Chemical & Engineering News Digital Edition - Institute of Materia ...

Chemical & Engineering News Digital Edition - Institute of Materia ...

Chemical & Engineering News Digital Edition - Institute of Materia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SOUTHERN COPPER<br />

SULFURIC ACID is one <strong>of</strong> those unheralded<br />

lubricants that keep the gears <strong>of</strong> the<br />

industrial economy spinning. Although less<br />

in the limelight than petrochemicals such<br />

as ethylene or polyethylene, it is in fact the<br />

largest volume chemical in the world. Over<br />

the past six months, it has become a very<br />

expensive chemical as well.<br />

The spot market price for sulfuric acid<br />

sold on the U.S. Gulf Coast is four times<br />

higher today than it was a year ago. And<br />

because sulfuric acid is critical to so many<br />

manufacturing operations, the price runup<br />

is causing grief for a wide range <strong>of</strong> industrial<br />

users.<br />

The story <strong>of</strong> sulfuric acid’s rise is intertwined<br />

with the stories <strong>of</strong> metals, fertilizers,<br />

grains, and other commodities that<br />

have been skyrocketing in price in recent<br />

months because <strong>of</strong> insatiable demand from<br />

China and other developing countries. Although<br />

industry observers advance various<br />

explanations for why acid prices are rising,<br />

they all agree that some kind <strong>of</strong> market hysteria<br />

is also at work.<br />

Robert Boyd, founder <strong>of</strong> the sulfur and<br />

sulfuric acid consulting firm PentaSul, traces<br />

the run-up back to what at the time must<br />

have seemed like an inconsequential hiccup:<br />

the inability <strong>of</strong> the Phoenix-based copper<br />

company Southern Copper to get a Peruvian<br />

sulfuric acid plant up and running on time.<br />

BUSINESS<br />

THE ACID TOUCH<br />

RISING PRICES for sulfuric acid have widespread industrial impact<br />

MICHAEL MCCOY, C&EN NORTHEAST NEWS BUREAU<br />

Smelters <strong>of</strong> copper, nickel, and other<br />

metals play a pivotal role in the sulfuric<br />

acid business. Traditional refining <strong>of</strong> sulfidic<br />

copper ores creates copious amounts<br />

<strong>of</strong> sulfur dioxide gas, which most modern<br />

smelters capture and convert into sulfuric<br />

acid. Yet refining copper via the comparatively<br />

new solvent extraction/electrowinning<br />

technique requires huge quantities <strong>of</strong><br />

sulfuric acid to leach metal out <strong>of</strong> copper<br />

oxide-rich ores. Depending on their location,<br />

metal companies can be big acid sellers<br />

or big acid buyers.<br />

Early last year, Southern was set to become<br />

a big acid seller following the installation <strong>of</strong><br />

abatement equipment designed to capture<br />

more than 92% <strong>of</strong> the company’s sulfur dioxide<br />

emissions in the form <strong>of</strong> 1 million metric<br />

tons <strong>of</strong> sulfuric acid annually. However, Boyd<br />

says the plant didn’t get fully going until May.<br />

In the meantime, Southern was forced to buy<br />

sulfuric acid on the open market to satisfy the<br />

customers it had lined up.<br />

That open market, however, was becoming<br />

crowded with producers <strong>of</strong> metals and<br />

fertilizers seeking sulfuric acid for their<br />

own operations. Prices for these commodi-<br />

WWW.CEN-ONLINE.ORG 27 APRIL 14, 2008<br />

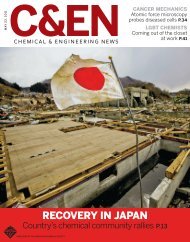

GIVE AND<br />

TAKE Refining<br />

copper,<br />

shown here<br />

at Southern<br />

Copper’s Ilo,<br />

Peru, smelter,<br />

can produce<br />

or consume<br />

sulfuric acid.<br />

ties were hitting all-time<br />

highs, and sellers were<br />

desperate to cash in while<br />

they could.<br />

Since the initial market<br />

tightening last spring,<br />

the situation has only<br />

intensified. “I have never<br />

seen anything like it, and<br />

I have been in the busi-<br />

ness for 23 years,” says Jack Weaverling,<br />

senior vice president <strong>of</strong> the Texas-based<br />

sulfuric acid marketer Shrieve <strong>Chemical</strong>.<br />

Part <strong>of</strong> the problem, Weaverling and<br />

other industry players say, is the way that<br />

disparate events are converging to drive up<br />

the price <strong>of</strong> sulfuric acid.<br />

These days, metal makers have an incentive<br />

to turn out as much copper as they can.<br />

According to the London Metal Exchange,<br />

copper is selling for more than $3.80 per<br />

lb today, compared with only about $1.40<br />

at the beginning <strong>of</strong> 2005. Many firms are<br />

turning to the solvent extraction method<br />

and need acid to run these facilities. For<br />

example, at the same time that Southern is<br />

capturing and selling acid at its new Peruvian<br />

operation, the company plans to build<br />

another copper facility in Peru that will<br />

consume more than two-thirds <strong>of</strong> that acid.<br />

EVEN CRAZIER than metals is the phosphate<br />

fertilizer market, thanks to booming<br />

global demand for corn and other foodstuffs.<br />

A World Bank report puts the average<br />

2006 price <strong>of</strong> diammonium phosphate<br />

(DAP), the most widely traded phosphate<br />

fertilizer, at $260 per metric ton on the<br />

U.S Gulf Coast. Last month, according to<br />

Penta Sul, DAP broke $1,000 per metric ton.<br />

U.S. phosphate fertilizer producers use<br />

sulfuric acid to convert phosphate rock,<br />

mined chiefly in central Florida, into phosphoric<br />

acid. Their operations account for<br />

fully 60% <strong>of</strong> U.S. sulfuric acid consumption.<br />

Although most big fertilizer producers<br />

make their own acid, times <strong>of</strong> outsized<br />

demand can prompt them to look to outside<br />

supplies. And with the returns they<br />

are getting on DAP, they can afford to pay<br />

whatever the market is charging.<br />

According to NorFalco, an Ohio-based<br />

company that markets sulfuric acid from<br />

several Canadian smelters and is one <strong>of</strong><br />

North America’s largest suppliers, fertil-<br />

Disparate events are converging to drive up<br />

the price <strong>of</strong> sulfuric acid to record highs.