BC Hydro Annual Report 2001

BC Hydro Annual Report 2001

BC Hydro Annual Report 2001

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

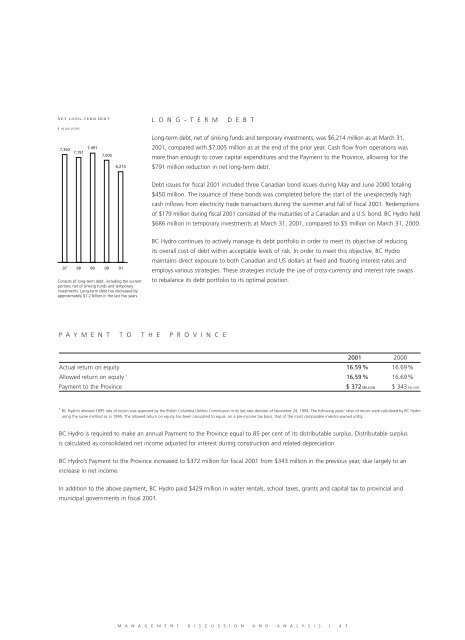

NET LONG-TERM DEBT<br />

$ IN MILLIONS<br />

7,392 7,191<br />

7,491<br />

7,005<br />

6,214<br />

97 98 99 00 01<br />

Consists of long-term debt, including the current<br />

portion, net of sinking funds and temporary<br />

investments. Long-term debt has decreased by<br />

approximately $1.2 billion in the last five years.<br />

L O N G - T E R M D E B T<br />

P A Y M E N T T O T H E P R O V I N C E<br />

Long-term debt, net of sinking funds and temporary investments, was $6,214 million as at March 31,<br />

<strong>2001</strong>, compared with $7,005 million as at the end of the prior year. Cash flow from operations was<br />

more than enough to cover capital expenditures and the Payment to the Province, allowing for the<br />

$791 million reduction in net long-term debt.<br />

Debt issues for fiscal <strong>2001</strong> included three Canadian bond issues during May and June 2000 totaling<br />

$450 million. The issuance of these bonds was completed before the start of the unexpectedly high<br />

cash inflows from electricity trade transactions during the summer and fall of fiscal <strong>2001</strong>. Redemptions<br />

of $179 million during fiscal <strong>2001</strong> consisted of the maturities of a Canadian and a U.S. bond. <strong>BC</strong> <strong>Hydro</strong> held<br />

$686 million in temporary investments at March 31, <strong>2001</strong>, compared to $5 million on March 31, 2000.<br />

<strong>BC</strong> <strong>Hydro</strong> continues to actively manage its debt portfolio in order to meet its objective of reducing<br />

its overall cost of debt within acceptable levels of risk. In order to meet this objective, <strong>BC</strong> <strong>Hydro</strong><br />

maintains direct exposure to both Canadian and US dollars at fixed and floating interest rates and<br />

employs various strategies. These strategies include the use of cross-currency and interest rate swaps<br />

to rebalance its debt portfolio to its optimal position.<br />

<strong>2001</strong> 2000<br />

Actual return on equity 16.59 % 16.69%<br />

Allowed return on equity 1 16.59 % 16.69%<br />

Payment to the Province $ 372 MILLION $ 343 MILLION<br />

1 <strong>BC</strong> <strong>Hydro</strong>’s allowed 1995 rate of return was approved by the British Columbia Utilities Commission in its last rate decision of November 24, 1994. The following years’ rates of return were calculated by <strong>BC</strong> <strong>Hydro</strong><br />

using the same method as in 1995. The allowed return on equity has been calculated to equal, on a pre-income tax basis, that of the most comparable investor-owned utility.<br />

<strong>BC</strong> <strong>Hydro</strong> is required to make an annual Payment to the Province equal to 85 per cent of its distributable surplus. Distributable surplus<br />

is calculated as consolidated net income adjusted for interest during construction and related depreciation.<br />

<strong>BC</strong> <strong>Hydro</strong>’s Payment to the Province increased to $372 million for fiscal <strong>2001</strong> from $343 million in the previous year, due largely to an<br />

increase in net income.<br />

In addition to the above payment, <strong>BC</strong> <strong>Hydro</strong> paid $429 million in water rentals, school taxes, grants and capital tax to provincial and<br />

municipal governments in fiscal <strong>2001</strong>.<br />

M A N A G E M E N T D I S C U S S I O N A N D A N A L Y S I S | 4 3