<br />

Sales<br />

EBIDTA<br />

% Margin<br />

Adj. PAT#<br />

% Margin<br />

EPS<br />

Equity<br />

Debt<br />

Debt: Equity<br />

1,211.30<br />

285.7<br />

23.60%<br />

(52.2)<br />

-4.30%<br />

(7.4)<br />

670.2<br />

2,596.80<br />

3.9<br />

1,251.00<br />

(171.2)<br />

-13.70%<br />

(555.2)<br />

-44.40%<br />

(78.8)<br />

979.6<br />

1,629.50<br />

1.7<br />

712.7<br />

161.6<br />

22.70%<br />

45.6<br />

6.40%<br />

6.5<br />

1,046.20<br />

1,726.80<br />

1.7<br />

1,159.00<br />

283.3<br />

24.40%<br />

98.2<br />

8.50%<br />

13.9<br />

NA<br />

NA<br />

NA<br />

Source: Company, Nirmal Bang Research<br />

������������������������������������������������������������������������������<br />

We find relief in the fact that the promoters of the<br />

company are increasing their stake by 5% (the maximum<br />

limit set by SEBI) every year. They currently hold a<br />

reasonable 31% in the company.<br />

We believe it is a positive development from the<br />

company’s point of view as this shows the management’s<br />

commitment <strong>to</strong>wards the business. The management is<br />

confident of achieving $350 million in revenues with<br />

22% EBITDA margins in FY11, translating in<strong>to</strong> an EPS<br />

of `22.<br />

On the valuation front, we believe that Orchid Pharma is<br />

available at attractive valuations and has a significant<br />

potential upside from the current level��<br />

It’s simplified...