Ferro-alloys - Metal Bulletin Store

Ferro-alloys - Metal Bulletin Store

Ferro-alloys - Metal Bulletin Store

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

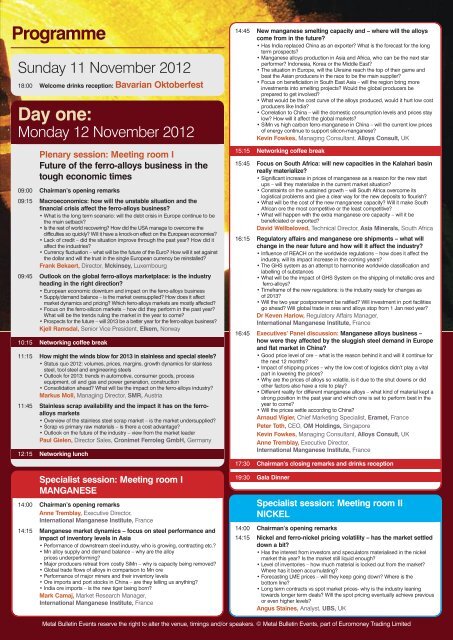

Programme<br />

Sunday 11 November 2012<br />

18:00 Welcome drinks reception: Bavarian Oktoberfest<br />

Day one:<br />

Monday 12 November 2012<br />

Plenary session: Meeting room I<br />

Future of the ferro-<strong>alloys</strong> business in the<br />

tough economic times<br />

09:00 Chairman’s opening remarks<br />

09:15 Macroeconomics: how will the unstable situation and the<br />

financial crisis affect the ferro-<strong>alloys</strong> business?<br />

• What is the long term scenario: will the debt crisis in Europe continue to be<br />

the main setback?<br />

• Is the rest of world recovering? How did the USA manage to overcome the<br />

difficulties so quickly? Will it have a knock-on effect on the European economies?<br />

• Lack of credit – did the situation improve through the past year? How did it<br />

affect the industries?<br />

• Currency fluctuation – what will be the future of the Euro? How will it set against<br />

the dollar and will the trust in the single European currency be reinstalled?<br />

Frank Bekaert, Director, Mckinsey, Luxembourg<br />

09:45 Outlook on the global ferro-<strong>alloys</strong> marketplace: is the industry<br />

heading in the right direction?<br />

• European economic downturn and impact on the ferro-<strong>alloys</strong> business<br />

• Supply/demand balance – is the market oversupplied? How does it affect<br />

market dynamics and pricing? Which ferro-<strong>alloys</strong> markets are mostly affected?<br />

• Focus on the ferro-silicon markets – how did they perform in the past year?<br />

What will be the trends ruling the market in the year to come?<br />

• Prospects for the future – will 2013 be a better year for the ferro-<strong>alloys</strong> business?<br />

Kjell Ramsdal, Senior Vice President, Elkem, Norway<br />

10:15 Networking coffee break<br />

11:15 How might the winds blow for 2013 in stainless and special steels?<br />

• Status quo 2012: volumes, prices, margins, growth dynamics for stainless<br />

steel, tool steel and engineering steels<br />

• Outlook for 2013: trends in automotive, consumer goods, process<br />

equipment, oil and gas and power generation, construction<br />

• Consolidation ahead? What will be the impact on the ferro-<strong>alloys</strong> industry?<br />

Markus Moll, Managing Director, SMR, Austria<br />

11:45 Stainless scrap availability and the impact it has on the ferro<strong>alloys</strong><br />

markets<br />

• Overview of the stainless steel scrap market – is the market undersupplied?<br />

• Scrap vs primary raw materials – is there a cost advantage?<br />

• Outlook on the future of the industry – view from the market leader<br />

Paul Gielen, Director Sales, Cronimet <strong>Ferro</strong>leg GmbH, Germany<br />

12:15 Networking lunch<br />

Specialist session: Meeting room I<br />

MANGANESE<br />

14:00 Chairman’s opening remarks<br />

Anne Tremblay, Executive Director,<br />

International Manganese Institute, France<br />

14:15 Manganese market dynamics – focus on steel performance and<br />

impact of inventory levels in Asia<br />

• Performance of downstream steel industry, who is growing, contracting etc.?<br />

• Mn alloy supply and demand balance – why are the alloy<br />

prices underperforming?<br />

• Major producers retreat from costly SiMn – why is capacity being removed?<br />

• Global trade flows of <strong>alloys</strong> in comparison to Mn ore<br />

• Performance of major miners and their inventory levels<br />

• Ore imports and port stocks in China – are they telling us anything?<br />

• India ore imports – is the new tiger being born?<br />

Mark Camaj, Market Research Manager,<br />

International Manganese Institute, France<br />

14:45 New manganese smelting capacity and – where will the <strong>alloys</strong><br />

come from in the future?<br />

• Has India replaced China as an exporter? What is the forecast for the long<br />

term prospects?<br />

• Manganese <strong>alloys</strong> production in Asia and Africa, who can be the next star<br />

performer? Indonesia, Korea or the Middle East?<br />

• The situation in Europe, will the Ukraine reach the top of their game and<br />

beat the Asian producers in the race to be the main supplier?<br />

• Focus on beneficiation in South East Asia – will the region bring more<br />

investments into smelting projects? Would the global producers be<br />

prepared to get involved?<br />

• What would be the cost curve of the <strong>alloys</strong> produced, would it hurt low cost<br />

producers like India?<br />

• Correlation to China – will the domestic consumption levels and prices stay<br />

low? How will it affect the global markets?<br />

• SiMn vs high carbon ferro-manganese in China – will the current low prices<br />

of energy continue to support silicon-manganese?<br />

Kevin Fowkes, Managing Consultant, Alloys Consult, UK<br />

15:15 Networking coffee break<br />

15:45 Focus on South Africa: will new capacities in the Kalahari basin<br />

really materialize?<br />

• Significant increase in prices of manganese as a reason for the new start<br />

ups – will they materialize in the current market situation?<br />

• Constraints on the sustained growth – will South Africa overcome its<br />

logistical problems and give a clear way for the new deposits to flourish?<br />

• What will be the cost of the new manganese capacity? Will it make South<br />

African ore the most competitive or the least competitive?<br />

• What will happen with the extra manganese ore capacity – will it be<br />

beneficiated or exported?<br />

David Wellbeloved, Technical Director, Asia Minerals, South Africa<br />

16:15 Regulatory affairs and manganese ore shipments – what will<br />

change in the near future and how will it affect the industry?<br />

• Influence of REACH on the worldwide regulations – how does it affect the<br />

industry, will its impact increase in the coming years?<br />

• The GHS system as an attempt to harmonise worldwide classification and<br />

labelling of substances<br />

• What will be the impact of GHS System on the shipping of metallic ores and<br />

ferro-<strong>alloys</strong>?<br />

• Timeframe of the new regulations: is the industry ready for changes as<br />

of 2013?<br />

• Will the two year postponement be ratified? Will investment in port facilities<br />

go ahead? Will global trade in ores and <strong>alloys</strong> stop from 1 Jan next year?<br />

Dr Keven Harlow, Regulatory Affairs Manager,<br />

International Manganese Institute, France<br />

16:45 Executives’ Panel discussion: Manganese <strong>alloys</strong> business –<br />

how were they affected by the sluggish steel demand in Europe<br />

and flat market in China?<br />

• Good price level of ore – what is the reason behind it and will it continue for<br />

the next 12 months?<br />

• Impact of shipping prices – why the low cost of logistics didn’t play a vital<br />

part in lowering the prices?<br />

• Why are the prices of <strong>alloys</strong> so volatile, is it due to the shut downs or did<br />

other factors also have a role to play?<br />

• Different reality for different manganese <strong>alloys</strong> – what kind of material kept a<br />

strong position in the past year and which one is set to perform best in the<br />

year to come?<br />

• Will the prices settle according to China?<br />

Arnaud Vigier, Chief Marketing Specialist, Eramet, France<br />

Peter Toth, CEO, OM Holdings, Singapore<br />

Kevin Fowkes, Managing Consultant, Alloys Consult, UK<br />

Anne Tremblay, Executive Director,<br />

International Manganese Institute, France<br />

17:30 Chairman’s closing remarks and drinks reception<br />

19:30 Gala Dinner<br />

Specialist session: Meeting room II<br />

NICKEL<br />

14:00 Chairman’s opening remarks<br />

14:15 Nickel and ferro-nickel pricing volatility – has the market settled<br />

down a bit?<br />

• Has the interest from investors and speculators materialised in the nickel<br />

market this year? Is the market still liquid enough?<br />

• Level of inventories – how much material is locked out from the market?<br />

Where has it been accumulating?<br />

• Forecasting LME prices – will they keep going down? Where is the<br />

bottom line?<br />

• Long term contracts vs spot market prices- why is the industry leaning<br />

towards longer term deals? Will the spot pricing eventually achieve previous<br />

or even higher levels?<br />

Angus Staines, Analyst, UBS, UK<br />

<strong>Metal</strong> <strong>Bulletin</strong> Events reserve the right to alter the venue, timings and/or speakers. © <strong>Metal</strong> <strong>Bulletin</strong> Events, part of Euromoney Trading Limited