RIO DE JANEIRO | 2016

RIO DE JANEIRO | 2016

RIO DE JANEIRO | 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Finance 7<br />

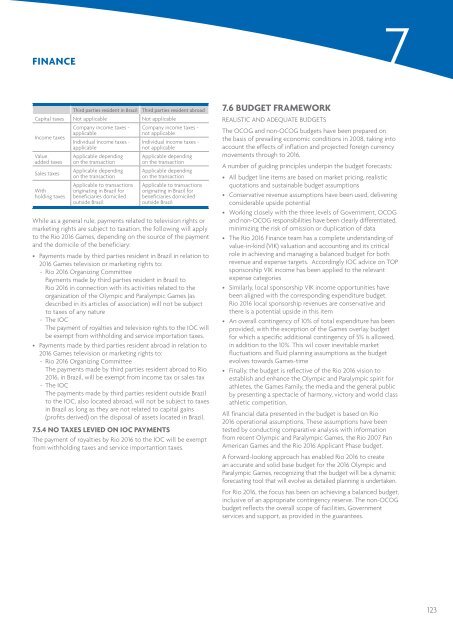

third parties resident in brazil third parties resident abroad<br />

Capital taxes not applicable not applicable<br />

Income taxes<br />

Value<br />

added taxes<br />

Sales taxes<br />

With<br />

holding taxes<br />

Company income taxes -<br />

applicable<br />

Individual income taxes -<br />

applicable<br />

Applicable depending<br />

on the transaction<br />

Applicable depending<br />

on the transaction<br />

Applicable to transactions<br />

originating in Brazil for<br />

beneficiaries domiciled<br />

outside Brazil<br />

Company income taxes -<br />

not applicable<br />

Individual income taxes -<br />

not applicable<br />

Applicable depending<br />

on the transaction<br />

Applicable depending<br />

on the transaction<br />

Applicable to transactions<br />

originating in Brazil for<br />

beneficiaries domiciled<br />

outside Brazil<br />

While as a general rule, payments related to television rights or<br />

marketing rights are subject to taxation, the following will apply<br />

to the Rio <strong>2016</strong> Games, depending on the source of the payment<br />

and the domicile of the beneficiary:<br />

• Payments made by third parties resident in Brazil in relation to<br />

<strong>2016</strong> Games television or marketing rights to:<br />

- Rio <strong>2016</strong> Organizing Committee<br />

Payments made by third parties resident in Brazil to<br />

Rio <strong>2016</strong> in connection with its activities related to the<br />

organization of the Olympic and Paralympic Games (as<br />

described in its articles of association) will not be subject<br />

to taxes of any nature<br />

- the IOC<br />

the payment of royalties and television rights to the IOC will<br />

be exempt from withholding and service importation taxes.<br />

• Payments made by third parties resident abroad in relation to<br />

<strong>2016</strong> Games television or marketing rights to:<br />

- Rio <strong>2016</strong> Organizing Committee<br />

the payments made by third parties resident abroad to Rio<br />

<strong>2016</strong>, in Brazil, will be exempt from income tax or sales tax<br />

- the IOC<br />

the payments made by third parties resident outside Brazil<br />

to the IOC, also located abroad, will not be subject to taxes<br />

in Brazil as long as they are not related to capital gains<br />

(profits derived) on the disposal of assets located in Brazil.<br />

7.5.4 no TaXes LeVied on ioc PaYMenTs<br />

the payment of royalties by Rio <strong>2016</strong> to the IOC will be exempt<br />

from withholding taxes and service importantion taxes.<br />

7.6 BudGeT FraMework<br />

REALIStIC AnD A<strong>DE</strong>qUAtE BUDGEtS<br />

the OCOG and non-OCOG budgets have been prepared on<br />

the basis of prevailing economic conditions in 2008, taking into<br />

account the effects of inflation and projected foreign currency<br />

movements through to <strong>2016</strong>.<br />

A number of guiding principles underpin the budget forecasts:<br />

• All budget line items are based on market pricing, realistic<br />

quotations and sustainable budget assumptions<br />

• Conservative revenue assumptions have been used, delivering<br />

considerable upside potential<br />

• Working closely with the three levels of Government, OCOG<br />

and non-OCOG responsibilities have been clearly differentiated,<br />

minimizing the risk of omission or duplication of data<br />

• the Rio <strong>2016</strong> finance team has a complete understanding of<br />

value-in-kind (VIK) valuation and accounting and its critical<br />

role in achieving and managing a balanced budget for both<br />

revenue and expense targets. Accordingly IOC advice on tOP<br />

sponsorship VIK income has been applied to the relevant<br />

expense categories<br />

• Similarly, local sponsorship VIK income opportunities have<br />

been aligned with the corresponding expenditure budget.<br />

Rio <strong>2016</strong> local sponsorship revenues are conservative and<br />

there is a potential upside in this item<br />

• An overall contingency of 10% of total expenditure has been<br />

provided, with the exception of the Games overlay budget<br />

for which a specific additional contingency of 5% is allowed,<br />

in addition to the 10%. this wil cover inevitable market<br />

fluctuations and fluid planning assumptions as the budget<br />

evolves towards Games-time<br />

• finally, the budget is reflective of the Rio <strong>2016</strong> vision to<br />

establish and enhance the Olympic and Paralympic spirit for<br />

athletes, the Games family, the media and the general public<br />

by presenting a spectacle of harmony, victory and world class<br />

athletic competition.<br />

All financial data presented in the budget is based on Rio<br />

<strong>2016</strong> operational assumptions. these assumptions have been<br />

tested by conducting comparative analysis with information<br />

from recent Olympic and Paralympic Games, the Rio 2007 Pan<br />

American Games and the Rio <strong>2016</strong> Applicant Phase budget.<br />

A forward-looking approach has enabled Rio <strong>2016</strong> to create<br />

an accurate and solid base budget for the <strong>2016</strong> Olympic and<br />

Paralympic Games, recognizing that the budget will be a dynamic<br />

forecasting tool that will evolve as detailed planning is undertaken.<br />

for Rio <strong>2016</strong>, the focus has been on achieving a balanced budget,<br />

inclusive of an appropriate contingency reserve. the non-OCOG<br />

budget reflects the overall scope of facilities, Government<br />

services and support, as provided in the guarantees.<br />

123