Ferro-alloys - Metal Bulletin Store

Ferro-alloys - Metal Bulletin Store

Ferro-alloys - Metal Bulletin Store

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

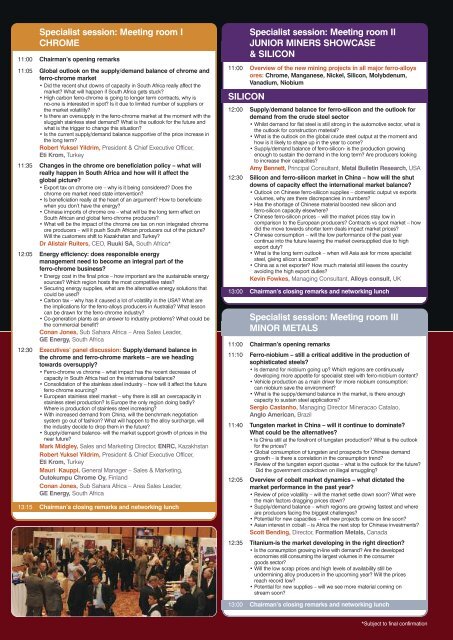

Specialist session: Meeting room I<br />

CHROME<br />

11:00 Chairman’s opening remarks<br />

11:05 Global outlook on the supply/demand balance of chrome and<br />

ferro-chrome market<br />

• Did the recent shut downs of capacity in South Africa really affect the<br />

market? What will happen if South Africa gets stuck?<br />

• High carbon ferro-chrome is going to longer term contracts, why is<br />

no-one is interested in spot? Is it due to limited number of suppliers or<br />

the market volatility?<br />

• Is there an oversupply in the ferro-chrome market at the moment with the<br />

sluggish stainless steel demand? What is the outlook for the future and<br />

what is the trigger to change this situation?<br />

• Is the current supply/demand balance supportive of the price increase in<br />

the long term?<br />

Robert Yuksel Yildrim, President & Chief Executive Officer,<br />

Eti Krom, Turkey<br />

11:35 Changes in the chrome ore beneficiation policy – what will<br />

really happen in South Africa and how will it affect the<br />

global picture?<br />

• Export tax on chrome ore – why is it being considered? Does the<br />

chrome ore market need state intervention?<br />

• Is beneficiation really at the heart of an argument? How to beneficiate<br />

when you don’t have the energy?<br />

• Chinese imports of chrome ore – what will be the long term effect on<br />

South African and global ferro-chrome producers?<br />

• What will be the impact of the chrome ore tax on non integrated chrome<br />

ore producers – will it push South African producers out of the picture?<br />

Will the customers shift to Kazakhstan and Turkey?<br />

Dr Alistair Ruiters, CEO, Ruuki SA, South Africa*<br />

12:05 Energy efficiency: does responsible energy<br />

management need to become an integral part of the<br />

ferro-chrome business?<br />

• Energy cost in the final price – how important are the sustainable energy<br />

sources? Which region hosts the most competitive rates?<br />

• Securing energy supplies, what are the alternative energy solutions that<br />

could be used?<br />

• Carbon tax – why has it caused a lot of volatility in the USA? What are<br />

the implications for the ferro-<strong>alloys</strong> producers in Australia? What lesson<br />

can be drawn for the ferro-chrome industry?<br />

• Co-generation plants as an answer to industry problems? What could be<br />

the commercial benefit?<br />

Conan Jones, Sub Sahara Africa – Area Sales Leader,<br />

GE Energy, South Africa<br />

12:30 Executives’ panel discussion: Supply/demand balance in<br />

the chrome and ferro-chrome markets – are we heading<br />

towards oversupply?<br />

• <strong>Ferro</strong>-chrome vs chrome – what impact has the recent decrease of<br />

capacity in South Africa had on the international balance?<br />

• Consolidation of the stainless steel industry – how will it affect the future<br />

ferro-chrome sourcing?<br />

• European stainless steel market – why there is still an overcapacity in<br />

stainless steel production? Is Europe the only region doing badly?<br />

Where is production of stainless steel increasing?<br />

• With increased demand from China, will the benchmark negotiation<br />

system go out of fashion? What will happen to the alloy surcharge, will<br />

the industry decide to drop them in the future?<br />

• Supply/demand balance- will the market support growth of prices in the<br />

near future?<br />

Mark Midgley, Sales and Marketing Director, ENRC, Kazakhstan<br />

Robert Yuksel Yildrim, President & Chief Executive Officer,<br />

Eti Krom, Turkey<br />

Mauri Kauppi, General Manager – Sales & Marketing,<br />

Outokumpu Chrome Oy, Finland<br />

Conan Jones, Sub Sahara Africa – Area Sales Leader,<br />

GE Energy, South Africa<br />

13:15 Chairman’s closing remarks and networking lunch<br />

Specialist session: Meeting room II<br />

JUNIOR MINERS SHOWCASE<br />

& SILICON<br />

11:00 Overview of the new mining projects in all major ferro-<strong>alloys</strong><br />

ores: Chrome, Manganese, Nickel, Silicon, Molybdenum,<br />

Vanadium, Niobium<br />

SILICON<br />

12:00 Supply/demand balance for ferro-silicon and the outlook for<br />

demand from the crude steel sector<br />

• Whilst demand for flat steel is still strong in the automotive sector, what is<br />

the outlook for construction material?<br />

• What is the outlook on the global crude steel output at the moment and<br />

how is it likely to shape up in the year to come?<br />

• Supply/demand balance of ferro-silicon- is the production growing<br />

enough to sustain the demand in the long term? Are producers looking<br />

to increase their capacities?<br />

Amy Bennett, Principal Consultant, <strong>Metal</strong> <strong>Bulletin</strong> Research, USA<br />

12:30 Silicon and ferro-silicon market in China – how will the shut<br />

downs of capacity effect the international market balance?<br />

• Outlook on Chinese ferro-siliicon supplies – domestic output vs exports<br />

volumes, why are there discrepancies in numbers?<br />

• Has the shortage of Chinese material boosted new silicon and<br />

ferro-silicon capacity elsewhere?<br />

• Chinese ferro-silicon prices – will the market prices stay low in<br />

comparison to the European producers? Contracts vs spot market – how<br />

did the move towards shorter term deals impact market prices?<br />

• Chinese consumption – will the low performance of the past year<br />

continue into the future leaving the market oversupplied due to high<br />

export duty?<br />

• What is the long term outlook – when will Asia ask for more specialist<br />

steel, giving silicon a boost?<br />

• China as a net exporter? How much material still leaves the country<br />

avoiding the high export duties?<br />

Kevin Fowkes, Managing Consultant, Alloys consult, UK<br />

13:00 Chairman’s closing remarks and networking lunch<br />

Specialist session: Meeting room III<br />

MINOR METALS<br />

11:00 Chairman’s opening remarks<br />

11:10 <strong>Ferro</strong>-niobium – still a critical additive in the production of<br />

sophisticated steels?<br />

• Is demand for niobium going up? Which regions are continuously<br />

developing more appetite for specialist steel with ferro-niobium content?<br />

• Vehicle production as a main driver for more niobium consumption:<br />

can niobium save the environment?<br />

• What is the suppy/demand balance in the market, is there enough<br />

capacity to sustain steel applications?<br />

Sergio Castanho, Managing Director Mineracao Catalao,<br />

Anglo American, Brazil<br />

11:40 Tungsten market in China – will it continue to dominate?<br />

What could be the alternatives?<br />

• Is China still at the forefront of tungsten production? What is the outlook<br />

for the prices?<br />

• Global consumption of tungsten and prospects for Chinese demand<br />

growth – is there a correlation in the consumption trend?<br />

• Review of the tungsten export quotas – what is the outlook for the future?<br />

Did the government crackdown on illegal smuggling?<br />

12:05 Overview of cobalt market dynamics – what dictated the<br />

market performance in the past year?<br />

• Review of price volatility – will the market settle down soon? What were<br />

the main factors dragging prices down?<br />

• Supply/demand balance – which regions are growing fastest and where<br />

are producers facing the biggest challenges?<br />

• Potential for new capacities – will new projects come on line soon?<br />

• Asian interest in cobalt – is Africa the next stop for Chinese investments?<br />

Scott Bending, Director, Formation <strong>Metal</strong>s, Canada<br />

12:35 Titanium-is the market developing in the right direction?<br />

• Is the consumption growing in-line with demand? Are the developed<br />

economies still consuming the largest volumes in the consumer<br />

goods sector?<br />

• Will the low scrap prices and high levels of availability still be<br />

undermining alloy producers in the upcoming year? Will the prices<br />

reach record low?<br />

• Potential for new supplies – will we see more material coming on<br />

stream soon?<br />

13:00 Chairman’s closing remarks and networking lunch<br />

*Subject to final confirmation