Interim Report Q3 2012 - Deutsche Post DHL

Interim Report Q3 2012 - Deutsche Post DHL

Interim Report Q3 2012 - Deutsche Post DHL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

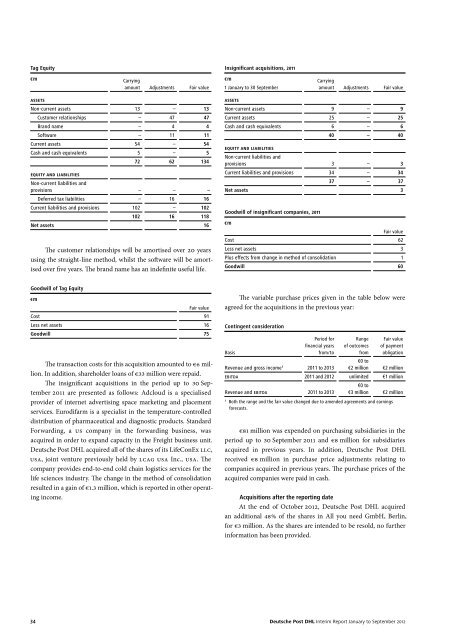

Tag Equity<br />

€ m Carrying<br />

amount Adjustments Fair value<br />

ASSETS<br />

Non-current assets 13 – 13<br />

Customer relationships – 47 47<br />

Brand name – 4 4<br />

Software – 11 11<br />

Current assets 54 – 54<br />

Cash and cash equivalents 5 – 5<br />

EQUITY AND LIABILITIES<br />

72 62 134<br />

Non-current liabilities and<br />

provisions – – –<br />

Deferred tax liabilities – 16 16<br />

Current liabilities and provisions 102 – 102<br />

102 16 118<br />

Net assets 16<br />

The customer relationships will be amortised over 20 years<br />

using the straight-line method, whilst the software will be amortised<br />

over five years. The brand name has an indefinite useful life.<br />

Goodwill of Tag Equity<br />

€ m<br />

Fair value<br />

Cost 91<br />

Less net assets 16<br />

Goodwill 75<br />

The transaction costs for this acquisition amounted to €6 million.<br />

In addition, shareholder loans of €33 million were repaid.<br />

The insignificant acquisitions in the period up to 30 September<br />

2011 are presented as follows: Adcloud is a specialised<br />

provider of internet advertising space marketing and placement<br />

services. Eurodifarm is a specialist in the temperature-controlled<br />

distribution of pharmaceutical and diagnostic products. Standard<br />

Forwarding, a US company in the forwarding business, was<br />

acquired in order to expand capacity in the Freight business unit.<br />

<strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong> acquired all of the shares of its LifeConEx LLC,<br />

USA, joint venture previously held by LCAG USA Inc., USA. The<br />

company provides end-to-end cold chain logistics services for the<br />

life sciences industry. The change in the method of consolidation<br />

resulted in a gain of €1.3 million, which is reported in other operating<br />

income.<br />

34<br />

Insignificant acquisitions, 2011<br />

€ m Carrying<br />

1 January to 30 September<br />

amount Adjustments Fair value<br />

ASSETS<br />

Non-current assets 9 – 9<br />

Current assets 25 – 25<br />

Cash and cash equivalents 6 – 6<br />

EQUITY AND LIABILITIES<br />

40 – 40<br />

Non-current liabilities and<br />

provisions 3 – 3<br />

Current liabilities and provisions 34 – 34<br />

37 – 37<br />

Net assets 3<br />

Goodwill of insignificant companies, 2011<br />

€ m<br />

Fair value<br />

Cost 62<br />

Less net assets 3<br />

Plus effects from change in method of consolidation 1<br />

Goodwill 60<br />

The variable purchase prices given in the table below were<br />

agreed for the acquisitions in the previous year:<br />

Contingent consideration<br />

Basis<br />

Period for<br />

financial years<br />

from / to<br />

Revenue and gross income 1 2011 to 2013<br />

Range<br />

of outcomes<br />

from<br />

Fair value<br />

of payment<br />

obligation<br />

€0 to<br />

€2 million €2 million<br />

EBITDA 2011 and <strong>2012</strong> unlimited €1 million<br />

Revenue and EBITDA 2011 to 2013<br />

€0 to<br />

€3 million €2 million<br />

1 Both the range and the fair value changed due to amended agreements and earnings<br />

forecasts.<br />

€81 million was expended on purchasing subsidiaries in the<br />

period up to 30 September 2011 and €8 million for subsidiaries<br />

acquired in previous years. In addition, <strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong><br />

received €8 million in purchase price adjustments relating to<br />

compan ies acquired in previous years. The purchase prices of the<br />

acquired companies were paid in cash.<br />

Acquisitions after the reporting date<br />

At the end of October <strong>2012</strong>, <strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong> acquired<br />

an additional 48 % of the shares in All you need GmbH, Berlin,<br />

for €3 million. As the shares are intended to be resold, no further<br />

information has been provided.<br />

<strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong> <strong>Interim</strong> <strong>Report</strong> January to September <strong>2012</strong>