major risk factors and their management within the ... - Euler Hermes

major risk factors and their management within the ... - Euler Hermes

major risk factors and their management within the ... - Euler Hermes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.2.4 COUNTERPARTY RISK<br />

Counterparty <strong>risk</strong> is <strong>the</strong> loss <strong>Euler</strong> <strong>Hermes</strong> would incur in <strong>the</strong> event of<br />

<strong>the</strong> insolvency of one of its business partners, namely <strong>the</strong> failure of a<br />

reinsurer, a bank, a bond or equity counterparty, or <strong>the</strong> non-execution by<br />

a policyholder of its commitments.<br />

<strong>Euler</strong> <strong>Hermes</strong> has implemented various mechanisms to anticipate <strong>and</strong><br />

limit <strong>the</strong> consequences of <strong>the</strong> failure of one of its counterparties.<br />

Failure of a reinsurer<br />

Mechanisms for detecting <strong>and</strong> limiting counterparty <strong>risk</strong>:<br />

■ selection of reinsurers on <strong>the</strong> basis of <strong><strong>the</strong>ir</strong> counterparties (rated A or<br />

higher or subject to <strong>the</strong> special prior approval of <strong>the</strong> <strong>Euler</strong> <strong>Hermes</strong><br />

Group Management Board in <strong>the</strong> event of <strong>the</strong> rating being below A);<br />

■ limits on concentration <strong>risk</strong> on a single reinsurer;<br />

■ constant monitoring by <strong>the</strong> various operational entities via maturity<br />

analysis of reinsurers’ credits <strong>and</strong> debits, <strong>and</strong> <strong>the</strong> amount of technical<br />

reserves transferred to <strong>the</strong>m;<br />

■ requests for letters of credit or security deposits from reinsurers;<br />

4<br />

MAJOR RISK FACTORS AND THEIR MANAGEMENT WITHIN THE GROUP<br />

Quantitative <strong>and</strong> qualitative appendices relating to <strong>risk</strong> <strong>factors</strong><br />

■ cut-offs of reinsurance treaties a few years after <strong>the</strong> implementation<br />

of <strong>the</strong> reinsurance contract.<br />

In <strong>the</strong> event of <strong>the</strong> failure of a reinsurer or any event that may result in <strong>the</strong><br />

failure of a reinsurer, <strong>the</strong> Company would conduct a <strong>risk</strong> analysis of <strong>the</strong><br />

event. It would <strong>the</strong>n take steps, on <strong>the</strong> basis of its findings, to minimize<br />

<strong>the</strong> negative impact on <strong>Euler</strong> <strong>Hermes</strong>.<br />

In such cases, assets carried by <strong>Euler</strong> <strong>Hermes</strong> in connection with <strong>the</strong><br />

relevant counterparty would be impaired.<br />

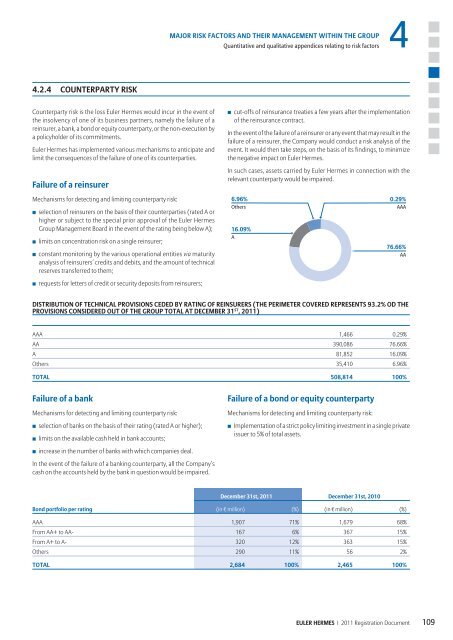

16.09%<br />

A<br />

76.66%<br />

AA<br />

DISTRIBUTION OF TECHNICAL PROVISIONS CEDED BY RATING OF REINSURERS (THE PERIMETER COVERED REPRESENTS 93.2% OD THE<br />

PROVISIONS CONSIDERED OUT OF THE GROUP TOTAL AT DECEMBER 31 ST , 2011)<br />

AAA 1,466 0.29%<br />

AA 390,086 76.66%<br />

A 81,852 16.09%<br />

O<strong>the</strong>rs 35,410 6.96%<br />

TOTAL 508,814 100%<br />

Failure of a bank<br />

Mechanisms for detecting <strong>and</strong> limiting counterparty <strong>risk</strong>:<br />

■ selection of banks on <strong>the</strong> basis of <strong><strong>the</strong>ir</strong> rating (rated A or higher);<br />

■ limits on <strong>the</strong> available cash held in bank accounts;<br />

■ increase in <strong>the</strong> number of banks with which companies deal.<br />

In <strong>the</strong> event of <strong>the</strong> failure of a banking counterparty, all <strong>the</strong> Company’s<br />

cash on <strong>the</strong> accounts held by <strong>the</strong> bank in question would be impaired.<br />

Bond portfolio per rating<br />

6.96%<br />

O<strong>the</strong>rs<br />

Failure of a bond or equity counterparty<br />

Mechanisms for detecting <strong>and</strong> limiting counterparty <strong>risk</strong>:<br />

0.29%<br />

AAA<br />

■ Implementation of a strict policy limiting investment in a single private<br />

issuer to 5% of total assets.<br />

December 31st, 2011 December 31st, 2010<br />

(in € million) (%) (in € million) (%)<br />

AAA 1,907 71% 1,679 68%<br />

From AA+ to AA- 167 6% 367 15%<br />

From A+ to A- 320 12% 363 15%<br />

O<strong>the</strong>rs 290 11% 56 2%<br />

TOTAL 2,684 100% 2,465 100%<br />

EULER HERMES I 2011 Registration Document<br />

109