Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

35. The requirements <strong>of</strong> being a public listed company may strain our resources <strong>and</strong> distract<br />

management.<br />

We have no experience as a public listed company or with the increased scrutiny <strong>of</strong> its affairs by<br />

shareholders, regulators <strong>and</strong> the public at large that is associated with being a public company. As a<br />

public listed company, we will incur significant legal, accounting, corporate governance <strong>and</strong> other<br />

expenses that we did not incur as an unlisted company. We will also be subject to the provisions <strong>of</strong> the<br />

listing agreements signed with the Stock <strong>Exchange</strong>s which require us to file unaudited financial results<br />

(on a limited review basis) on a quarterly basis. In order to meet our financial control <strong>and</strong> disclosure<br />

obligations, significant resources <strong>and</strong> management supervision will be required. As a result, our<br />

management's attention may be diverted from other business concerns, which could have an adverse<br />

effect on our business <strong>and</strong> operations. There can be no assurance that we will be able to satisfy our<br />

reporting obligations <strong>and</strong>/or readily determine <strong>and</strong> report any changes to our results <strong>of</strong> operations in as<br />

timely a manner as other listed companies. In addition, we may need to increase the strength <strong>of</strong> team<br />

<strong>and</strong> hire additional legal <strong>and</strong> accounting staff with appropriate experience in a public listed company<br />

<strong>and</strong> accounting knowledge <strong>and</strong> we cannot assure you that we will be able to do so in a timely manner.<br />

Furthermore, we may not be able to attract suitable employees which may have an adverse effect in our<br />

results <strong>of</strong> operations <strong>and</strong> financial performance.<br />

36. Our ability to pay dividends will depend upon future earnings, financial condition, cash flows,<br />

working capital requirements, capital expen�����������������������������������������������<br />

The amount <strong>of</strong> our future dividend payments, if any, will depend upon our future earnings, financial<br />

��������������������������������������������������������������������������������������������������������<br />

factors. There can be no assurance that we shall have distributable funds or that we will declare<br />

dividends in the future. Additionally, the terms <strong>of</strong> any financing we obtain in the future, may contain<br />

restrictive covenants which may also affect some <strong>of</strong> the rights <strong>of</strong> our shareholders, including the<br />

payment <strong>of</strong> the dividend.<br />

37. We have entered into certain related party transactions<br />

We have, in the course <strong>of</strong> our business, entered into transactions with related parties that include our<br />

Promoter Group, our Subsidiary, our associate companies <strong>and</strong> our Group Companies. While we believe<br />

that all such transactions have been conducted on an arm's length basis, there can be no assurance that<br />

we could not have achieved more favourable terms had such transactions not been entered into with<br />

related parties. Furthermore, it is likely that we may enter into related party transactions in the future.<br />

There can be no assurance that such transactions, individually or in the aggregate, will not have an<br />

adverse effect on our financial condition <strong>and</strong> results <strong>of</strong> operations. For more information on Related<br />

Party Transactions, please see the section titled "��������������������� ���������� ������������ �������<br />

Company������appearing on page no. 149.<br />

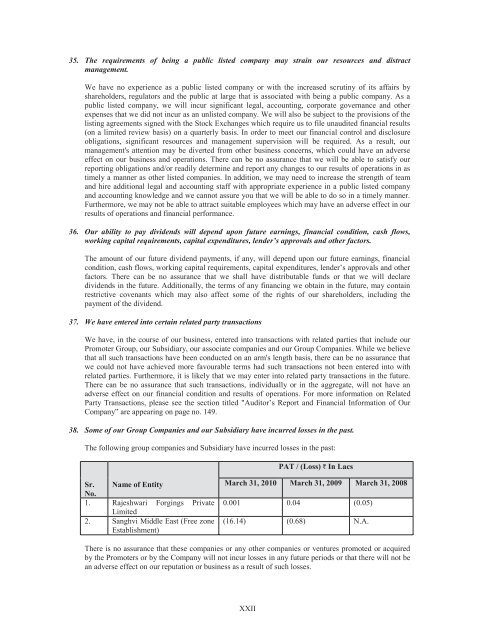

38. Some <strong>of</strong> our Group Companies <strong>and</strong> our Subsidiary have incurred losses in the past.<br />

The following group companies <strong>and</strong> Subsidiary have incurred losses in the past:<br />

Sr.<br />

No.<br />

Name <strong>of</strong> Entity<br />

1. Rajeshwari<br />

Limited<br />

Forgings Private<br />

2. Sanghvi Middle East (Free zone<br />

Establishment)<br />

XXII<br />

PAT / (Loss) ` In Lacs<br />

March 31, 2010 March 31, 2009 March 31, 2008<br />

0.001 0.04 (0.05)<br />

(16.14)<br />

(0.68) N.A.<br />

There is no assurance that these companies or any other companies or ventures promoted or acquired<br />

by the Promoters or by the Company will not incur losses in any future periods or that there will not be<br />

an adverse effect on our reputation or business as a result <strong>of</strong> such losses.