Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Pursuant to <strong>India</strong>n regulations, certain actions must be completed before the Equity Shares can be listed<br />

<strong>and</strong> trading may commence. Investors demat accounts with depository participants in <strong>India</strong> are<br />

expected to be credited within two working days <strong>of</strong> the date on which the basis <strong>of</strong> allotment is<br />

approved by the Designated Stock <strong>Exchange</strong>. Thereafter, upon receipt <strong>of</strong> trading approval from the<br />

Stock <strong>Exchange</strong>s, trading in the Equity Shares is expected to commence within seven working days <strong>of</strong><br />

the date on which the basis <strong>of</strong> allotment is approved. We cannot assure you that the Equity Shares will<br />

���������������������������������������������������������������������������������������������������������<br />

time periods specified above. Any delay in obtaining the approvals would restrict your ability to<br />

dispose <strong>of</strong> your Equity Shares.<br />

60. You may be subject to <strong>India</strong>n taxes arising out <strong>of</strong> capital gains on the sale <strong>of</strong> the Equity Shares.<br />

Capital gains arising from the sale <strong>of</strong> shares <strong>and</strong> debentures are generally taxable in <strong>India</strong>. Any gain<br />

realised on the sale <strong>of</strong> shares <strong>and</strong> debentures on a stock exchange held for more than 12 months will not<br />

be subject to capital gains tax in <strong>India</strong> if the securities transaction tax, or STT, has been paid on the<br />

transaction. The STT will be levied on <strong>and</strong> collected by an <strong>India</strong>n stock exchange on which shares or<br />

debentures are sold. Any gain realised on the sale <strong>of</strong> shares <strong>and</strong>/or held for more than 12 months to an<br />

<strong>India</strong>n resident, which are sold other than on a recognised stock exchange <strong>and</strong> as a result <strong>of</strong> which no<br />

STT has been paid, will be subject to capital gains tax in <strong>India</strong>. Further, any gain realised on the sale <strong>of</strong><br />

shares <strong>and</strong>/or debentures held for a period <strong>of</strong> 12 months or less will be subject to capital gains tax in<br />

<strong>India</strong>. Capital gains arising from the sale <strong>of</strong> shares <strong>and</strong>/or debentures will be exempt from taxation in<br />

<strong>India</strong> in cases where an exemption is provided under a treaty between <strong>India</strong> <strong>and</strong> the country <strong>of</strong> which<br />

the seller is a resident. Generally, <strong>India</strong>n tax treaties do not limit <strong>India</strong>'s ability to impose tax on capital<br />

gains. As a result, residents <strong>of</strong> other countries may be liable for tax in <strong>India</strong> as well as in their own<br />

jurisdictions on gains arising from a sale <strong>of</strong> the shares <strong>and</strong>/or debentures, as the case may be. However,<br />

capital gains on the sale <strong>of</strong> the Equity Shares purchased in the Issue by residents <strong>of</strong> certain countries<br />

will not be taxable in <strong>India</strong> by virtue <strong>of</strong> the provisions contained in the taxation treaties between <strong>India</strong><br />

<strong>and</strong> such countries.<br />

<strong>Prominent</strong> <strong>Notes</strong>:<br />

The investors may contact the BRLM for any complaint pertaining to the Issue.<br />

Public Issue <strong>of</strong> 43,41,195 Equity Shares <strong>of</strong> ` 10 each for cash at a price <strong>of</strong> ` 85 per Equity<br />

Share (including a share premium <strong>of</strong> ` 75 per Equity Share) aggregating upto ` 3690.02 Lacs.<br />

����������������������������������������������������December 31, 2010 was ` 1736.03 Lacs<br />

����������������������������������������������������������December 31, 2010 was ` 1708.80<br />

Lacs.<br />

Based on our restated consolidated financial statements, the net asset value per equity share<br />

having a face value <strong>of</strong> ` 10/- each was ` 22.32 as <strong>of</strong> December 31, 2010.<br />

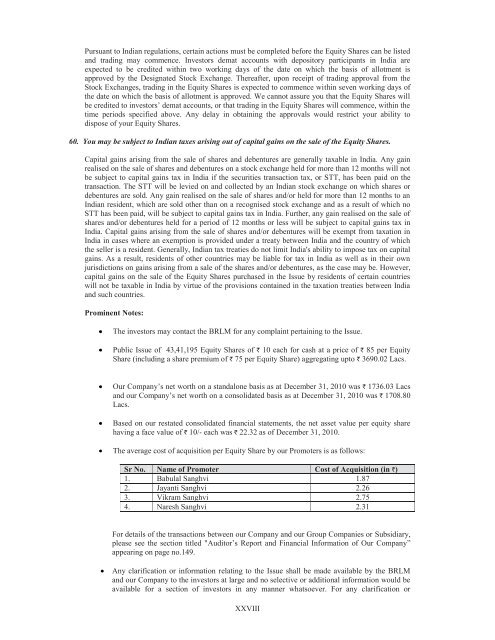

The average cost <strong>of</strong> acquisition per Equity Share by our Promoters is as follows:<br />

Sr No. Name <strong>of</strong> Promoter Cost <strong>of</strong> Acquisition (in `)<br />

1. Babulal Sanghvi 1.87<br />

2. Jayanti Sanghvi 2.26<br />

3. Vikram Sanghvi 2.75<br />

4. Naresh Sanghvi 2.31<br />

For details <strong>of</strong> the transactions between our Company <strong>and</strong> our Group Companies or Subsidiary,<br />

please see the section titled "��������������������� ���������������������� ������� ���������<br />

appearing on page no.149.<br />

Any clarification or information relating to the Issue shall be made available by the BRLM<br />

<strong>and</strong> our Company to the investors at large <strong>and</strong> no selective or additional information would be<br />

available for a section <strong>of</strong> investors in any manner whatsoever. For any clarification or<br />

XXVIII