Interim Report Q3 2012 - Deutsche Post DHL

Interim Report Q3 2012 - Deutsche Post DHL

Interim Report Q3 2012 - Deutsche Post DHL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The impairment losses result mainly from changes to the useful<br />

lives of aircraft.<br />

The impairment losses for the previous year are attributable<br />

to land and buildings, technical equipment and machinery, IT<br />

equipment and transport equipment.<br />

8<br />

Net income from associates<br />

Investments in companies on which a significant influence<br />

can be exercised and which are accounted for using the equity<br />

method contributed €0 million (previous year: €58 million) to<br />

net finance costs. This item decreased as a result of the disposal of<br />

<strong>Deutsche</strong> <strong>Post</strong>bank AG.<br />

9<br />

Net other finance costs<br />

The net other finance costs of €264 million (previous year:<br />

€469 million) are largely due to the effects of the <strong>Post</strong>bank sale,<br />

which was completed in February <strong>2012</strong>, as well as to the interest<br />

expense on the additional VAT payment; Note 3.<br />

10<br />

Earnings per share<br />

Basic earnings per share in the period under review were<br />

€0.92.<br />

Basic earnings per share<br />

9 M 2011 9 M <strong>2012</strong><br />

Consolidated net profit for<br />

the period attributable<br />

to <strong>Deutsche</strong> <strong>Post</strong> AG shareholders € m 988 1,116<br />

Weighted average number of shares<br />

outstanding shares 1,208,832,541 1,208,849,207<br />

Basic earnings per share € 0.82 0.92<br />

Diluted earnings per share in the reporting period were<br />

€0.92. Executives were entitled to 6,256,885 rights to shares as at<br />

the reporting date.<br />

Diluted earnings per share<br />

9 M 2011 9 M <strong>2012</strong><br />

Consolidated net profit for<br />

the period attributable<br />

to <strong>Deutsche</strong> <strong>Post</strong> AG shareholders € m 988 1,116<br />

Weighted average number of shares<br />

outstanding shares 1,208,832,541 1,208,849,207<br />

Potentially dilutive shares shares 1,253,264 2,925,331<br />

Weighted average number of shares<br />

for diluted earnings shares 1,210,085,805 1,211,774,538<br />

Diluted earnings per share € 0.82 0.92<br />

38<br />

11<br />

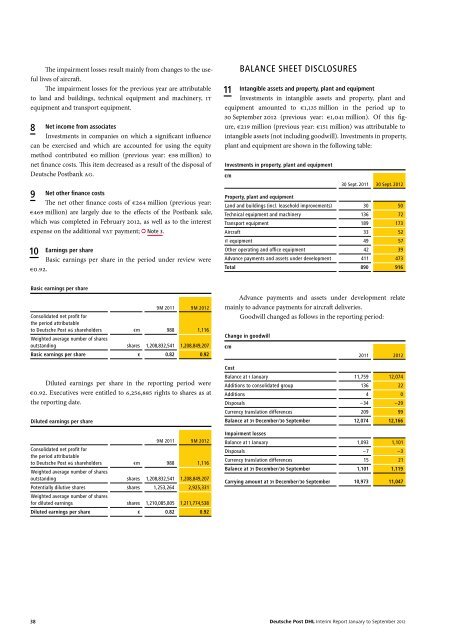

BALANCE SHEET DISCLOSURES<br />

Intangible assets and property, plant and equipment<br />

Investments in intangible assets and property, plant and<br />

equipment amounted to €1,135 million in the period up to<br />

30 September <strong>2012</strong> (previous year: €1,041 million). Of this figure,<br />

€219 million (previous year: €151 million) was attributable to<br />

intangible assets (not including goodwill). Investments in property,<br />

plant and equipment are shown in the following table:<br />

Investments in property, plant and equipment<br />

€ m<br />

Property, plant and equipment<br />

30 Sept. 2011 30 Sept. <strong>2012</strong><br />

Land and buildings (incl. leasehold improvements) 30 50<br />

Technical equipment and machinery 136 72<br />

Transport equipment 189 173<br />

Aircraft 33 52<br />

IT equipment 49 57<br />

Other operating and office equipment 42 39<br />

Advance payments and assets under development 411 473<br />

Total 890 916<br />

Advance payments and assets under development relate<br />

mainly to advance payments for aircraft deliveries.<br />

Goodwill changed as follows in the reporting period:<br />

Change in goodwill<br />

€ m<br />

Cost<br />

2011 <strong>2012</strong><br />

Balance at 1 January 11,759 12,074<br />

Additions to consolidated group 136 22<br />

Additions 4 0<br />

Disposals –34 –29<br />

Currency translation differences 209 99<br />

Balance at 31 December / 30 September 12,074 12,166<br />

Impairment losses<br />

Balance at 1 January 1,093 1,101<br />

Disposals –7 –3<br />

Currency translation differences 15 21<br />

Balance at 31 December / 30 September 1,101 1,119<br />

Carrying amount at 31 December / 30 September 10,973 11,047<br />

<strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong> <strong>Interim</strong> <strong>Report</strong> January to September <strong>2012</strong>