Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

Prominent Notes: - Securities and Exchange Board of India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Near Pizza hut, Race course Circle (north)<br />

Vadodara- 390007<br />

Tel: 91- 265 - 6690701<br />

Fax: 91- 265- 2351185<br />

Website: www.axisbank.com<br />

Contact Person: Mr. Gitang Dave<br />

Email : gitang.dave@axisbank.com<br />

SEBI Regn. No. IBNI00000017<br />

SELF CERTIFIED SYNDICATE BANKS<br />

���������������������������������������������������������������������www.sebi.gov.in/pmd/scsb.pdf.<br />

Investors are requested to refer the SEBI website for updated list <strong>of</strong> SCSBs <strong>and</strong> their designated<br />

branches.<br />

All grievances relating to the ASBA process may be addressed to the Registrar to the Issue, with a copy<br />

to the SCSBs, giving full details such as name, address <strong>of</strong> the applicant, number <strong>of</strong> Equity Shares<br />

applied for, Bid Amount blocked, ASBA Account number <strong>and</strong> the Designated Branch <strong>of</strong> the SCSBs<br />

where the ASBA Form was submitted by the ASBA Bidders.<br />

For all Issue related queries <strong>and</strong> for redressal <strong>of</strong> complaints, Bidders may also write to the Book<br />

Running Lead Manager. All complaints, queires or comments received by SEBI shall be forwarded to<br />

the Book Running Lead Manager, who will respond to the same.<br />

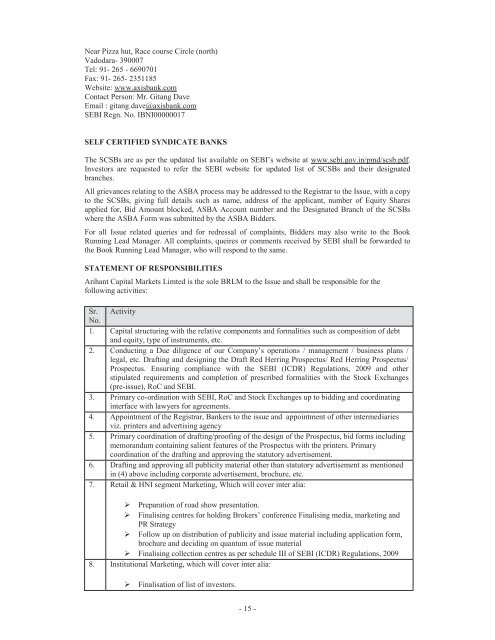

STATEMENT OF RESPONSIBILITIES<br />

Arihant Capital Markets Limted is the sole BRLM to the Issue <strong>and</strong> shall be responsible for the<br />

following activities:<br />

Sr. Activity<br />

No.<br />

1. Capital structuring with the relative components <strong>and</strong> formalities such as composition <strong>of</strong> debt<br />

<strong>and</strong> equity, type <strong>of</strong> instruments, etc.<br />

2. ����������� �� ���� ���������� ��� ���� ���������� ����������� �� ����������� �� ��������� ������ �<br />

legal, etc. Drafting <strong>and</strong> designing the Draft Red Herring Prospectus/ Red Herring Prospectus/<br />

Prospectus. Ensuring compliance with the SEBI (ICDR) Regulations, 2009 <strong>and</strong> other<br />

stipulated requirements <strong>and</strong> completion <strong>of</strong> prescribed formalities with the Stock <strong>Exchange</strong>s<br />

(pre-issue), RoC <strong>and</strong> SEBI.<br />

3. Primary co-ordination with SEBI, RoC <strong>and</strong> Stock <strong>Exchange</strong>s up to bidding <strong>and</strong> coordinating<br />

interface with lawyers for agreements.<br />

4. Appointment <strong>of</strong> the Registrar, Bankers to the issue <strong>and</strong> appointment <strong>of</strong> other intermediaries<br />

viz. printers <strong>and</strong> advertising agency<br />

5. Primary coordination <strong>of</strong> drafting/pro<strong>of</strong>ing <strong>of</strong> the design <strong>of</strong> the Prospectus, bid forms including<br />

memor<strong>and</strong>um containing salient features <strong>of</strong> the Prospectus with the printers. Primary<br />

coordination <strong>of</strong> the drafting <strong>and</strong> approving the statutory advertisement.<br />

6. Drafting <strong>and</strong> approving all publicity material other than statutory advertisement as mentioned<br />

in (4) above including corporate advertisement, brochure, etc.<br />

7. Retail & HNI segment Marketing, Which will cover inter alia:<br />

� Preparation <strong>of</strong> road show presentation.<br />

� �����������������������������������������������������������������������������������<br />

PR Strategy<br />

� Follow up on distribution <strong>of</strong> publicity <strong>and</strong> issue material including application form,<br />

brochure <strong>and</strong> deciding on quantum <strong>of</strong> issue material<br />

� Finalising collection centres as per schedule III <strong>of</strong> SEBI (ICDR) Regulations, 2009<br />

8. Institutional Marketing, which will cover inter alia:<br />

� Finalisation <strong>of</strong> list <strong>of</strong> investors.<br />

- 15 -